MicroStrategy Options Trading: A Deep Dive Into Market Sentiment

MicroStrategy Options Trading: A Deep Dive Into Market Sentiment

Financial giants have made a conspicuous bullish move on MicroStrategy. Our analysis of options history for MicroStrategy (NASDAQ:MSTR) revealed 49 unusual trades.

巨頭金融機構在MicroStrategy上展開了明顯的看好行動。我們對MicroStrategy(納斯達克股票代碼:MSTR)期權歷史進行了分析,發現了49筆異常交易。

Delving into the details, we found 48% of traders were bullish, while 30% showed bearish tendencies. Out of all the trades we spotted, 11 were puts, with a value of $502,295, and 38 were calls, valued at $3,057,230.

深入細節,我們發現48%的交易者持看漲觀點,而30%顯示看淡傾向。在我們發現的所有交易中,有11筆爲看跌交易,價值爲502,295美元,38筆爲看漲交易,價值爲3,057,230美元。

What's The Price Target?

目標價是多少?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $123.0 to $250.0 for MicroStrategy over the recent three months.

根據交易活動情況,顯然有重要投資者瞄準MicroStrategy在過去三個月的價格區間從123.0美元到250.0美元。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

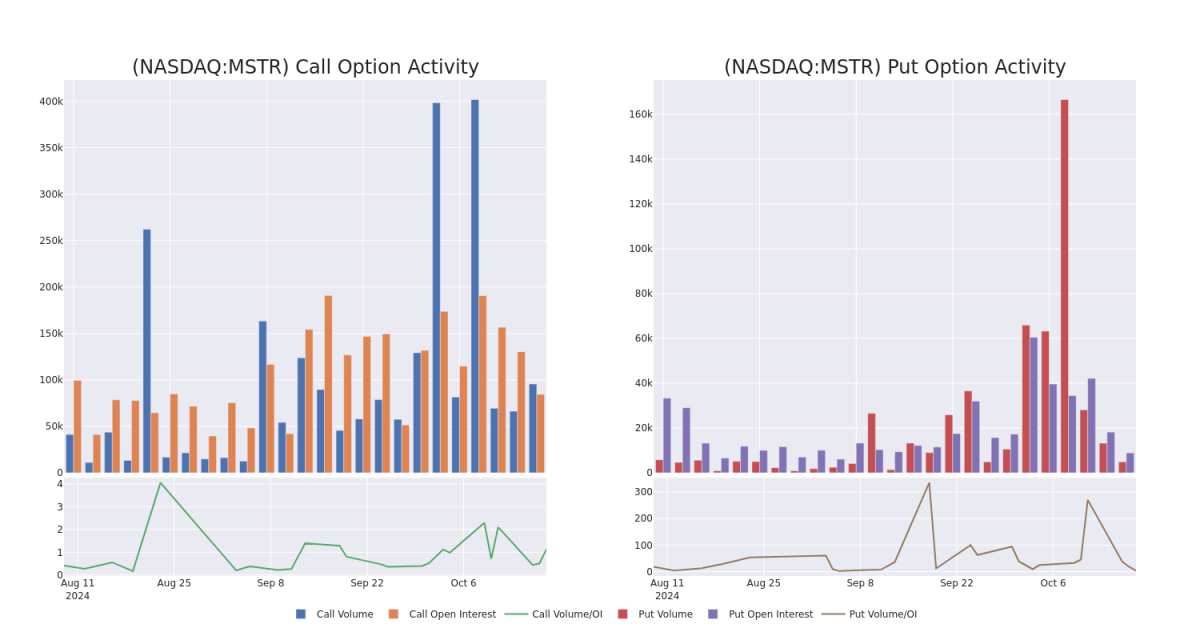

In today's trading context, the average open interest for options of MicroStrategy stands at 2830.09, with a total volume reaching 100,468.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in MicroStrategy, situated within the strike price corridor from $123.0 to $250.0, throughout the last 30 days.

在今日的交易背景下,MicroStrategy期權的平均未平倉量爲2830.09,總成交量達到100,468.00。伴隨的圖表描繪了在過去30天的時間裏,MicroStrategy高價位交易中看漲和看跌期權成交量和未平倉量的發展情況,分佈在123.0美元到250.0美元的行權價格走廊內。

MicroStrategy 30-Day Option Volume & Interest Snapshot

MicroStrategy 30日期權成交量和持倉量快照

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MSTR | CALL | SWEEP | BULLISH | 11/15/24 | $33.2 | $32.55 | $33.2 | $190.00 | $664.0K | 1.8K | 782 |

| MSTR | CALL | SWEEP | NEUTRAL | 10/18/24 | $3.7 | $3.3 | $3.35 | $200.00 | $186.2K | 10.3K | 1.6K |

| MSTR | CALL | SWEEP | NEUTRAL | 10/25/24 | $10.6 | $10.2 | $10.2 | $207.50 | $152.3K | 370 | 765 |

| MSTR | CALL | TRADE | BEARISH | 10/25/24 | $14.4 | $13.8 | $13.8 | $200.00 | $138.0K | 2.6K | 1.7K |

| MSTR | CALL | TRADE | BULLISH | 10/25/24 | $13.7 | $13.35 | $13.7 | $200.00 | $135.6K | 2.6K | 1.3K |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MicroStrategy | 看漲 | SWEEP | 看好 | 11/15/24 | $33.2 | $32.55 | $33.2 | $190.00 | $664.0K | 1.8K | 782 |

| MicroStrategy | 看漲 | SWEEP | 中立 | 10/18/24 | $3.7 | $3.3 | $3.35 | 。 | $186.2K | 10.3K | 1.6K |

| MicroStrategy | 看漲 | SWEEP | 中立 | 10/25/24 | $10.6 | $10.2 | $10.2 | $207.50 | $152.3K | 370 | 765 |

| MicroStrategy | 看漲 | 交易 | 看淡 | 10/25/24 | 14.4美元 | $13.8 | $13.8 | 。 | $138.0K | 2.6K | 1.7K |

| MicroStrategy | 看漲 | 交易 | 看好 | 10/25/24 | $13.7 | $13.35 | $13.7 | 。 | $135.6K | 2.6K | 1.3K |

About MicroStrategy

關於MicroStrategy

MicroStrategy Inc is a provider of enterprise analytics and mobility software. It offers MicroStrategy Analytics platform that delivers reports and dashboards and enables users to conduct ad hoc analysis and share insights through mobile devices or the Web; MicroStrategy Server, which provides analytical processing and job management. The company's reportable operating segment is engaged in the design, development, marketing, and sales of its software platform through licensing arrangements and cloud-based subscriptions and related services.

MicroStrategy是一家企業分析和移動軟件提供商。它提供MicroStrategy Analytics平台,通過移動設備或Web提供報告和儀表板,並使用戶能夠進行臨時分析和分享見解;MicroStrategy Server提供分析處理和作業管理。該公司報告的經營部門從事通過許可安排和雲訂閱及相關服務的方式設計、開發、營銷和銷售其軟件平台。

Following our analysis of the options activities associated with MicroStrategy, we pivot to a closer look at the company's own performance.

在我們分析完MicroStrategy期權活動後,我們再仔細觀察該公司的績效表現。

Where Is MicroStrategy Standing Right Now?

MicroStrategy現在處於何種地位?

- Currently trading with a volume of 6,063,318, the MSTR's price is up by 7.01%, now at $206.98.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 12 days.

- microstrategy的成交量爲6,063,318,漲幅爲7.01%,目前報價爲206.98美元。

- RSI讀數表明股票目前可能超買。

- 預期收益將於 12 天內發佈。

Expert Opinions on MicroStrategy

關於MicroStrategy的專家意見

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $222.0.

在過去的一個月裏,有4位行業分析師分享了他們對這支股票的見解,提出了平均目標價爲222.0美元。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on MicroStrategy with a target price of $173. * An analyst from TD Cowen has decided to maintain their Buy rating on MicroStrategy, which currently sits at a price target of $200. * An analyst from Bernstein has decided to maintain their Outperform rating on MicroStrategy, which currently sits at a price target of $290. * Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on MicroStrategy with a target price of $225.

20年期權交易老手揭示了他的一行圖表技術,顯示何時買入和賣出。複製他的交易,平均每20天獲利27%。點擊這裏獲取* 巴克萊銀行的一位分析師在評估過程中保持一致,對MicroStrategy給予超配評級,目標價爲173美元。* TD Cowen的一位分析師決定維持對MicroStrategy的買入評級,目前的價格目標爲200美元。* Bernstein的一位分析師決定維持對MicroStrategy的跑贏評級,目前的價格目標爲290美元。* 巴克萊銀行的一位分析師在評估過程中保持一致,對MicroStrategy給予超配評級,目標價爲225美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest MicroStrategy options trades with real-time alerts from Benzinga Pro.

期權交易具有較高的風險和潛在回報。精明的交易者通過不斷學習、調整他們的策略、監控多個因子和密切關注市場走勢來管理這些風險。通過Benzinga Pro的實時提醒,及時了解最新的MicroStrategy期權交易信息。

In today's trading context, the average open interest for options of MicroStrategy stands at 2830.09, with a total volume reaching 100,468.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in MicroStrategy, situated within the strike price corridor from $123.0 to $250.0, throughout the last 30 days.

In today's trading context, the average open interest for options of MicroStrategy stands at 2830.09, with a total volume reaching 100,468.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in MicroStrategy, situated within the strike price corridor from $123.0 to $250.0, throughout the last 30 days.