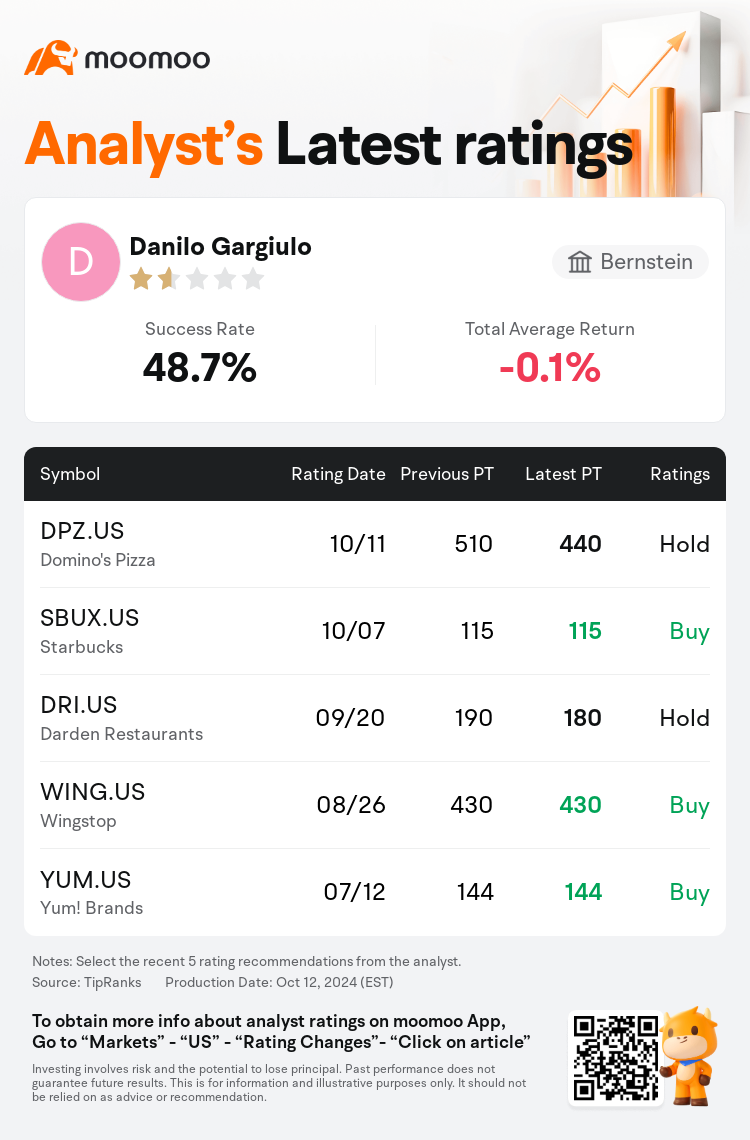

Bernstein analyst Danilo Gargiulo maintains $Domino's Pizza (DPZ.US)$ with a hold rating, and adjusts the target price from $510 to $440.

According to TipRanks data, the analyst has a success rate of 48.7% and a total average return of -0.1% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Domino's Pizza (DPZ.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Domino's Pizza (DPZ.US)$'s main analysts recently are as follows:

The recent quarter for Domino's Pizza is described as varied with the U.S. performance aligning with expectations, whereas the International segment is mainly responsible for a subdued revenue forecast. Considering the moderately cautious expectations, the future perspective for 2025 might be seen as somewhat cautious, which could potentially lower the risk. However, there are still lingering questions about the cautious nature of this outlook and what will drive the U.S. to maintain a same-store sales growth exceeding 3% in FY25.

Domino's Pizza's recent U.S. comparable sales figure of 3.0% involved a notable 2.7% contribution from partnerships with Uber and other third-party channels, complemented by a 1.6% increase in pricing. The overall performance indicates that Domino's is facing challenges in a significantly more competitive market landscape.

Domino's Pizza's Q3 results and subsequent discussions have indicated a normalization of the U.S. pizza sector to its pre-pandemic performance levels. The segment remains fiercely competitive, and despite Domino's standing as a leader and consistent market share gainer over the long term, its quarterly same-store-sales are influenced by the ongoing battles over value, promotional activities, and product innovation.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

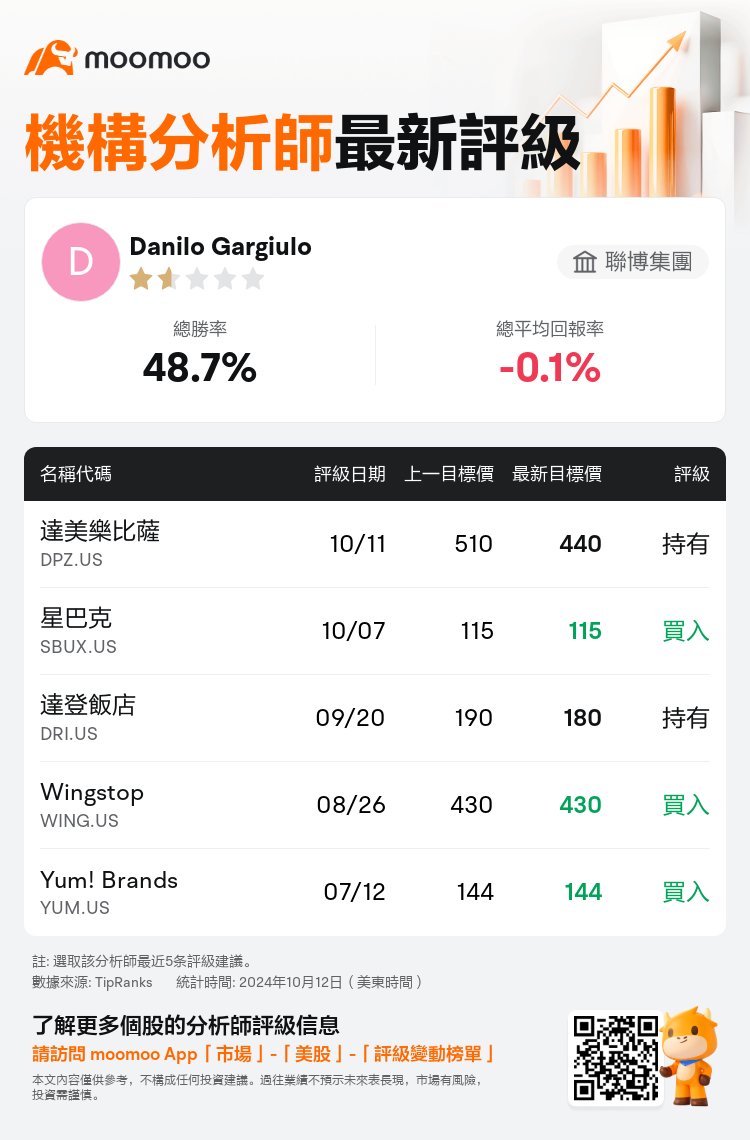

聯博集團分析師Danilo Gargiulo維持$達美樂比薩 (DPZ.US)$持有評級,並將目標價從510美元下調至440美元。

根據TipRanks數據顯示,該分析師近一年總勝率為48.7%,總平均回報率為-0.1%。

此外,綜合報道,$達美樂比薩 (DPZ.US)$近期主要分析師觀點如下:

此外,綜合報道,$達美樂比薩 (DPZ.US)$近期主要分析師觀點如下:

最近的一個季度達美樂披薩的情況各不相同,美國業績符合預期,而國際板塊主要負責抑制營業收入預期。考慮到相對謹慎的預期,2025年的未來展望可能被視爲有些謹慎,這可能會降低風險。然而,對於此展望謹慎性質仍存有疑問,以及是什麼將推動美國在2025財年保持同店銷售增長超過3%的問題尚未解答。

達美樂披薩最近在美國的可比銷售增長率爲3.0%,其中有顯著的2.7%來自與優步和其他第三方渠道的合作,再加上1.6%的定價增長。總體表現表明,達美樂面臨着一個競爭更爲激烈的市場格局帶來的挑戰。

達美樂披薩的第三季度業績及隨後的討論表明,美國披薩行業正逐漸恢復到疫情前的水平。該板塊仍然充滿激烈競爭,儘管達美樂始終是領導者且在長期內市場份額穩定增長,但其季度同店銷售受到價值、促銷活動和產品創新的持續競爭影響。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$達美樂比薩 (DPZ.US)$近期主要分析師觀點如下:

此外,綜合報道,$達美樂比薩 (DPZ.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of