Smart Money Is Betting Big In ARM Options

Smart Money Is Betting Big In ARM Options

Whales with a lot of money to spend have taken a noticeably bearish stance on ARM Holdings.

有大量資金可以花的鯨魚對ARM Holdings採取了明顯的看跌立場。

Looking at options history for ARM Holdings (NASDAQ:ARM) we detected 17 trades.

查看ArM Holdings(納斯達克股票代碼:ARM)的期權歷史記錄,我們發現了17筆交易。

If we consider the specifics of each trade, it is accurate to state that 29% of the investors opened trades with bullish expectations and 52% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,29%的投資者以看漲的預期開盤,52%的投資者持看跌預期。

From the overall spotted trades, 7 are puts, for a total amount of $302,995 and 10, calls, for a total amount of $478,313.

在已發現的全部交易中,有7筆是看跌期權,總額爲302,995美元,10筆是看漲期權,總額爲478,313美元。

Projected Price Targets

預計價格目標

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $87.5 to $215.0 for ARM Holdings over the last 3 months.

考慮到這些合約的交易量和未平倉合約,在過去的3個月中,鯨魚似乎一直將Arm Holdings的價格定在87.5美元至215.0美元之間。

Volume & Open Interest Trends

交易量和未平倉合約趨勢

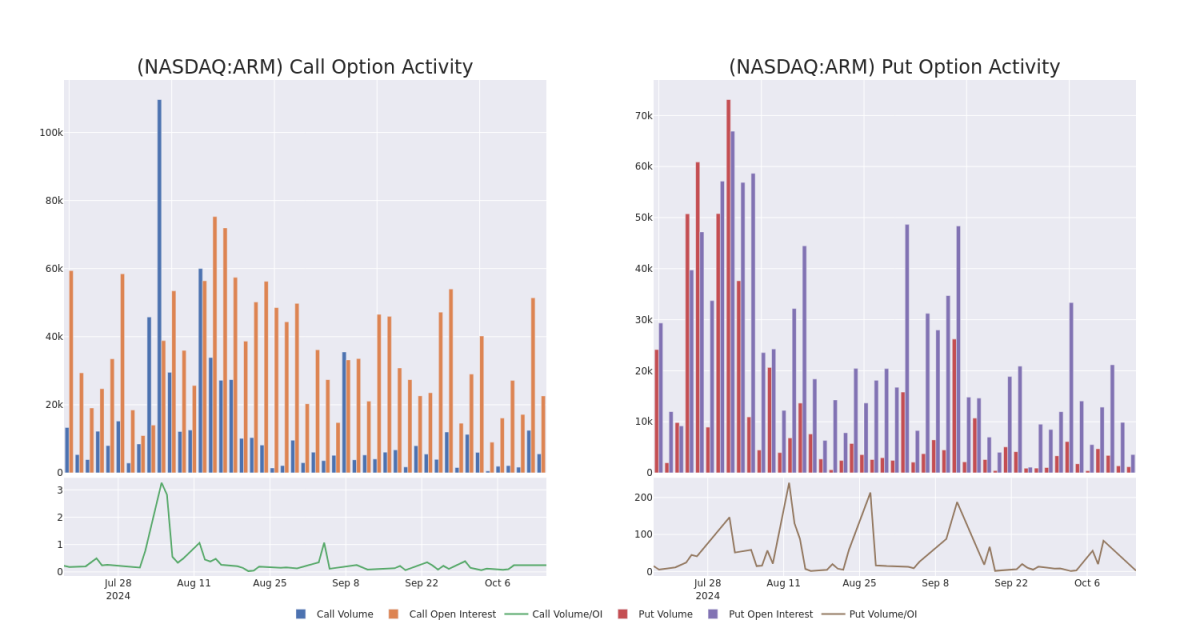

In terms of liquidity and interest, the mean open interest for ARM Holdings options trades today is 2378.64 with a total volume of 6,753.00.

就流動性和利息而言,今天ArM Holdings期權交易的平均未平倉合約爲2378.64份,總交易量爲6,753.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for ARM Holdings's big money trades within a strike price range of $87.5 to $215.0 over the last 30 days.

在下圖中,我們可以跟蹤過去30天在87.5美元至215.0美元的行使價區間內,arM Holdings大額資金交易的看漲期權和未平倉合約的發展情況。

ARM Holdings Option Activity Analysis: Last 30 Days

arM Holdings 期權活動分析:過去 30 天

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ARM | PUT | SWEEP | BEARISH | 11/15/24 | $20.0 | $19.9 | $20.0 | $170.00 | $75.8K | 507 | 63 |

| ARM | CALL | TRADE | BULLISH | 01/17/25 | $36.0 | $35.4 | $36.0 | $135.00 | $72.0K | 1.1K | 0 |

| ARM | CALL | SWEEP | NEUTRAL | 10/25/24 | $1.5 | $1.34 | $1.5 | $175.00 | $60.0K | 1.7K | 404 |

| ARM | CALL | SWEEP | BULLISH | 10/18/24 | $1.38 | $1.01 | $1.38 | $170.00 | $56.5K | 13.4K | 1.2K |

| ARM | CALL | SWEEP | BULLISH | 10/18/24 | $1.37 | $1.02 | $1.37 | $170.00 | $50.8K | 13.4K | 2.0K |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 手臂 | 放 | 掃 | 粗魯的 | 11/15/24 | 20.0 美元 | 19.9 美元 | 20.0 美元 | 170.00 美元 | 75.8 萬美元 | 507 | 63 |

| 手臂 | 打電話 | 貿易 | 看漲 | 01/17/25 | 36.0 美元 | 35.4 美元 | 36.0 美元 | 135.00 美元 | 72.0 萬美元 | 1.1K | 0 |

| 手臂 | 打電話 | 掃 | 中立 | 10/25/24 | 1.5 美元 | 1.34 | 1.5 美元 | 175.00 美元 | 60.0 萬美元 | 1.7K | 404 |

| 手臂 | 打電話 | 掃 | 看漲 | 10/18/24 | 1.38 | 1.01 | 1.38 | 170.00 美元 | 56.5 萬美元 | 13.4K | 1.2K |

| 手臂 | 打電話 | 掃 | 看漲 | 10/18/24 | 1.37 美元 | 1.02 | 1.37 美元 | 170.00 美元 | 50.8 萬美元 | 13.4K | 2.0K |

About ARM Holdings

關於 ARM 控股

Arm Holdings is the IP owner and developer of the ARM architecture (ARM stands for Acorn RISC Machine), which is used in 99% of the world's smartphone CPU cores, and it also has high market share in other battery-powered devices like wearables, tablets, or sensors. Arm licenses its architecture for a fee, offering different types of licenses depending on the flexibility the customer needs. Customers like Apple or Qualcomm buy architectural licenses, which allows them to modify the architecture and add or delete instructions to tailor the chips to their specific needs. Other clients directly buy off-the-shelf designs from Arm. Off-the-shelf and architectural customers pay a royalty fee per chip shipped.

Arm Holdings是ARM架構(ARM代表Acorn RISC Machine)的知識產權所有者和開發者,該架構用於全球99%的智能手機CPU內核,並且在可穿戴設備、平板電腦或傳感器等其他電池供電設備中也佔有很高的市場份額。Arm 對其架構進行付費許可,根據客戶需要的靈活性提供不同類型的許可證。蘋果或高通等客戶購買架構許可證,這使他們能夠修改架構並添加或刪除指令,以根據自己的特定需求定製芯片。其他客戶直接從Arm購買現成設計。現成和架構客戶爲每發貨的芯片支付特許權使用費。

Having examined the options trading patterns of ARM Holdings, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了ARM Holdings的期權交易模式之後,我們的注意力現在直接轉向了該公司。這種轉變使我們能夠深入研究其目前的市場地位和表現

ARM Holdings's Current Market Status

ARM Holdings的當前市場狀況

- With a volume of 392,215, the price of ARM is down -1.28% at $159.75.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 22 days.

- ARM的價格下跌了-1.28%,至159.75美元,交易量爲392,215美元。

- RSI 指標暗示標的股票可能處於超買狀態。

- 下一份業績預計將在22天后公佈。

Turn $1000 into $1270 in just 20 days?

在短短 20 天內將 1000 美元變成 1270 美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年專業期權交易員透露了他的單線圖技術,該技術顯示何時買入和賣出。複製他的交易,平均每20天獲利27%。點擊此處訪問。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for ARM Holdings with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了獲得更高利潤的可能性。精明的交易者通過持續的教育、戰略交易調整、利用各種指標以及隨時關注市場動態來降低這些風險。使用Benzinga Pro了解ARM Holdings的最新期權交易,獲取實時提醒。

From the overall spotted trades, 7 are puts, for a total amount of $302,995 and 10, calls, for a total amount of $478,313.

From the overall spotted trades, 7 are puts, for a total amount of $302,995 and 10, calls, for a total amount of $478,313.