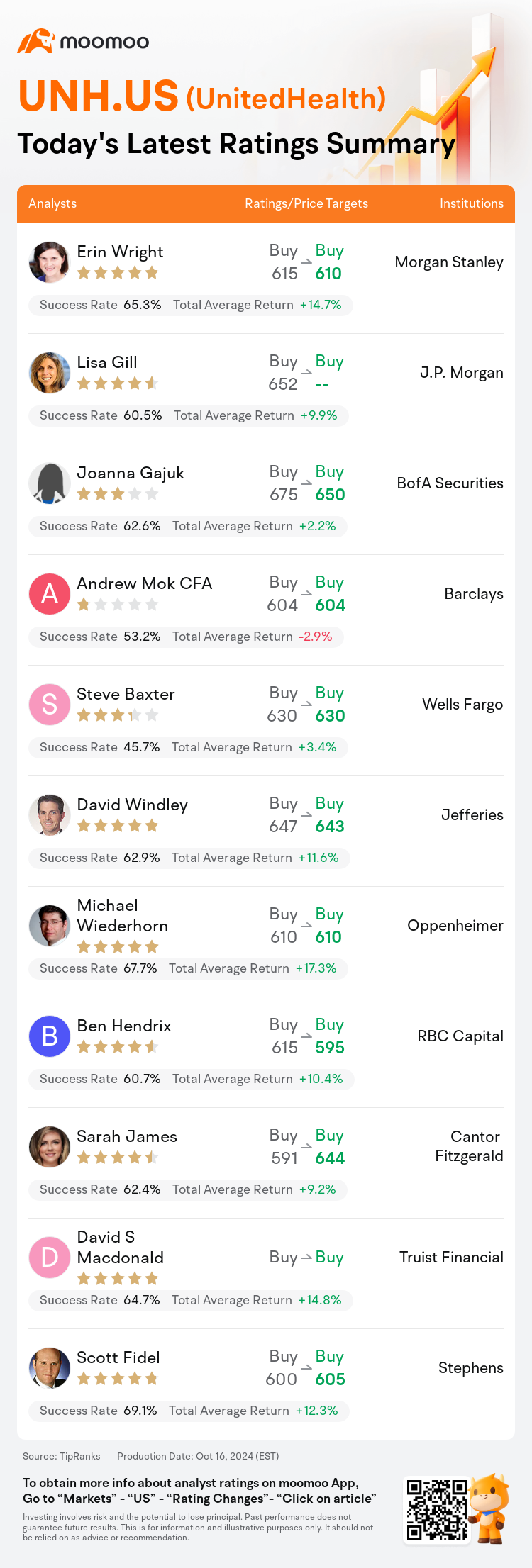

On Oct 16, major Wall Street analysts update their ratings for $UnitedHealth (UNH.US)$, with price targets ranging from $595 to $650.

Morgan Stanley analyst Erin Wright maintains with a buy rating, and adjusts the target price from $615 to $610.

J.P. Morgan analyst Lisa Gill maintains with a buy rating.

BofA Securities analyst Joanna Gajuk maintains with a buy rating, and adjusts the target price from $675 to $650.

BofA Securities analyst Joanna Gajuk maintains with a buy rating, and adjusts the target price from $675 to $650.

Barclays analyst Andrew Mok CFA maintains with a buy rating, and maintains the target price at $604.

Wells Fargo analyst Steve Baxter maintains with a buy rating, and maintains the target price at $630.

Furthermore, according to the comprehensive report, the opinions of $UnitedHealth (UNH.US)$'s main analysts recently are as follows:

The initial forecast for UnitedHealth's FY25 EPS of approximately $30 at the upper end was characterized as a more cautious estimation compared to previous tendencies, influencing the stock's performance. Nevertheless, this prediction is seen as an easily surpassable minimum threshold by the company.

Following the decline in share value after guidance for 2025 fell short of expectations, the focus has been directed toward why UnitedHealth may be better situated compared to its competitors, with potential benefits arising from market share expansions. Despite the Medicare Advantage sector experiencing challenges with rates and reimbursements, UnitedHealth appears well-equipped to handle these pressures due to the profitability of its Medicare Advantage business. Post the company's Q3 report, earnings per share estimates were modestly revised, along with a corresponding adjustment to the valuation multiple.

The analyst notes that after UnitedHealth's Q3 results, expectations for the company's future earnings per share have been adjusted to account for continued 'elevated' Medicare coding intensity that has endured even after the resumption of prior authorization. Additionally, there are headwinds related to Medicaid acuity, but these are anticipated to be 'transitory'.

The third quarter results for UnitedHealth were not up to par, chiefly due to elevated medical costs and an initial EPS forecast for 2025 that fell short of projections. Despite a prior cautious stance on MA MCOs preceding the third-quarter earnings, there was an expectation that UnitedHealth could hasten EPS growth in 2025 to align with long-term goals. Nonetheless, persistent challenges, compounded by UnitedHealth's choice to continue organic investments, suggest that this scenario may be deferred until 2026.

Here are the latest investment ratings and price targets for $UnitedHealth (UNH.US)$ from 11 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

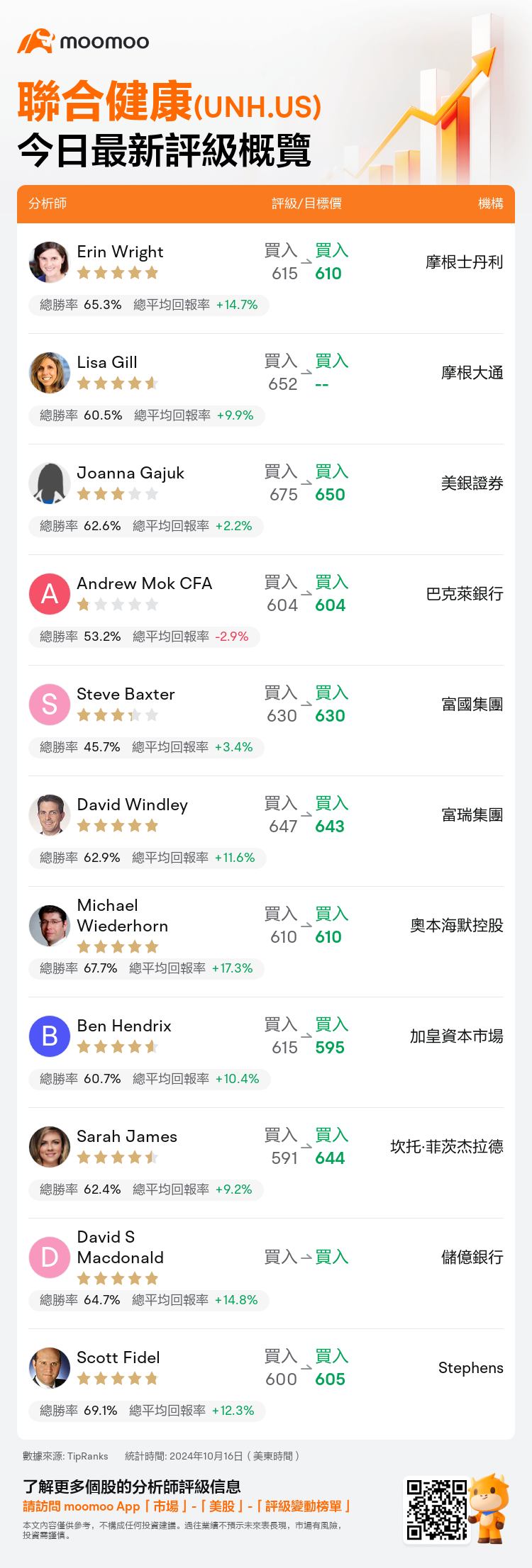

美東時間10月16日,多家華爾街大行更新了$聯合健康 (UNH.US)$的評級,目標價介於595美元至650美元。

摩根士丹利分析師Erin Wright維持買入評級,並將目標價從615美元下調至610美元。

摩根大通分析師Lisa Gill維持買入評級。

美銀證券分析師Joanna Gajuk維持買入評級,並將目標價從675美元下調至650美元。

美銀證券分析師Joanna Gajuk維持買入評級,並將目標價從675美元下調至650美元。

巴克萊銀行分析師Andrew Mok CFA維持買入評級,維持目標價604美元。

富國集團分析師Steve Baxter維持買入評級,維持目標價630美元。

此外,綜合報道,$聯合健康 (UNH.US)$近期主要分析師觀點如下:

聯合健康(FY25年度每股收益約30美元的初始預測位於較爲謹慎的估計範圍,高端定位相較於之前的趨勢更爲審慎,從而影響了股票的表現。然而,公司認爲這一預測可輕鬆超過最低閾值。

在2025年業績預期未達預期後,股價下跌,焦點轉向了爲何聯合健康可能與競爭對手相比更具優勢,潛在收益源自市場份額的擴張。儘管醫療保健部門在費率和報銷方面面臨挑戰,但聯合健康似乎已做好準備應對這些壓力,因其醫療保險業務的盈利能力。公佈公司Q3報告後,每股收益預期略有修正,估值倍數相應調整。

分析師指出,根據聯合健康(Q3業績後)的業績,公司未來每股收益預期已經調整,以考慮持續存在即便在事前授權恢復後仍持續的『提高』醫療保險編碼強度。此外,與醫療敏銳度相關的逆風亦是存在的,但這些預計將是『暫時的』。

因醫療成本上升和2025年的初始每股收益預測未達到預期,聯合健康第三季度的業績未達預期。儘管在第三季度業績前曾持保守態度對MA MCOs,但預期聯合健康能加快2025年的每股收益增長以與長期目標保持一致。儘管如此,持續的挑戰,加之聯合健康繼續有機投資,暗示這種情況可能推遲至2026年。

以下爲今日11位分析師對$聯合健康 (UNH.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

美銀證券分析師Joanna Gajuk維持買入評級,並將目標價從675美元下調至650美元。

美銀證券分析師Joanna Gajuk維持買入評級,並將目標價從675美元下調至650美元。

BofA Securities analyst Joanna Gajuk maintains with a buy rating, and adjusts the target price from $675 to $650.

BofA Securities analyst Joanna Gajuk maintains with a buy rating, and adjusts the target price from $675 to $650.