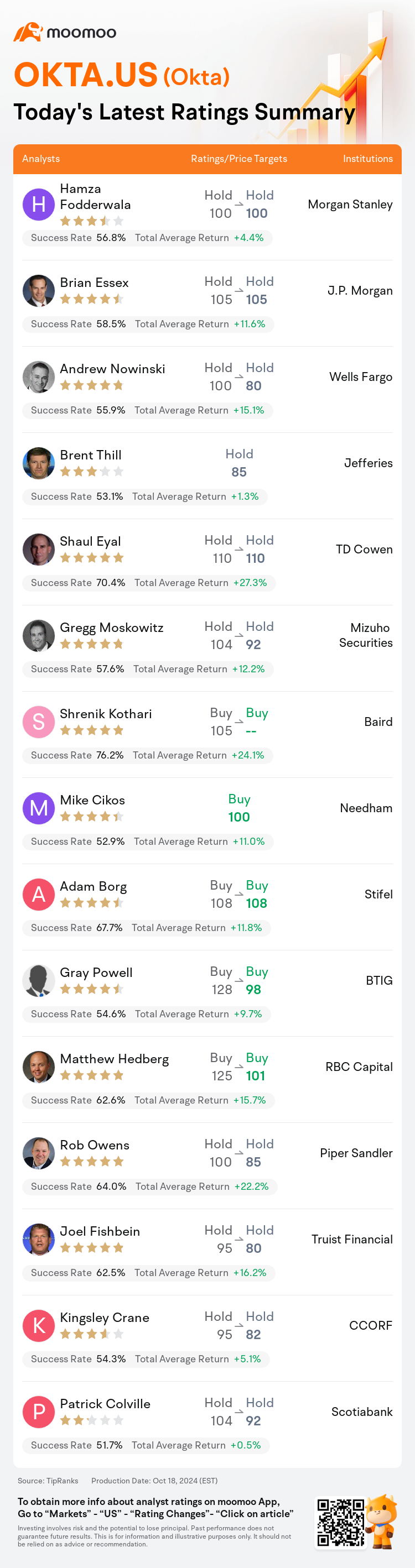

On Oct 18, major Wall Street analysts update their ratings for $Okta (OKTA.US)$, with price targets ranging from $80 to $110.

Morgan Stanley analyst Hamza Fodderwala maintains with a hold rating, and maintains the target price at $100.

J.P. Morgan analyst Brian Essex maintains with a hold rating, and maintains the target price at $105.

Wells Fargo analyst Andrew Nowinski maintains with a hold rating, and adjusts the target price from $100 to $80.

Wells Fargo analyst Andrew Nowinski maintains with a hold rating, and adjusts the target price from $100 to $80.

Jefferies analyst Brent Thill initiates coverage with a hold rating, and sets the target price at $85.

TD Cowen analyst Shaul Eyal maintains with a hold rating, and maintains the target price at $110.

Furthermore, according to the comprehensive report, the opinions of $Okta (OKTA.US)$'s main analysts recently are as follows:

Concerns have been raised regarding Okta's delayed product rollouts historically, and the lack of full maturity and complexity, particularly with its Privileged Access Management, following observations from a recent conference.

After attending the company's user event, it was observed that management presented a balanced viewpoint to investors. It's anticipated that challenges affecting the number of workforce identity seats and monthly active users within customer identity will continue until the first half of 2026. It is suggested that Okta's efforts to gain better engagement with large enterprise clients, along with the introduction of new offerings and market growth initiatives, are expected to require additional time.

Okta continues to stand out as a prominent entity in the vital identity management sector, and its stock's valuation appears to be reasonably modest. Nevertheless, the company is encountering growing competitive challenges, particularly from major players like Microsoft. Additionally, there have been irregularities in execution over recent years, leading to a hesitance in predicting a steadfast fundamental recovery at present.

Following the Oktane 2024 event and interactions with customers, partners, and employees, there's a focus on the company's expansion with new products, growth initiatives, and challenges related to seat count. Management anticipates that these seat count challenges may continue through the first half of the next fiscal year but expects normalization in the latter half of FY26. The company's valuation is also seen as appealing.

Okta is recognized for having a comprehensive platform, however, challenges such as pricing and competition persist. Despite management pinpointing significant growth drivers, there is a sentiment that FY26 projections may be overly optimistic.

Here are the latest investment ratings and price targets for $Okta (OKTA.US)$ from 15 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

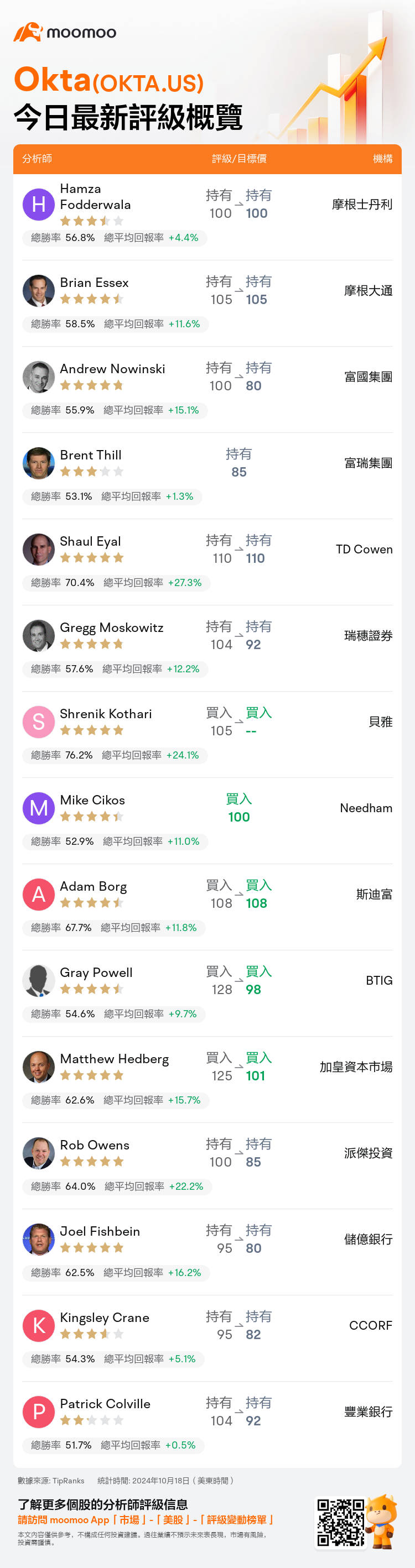

美東時間10月18日,多家華爾街大行更新了$Okta (OKTA.US)$的評級,目標價介於80美元至110美元。

摩根士丹利分析師Hamza Fodderwala維持持有評級,維持目標價100美元。

摩根大通分析師Brian Essex維持持有評級,維持目標價105美元。

富國集團分析師Andrew Nowinski維持持有評級,並將目標價從100美元下調至80美元。

富國集團分析師Andrew Nowinski維持持有評級,並將目標價從100美元下調至80美元。

富瑞集團分析師Brent Thill首次給予持有評級,目標價85美元。

TD Cowen分析師Shaul Eyal維持持有評級,維持目標價110美元。

此外,綜合報道,$Okta (OKTA.US)$近期主要分析師觀點如下:

近期會議觀察到,有關Okta歷史上產品推出延遲、完整度和複雜度不足的擔憂,特別是在其特權訪問管理方面。

參加公司用戶活動後,發現管理團隊向投資者展示了一個平衡的觀點。預計影響工作人員身份席位數量和客戶身份中的月活躍用戶數量的挑戰將持續到2026年上半年。建議Okta努力與大型企業客戶建立更好的互動,同時推出新的產品和市場增長項目,預計需要更多時間。

Okta在關鍵的身份管理板塊繼續表現出色,其股票估值似乎相當適中。然而,該公司面臨着日益激烈的競爭挑戰,特別是來自微軟等主要參與者。此外,最近幾年執行方面存在不規範之處,導致目前對穩健基本復甦的預測產生猶豫。

在Oktane 2024活動以及與客戶、合作伙伴和員工的互動之後,公司關注於新產品、增長舉措以及與席位數量相關的挑戰的擴張。管理層預計這些席位數量方面的挑戰可能持續到下一個財政年度的上半年,但預計在FY26的後半年會實現正常化。公司的估值也被視爲吸引人的。

Okta因擁有全面的平台而聞名,然而,諸如定價和競爭等挑戰仍然存在。儘管管理層指出了重要的增長驅動因素,但人們認爲FY26的預測可能過於樂觀。

以下爲今日15位分析師對$Okta (OKTA.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

富國集團分析師Andrew Nowinski維持持有評級,並將目標價從100美元下調至80美元。

富國集團分析師Andrew Nowinski維持持有評級,並將目標價從100美元下調至80美元。

Wells Fargo analyst Andrew Nowinski maintains with a hold rating, and adjusts the target price from $100 to $80.

Wells Fargo analyst Andrew Nowinski maintains with a hold rating, and adjusts the target price from $100 to $80.