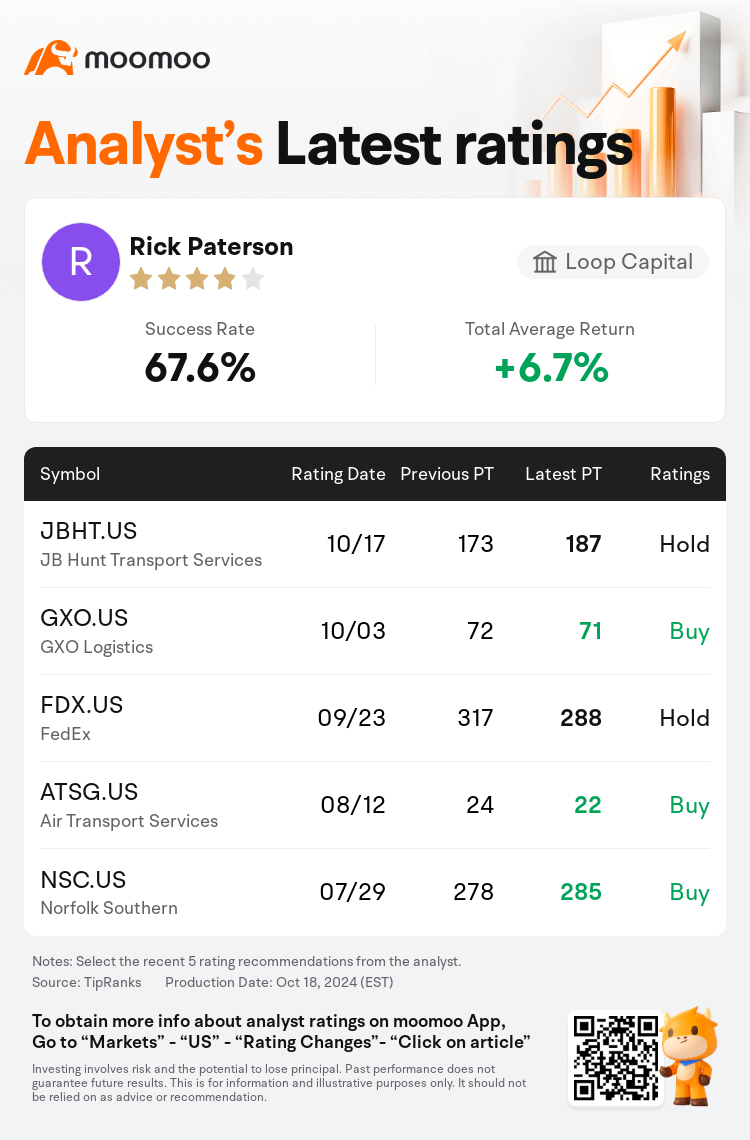

Loop Capital analyst Rick Paterson maintains $JB Hunt Transport Services (JBHT.US)$ with a hold rating, and adjusts the target price from $173 to $187.

According to TipRanks data, the analyst has a success rate of 67.6% and a total average return of 6.7% over the past year.

Furthermore, according to the comprehensive report, the opinions of $JB Hunt Transport Services (JBHT.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $JB Hunt Transport Services (JBHT.US)$'s main analysts recently are as follows:

J.B. Hunt's third-quarter EPS of $1.49 represented a 9% decline from the same quarter the previous year, yet exceeded forecasts, driven by higher-than-expected Intermodal Load growth as shippers anticipated a potential East Coast Port strike. Following the earnings report, estimates for the company's 2024 EPS were modestly increased, while projections for 2025 remain significantly above average market expectations.

Expectations were modest, yet improved intermodal volume and yield trends suggest a somewhat more optimistic outlook for the conclusion of 2024. This comes despite worries that recent activity may have been spurred by a temporary 'pull forward'.

The firm's analysis on J.B. Hunt reflects an update to their model following the company's Q3 results, which surpassed earnings estimates. Despite this, the commentary suggests that the results closely mirrored those of previous quarters, with a noted overall lackluster demand.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

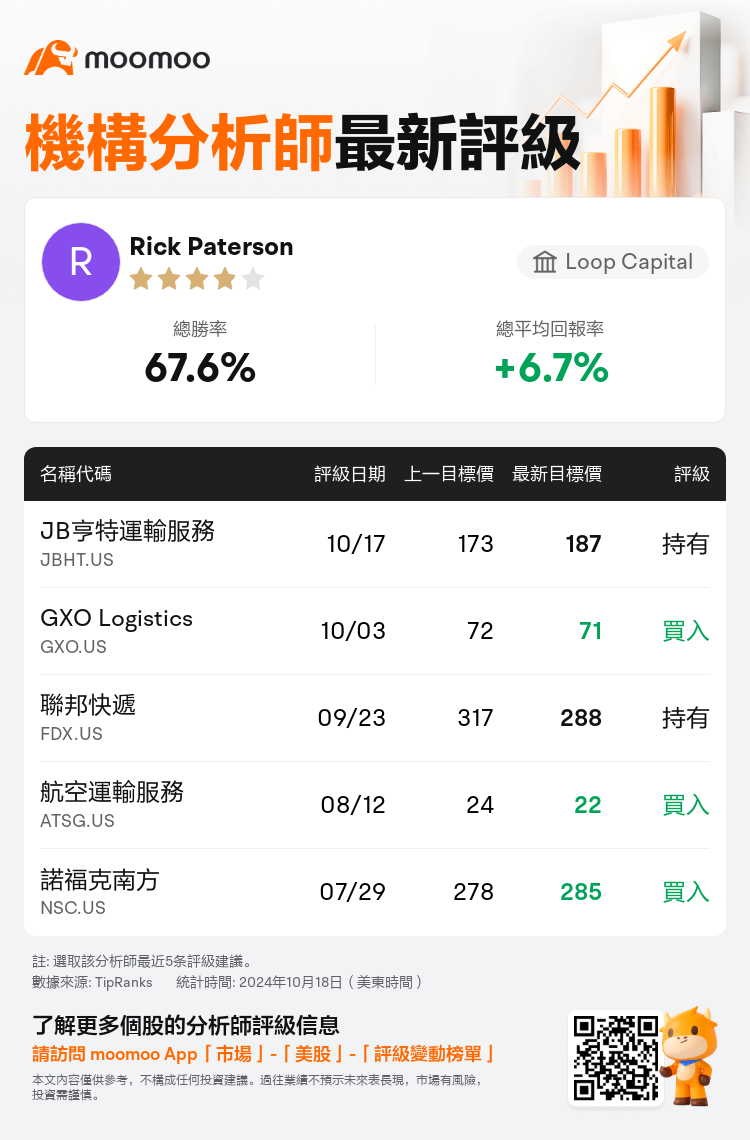

Loop Capital分析師Rick Paterson維持$JB亨特運輸服務 (JBHT.US)$持有評級,並將目標價從173美元上調至187美元。

根據TipRanks數據顯示,該分析師近一年總勝率為67.6%,總平均回報率為6.7%。

此外,綜合報道,$JB亨特運輸服務 (JBHT.US)$近期主要分析師觀點如下:

此外,綜合報道,$JB亨特運輸服務 (JBHT.US)$近期主要分析師觀點如下:

J.b.亨特的第三季度每股收益爲1.49美元,較上一年同期下降了9%,但超出了預期,主要受到超出預期的聯運成交量增長的推動,貨主們預期東海岸港口可能會發生罷工。在業績發佈後,公司2024年的每股收益預測略有增加,而2025年的預測仍然顯著高於市場平均預期。

預期是溫和的,但改善的聯運成交量和收益趨勢表明對2024年年底的前景更爲樂觀。儘管擔憂最近的活動可能是由於臨時性的「提前拉動」,但情況似乎仍在好轉。

該公司對J.b.亨特的分析反映了他們在掌握公司Q3業績後的模型更新,超出了盈利預期。儘管如此,評論表明,結果與之前的季度非常相似,總體上呈現出需求疲軟的局面。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$JB亨特運輸服務 (JBHT.US)$近期主要分析師觀點如下:

此外,綜合報道,$JB亨特運輸服務 (JBHT.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of