Super Micro Computers AI Deployment 'Breadth Is Broad,' But SMCI Stock Stagnation Raises Questions

Super Micro Computers AI Deployment 'Breadth Is Broad,' But SMCI Stock Stagnation Raises Questions

Super Micro Computer Inc. (NASDAQ:SMCI) showcased its extensive capabilities in the AI infrastructure space, but the stock's recent stagnation raises questions as earnings approach.

超級微電腦公司(納斯達克股票代碼:SMCI)展示了其在人工智能基礎設施領域的廣泛能力,但隨着收益的臨近,該股最近的停滯引發了質疑。

With a year-to-date gain of 67.53% and a remarkable 63.97% increase over the past year, investors might wonder why the stock dipped 51.01% in the past six months.

今年迄今爲止的漲幅爲67.53%,在過去一年中顯著增長了63.97%,投資者可能想知道爲什麼該股在過去六個月中下跌了51.01%。

SMCI Stock: Current Trends Indicate Mixed Signals

SMCI 股票:當前趨勢表明信號好壞參半

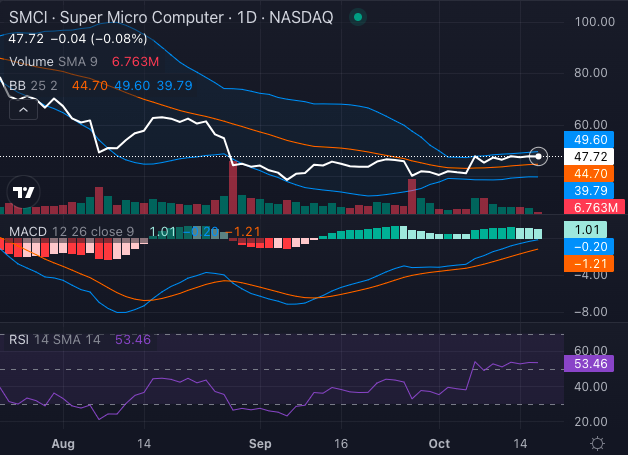

The current trend for SMCI appears relatively stagnant, with slight buying pressure noted recently.

SMCI當前的趨勢似乎相對停滯,最近出現了輕微的買盤壓力。

Chart created using Benzinga Pro

使用 Benzinga Pro 創建的圖表

SMCI stock price sits at $47.69, while the eight-day simple moving average (SMA) is at $47.19, indicating a bullish signal. This bullish sentiment is further supported by the stock trading above the 20-day SMA of $44.75.

SMCI股價爲47.69美元,而八天簡單移動平均線(SMA)爲47.19美元,表明看漲信號。股票交易價格在20天均線44.75美元上方進一步支撐了這種看漲情緒。

However, a closer look reveals that the 50-day SMA stands at $48.15, suggesting a bearish signal, while the 200-day SMA is significantly higher at $71.46, reinforcing bearish sentiments.

但是,仔細觀察後發現,50天均線爲48.15美元,表明看跌信號,而200日均線大幅上漲至71.46美元,強化了看跌情緒。

Chart created using Benzinga Pro

使用 Benzinga Pro 創建的圖表

Additionally, the Moving Average Convergence Divergence (MACD) indicator for SMCI stock is at a negative 0.20 also leans towards a bearish sentiment.

此外,SMCI股票的移動平均收斂散度(MACD)指標爲負0.20,也傾向於看跌情緒。

However, the Bollinger Bands can be seen squeezing in. This indicates low volatility and suggests that a significant price movement might be on the way.

但是,可以看到布林帶正在擠進。這表明波動性較低,也表明價格可能即將出現重大波動。

However, investors must keep in mind that volatility tends to return to normal, so the bands will likely widen, indicating a possible big price change in SMCI stock ahead.

但是,投資者必須記住,波動率往往會恢復正常,因此波動幅度可能會擴大,這表明未來SMCI股票的價格可能會出現重大變化。

Read Also: Stock Of The Day: Does Super Micro Computer Offer 'Super Trading' Opportunities?

另請閱讀:每日股票:超級微電腦是否提供 「超級交易」 機會?

SMCI Analyst Highlights Strong Capabilities

SMCI 分析師強調強大的能力

Analysts are keeping an eye on Super Micro's upcoming earnings report on Oct. 30.

分析師正在關注超級微即將於10月30日發佈的收益報告。

JPMorgan analyst Samik Chatterjee shared his insights from the first day of the 2024 Open Compute Project (OCP) Global Summit. Chatterjee underscored Super Micro's AI deployment capabilities, saying: "While Super Micro's breath is broad, it underscored its flexibility to work with customers in a bespoke manner in order to support them to the degree needed." This is to say that Super Micro is positioned to deploy AI in a broad spectrum, from liquid cooling to networking services.

摩根大通分析師薩米克·查特吉分享了他在2024年開放計算項目(OCP)全球峯會第一天的見解。Chatterjee強調了Super Micro的人工智能部署能力,他說:「儘管Super Micro的呼吸廣闊,但它強調了其以定製方式與客戶合作的靈活性,以便爲他們提供所需的支持。」也就是說,Super Micro有能力在從液體冷卻到網絡服務等廣泛領域部署人工智能。

While the company believes it is well positioned to support customers in deploying their AI infrastructure on time, SMCI stock's stagnant performance raises questions about investor confidence and market perception.

儘管該公司認爲自己完全有能力支持客戶按時部署其人工智能基礎設施,但SMCI股票的停滯表現引發了人們對投資者信心和市場認知的質疑。

As Super Micro prepares for its earnings report, market participants will be keen to see if the stock can overcome its current stagnation and continue capitalizing on its broad capabilities in the rapidly evolving AI landscape.

在Super Micro爲業績做準備之際,市場參與者將渴望看到該股能否克服當前的停滯,繼續利用其在快速變化的人工智能領域中的廣泛能力。

- Super Micro Expands Liquid-Cooled AI Servers With Nvidia Power

- Super Micro 使用 Nvidia Power 擴展液冷式 AI 服務器

Photo: T. Schneider via Shutterstock

照片:T. Schneider 通過 Shutterstock