Market Mover | ASML Shares Are Trading Lower After Publishing Q3 Results

Market Mover | ASML Shares Are Trading Lower After Publishing Q3 Results

October 15, 2024 - $ASML Holding (ASML.US)$ shares decreased 13.72% to $752.57 in market trading on Tuesday. Today, the company has published its 2024 third-quarter results.

2024年10月15日 - $阿斯麥 (ASML.US)$ 股價週二在市場交易中下跌了13.72%,至752.57美元。今天,該公司發佈了2024年第三季度的業績。

Performance for 2024 third-quarter results

2024年第三季度業績表現

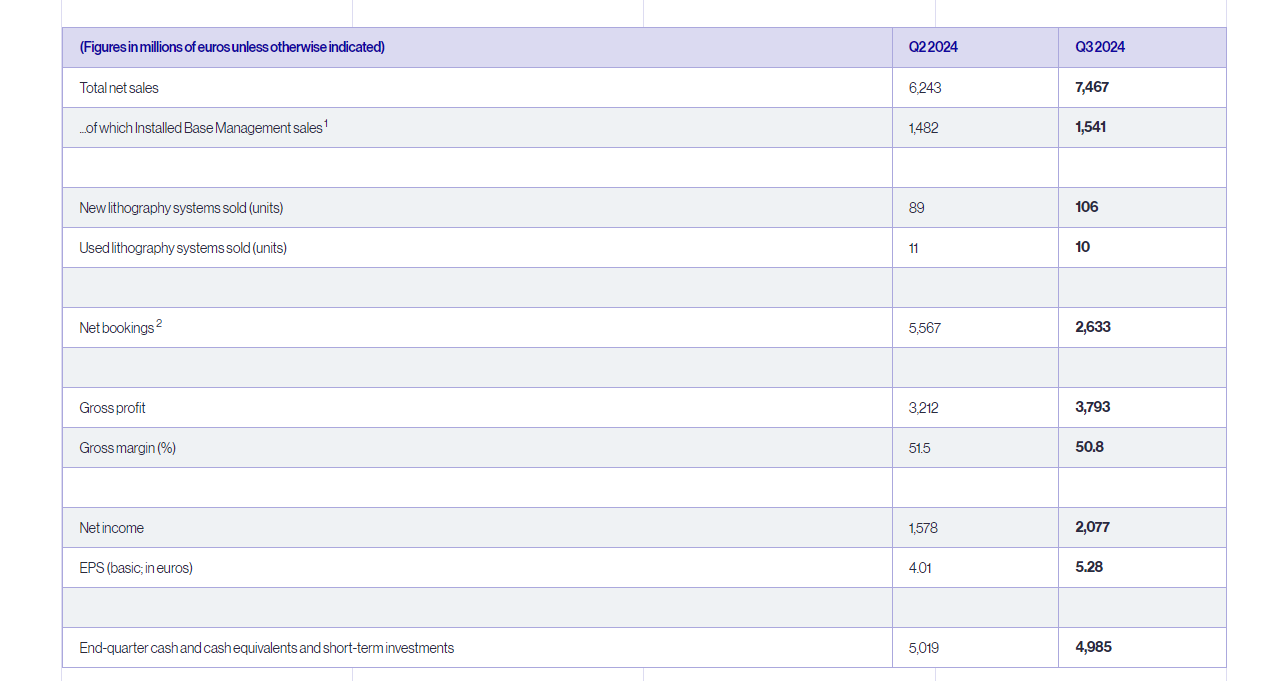

Q3 total net sales of €7.5 billion, gross margin of 50.8%, net income of €2.1 billion

Quarterly net bookings in Q3 of €2.6 billion of which €1.4 billion is EUV

ASML expects Q4 2024 total net sales between €8.8 billion and €9.2 billion, and a gross margin between 49% and 50%

ASML expects 2024 total net sales of around €28 billion

ASML expects 2025 total net sales to be between €30 billion and €35 billion, with a gross margin between 51% and 53%

第三季度總淨銷售額爲75億歐元,毛利率爲50.8%,淨利潤爲21億歐元

第三季度淨預訂額爲26億歐元,其中14億歐元爲EUV

ASML預計2024年第四季度總淨銷售額將在88億歐元至92億歐元之間,毛利率在49%至50%之間

ASML預計2024年總淨銷售額約爲280億歐元

ASML預計2025年總淨銷售額將在300億歐元和350億歐元之間,毛利率在51%至53%之間。

CEO statement and outlook

CEO聲明和展望

"Our third-quarter total net sales came in at €7.5 billion, above our guidance, driven by more DUV and Installed Base Management1 sales. The gross margin came in at 50.8%, within guidance.

“我們第三季度總淨銷售額爲750億歐元,超出了我們的預期,主要受到更多DUV和已安裝基礎管理1銷售的推動。毛利率爲50.8%,處於指導範圍內。

"While there continue to be strong developments and upside potential in AI, other market segments are taking longer to recover. It now appears the recovery is more gradual than previously expected. This is expected to continue in 2025, which is leading to customer cautiousness. Regarding Logic, the competitive foundry dynamics have resulted in a slower ramp of new nodes at certain customers, leading to several fab push outs and resulting changes in litho demand timing, in particular EUV. In Memory, we see limited capacity additions, with the focus still on technology transitions supporting the HBM and DDR5 AI-related demand.

“儘管人工智能領域仍然存在強勁的發展和增長潛力,但其他市場領域的復甦需要更長時間。目前看來,復甦過程比之前預期的更爲漸進。預計這種情況將持續到2025年,這導致客戶表現出謹慎態度。在邏輯芯片領域,競爭性晶圓代工動態導致某些客戶新節點的啓動速度減緩,推遲了數家晶圓廠的投產並改變了光刻需求時間,尤其是EUV技術。在存儲領域,我們看到容量增長有限,重點仍在支持HBm和DDR5人工智能相關需求的技術轉換上。

"We expect fourth-quarter total net sales between €8.8 billion and €9.2 billion with a gross margin between 49% and 50% which includes the recognition of the first two High NA systems upon customer acceptance, reflecting progress on imaging, overlay and contrast. ASML expects R&D costs of around €1.1 billion and SG&A costs of around €300 million. We expect full-year 2024 total net sales of around €28 billion. Based on the recent market dynamics as mentioned above, we expect our 2025 total net sales to grow to a range between €30 billion and €35 billion, which is the lower half of the range that we provided at our 2022 Investor Day. We expect a gross margin between 51% and 53%, which is below the range we then provided, mainly related to the delayed timing of EUV demand," said ASML President and Chief Executive Officer Christophe Fouquet.

「我們預計第四季度總淨銷售額在88億歐元至92億歐元之間,毛利率在49%至50%之間,其中包括首次接受客戶驗收的前兩臺High NA系統的確認,反映了成像、疊加和對比度方面取得的進展。ASML預計研發成本約爲11億歐元,銷售及管理成本約爲30000萬歐元。我們預計2024年全年總淨銷售額約爲280億歐元。基於以上所述的最近市場動態,我們預計2025年總淨銷售額將增長到300億歐元和350億歐元之間,這在2022年投資者日提供的範圍中處於下限。我們預計毛利率在51%至53%之間,低於我們當時提供的範圍,主要是因爲EUV需求的推遲。」 ASML總裁兼首席執行官Christophe Fouquet如是說。

Related Reading: ASML announces Q3 2024 financial results

相關閱讀:ASML宣佈2024年第三季度財務業績

Quarterly net bookings in Q3 of €2.6 billion of which €1.4 billion is EUV

Quarterly net bookings in Q3 of €2.6 billion of which €1.4 billion is EUV