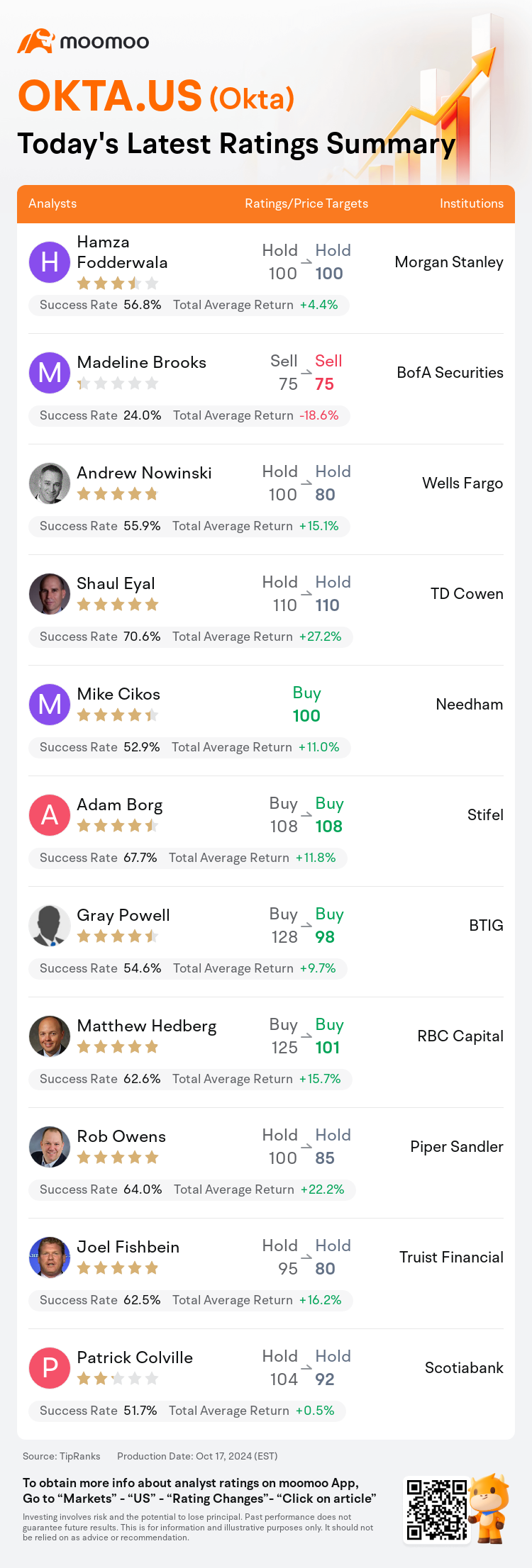

On Oct 17, major Wall Street analysts update their ratings for $Okta (OKTA.US)$, with price targets ranging from $75 to $110.

Morgan Stanley analyst Hamza Fodderwala maintains with a hold rating, and maintains the target price at $100.

BofA Securities analyst Madeline Brooks maintains with a sell rating, and maintains the target price at $75.

Wells Fargo analyst Andrew Nowinski maintains with a hold rating, and adjusts the target price from $100 to $80.

Wells Fargo analyst Andrew Nowinski maintains with a hold rating, and adjusts the target price from $100 to $80.

TD Cowen analyst Shaul Eyal maintains with a hold rating, and maintains the target price at $110.

Needham analyst Mike Cikos initiates coverage with a buy rating, and sets the target price at $100.

Furthermore, according to the comprehensive report, the opinions of $Okta (OKTA.US)$'s main analysts recently are as follows:

Okta is acknowledged as a distinct frontrunner in the crucial identity management sector, and its stock's valuation appears quite reasonable. Nevertheless, the company is confronting rising competition, particularly from a major technology corporation, while its execution has experienced unevenness in recent years. At present, there remains a lack of assurance in the company's ability to achieve a lasting and solid improvement in its fundamentals.

After attending the Oktane 2024 event and engaging with customers, partners, and employees, there is a focus on the company's expansion through new products, growth strategies, and the challenges associated with the number of seats. Management anticipates that these seat count challenges may continue into the first half of the next fiscal year but expects them to normalize as they move into the second half of FY26. The company's valuation is still considered appealing.

Okta possesses a comprehensive platform, yet it continues to face challenges due to pricing and competitive pressures. Despite management pinpointing significant growth drivers, projections for FY26 are perceived as overly optimistic.

Okta has faced significant growth challenges due to pressures on seat expansion as customers' buying patterns shift in the current economic climate. Despite this, it's anticipated that the bulk of the renewal cycle has passed, and pressures from existing customers will lessen. Furthermore, the implementation of go-to-market strategies through sales incentives and partnerships is seen as completing the set of tactics to reignite growth and enhance margins.

Here are the latest investment ratings and price targets for $Okta (OKTA.US)$ from 11 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

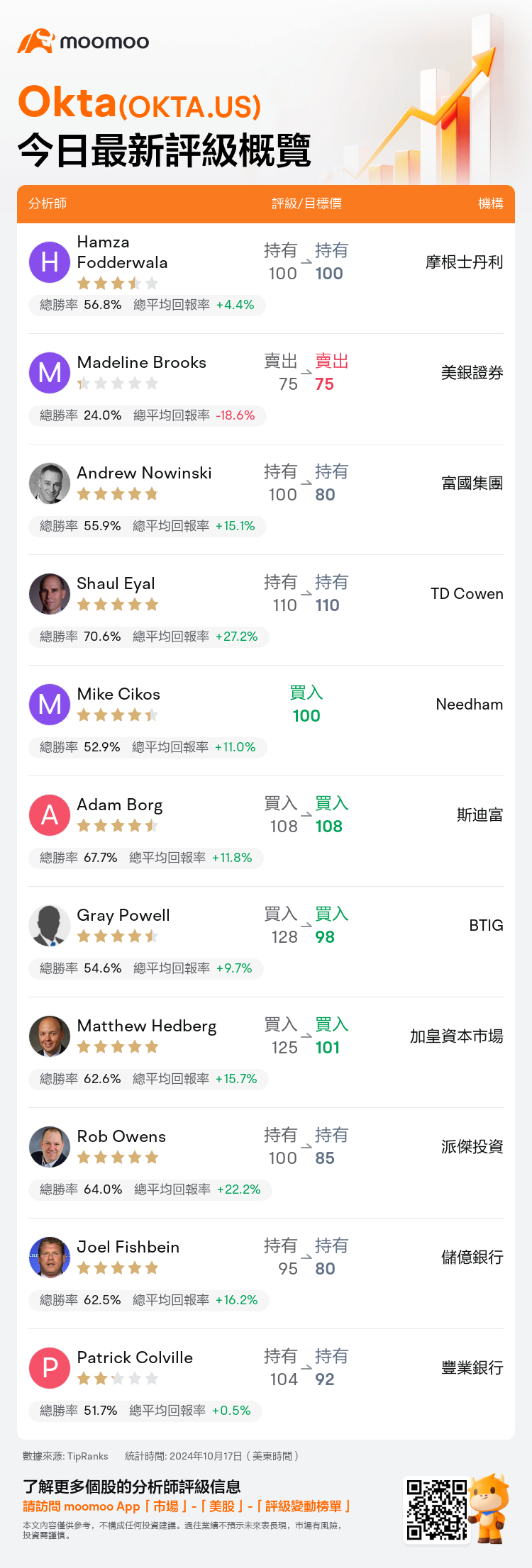

美東時間10月17日,多家華爾街大行更新了$Okta (OKTA.US)$的評級,目標價介於75美元至110美元。

摩根士丹利分析師Hamza Fodderwala維持持有評級,維持目標價100美元。

美銀證券分析師Madeline Brooks維持賣出評級,維持目標價75美元。

富國集團分析師Andrew Nowinski維持持有評級,並將目標價從100美元下調至80美元。

富國集團分析師Andrew Nowinski維持持有評級,並將目標價從100美元下調至80美元。

TD Cowen分析師Shaul Eyal維持持有評級,維持目標價110美元。

Needham分析師Mike Cikos首次給予買入評級,目標價100美元。

此外,綜合報道,$Okta (OKTA.US)$近期主要分析師觀點如下:

Okta被公認爲關鍵身份管理板塊中的一家獨特領跑者,其股價估值似乎相當合理。然而,該公司面臨着日益激烈的競爭,尤其是來自一家主要科技公司,而近年來其執行存在不穩定性。目前,公司的能力仍然缺乏確保能夠在基本面上取得持久和穩固改善的保證。

參加了Oktane 2024活動並與客戶、合作伙伴和員工互動後,公司側重於通過新產品、增長策略以及與座位數量相關的挑戰來擴張。管理層預計這些座位數量挑戰可能持續到下一財年的上半年,但預計它們在FY26的下半年會趨於正常化。公司的估值仍被視爲具吸引力。

Okta擁有一套綜合平台,但由於定價和競爭壓力,它仍然面臨着挑戰。儘管管理層確定了顯著的增長驅動因素,但FY26的預測被認爲過分樂觀。

由於客戶購買模式在當前經濟環境中發生變化,Okta面臨着座位擴張壓力帶來的顯著增長挑戰。儘管如此,預計大部分續約週期已經過去,而來自現有客戶的壓力將減輕。此外,通過銷售激勵和合作夥伴關係實施的營銷策略被視爲完成重新激發增長和提升利潤率的一套策略。

以下爲今日11位分析師對$Okta (OKTA.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

富國集團分析師Andrew Nowinski維持持有評級,並將目標價從100美元下調至80美元。

富國集團分析師Andrew Nowinski維持持有評級,並將目標價從100美元下調至80美元。

Wells Fargo analyst Andrew Nowinski maintains with a hold rating, and adjusts the target price from $100 to $80.

Wells Fargo analyst Andrew Nowinski maintains with a hold rating, and adjusts the target price from $100 to $80.