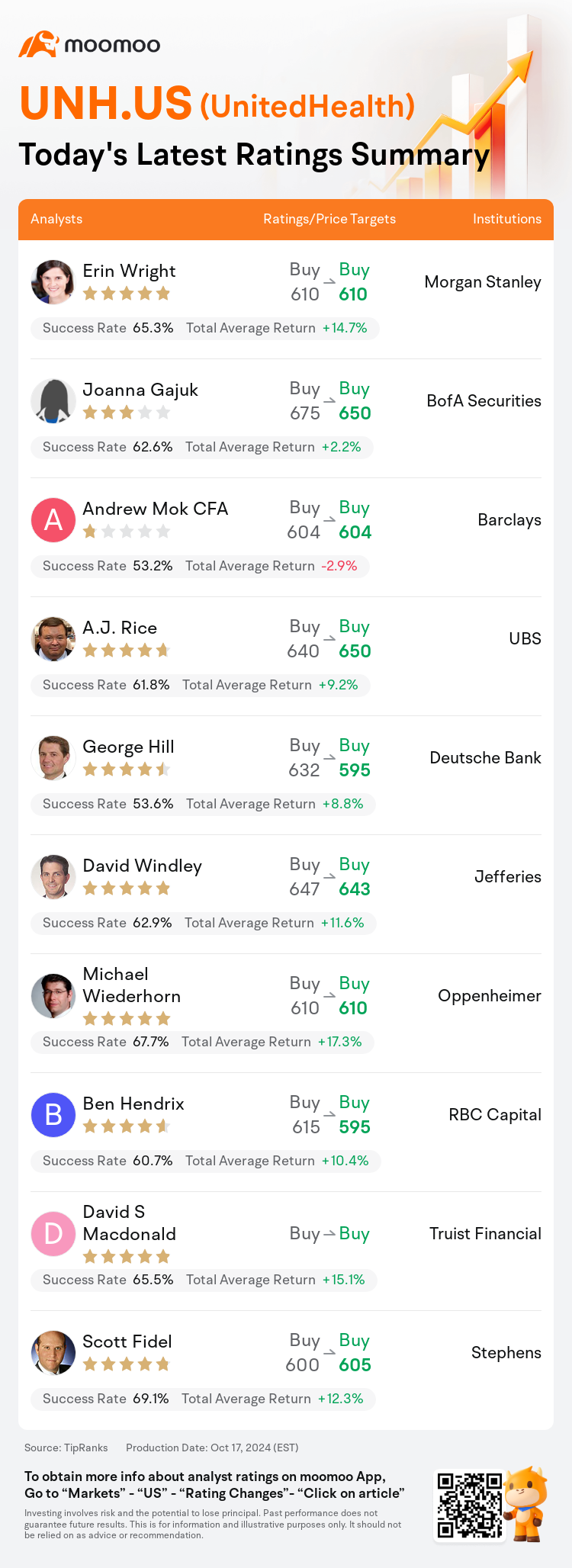

On Oct 17, major Wall Street analysts update their ratings for $UnitedHealth (UNH.US)$, with price targets ranging from $595 to $650.

Morgan Stanley analyst Erin Wright maintains with a buy rating, and maintains the target price at $610.

BofA Securities analyst Joanna Gajuk maintains with a buy rating, and adjusts the target price from $675 to $650.

Barclays analyst Andrew Mok CFA maintains with a buy rating, and maintains the target price at $604.

Barclays analyst Andrew Mok CFA maintains with a buy rating, and maintains the target price at $604.

UBS analyst A.J. Rice maintains with a buy rating, and adjusts the target price from $640 to $650.

Deutsche Bank analyst George Hill maintains with a buy rating, and adjusts the target price from $632 to $595.

Furthermore, according to the comprehensive report, the opinions of $UnitedHealth (UNH.US)$'s main analysts recently are as follows:

UnitedHealth's early indication of FY25 EPS being approximately $30 at the high-end, which was seen as a more conservative forecast compared to previous practices, appeared to exert pressure on the company's shares. Nonetheless, this forecast is perceived as 'a low bar' that the company is expected to surpass with ease, according to an analyst in a post-earnings briefing.

After the stock experienced a sell-off following guidance for 2025 that didn't meet expectations, analysts maintain a positive outlook on UnitedHealth, highlighting its stronger positioning compared to competitors and the potential for gains in market share. Despite the pressures on rates and reimbursements within the Medicare Advantage industry, UnitedHealth is perceived to be in a favorable position to navigate these challenges due to its profitable Medicare Advantage business. Nonetheless, there has been a slight reduction in earnings per share estimates, as well as in the applied multiple, subsequent to the company's third-quarter financial report.

The reduction in the forecast for UnitedHealth's FY25 and FY26 EPS is to account for the sustained 'elevated' Medicare coding intensity beyond the resumption of prior authorization and Medicaid acuity challenges. These conditions are anticipated to be temporary, according to the analyst's perspective shared with investors.

The firm's assessment indicates that UnitedHealth's Q3 outcomes were unsatisfactory, chiefly due to elevated medical expenses and an initial EPS forecast for 2025 that did not meet expectations. Previously, there was a cautious stance on MA MCOs heading into Q3 earnings, yet there was optimism that UnitedHealth could return to long-term EPS growth targets by 2025. Nonetheless, persistent challenges, coupled with UnitedHealth's choice to continue organic investments, suggest that the realization of this growth expectation may be deferred to 2026.

Here are the latest investment ratings and price targets for $UnitedHealth (UNH.US)$ from 10 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

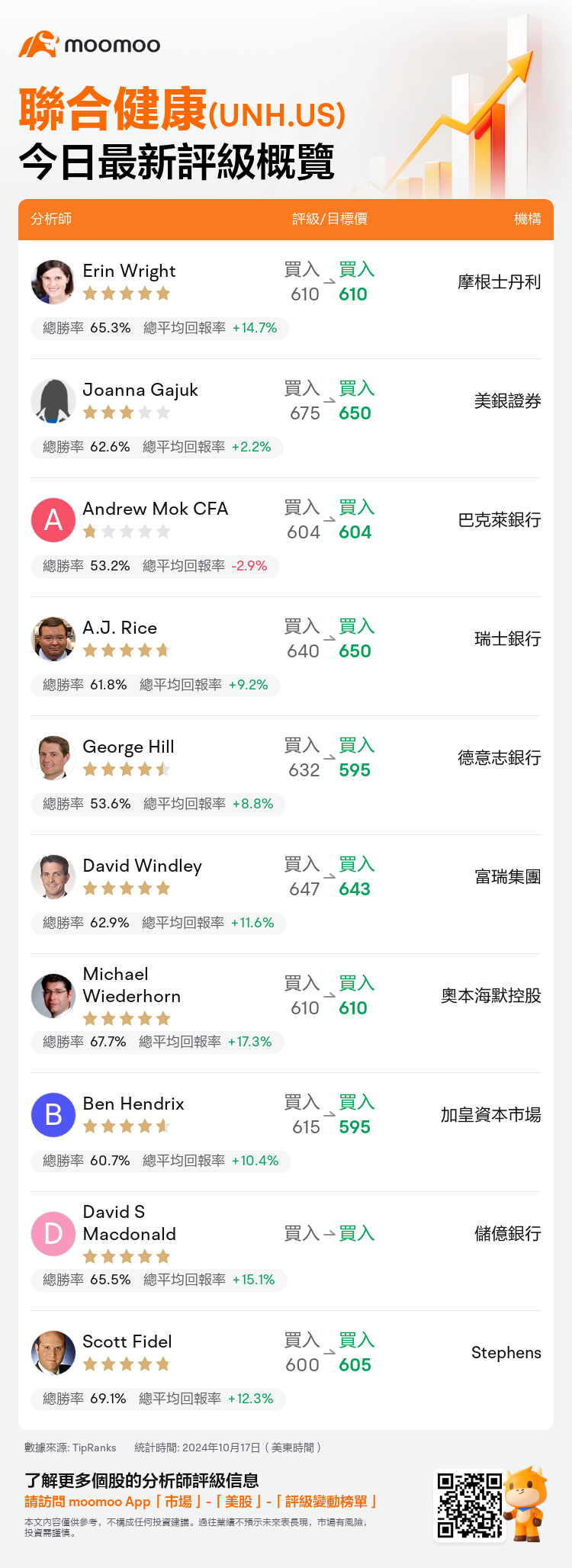

美東時間10月17日,多家華爾街大行更新了$聯合健康 (UNH.US)$的評級,目標價介於595美元至650美元。

摩根士丹利分析師Erin Wright維持買入評級,維持目標價610美元。

美銀證券分析師Joanna Gajuk維持買入評級,並將目標價從675美元下調至650美元。

巴克萊銀行分析師Andrew Mok CFA維持買入評級,維持目標價604美元。

巴克萊銀行分析師Andrew Mok CFA維持買入評級,維持目標價604美元。

瑞士銀行分析師A.J. Rice維持買入評級,並將目標價從640美元上調至650美元。

德意志銀行分析師George Hill維持買入評級,並將目標價從632美元下調至595美元。

此外,綜合報道,$聯合健康 (UNH.US)$近期主要分析師觀點如下:

聯合健康公司早期預示FY25每股收益在30美元左右的高端水平,相較於以往的慣例更加保守,似乎對公司股票施加了壓力。然而,根據一位分析師在盈利後的簡報中的看法,這一預測被視爲「一個低門檻」,公司預計將輕鬆超過。

在股票在2025年指引未達預期後經歷拋售後,分析師們對聯合健康保持積極態度,強調其較競爭對手更強勢的定位以及在市場份額增長潛力。儘管在醫療保健優勢行業的費率和報銷方面面臨壓力,由於其獲利豐厚的醫療保健優勢業務,聯合健康被認爲處於有利位置來應對這些挑戰。然而,在公司第三季度財務報告後,每股收益的預期以及應用倍數均有輕微下調。

對聯合健康FY25和FY26每股收益預測的下調是爲了對持續『升高』的醫療保健編碼強度以及繼續操作前授權和醫療衡量挑戰進行考慮。根據分析師與投資者分享的觀點,這些狀況被預期爲暫時的。

公司的評估顯示,聯合健康Q3的業績不佳,主要是由於高額的醫療費用以及2025年初始每股收益預測未達預期。此前,在迎來Q3收益之前對醫療保險機構管理組織(MA MCOs)持謹慎態度,但樂觀認爲聯合健康有望在2025年實現長期每股收益增長目標。然而,持續的挑戰,再加上聯合健康選擇繼續有機投資,表明這一增長預期的實現可能被推遲至2026年。

以下爲今日10位分析師對$聯合健康 (UNH.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

巴克萊銀行分析師Andrew Mok CFA維持買入評級,維持目標價604美元。

巴克萊銀行分析師Andrew Mok CFA維持買入評級,維持目標價604美元。

Barclays analyst Andrew Mok CFA maintains with a buy rating, and maintains the target price at $604.

Barclays analyst Andrew Mok CFA maintains with a buy rating, and maintains the target price at $604.