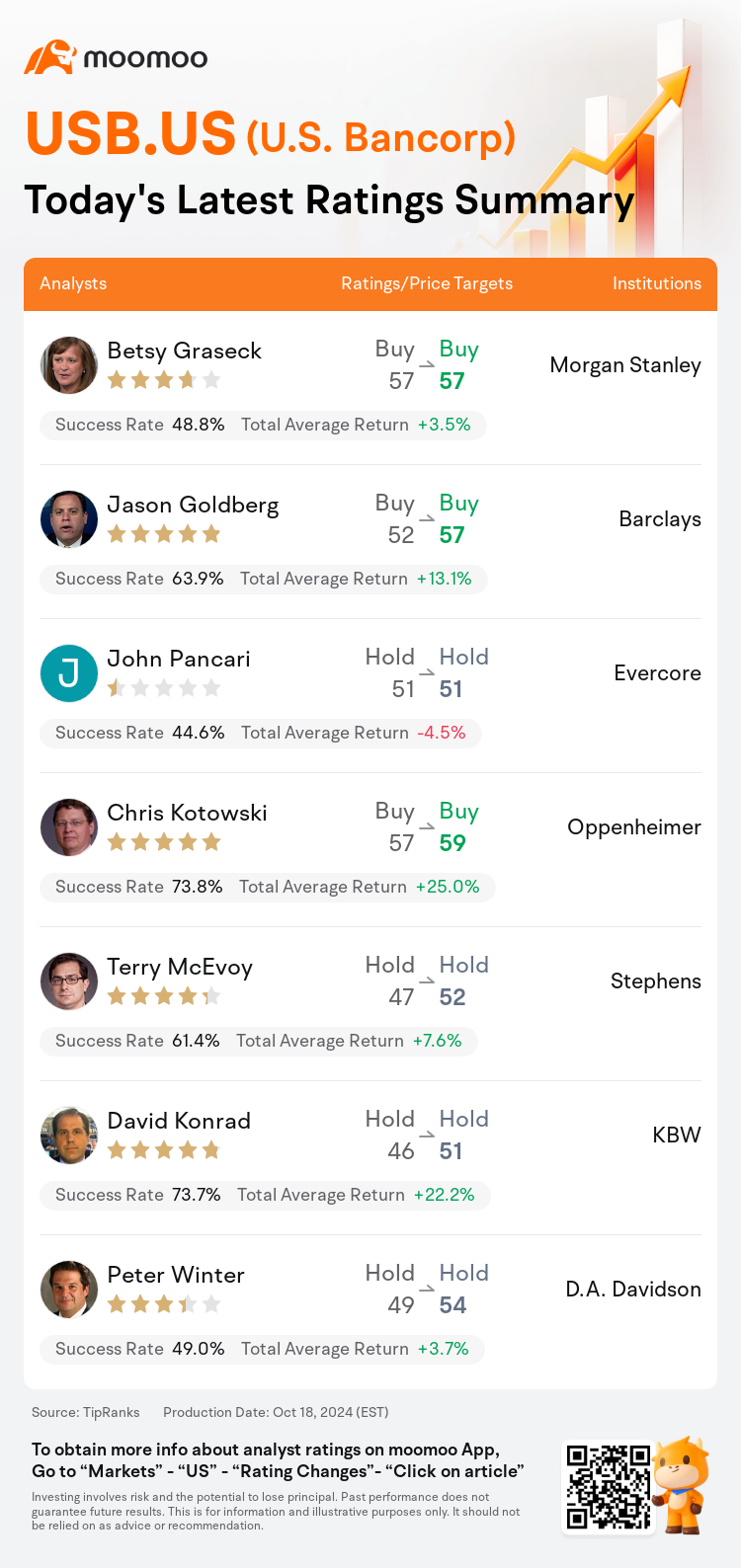

On Oct 18, major Wall Street analysts update their ratings for $U.S. Bancorp (USB.US)$, with price targets ranging from $51 to $59.

Morgan Stanley analyst Betsy Graseck maintains with a buy rating, and maintains the target price at $57.

Barclays analyst Jason Goldberg maintains with a buy rating, and adjusts the target price from $52 to $57.

Evercore analyst John Pancari maintains with a hold rating, and maintains the target price at $51.

Evercore analyst John Pancari maintains with a hold rating, and maintains the target price at $51.

Oppenheimer analyst Chris Kotowski maintains with a buy rating, and adjusts the target price from $57 to $59.

Stephens analyst Terry McEvoy maintains with a hold rating, and adjusts the target price from $47 to $52.

Furthermore, according to the comprehensive report, the opinions of $U.S. Bancorp (USB.US)$'s main analysts recently are as follows:

The decline in U.S. Bancorp's stock following the investor day last month was attributed to concerns over potential M&A activities. However, during the Q3 earnings conference, management clarified that M&A was not a focus and should not be considered a priority. Subsequent to the Q3 earnings surpassing expectations, forecasts for Q4 and FY25 earnings per share have been adjusted to higher figures.

Following the third-quarter report, it was noted that U.S. Bancorp's earnings exceeded expectations as net interest income surpassed projections and provisions were lower than anticipated.

U.S. Bancorp's Q3 earnings surpassed expectations, with core pre-provision net revenue reaching $2.8B, slightly above the consensus. This was attributed to a 2% increase in net interest income, balanced core expenses, and despite a 2% dip in fee income. Furthermore, an optimistic outlook is reflected in the management's updated net interest income guidance for FY24, which suggests figures at the top range of prior forecasts, considering the anticipation of additional interest rate reductions by year-end and the current subdued loan growth.

U.S. Bancorp has been recognized for consistently delivering some of the best returns in the industry, although it has faced challenges with net interest income (NII) and operating leverage for more than a year. NII experienced a downward trend for four consecutive quarters, seeing a total decrease of 14% from the first quarter of 2023 to the first quarter of 2024, before it finally saw a slight increase in the following two quarters. Similarly, operating leverage was negative for five quarters in a row. However, after accounting for a one-time loss related to securities portfolio restructuring, there was a marginal improvement. With recent signs of growth in NII and an uptick in operating leverage, there is optimism for continued positive performance.

The analyst notes that U.S. Bancorp has shifted from a negative to a positive stance with respect to net interest income growth and operating leverage, indicating what may be the start of a multi-year turning point. Estimates have been modestly increased.

Here are the latest investment ratings and price targets for $U.S. Bancorp (USB.US)$ from 7 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

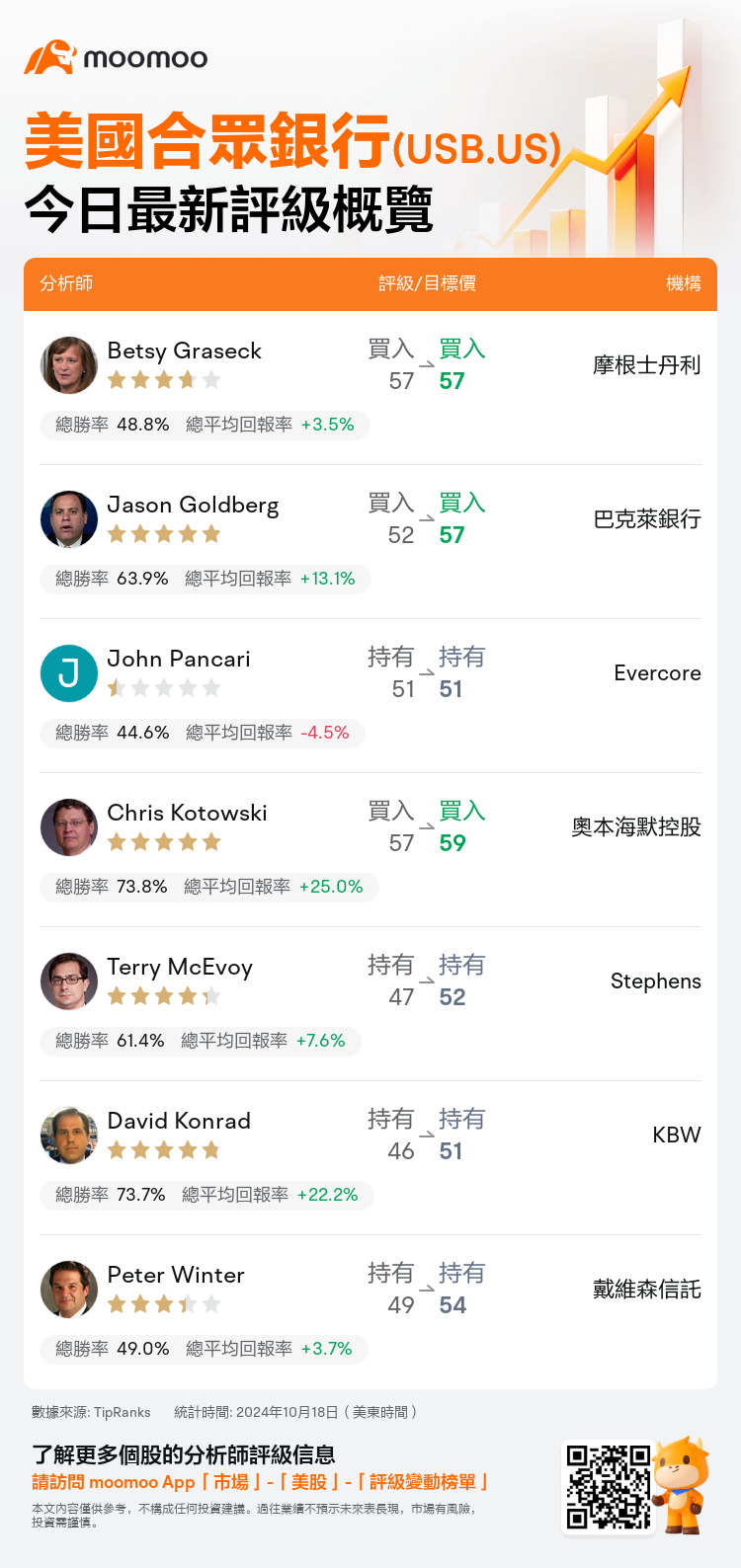

美東時間10月18日,多家華爾街大行更新了$美國合眾銀行 (USB.US)$的評級,目標價介於51美元至59美元。

摩根士丹利分析師Betsy Graseck維持買入評級,維持目標價57美元。

巴克萊銀行分析師Jason Goldberg維持買入評級,並將目標價從52美元上調至57美元。

Evercore分析師John Pancari維持持有評級,維持目標價51美元。

Evercore分析師John Pancari維持持有評級,維持目標價51美元。

奧本海默控股分析師Chris Kotowski維持買入評級,並將目標價從57美元上調至59美元。

Stephens分析師Terry McEvoy維持持有評級,並將目標價從47美元上調至52美元。

此外,綜合報道,$美國合眾銀行 (USB.US)$近期主要分析師觀點如下:

上個月投資者日之後美國合衆銀行股票下跌,原因是市場擔憂可能進行的併購活動。然而,在第三季度業績會上,管理層澄清併購不是焦點,也不應被視爲優先事項。隨着第三季度業績超出預期,第四季度和25財年每股收益的預測已調高。

第三季度報告後發現,美國合衆銀行的收益超過預期,淨利息收入超過預期,備抵金低於預期。

美國合衆銀行第三季度業績超出預期,核心調研前營收達到28億美元,略高於共識。這歸因於淨利息收入增長2%,平衡的核心支出,儘管手續費收入下降2%。此外,管理層更新了FY24的淨利息收入指導,表明相關數字處於先前預測範圍的頂部,考慮到預期年底進一步減息以及當前低迷的貸款增長。

美國合衆銀行因在行業中持續提供最佳回報而得到認可,儘管過去一年多以來一直面臨淨利息收入(NII)和營運槓桿方面的挑戰。 NII連續四個季度呈下降趨勢,從2023年第一季度到2024年第一季度總計下降了14%,然後在接下來的兩個季度中終於略微增長。同樣,營運槓桿連續五個季度爲負。然而,在考慮到一次性與證券組合重組相關的損失後,出現了輕微改善。隨着NII的增長跡象和營運槓桿的提高,人們對持續正面表現持樂觀態度。

分析師指出,美國合衆銀行在淨利息收入增長和營運槓桿方面已經從負面轉爲正面,這表明可能是多年轉折點的開始。預估已適度增加。

以下爲今日7位分析師對$美國合眾銀行 (USB.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

Evercore分析師John Pancari維持持有評級,維持目標價51美元。

Evercore分析師John Pancari維持持有評級,維持目標價51美元。

Evercore analyst John Pancari maintains with a hold rating, and maintains the target price at $51.

Evercore analyst John Pancari maintains with a hold rating, and maintains the target price at $51.