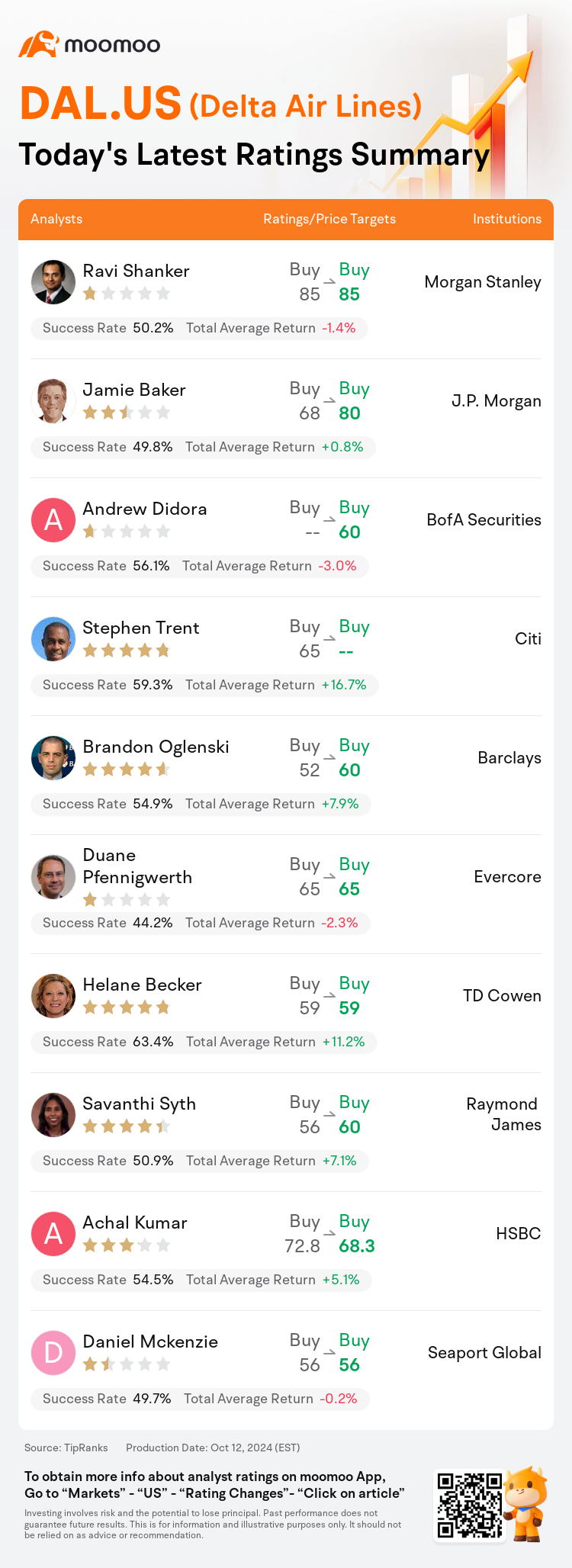

On Oct 12, major Wall Street analysts update their ratings for $Delta Air Lines (DAL.US)$, with price targets ranging from $56 to $85.

Morgan Stanley analyst Ravi Shanker maintains with a buy rating, and maintains the target price at $85.

J.P. Morgan analyst Jamie Baker maintains with a buy rating, and adjusts the target price from $68 to $80.

BofA Securities analyst Andrew Didora maintains with a buy rating, and sets the target price at $60.

BofA Securities analyst Andrew Didora maintains with a buy rating, and sets the target price at $60.

Citi analyst Stephen Trent maintains with a buy rating.

Barclays analyst Brandon Oglenski maintains with a buy rating, and adjusts the target price from $52 to $60.

Furthermore, according to the comprehensive report, the opinions of $Delta Air Lines (DAL.US)$'s main analysts recently are as follows:

Delta Air Lines' Q4 revenue growth forecast, ranging from 2% to 4%, came in slightly below the anticipated 3.5% at the midpoint. This was due to a somewhat lower than predicted capacity growth, coupled with unit revenues that met expectations. The attention of investors is now turning towards the investor day scheduled for November 20. During this event, it is anticipated that further insights will be shared about Delta's long-term earnings prospects, return on invested capital (ROIC) goals, financial objectives, and priorities in capital distribution.

The forecast for Delta Air Lines' Q4 unit revenue was slightly below expectations. Nonetheless, it suggests an improving industry environment as the pace of capacity expansion moderates following a period of vigorous growth earlier in the year.

Here are the latest investment ratings and price targets for $Delta Air Lines (DAL.US)$ from 10 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

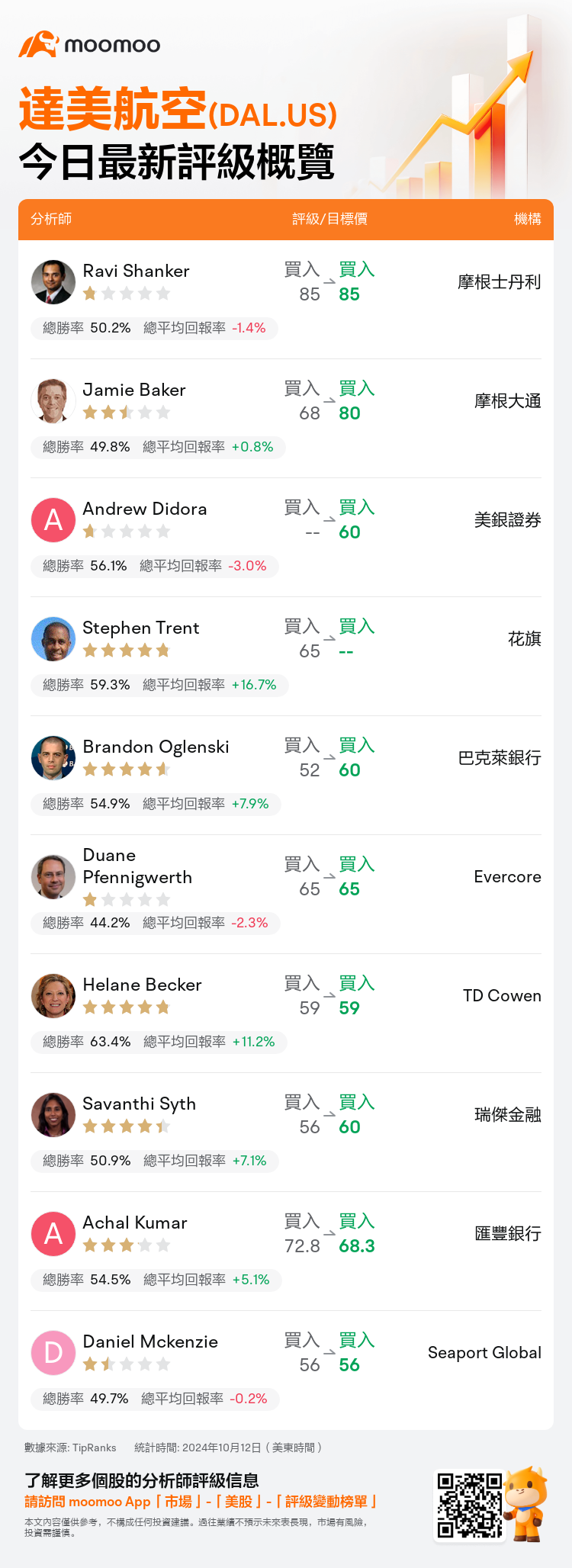

美東時間10月12日,多家華爾街大行更新了$達美航空 (DAL.US)$的評級,目標價介於56美元至85美元。

摩根士丹利分析師Ravi Shanker維持買入評級,維持目標價85美元。

摩根大通分析師Jamie Baker維持買入評級,並將目標價從68美元上調至80美元。

美銀證券分析師Andrew Didora維持買入評級,目標價60美元。

美銀證券分析師Andrew Didora維持買入評級,目標價60美元。

花旗分析師Stephen Trent維持買入評級。

巴克萊銀行分析師Brandon Oglenski維持買入評級,並將目標價從52美元上調至60美元。

此外,綜合報道,$達美航空 (DAL.US)$近期主要分析師觀點如下:

達美航空第四季度營業收入增長預測爲2%至4%,略低於預期的3.5%中點。這是由於座艙容量增長略低於預期,同時單位收入符合預期。投資者的關注現在轉向了安排在11月20日的投資者日。在此活動中,預計將進一步分享有關達美航空長期收益前景、投資回報率(ROIC)目標、財務目標以及資本分配優先事項的見解。

達美航空第四季度單位收入預測略低於預期。然而,這表明在經歷了年初快速增長之後,座艙擴展步伐逐漸放緩,暗示行業環境正在改善。

以下爲今日10位分析師對$達美航空 (DAL.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

美銀證券分析師Andrew Didora維持買入評級,目標價60美元。

美銀證券分析師Andrew Didora維持買入評級,目標價60美元。

BofA Securities analyst Andrew Didora maintains with a buy rating, and sets the target price at $60.

BofA Securities analyst Andrew Didora maintains with a buy rating, and sets the target price at $60.