Markets Weekly Update (October 18): Robust Consumer Demand Fuels Stronger-than-Expected September Retail Sales

Markets Weekly Update (October 18): Robust Consumer Demand Fuels Stronger-than-Expected September Retail Sales

Macro Matters

宏觀事項

Robust Consumer Demand Fuels Stronger-than-Expected September Retail Sales

強勁的消費需求推動了九月零售銷售超出預期

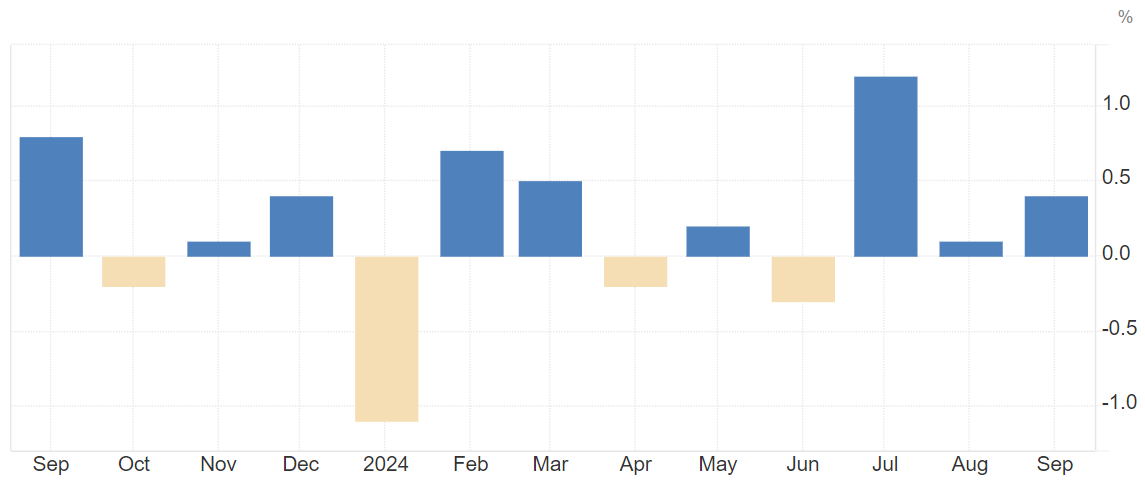

US retail sales surged 0.4% in September 2024 compared to the previous month, surpassing both August's 0.1% increase and market projections of 0.3%. Miscellaneous store retailers led the growth with a 4% rise, followed by clothing (1.5%), health and personal care stores (1.1%), and food and beverage outlets (1%). However, electronics and appliance stores experienced a significant 3.3% decline, while gasoline stations and furniture stores saw decreases of 1.6% and 1.4%, respectively. Auto dealer sales remained unchanged.

2024年9月美國零售銷售比上個月激增0.4%,超過了8月的0.1%增長和市場預期的0.3%。雜貨店零售商以4%的增長領跑,緊隨其後的是服飾(1.5%)、健康個人護理店(1.1%)和食品飲料店(1%)。然而,電子電器店出現了3.3%的顯著下降,而加油站和傢俱店分別跌幅達1.6%和1.4%。汽車經銷商銷售持平。

Notably, the core retail sales figure—which excludes food services, auto dealers, building materials stores, and gasoline stations, and is used in GDP calculations—jumped 0.7%, marking the highest increase in three months. This indicator suggests robust underlying consumer spending trends despite mixed performance across various retail sectors.

值得注意的是,核心零售銷售數據——除了食品服務、汽車經銷商、建築材料店和加油站外,在GDP計算中使用——上漲了0.7%,標誌着三個月來增長最快。這一指標表明,儘管各種零售板塊表現不一,但消費者支出趨勢仍然強勁。

Source: Trading Economics

資料來源:Trading Economics

Builder Optimism Continues to Climb in October Housing Market

建築師樂觀情緒在十月的住房市場持續攀升

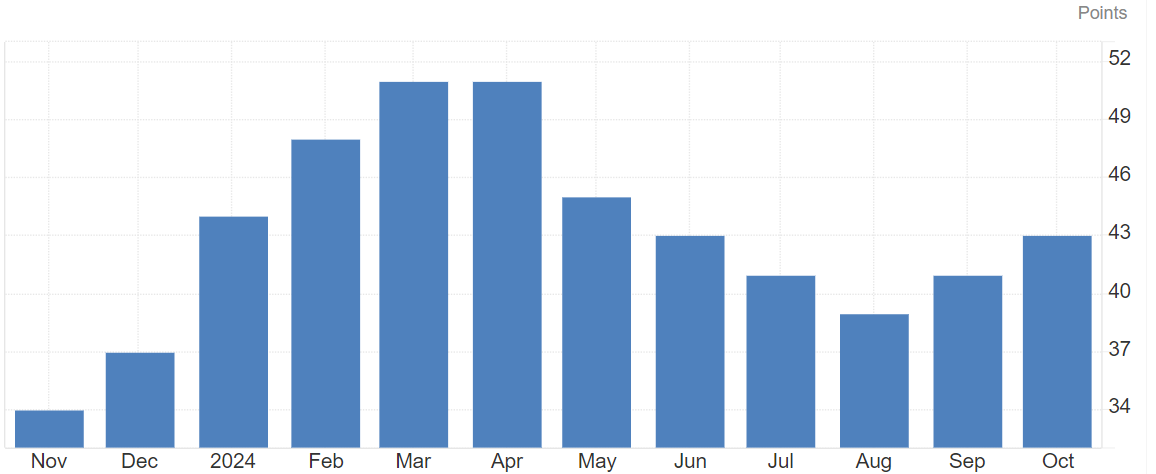

The National Association of Home Builders (NAHB) reported a second consecutive month of increased confidence among builders in the new single-family home market. The NAHB/Wells Fargo Housing Market Index (HMI) rose by two points to reach 43 in October.

全國家居建築商協會(NAHB)報告顯示,新的單一家庭住房市場建築商信心連續第二個月提高。10月,NAHB/富國銀行住房市場指數(HMI)上升兩個點,達到43。

This uptick in builder sentiment is attributed to easing inflation and positive expectations regarding mortgage rates. The HMI, which measures builder perceptions of current and future home sales, operates on a scale where any reading above 50 indicates that more builders view market conditions as "good" rather than "poor."

建築師情緒上升歸因於通脹放緩以及對抵押貸款利率的積極預期。HMI衡量建築商對當前和未來住房銷售的看法,採用一個超過50的讀數表明更多的建築商認爲市場狀況是「好的」,而不是「糟糕的」。

While the current index of 43 still falls below the threshold of 50, the consecutive monthly increases suggest a growing sense of optimism in the housing construction sector.

目前指數爲43,仍低於50的閾值,連續幾個月的增長表明建築施工板塊日益樂觀。

Source: Trading Economics

資料來源:Trading Economics

Smart Money Flow

智能資金流

Spot gold surpasses $2,700/oz. to reach an all time RECORD high. Uncertainty around the U.S. election and expectations around looser monetary policy has driven it higher almost every single month this year.

現貨黃金突破每盎司2700美元,創下歷史新高。圍繞美國大選的不確定性以及對貨幣政策放鬆的預期推動黃金今年幾乎每個月都走高。

Chinese Stock Rally Resumes as Xi, PBOC Fuel Policy Optimism.

中國股市反彈,習近平和央行推動政策樂觀情緒。

Chinese stocks extended gains in the afternoon as President Xi Jinping’s emphasis on technology development and a slew of central bank statements reignited optimism over policy support.

下午,中國股市繼續上漲,習近平主席對技術發展的強調以及央行一系列聲明重新點燃了對政策支持的樂觀情緒。

The CSI 300 Index closed up 3.6%, rebounding from a three-day loss, with chip shares leading the advance. A gauge of Chinese tech stocks listed in Hong Kong was up more than 7% at its session high.

滬深300指數收漲3.6%,從連續三天的下跌中反彈,芯片股領漲。在港上市的中國科技股指數在盤中高位上漲了超過7%。

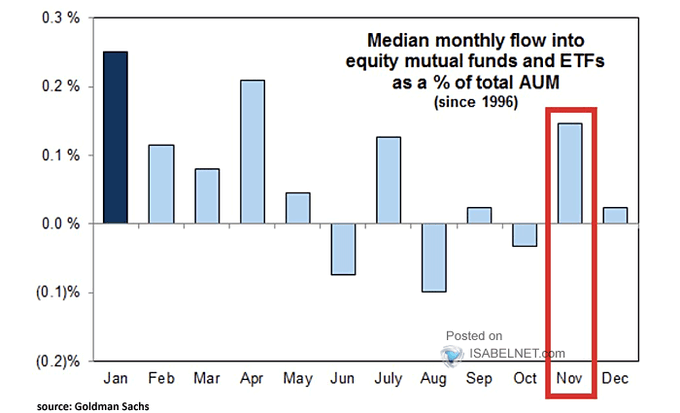

November historically marks a period of increased investor activity in equity markets, often leading to substantial inflows.

11月通常是股票市場投資者活躍度增加的時期,往往會導致大規模資金流入。

BofA's private clients have been buying REITS, financials, utilities ETFs, and selling low-vol, industrials, staples ETFs over the past four weeks.

美銀的私人客戶在過去四周裏一直在購買信託、金融、公用事業等etf,並賣出低波動性、工業和主要消費品etf。

Top Corporate News

頭條公司新聞

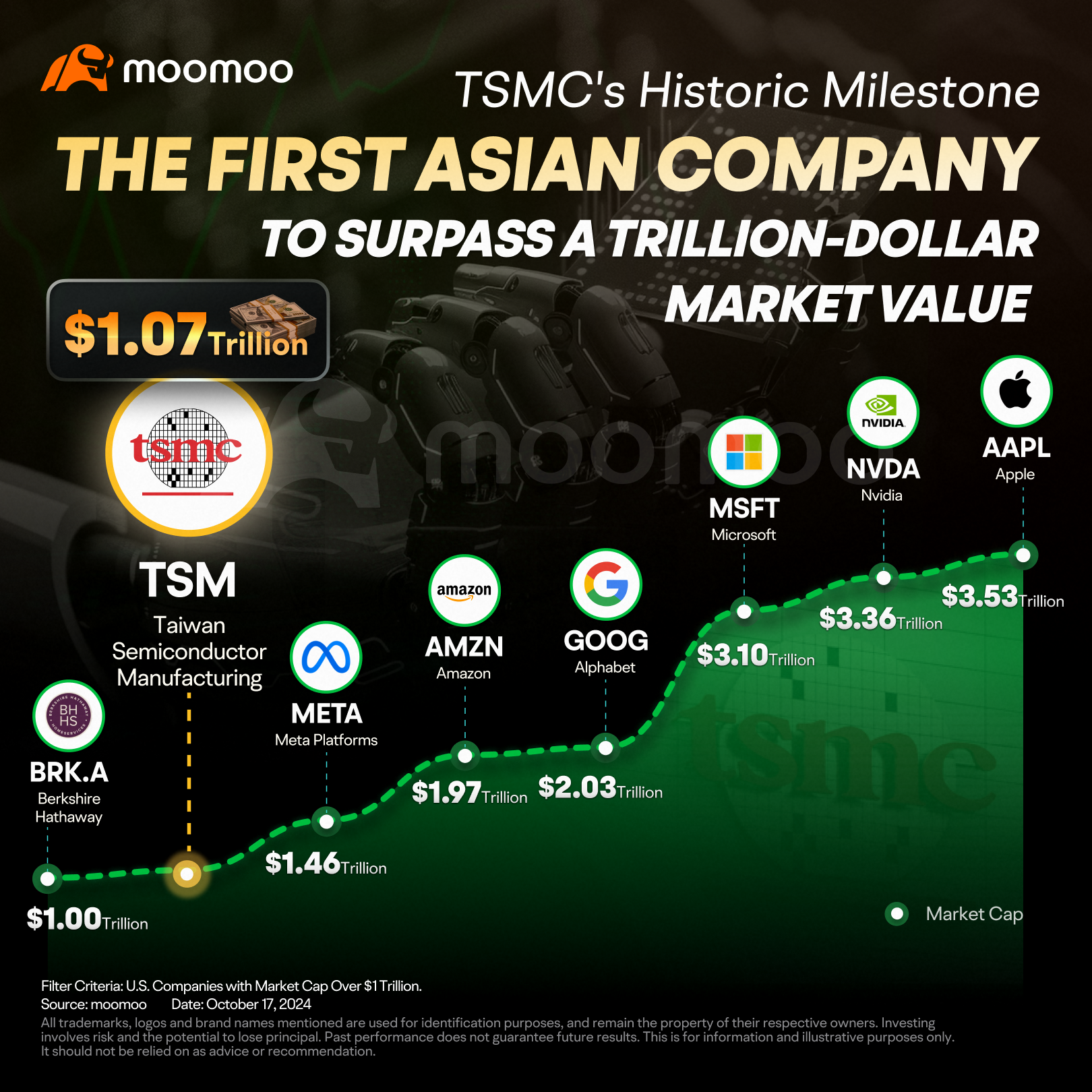

TSMC Hits $1 Trillion Market Cap, Setting New Benchmark for Asian Companies.

台積電市值超過1萬億美元,爲亞洲公司設立了新的基準。

On Thursday, TSMC announced a substantial 54% increase in net profit for the September quarter, reaching NT$325.3 billion ($10.1 billion), surpassing expectations. The company also projected fourth-quarter revenues between $26.1 billion and $26.9 billion, exceeding forecasts of $24.9 billion.

台積電宣佈,截至9月季度淨利潤大幅增長54%,達到3253億新臺幣(約101億美元),超出預期。公司還預計第四季度營收在261億美元至269億美元之間,超過了249億美元的預測。

In the third quarter, revenue from 3-nanometer wafer shipments constituted 20% of the total, while 5-nanometer and 7-nanometer technologies contributed 32% and 17%, respectively. Collectively, advanced technologies, which include 7-nanometer and more sophisticated processes, made up 69% of the total wafer revenue. Wendell Huang, the CFO, noted, "Our third-quarter performance was bolstered by robust demand for our cutting-edge 3nm and 5nm technologies, driven primarily by the smartphone sector and AI-related applications."

在第三季度,3納米晶片的銷售收入佔總收入的20%,而5納米和7納米技術分別貢獻了32%和17%。而先進技術(包括7納米和更先進的工藝)共佔總晶片收入的69%。首席財務官黃建利指出:「我們的第三季度表現得到了尖端3納米和5納米技術的強勁需求支撐,主要受到智能手機和人工智能相關應用的推動。」

According to Bloomberg analyst Charles Shum, TSMC's guidance for a gross margin exceeding 57% in the fourth quarter—higher than the consensus estimate of 54.7% underscores strong ongoing demand for its AI chips, particularly from Nvidia and other clients. TSMC further sees gross profit margin in the 4thquarter to be between 57.0% and 59.0%. Shum suggests that a 25% sales growth in 2025 is achievable, supported by TSMC's proprietary CoWoS semiconductor packaging technology.

據彭博分析師沈曼傑介紹,台積電第四季度毛利率的預估超過57%,高於市場的54.7%,彰顯其在AI芯片領域持續強勁的需求,特別是來自英偉達和其他客戶的訂單增長。台積電還預計第四季度毛利率將在57.0%至59.0%之間。沈認爲,2025年能夠實現25%的銷售增長,得益於台積電專有的CoWoS半導體封裝技術。

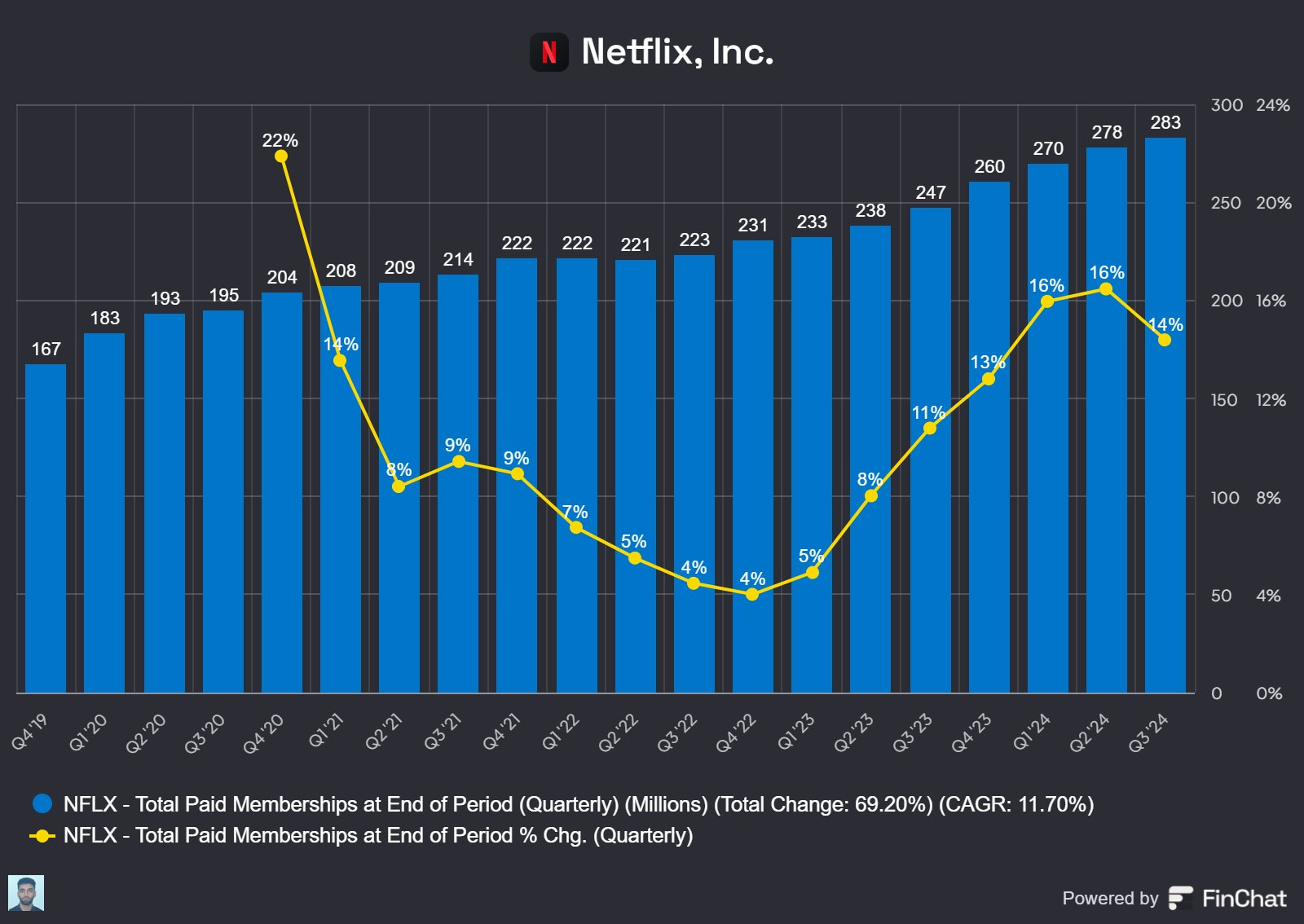

Netflix added 5.1 million subscribers, exceeding estimates and alleviating concerns about its ability to produce compelling new content.

奈飛新增了510萬訂閱用戶,超出預期,並消除了對其生產引人注目新內容能力的擔憂。

The streaming giant reported $5.40 per share earnings, up from $3.73 a year earlier, topping the FactSet consensus of $5.12. Revenue rose to $9.83 billion from $8.54 billion, exceeding expectations of $9.77 billion.

這家流媒體巨頭報告每股收益爲5.40美元,較一年前的3.73美元有所增長,並超過FactSet的共識價值5.12美元。營業收入從85.4億美元增至98.3億美元,超過了97.7億美元的預期。

In Q4, Netflix expects subscriber growth to accelerate, spurred by seasonal trends and high-profile content releases such as 'Squid Game' Season 2 and the much-anticipated Jake Paul/Mike Tyson fight.

在第四季度,奈飛預計訂閱用戶增長將加速,受季節性趨勢和高知名度內容發佈的推動,如《烏賊遊戲》第二季和備受期待的傑克·保羅/邁克·泰森之戰。

ASML shares drop sharply after warning on semiconductor recovery.

安森美半導體(ASML)股票因半導體復甦預警而大幅下跌。

Shares in ASML led a tech rout on Nasdaq on Tuesday after the chip equipment maker warned of a slower recovery in the semiconductor market, in results accidentally published a day early. Net bookings — a measure of orders placed by ASML’s customers — were €2.6bn for the third quarter, far lower than the more than €5bn analysts had expected. Analysts at Stifel said in a note to clients that the order intake was “very weak”.

安森美半導體(ASML)股票在納斯達克週二引發科技行業大跌,因爲這家芯片設備製造商警告稱半導體市場復甦速度較慢,在提前一天意外發布的業績中顯示,淨訂貨額(ASML客戶下訂單的一種衡量標準)爲第三季度的26億歐元,遠低於分析師預期的50多億歐元。Stifel的分析師在寫給客戶的備忘中表示,訂單接受非常疲弱。

Upcoming Economic Data

免責聲明:本演示僅供信息和教育目的;不是任何特定投資或投資策略的建議或認可。在此提供的投資信息具有一般性質,僅供說明目的,並可能不適合所有投資者。它是在沒有考慮個人投資者的財務知識水平、財務狀況、投資目標、投資時間範圍或風險承受能力的情況下提供的。在做出任何投資決策之前,您應考慮此信息是否適合您的相關個人情況。過去的投資業績並不表明或保證未來的成功。收益將有所不同,所有投資都存在風險,包括本金損失。

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

moomoo 是由 Moomoo Technologies Inc 提供的一款金融信息和交易應用程序,在美國,Moomoo Financial Inc 爲投資者提供投資產品和服務,爲 FINRA/SIPC 的成員。

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

Moomoo是由Moomoo Technologies Inc.提供的金融信息和交易應用程序。在美國,Moomoo的投資產品和服務由Moomoo Financial Inc.提供,成爲FINRA/SIPC成員。

Source: Trading Economics

Source: Trading Economics