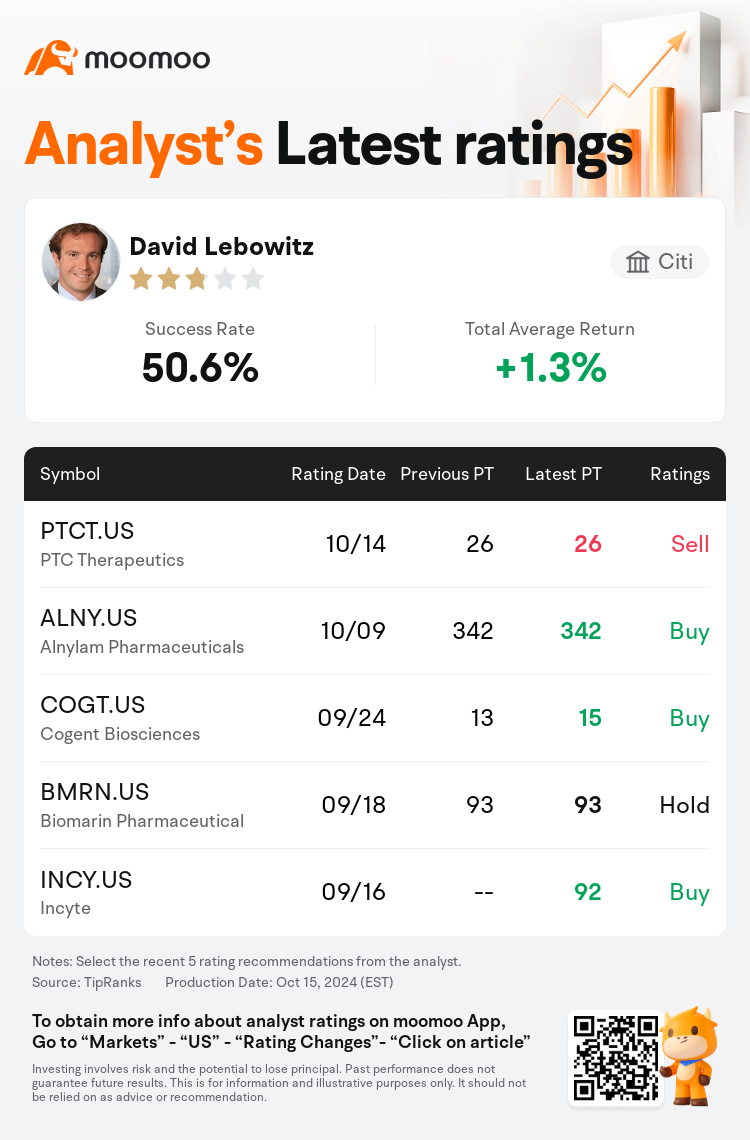

Citi analyst David Lebowitz maintains $PTC Therapeutics (PTCT.US)$ with a sell rating, and maintains the target price at $26.

According to TipRanks data, the analyst has a success rate of 50.6% and a total average return of 1.3% over the past year.

Furthermore, according to the comprehensive report, the opinions of $PTC Therapeutics (PTCT.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $PTC Therapeutics (PTCT.US)$'s main analysts recently are as follows:

PTC Therapeutics recently disclosed Q2 results, with notable sales for Translarna and Emflaza. However, the future of Translarna in EU markets remains uncertain after several adverse opinions from the Committee for Medicinal Products for Human Use (CHMP). A conclusive CHMP opinion is anticipated by mid-October, which could lead to Translarna's withdrawal from the EU market if unfavorable. The success of the company's pipeline programs is deemed essential before contemplating a change in the current analytical outlook.

Estimations are modestly ahead of the consensus regarding Translarna net product revenues and align with expectations on Emflaza net product revenue. Attention is directed towards gaining insights on the CHMP re-examination process and the provision of further details requested by the FDA concerning the NDA re-submission.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

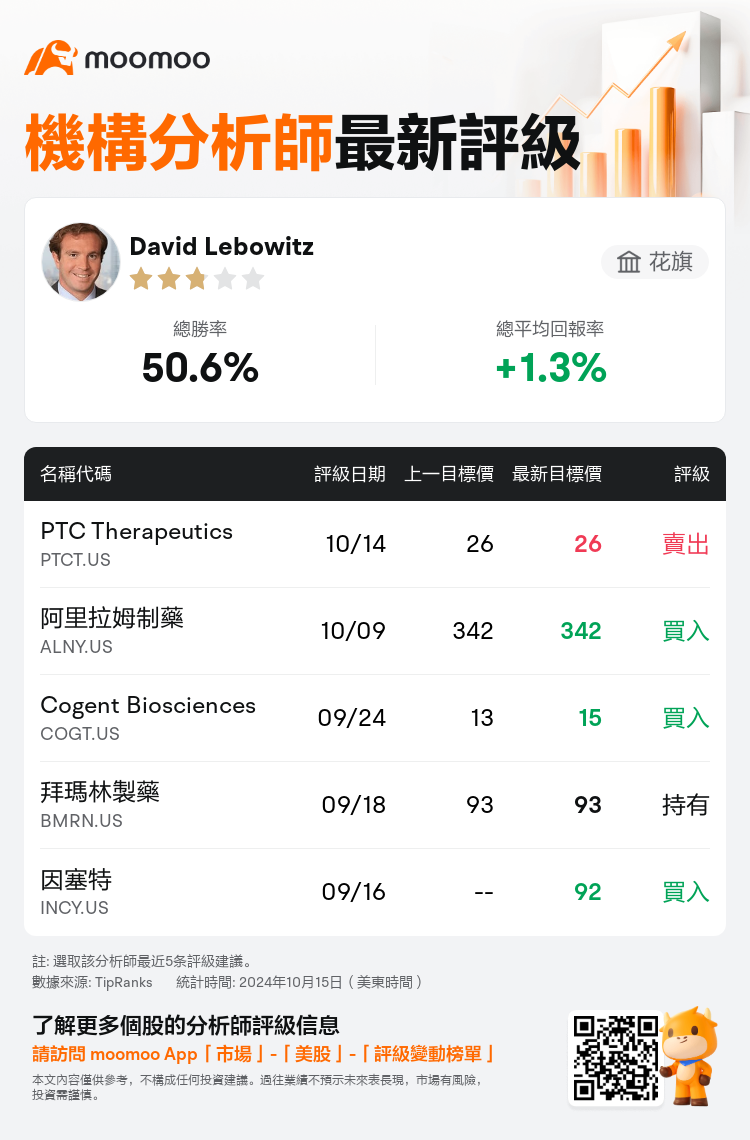

花旗分析師David Lebowitz維持$PTC Therapeutics (PTCT.US)$賣出評級,維持目標價26美元。

根據TipRanks數據顯示,該分析師近一年總勝率為50.6%,總平均回報率為1.3%。

此外,綜合報道,$PTC Therapeutics (PTCT.US)$近期主要分析師觀點如下:

此外,綜合報道,$PTC Therapeutics (PTCT.US)$近期主要分析師觀點如下:

ptc therapeutics最近披露了Q2的結果,Translarna和Emflaza的銷售額顯著。然而,在歐盟市場,由於多次被歐洲藥物人用委員會(CHMP)發表負面意見,Translarna的未來仍然不確定。預計CHMP將在10月中旬作出最終意見,如果不利,可能導致Translarna退出歐盟市場。在考慮改變當前分析觀點之前,公司管道項目的成功被認爲是至關重要的。

對於Translarna淨產品收入方面的估計略高於共識,與Emflaza淨產品收入的預期一致。注意力集中在獲得有關CHMP重新審查過程以及美國食品和藥物管理局要求有關NDA再提交的進一步細節上。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$PTC Therapeutics (PTCT.US)$近期主要分析師觀點如下:

此外,綜合報道,$PTC Therapeutics (PTCT.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of