Huitongda Network's (HKG:9878) Returns Have Hit A Wall

Huitongda Network's (HKG:9878) Returns Have Hit A Wall

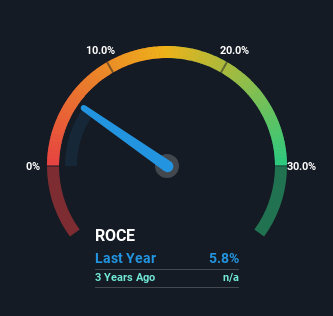

What are the early trends we should look for to identify a stock that could multiply in value over the long term? Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. In light of that, when we looked at Huitongda Network (HKG:9878) and its ROCE trend, we weren't exactly thrilled.

我們應該尋找哪些早期趨勢,以識別可能在長期內增值的股票?通常情況下,我們會希望注意不斷增長的資本僱用回報率(ROCE)的趨勢,以及與此同時,資本僱用基礎的擴大。最終,這表明這是一家正在以增加的投資回報率再投資利潤的業務。基於這一點,當我們看着匯通達網絡(HKG:9878)及其ROCE趨勢時,並沒有讓人感到特別興奮。

Understanding Return On Capital Employed (ROCE)

上面您可以看到蒙托克可再生能源現行ROCE與之前資本回報的比較,但過去只能知道這麼多。如果您感興趣,可以查看我們免費的蒙托克可再生能源分析師報告,了解分析師的預測。

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for Huitongda Network:

只是爲了澄清,如果您不確定,ROCE是評估公司在其業務中投資的資本上賺取多少稅前收入(以百分比表示)的指標。分析師使用這個公式來計算匯通達網絡的ROCE:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

資產僱用回報率(ROCE)是指企業利潤,即企業稅前利潤除以企業投入的總資本(負債加股權)。如果ROCE高於企業財務成本的承受能力,那麼企業就會創造出更多的價值。

0.058 = CN¥563m ÷ (CN¥30b - CN¥21b) (Based on the trailing twelve months to June 2024).

0.058 = 56300萬人民幣 ÷ (300億人民幣 - 210億人民幣)(基於截至2024年6月的過去十二個月)。

Thus, Huitongda Network has an ROCE of 5.8%. On its own that's a low return on capital but it's in line with the industry's average returns of 5.9%.

因此,匯通達網絡的ROCE爲5.8%。單獨看來,這是一個較低的資本回報率,但與行業平均回報率5.9%相符。

Above you can see how the current ROCE for Huitongda Network compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering Huitongda Network for free.

您可以看到匯通達(臨時代碼)網絡當前的ROCE相對於其以往資本回報率的比較,但過去能了解的信息有限。如果您願意,您可以免費查看覆蓋匯通達(臨時代碼)網絡的分析師的預測。

What The Trend Of ROCE Can Tell Us

儘管如此,當我們看 enphase energy (納斯達克股票代碼:ENPH) 的時候,它似乎並沒有完全符合這些要求。

Over the past two years, Huitongda Network's ROCE and capital employed have both remained mostly flat. This tells us the company isn't reinvesting in itself, so it's plausible that it's past the growth phase. So unless we see a substantial change at Huitongda Network in terms of ROCE and additional investments being made, we wouldn't hold our breath on it being a multi-bagger.

在過去兩年裏,匯通達(臨時代碼)網絡的ROCE和資本投入都基本保持不變。這告訴我們該公司並沒有對自身進行再投資,因此可以推測它已經過了增長階段。除非我們在匯通達(臨時代碼)網絡看到ROCE和額外投資發生實質性變化,我們不會對它成爲翻番股持有期待。

On a separate but related note, it's important to know that Huitongda Network has a current liabilities to total assets ratio of 68%, which we'd consider pretty high. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. While it's not necessarily a bad thing, it can be beneficial if this ratio is lower.

另外需要注意的是,匯通達(臨時代碼)網絡的流動負債佔總資產比率爲68%,這個比例我們認爲相當高。這實際上意味着供應商(或短期債權人)正在資助業務的大部分,因此請注意這可能會帶來一些風險因素。雖然這並不一定是壞事,但如果這個比率較低會更有益。

The Key Takeaway

重要提示

In a nutshell, Huitongda Network has been trudging along with the same returns from the same amount of capital over the last two years. And in the last year, the stock has given away 30% so the market doesn't look too hopeful on these trends strengthening any time soon. All in all, the inherent trends aren't typical of multi-baggers, so if that's what you're after, we think you might have more luck elsewhere.

簡而言之,匯通達(臨時代碼)網絡在過去兩年裏利用相同資本獲得了相同回報。而在過去一年,股票跌去了30%,因此市場對這些趨勢短期內不太樂觀。總的來說,這些固有的趨勢並不典型於翻番股,因此如果您追求翻番股,我們認爲您可能能在其他地方更幸運。

If you'd like to know about the risks facing Huitongda Network, we've discovered 1 warning sign that you should be aware of.

如果您想了解匯通達(臨時代碼)面臨的風險,我們已經發現了1個警示信號,您應該注意。

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

如果您想尋找財務狀況良好、回報卓越的實力強企業,可以免費查看以下公司列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

0.058 = CN¥563m ÷ (CN¥30b - CN¥21b)

0.058 = CN¥563m ÷ (CN¥30b - CN¥21b)