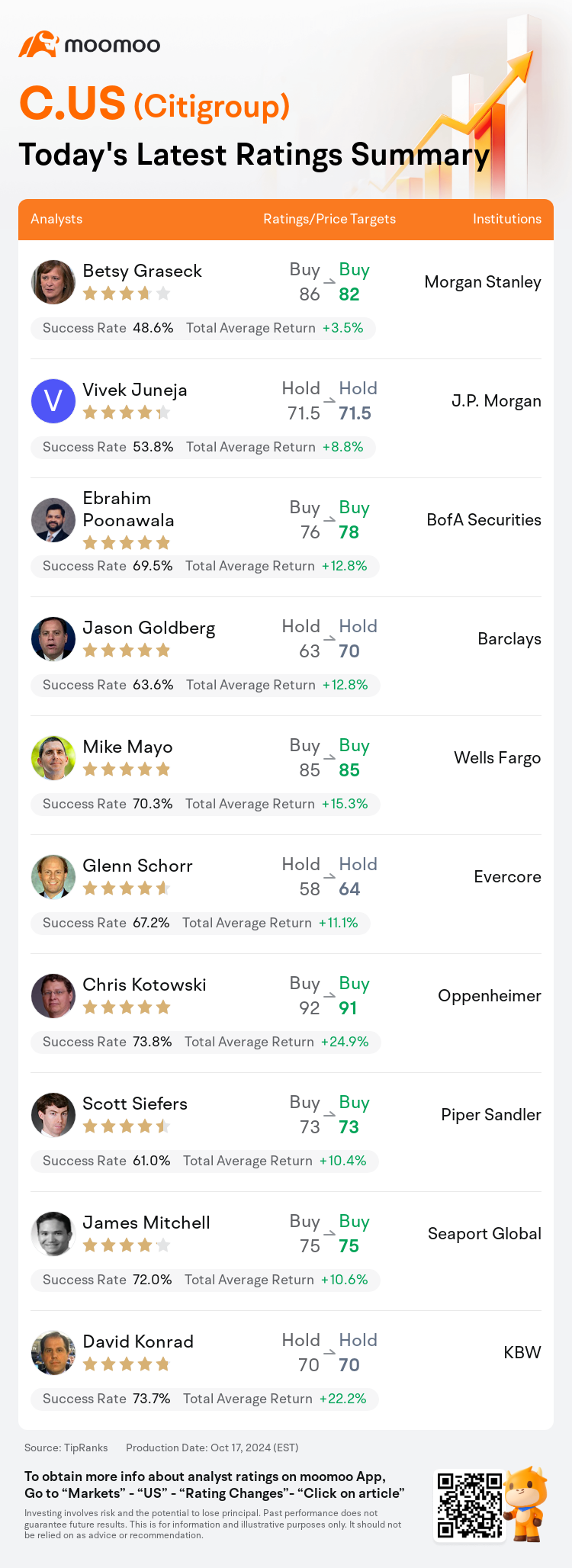

On Oct 17, major Wall Street analysts update their ratings for $Citigroup (C.US)$, with price targets ranging from $64 to $91.

Morgan Stanley analyst Betsy Graseck maintains with a buy rating, and adjusts the target price from $86 to $82.

J.P. Morgan analyst Vivek Juneja maintains with a hold rating, and maintains the target price at $71.5.

BofA Securities analyst Ebrahim Poonawala maintains with a buy rating, and adjusts the target price from $76 to $78.

BofA Securities analyst Ebrahim Poonawala maintains with a buy rating, and adjusts the target price from $76 to $78.

Barclays analyst Jason Goldberg maintains with a hold rating, and adjusts the target price from $63 to $70.

Wells Fargo analyst Mike Mayo maintains with a buy rating, and maintains the target price at $85.

Furthermore, according to the comprehensive report, the opinions of $Citigroup (C.US)$'s main analysts recently are as follows:

Despite surpassing both BofA's and consensus earnings per share estimates for Q3, experiencing a 16% and 13% beat respectively, the company's shares declined. The downturn in share value intensified when management provided an unsatisfactory initial response regarding the potential for a regulatory-imposed asset cap. Although the CEO later clarified that there is no such asset cap, the initial uncertainty contributed to the stock undergoing some profit-taking, particularly since it was trading close to its year-to-date peak just before the earnings announcement.

Despite an EPS beat fueled by robust capital markets and decreased expenses, the share performance was impacted negatively by the steady expense guidance for 2024. This outlook implies a quarter-over-quarter increase of 2% in Q4 expenses, which may affect the earnings run-rate leading into 2025. Subsequent to the earnings report, there has been a revision in the 2025 EPS estimate downwards by 4% to $7.46, factoring in elevated expenses and a dip in net interest income, which is somewhat balanced by an uptick in fee income.

The company's Q3 earnings surpassed estimates, supported by fee income, with trading and investment banking fees outperforming intra-quarter guidance.

Citi's third quarter earnings per share of $1.51 surpassed estimates, outdoing both the $1.43 forecast and the consensus of $1.31. Despite this, the company's shares declined by 5.1% on a day when the S&P 500 saw only a 0.7% drop and the BKX rose by 0.3%. During the Q&A session, key issues raised included credit card losses reaching the higher end of expectations, speculation on an unannounced asset cap, uncertainties around the Banamex IPO launch by 2025, and how the company plans to achieve its 2026 expense guidance of $51-$53 billion compared to this year's $53.8 billion.

Here are the latest investment ratings and price targets for $Citigroup (C.US)$ from 10 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間10月17日,多家華爾街大行更新了$花旗集團 (C.US)$的評級,目標價介於64美元至91美元。

摩根士丹利分析師Betsy Graseck維持買入評級,並將目標價從86美元下調至82美元。

摩根大通分析師Vivek Juneja維持持有評級,維持目標價71.5美元。

美銀證券分析師Ebrahim Poonawala維持買入評級,並將目標價從76美元上調至78美元。

美銀證券分析師Ebrahim Poonawala維持買入評級,並將目標價從76美元上調至78美元。

巴克萊銀行分析師Jason Goldberg維持持有評級,並將目標價從63美元上調至70美元。

富國集團分析師Mike Mayo維持買入評級,維持目標價85美元。

此外,綜合報道,$花旗集團 (C.US)$近期主要分析師觀點如下:

儘管超過了美國銀行和共識的每股收益,分別超過了16%和13%,但該公司的股價下跌。在管理層就潛在的監管強制性資產上限問題提供不令人滿意的初始回應後,股價下跌的勢頭加劇。儘管首席執行官後來澄清稱不存在此類資產上限,但最初的不確定性導致股票經歷一些利潤回吐,特別是因爲在盈利公告前股票交易接近今年的峯值。

儘管盈利能力強勁的資本市場和降低的費用推動了每股收益的超額利潤,但2024年穩定費用展望對股價表現產生了負面影響。這一展望意味着2024年Q4費用環比增長2%,這可能會影響2025年利潤的增長率。在盈利報告之後,2025年每股收益預期下調了4%,至7.46美元,考慮到費用上升和淨利息收入下降,部分平衡了費用收入上升。

該公司的第三季度盈利超出預期,得益於費用收入,其中交易和投資銀行手續費表現優異,超出了季內指導。

花旗銀行第三季度每股收益爲1.51美元,超出了預期,分別超過了1.43美元的預測和1.31的共識。儘管如此,公司的股價在標普500指數下跌0.7%、銀行指數上漲0.3%的一天下跌了5.1%。在問答環節中,涉及的主要問題包括信用卡損失達到預期的較高水平、對未宣佈的資產上限的猜測、關於巴納梅克斯銀行在2025年上市的不確定性,以及公司如何實現2026年的費用指引爲510-530億美元,相比今年的538億美元。

以下爲今日10位分析師對$花旗集團 (C.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

美銀證券分析師Ebrahim Poonawala維持買入評級,並將目標價從76美元上調至78美元。

美銀證券分析師Ebrahim Poonawala維持買入評級,並將目標價從76美元上調至78美元。

BofA Securities analyst Ebrahim Poonawala maintains with a buy rating, and adjusts the target price from $76 to $78.

BofA Securities analyst Ebrahim Poonawala maintains with a buy rating, and adjusts the target price from $76 to $78.