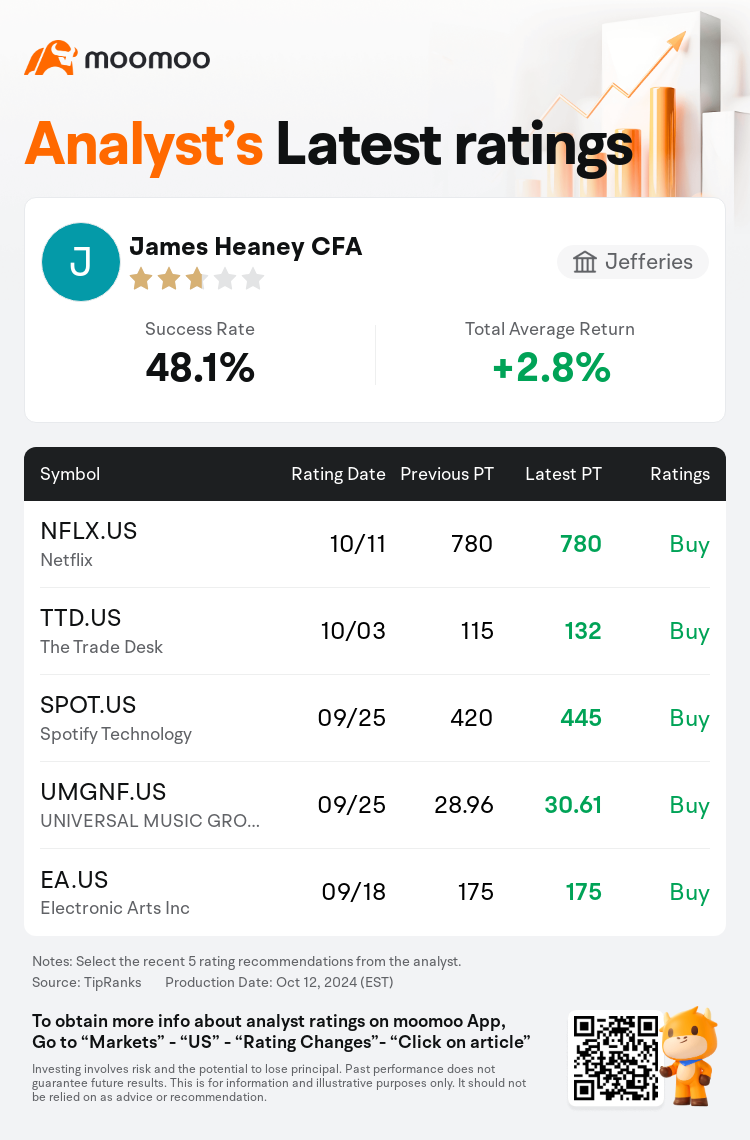

Jefferies analyst James Heaney CFA maintains $Netflix (NFLX.US)$ with a buy rating, and maintains the target price at $780.

According to TipRanks data, the analyst has a success rate of 48.1% and a total average return of 2.8% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Netflix (NFLX.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Netflix (NFLX.US)$'s main analysts recently are as follows:

The 'new normal' in Hollywood is believed to be advantageous for Netflix. It is suggested that the intensity of competition for content has lessened and that media company studios are more inclined to enter into licensing agreements. The potential introduction of an advertising tier is seen as a way for Netflix to further maximize revenue streams, with expectations that this could expand the total addressable market rather than just enhance average revenue per user. Forecasts for subscriber net additions remain positive, with projections for the third quarter described as 'likely conservative' and anticipation of growth continuing into the fourth quarter.

Netflix is still seen as a robust growth narrative with considerable potential for revenue, earnings, and free cash flow expansion in the upcoming years. Nonetheless, the current stock valuation suggests limited scope for further multiple expansion and anticipates a likely contraction as the company's growth decelerates into 2025, influenced by the diminishing transient benefit from paid sharing. It's assessed that Netflix sustained elevated subscriber growth due to paid sharing in the recent quarter, although the ephemeral advantages from this strategy are expected to diminish. The estimate for net additions in the third quarter has been revised upward.

The updated models within the media technology sector indicate a solid advertising market, as evidenced by a consistent 3% ad agency organic growth in the third quarter. This scenario is expected to contribute to a slight uptick in linear TV advertising revenues, notwithstanding the general decline when excluding Olympic-related revenues. There is a long-term confidence in the ad-supported tier of streaming services, which may be further strengthened by the inclusion of sports content and the potential for subscription price hikes.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

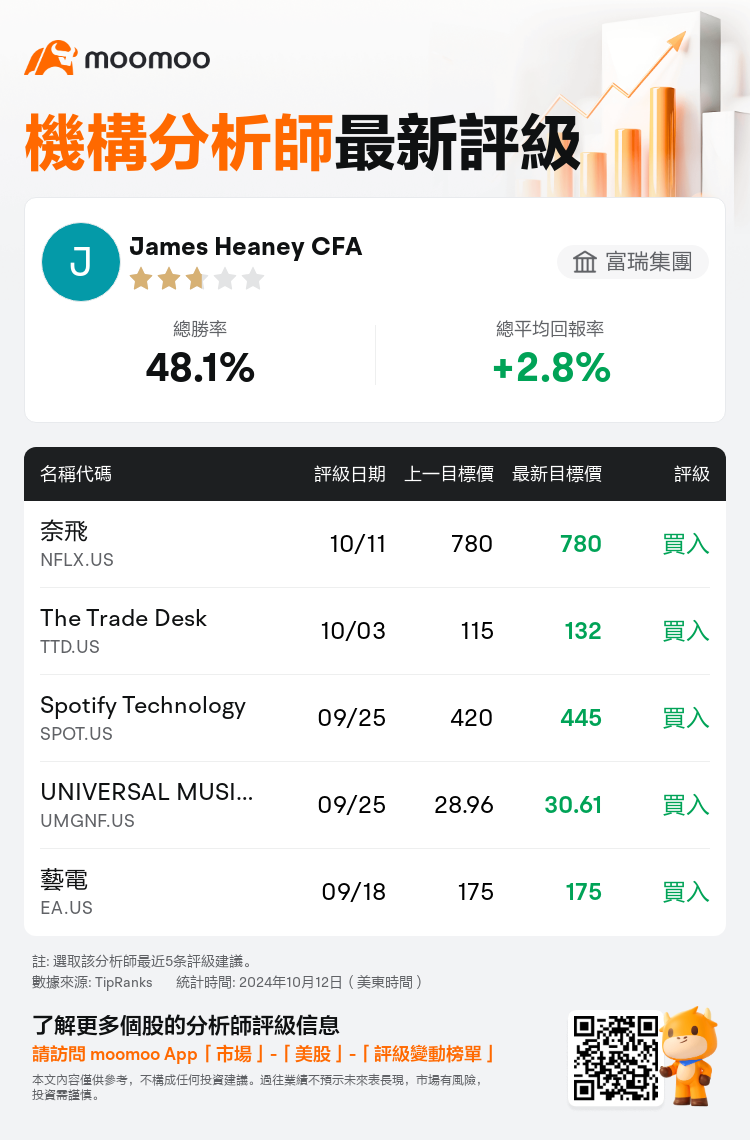

富瑞集團分析師James Heaney CFA維持$奈飛 (NFLX.US)$買入評級,維持目標價780美元。

根據TipRanks數據顯示,該分析師近一年總勝率為48.1%,總平均回報率為2.8%。

此外,綜合報道,$奈飛 (NFLX.US)$近期主要分析師觀點如下:

此外,綜合報道,$奈飛 (NFLX.US)$近期主要分析師觀點如下:

好萊塢的 「新常態」 被認爲對Netflix有利。有人認爲,內容競爭的激烈程度有所減弱,媒體公司的工作室更傾向於簽訂許可協議。可能引入廣告層被視爲Netflix進一步最大化收入來源的一種方式,預計這可能會擴大整個潛在市場,而不僅僅是提高每位用戶的平均收入。對訂戶淨增量的預測仍然樂觀,對第三季度的預測被描述爲 「可能比較保守」,對增長的預期將持續到第四季度。

Netflix仍被視爲強勁的增長敘事,在未來幾年中具有巨大的收入、收益和自由現金流擴張潛力。儘管如此,當前的股票估值表明進一步多次擴張的空間有限,並預計隨着公司增長減速到2025年,受有償共享的短暫收益減少的影響,可能會出現收縮。據評估,由於付費共享,Netflix在最近一個季度持續保持較高的訂戶增長,儘管該策略的短暫優勢預計將減弱。第三季度淨增量的估計已向上修正。

媒體技術領域的最新模型表明廣告市場穩健,第三季度廣告代理商持續實現3%的有機增長就證明了這一點。儘管不包括與奧運會相關的收入普遍下降,但這種情況預計將導致線性電視廣告收入略有增加。長期以來,人們對廣告支持的流媒體服務層面抱有信心,而體育內容的加入以及訂閱價格上漲的可能性可能會進一步增強這種信心。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$奈飛 (NFLX.US)$近期主要分析師觀點如下:

此外,綜合報道,$奈飛 (NFLX.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of