Market Mover | AMP stock rises 13%, maintaining a strong bullish trend

Market Mover | AMP stock rises 13%, maintaining a strong bullish trend

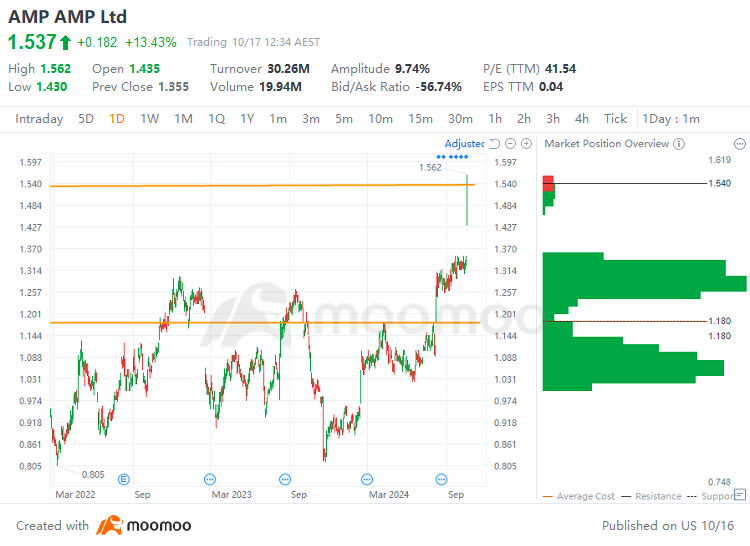

$AMP Ltd (AMP.AU)$ stock rose 13.43% on Thursday, with trading volume expanding to A$30.26 million. AMP has risen 14.7% in the past week, with a cumulative gain of 70.88% year-to-date.

$AMP Ltd (AMP.AU)$ 週四股票上漲13.43%,交易量擴大至A$3026萬。AMP過去一週上漲了14.7%,年初至今累計漲幅達70.88%。

AMP's technical analysis chart:

AMP的技術面分析圖表:

Technical Analysis:

技術面分析:

Support: A$1.18

壓力位:A$1.18

Resistance: A$1.54

支撐位:A$1.54

Price range A$1.18 to A$1.54: The trading range indicates a heavy concentration of buy orders, with the stock price on an upward trend and strong upward momentum. However, there is a risk of profit-taking as some gains have been accumulated. The stock had found support near the A$1.18. Currently, the stock is near the upper resistance level of near the A$1.54. Going forward, it is necessary to observe whether the resistance near A$1.54 can be effectively broken through.

價格區間爲A$1.18至A$1.54:交易區間顯示買入訂單集中,股價呈上漲趨勢且具有強勁的向上動能。然而,存在一定盈利回吐的風險,部分收益已經積累。股價在A$1.18附近找到支撐。目前,股價接近A$1.54附近的上方壓力位。未來需要觀察A$1.54附近的阻力是否能夠有效突破。

Market News :

市場資訊:

AMP released its Q3 24 cashflows and business update on October 17, 2024. The report highlighted several positive financial indicators: Platforms net cashflows reached A$750 million, marking a 76% increase from Q3 23. Notably, North inflows from Independent Financial Advisers (IFAs) saw a significant surge, increasing by 47% compared to Q3 23, to reach A$832 million. The Platforms Assets Under Management (AUM) also showed robust growth, climbing to A$78.1 billion, up from A$74.7 billion in Q2 24. In the Superannuation & Investments sector, AUM rose to A$55.8 billion, from A$54.0 billion in Q2 24, with net cash outflows significantly reduced by 46% to A$334 million, compared to net cash outflows of A$619 million in Q3 23, excluding a A$4.3 billion mandate loss. The New Zealand Wealth Management division reported net cashflows of A$40 million, up from A$6 million in Q3 23, with AUM increasing to A$11.6 billion, from A$11.2 billion in Q2 24. Lastly, AMP Bank reported a total loan book of A$23.0 billion, slightly up from A$22.9 billion in Q2 24, and total deposits increased to A$20.9 billion, from A$20.6 billion in Q2 24.

AMP在2024年10月17日發佈了其Q3 24的現金流和業務更新。該報告突出了幾個積極的財務指標:平台淨現金流達到了75000萬澳元,比Q3 23增長了76%。值得注意的是,來自獨立金融顧問(IFAs)的北部資金流入量大幅增長,較Q3 23增加了47%,達到了83200萬澳元。平台管理的資產(AUM)也表現出強勁增長,從Q2 24的747億澳元上升到了781億澳元。在養老金和投資板塊,AUM從Q2 24的540億澳元上升到了558億澳元,淨現金流出較去除了43億澳元委託損失後,大幅減少了46%,相比Q3 23的淨現金流出5.19億澳元。新西蘭财富管理部門報告的淨現金流量爲4千萬澳元,比Q3 23的600萬澳元增加,管理的資產(AUm)從Q2 24的112億澳元增至116億澳元。最後,AMP銀行報告的總貸款規模爲230億澳元,略高於Q2 24的229億澳元,總存款從Q2 24的206億澳元增加至209億澳元。

Overall Analysis:

總體分析:

Fundamentally, focus on the company's performance and operational status. Technically, pay attention to whether the support levels hold and if the resistance levels can be effectively breached.

基本上,關注公司的業績和運營狀況。從技術上講,要注意支撐位能否持穩,以及阻力位是否能被有效突破。

In this scenario, investors should adopt a cautious strategy, setting stop-loss points to manage risk and maintaining ongoing vigilance regarding company developments and market conditions.

在這種情況下,投資者應採取謹慎的策略,設置止損點來管理風險,並對公司發展和市場情況保持持續警惕。

Source: AMP

資料來源:AMP

Support: A$1.18

Support: A$1.18