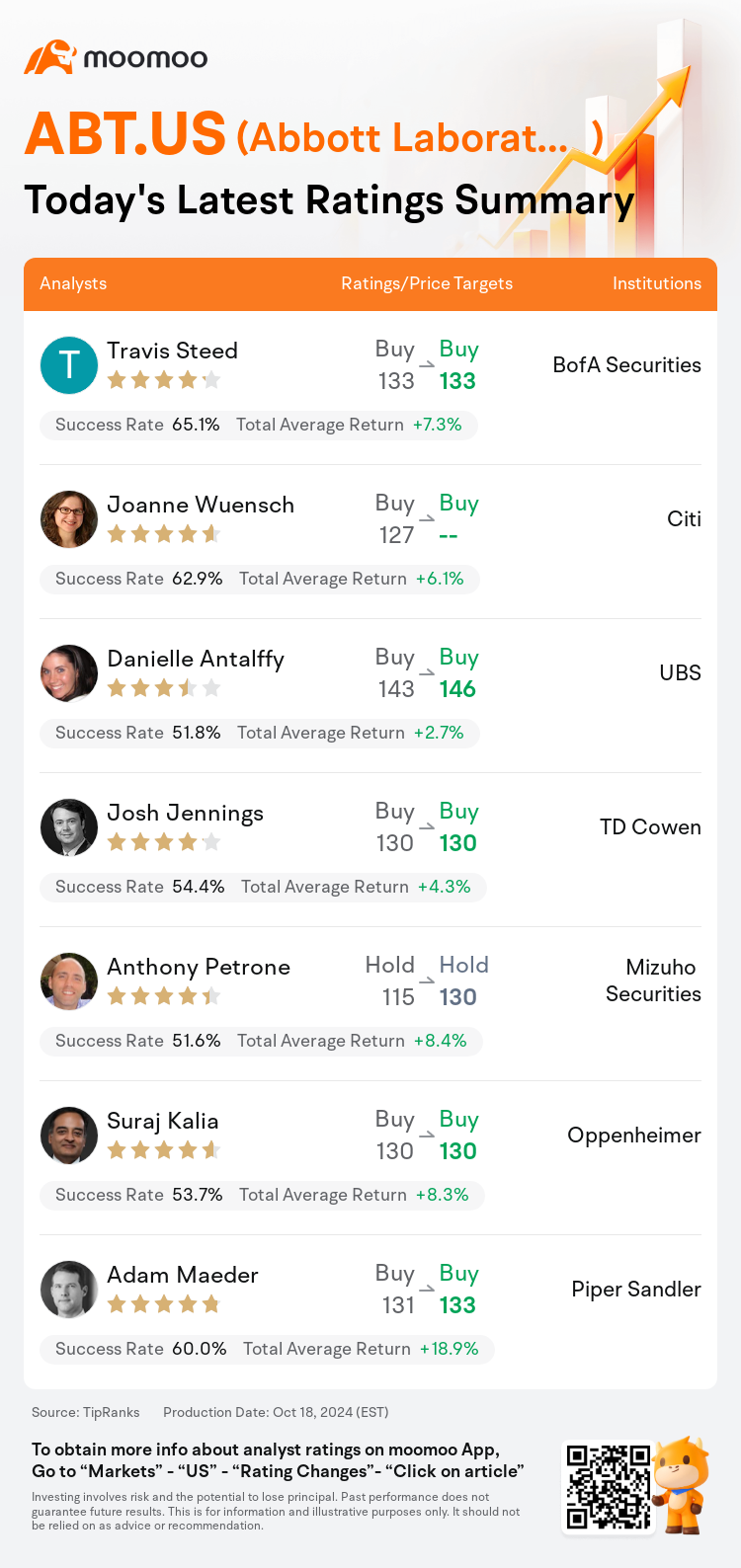

On Oct 18, major Wall Street analysts update their ratings for $Abbott Laboratories (ABT.US)$, with price targets ranging from $130 to $146.

BofA Securities analyst Travis Steed maintains with a buy rating, and maintains the target price at $133.

Citi analyst Joanne Wuensch maintains with a buy rating.

UBS analyst Danielle Antalffy maintains with a buy rating, and adjusts the target price from $143 to $146.

UBS analyst Danielle Antalffy maintains with a buy rating, and adjusts the target price from $143 to $146.

TD Cowen analyst Josh Jennings maintains with a buy rating, and maintains the target price at $130.

Mizuho Securities analyst Anthony Petrone maintains with a hold rating, and adjusts the target price from $115 to $130.

Furthermore, according to the comprehensive report, the opinions of $Abbott Laboratories (ABT.US)$'s main analysts recently are as follows:

Abbott's recent modest sales and EPS beat reinforces confidence in the company's capacity to maintain double-digit MedTech sales expansion for the foreseeable future and overall high single-digit sales growth. The sustainability of Abbott's MedTech business growth trajectory is thought to be undervalued, presenting Abbott as a top opportunity for high single-digit to low double-digit sales growth.

Following Q3 results, adjustments have been made to the outlook for Abbott, suggesting the company is in a good position to handle any competitive pressures from pulsed field ablation. Additionally, the potential for leadless pacing may contribute to an acceleration of cardiac rhythm management growth beyond 3%. Despite the strong position and solid operational execution, it is assessed that market expectations have been met and that the company's valuation is reasonable when compared to its peers.

Despite the company's momentum, there is an ongoing search for sustainable operating margin expansion beyond the period of Testing decline.

Abbott's third-quarter sales exceeded expectations, propelled by strong performance in MedTech and COVID-19 testing, while keeping its organic growth forecast for FY24 steady and slightly raising the midpoint of its EPS outlook. Despite concerns regarding valuation and ongoing litigation, there's a sense of optimism about Abbott's performance.

Abbott's management conveyed optimism regarding the company's forecast for continued high single-digit revenue growth and double-digit earnings expansion. The CEO indicated that a high single-digit revenue increase and 10% earnings per share growth are within reach as a fundamental expectation. The presence of multiple new offerings in the rapidly advancing Diabetes Care and Structural Heart sectors suggests that Abbott's entire medical Device collection is poised for superior growth within the MedTech industry.

Here are the latest investment ratings and price targets for $Abbott Laboratories (ABT.US)$ from 7 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間10月18日,多家華爾街大行更新了$雅培 (ABT.US)$的評級,目標價介於130美元至146美元。

美銀證券分析師Travis Steed維持買入評級,維持目標價133美元。

花旗分析師Joanne Wuensch維持買入評級。

瑞士銀行分析師Danielle Antalffy維持買入評級,並將目標價從143美元上調至146美元。

瑞士銀行分析師Danielle Antalffy維持買入評級,並將目標價從143美元上調至146美元。

TD Cowen分析師Josh Jennings維持買入評級,維持目標價130美元。

瑞穗證券分析師Anthony Petrone維持持有評級,並將目標價從115美元上調至130美元。

此外,綜合報道,$雅培 (ABT.US)$近期主要分析師觀點如下:

近期Abbott的銷售額和每股收益略有超出,進一步鞏固了對公司在可預見未來能夠保持兩位數醫療科技銷售額增長和整體高個位數銷售增長能力的信心。人們認爲Abbott醫療科技業務增長軌跡的可持續性被低估,將Abbott視爲實現高個位數至低兩位數銷售增長的最佳機會。

根據第三季度業績結果,已調整了Abbott的前景,表明公司處於良好位置,能夠應對來自脈衝場消融的任何競爭壓力。此外,無導線起搏的潛力可能有助於使心臟節律管理增長加速超過3%。儘管處於強勢地位和實施了紮實的運營,但評估認爲市場預期得到滿足,與同行相比,公司估值合理。

儘管公司勢頭強勁,但在試驗衰退期過後,對可持續營業利潤率擴張的尋求仍在進行中。

Abbott第三季度銷售額超出預期,受益於醫療科技和COVID-19檢測的強勁表現,同時將其FY24的有機增長預測保持穩定,並稍微提高了每股收益預期的中點。儘管存在估值和持續訴訟方面的擔憂,但人們對Abbott的表現持樂觀態度。

Abbott管理層表示樂觀,認爲公司將繼續實現高個位數的營業收入增長和兩位數的盈利增長。首席執行官表示,高個位數的營業收入增加和10%的每股收益增長是基本預期。在快速發展的糖尿病護理和結構性心臟領域推出多種新產品,表明Abbott的整個醫療器械繫列在醫療科技行業內具備卓越增長潛力。

以下爲今日7位分析師對$雅培 (ABT.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

瑞士銀行分析師Danielle Antalffy維持買入評級,並將目標價從143美元上調至146美元。

瑞士銀行分析師Danielle Antalffy維持買入評級,並將目標價從143美元上調至146美元。

UBS analyst Danielle Antalffy maintains with a buy rating, and adjusts the target price from $143 to $146.

UBS analyst Danielle Antalffy maintains with a buy rating, and adjusts the target price from $143 to $146.