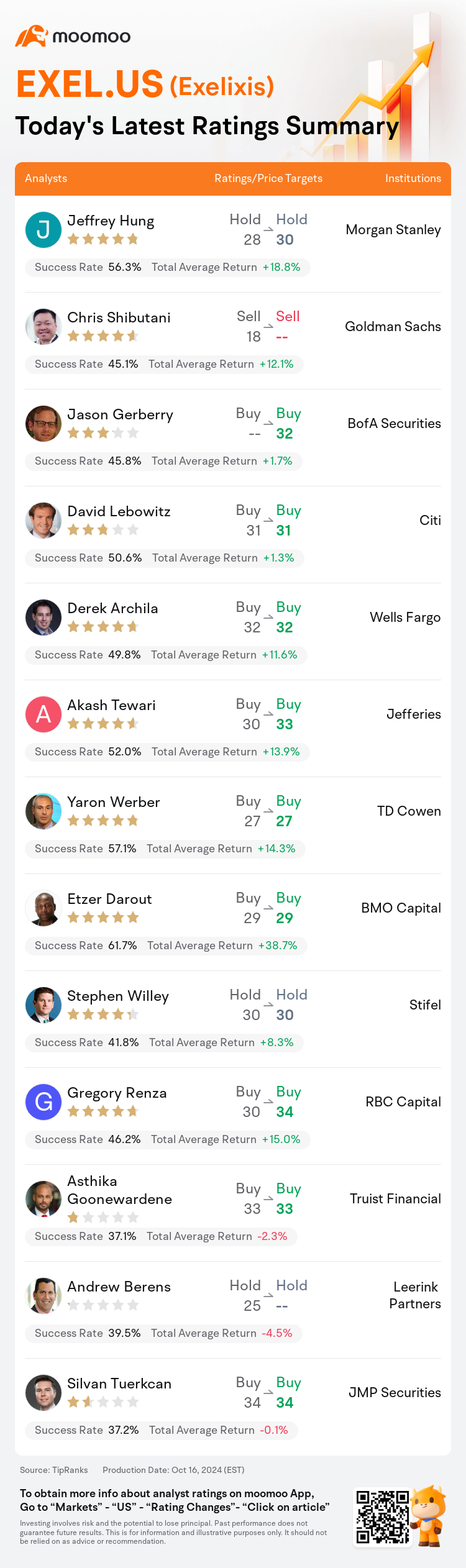

On Oct 16, major Wall Street analysts update their ratings for $Exelixis (EXEL.US)$, with price targets ranging from $27 to $34.

Morgan Stanley analyst Jeffrey Hung maintains with a hold rating, and adjusts the target price from $28 to $30.

Goldman Sachs analyst Chris Shibutani maintains with a sell rating.

BofA Securities analyst Jason Gerberry maintains with a buy rating, and sets the target price at $32.

BofA Securities analyst Jason Gerberry maintains with a buy rating, and sets the target price at $32.

Citi analyst David Lebowitz maintains with a buy rating, and maintains the target price at $31.

Wells Fargo analyst Derek Archila maintains with a buy rating, and maintains the target price at $32.

Furthermore, according to the comprehensive report, the opinions of $Exelixis (EXEL.US)$'s main analysts recently are as follows:

The recent judgment regarding the Cabometyx MSN II case confirmed that the Malate Salt Patents remain valid and the '349 patent was neither infringed upon nor invalid. This outcome is seen as beneficial because it ensures patent protection until 2030. Although the decision falls shy of the more optimal scenario that could have extended the patent protection until 2032, it still represents a solid victory.

The affirmation of Cabometyx patent protection extending into 2030 has provided a new viewpoint for the company's future, with the progression of its pipeline now serving as a key narrative in driving the stock's value. The extended exclusivity period for Cabo and the improved prospects for the stock contribute to a more optimistic stance.

The recent legal ruling regarding MSN Laboratories litigation is considered a positive development for Exelixis, significantly enhancing the outlook for Cabometyx's patent exclusivity. This provides the company clear insights into prospective business development endeavors. The potential of zanzalintinib is viewed as a crucial element for the company's transition strategy beyond Cabometyx, with recent partnerships also garnering interest.

The affirmation of patent infringement and the validity of claims related to Exelixis' polymorph patents is seen as significantly positive. This development not only reinforces the intellectual protection for Cabometyx, potentially translating into considerable free cash flow, but also may lead to increased investor interest in other assets within the pipeline, including zanza.

Here are the latest investment ratings and price targets for $Exelixis (EXEL.US)$ from 13 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

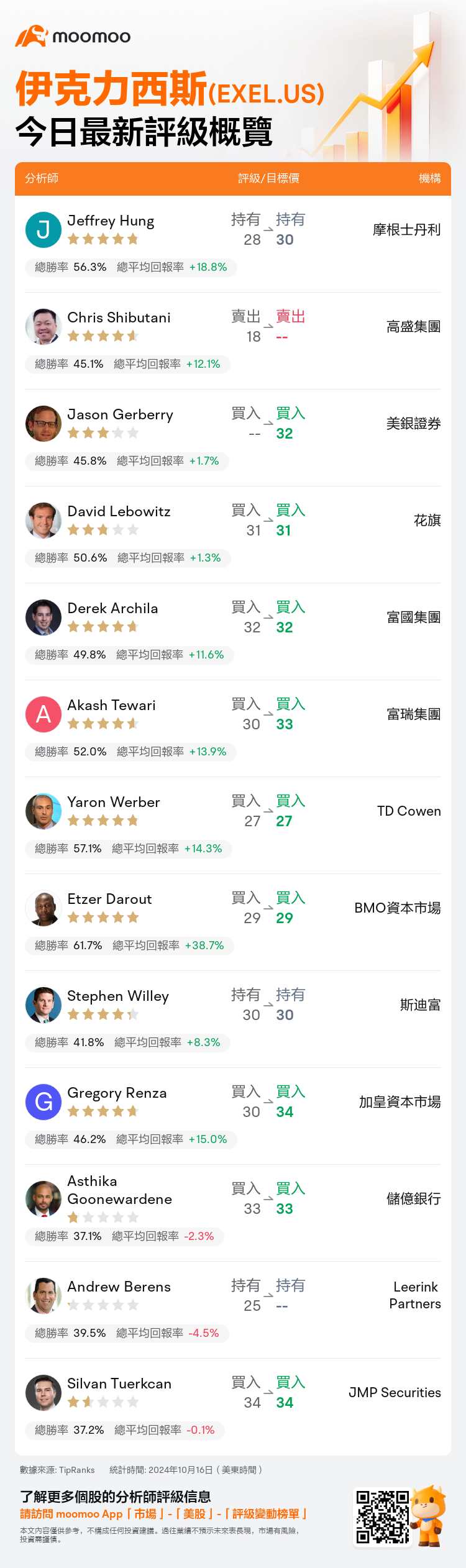

美東時間10月16日,多家華爾街大行更新了$伊克力西斯 (EXEL.US)$的評級,目標價介於27美元至34美元。

摩根士丹利分析師Jeffrey Hung維持持有評級,並將目標價從28美元上調至30美元。

高盛集團分析師Chris Shibutani維持賣出評級。

美銀證券分析師Jason Gerberry維持買入評級,目標價32美元。

美銀證券分析師Jason Gerberry維持買入評級,目標價32美元。

花旗分析師David Lebowitz維持買入評級,維持目標價31美元。

富國集團分析師Derek Archila維持買入評級,維持目標價32美元。

此外,綜合報道,$伊克力西斯 (EXEL.US)$近期主要分析師觀點如下:

關於Cabometyx MSN II案件的最新裁決確認Malate鹽專利仍然有效,'349專利既沒有侵權也不無效。這一結果被視爲有利,因爲它確保了專利保護至2030年。儘管該決定未能達到將專利保護延長至2032年的更理想情況,但仍代表一次堅實的勝利。

Cabometyx專利保護延伸至2030年的確認爲公司未來提供了新的視角,其產品線的進展現在成爲推動股價價值的關鍵敘事。Cabometyx和股票前景的擴展獨家期限有助於更加樂觀的立場。

關於MSN實驗室訴訟的最新法律裁決被視爲Exelixis的積極發展,顯著增強了Cabometyx專利獨家性的前景。這爲公司提供了對未來業務發展的清晰洞察。zanzalintinib的潛力被視爲公司在Cabometyx之外過渡策略的關鍵要素,最近的合作伙伴也引起了關注。

對於Exelixis的多形態專利侵權和索賠有效性的確認被視爲極爲積極的。這一發展不僅加強了Cabometyx的知識產權保護,有望轉化爲可觀的自由現金流,還可能導致投資者對管道內其他資產,包括zanza,產生更多興趣。

以下爲今日13位分析師對$伊克力西斯 (EXEL.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

美銀證券分析師Jason Gerberry維持買入評級,目標價32美元。

美銀證券分析師Jason Gerberry維持買入評級,目標價32美元。

BofA Securities analyst Jason Gerberry maintains with a buy rating, and sets the target price at $32.

BofA Securities analyst Jason Gerberry maintains with a buy rating, and sets the target price at $32.