Shareholders Will Probably Hold Off On Increasing HSC Resources Group Limited's (HKG:1850) CEO Compensation For The Time Being

Shareholders Will Probably Hold Off On Increasing HSC Resources Group Limited's (HKG:1850) CEO Compensation For The Time Being

Key Insights

主要見解

- HSC Resources Group will host its Annual General Meeting on 25th of October

- Salary of HK$3.00m is part of CEO Alexander Li's total remuneration

- The total compensation is 69% higher than the average for the industry

- Over the past three years, HSC Resources Group's EPS fell by 48% and over the past three years, the total loss to shareholders 99%

- 鴻盛昌資源集團將於10月25日舉行年度股東大會

- CEO李澤宇的薪水爲300萬港元,是他的總報酬的一部分

- 總報酬比行業平均水平高出69%

- 過去三年,鴻盛昌資源集團的每股收益下降了48%,過去三年,股東的總損失達到了99%

The underwhelming share price performance of HSC Resources Group Limited (HKG:1850) in the past three years would have disappointed many shareholders. Per share earnings growth is also lacking, despite revenue growth. Shareholders will have a chance to take their concerns to the board at the next AGM on 25th of October and vote on resolutions including executive compensation, which studies show may have an impact on company performance. Here's our take on why we think shareholders might be hesitant about approving a raise at the moment.

鴻盛昌資源集團有限公司(HKG:1850)過去三年的股價表現令許多股東感到失望。每股收益增長也不盡人意,儘管營業收入增長。股東們將有機會在下次於10月25日舉行的股東大會上向董事會提出關切,並投票表決,包括執行薪酬等議題,研究表明這可能會對公司績效產生影響。我們分析認爲,股東們可能會對目前批准加薪持謹慎態度。

How Does Total Compensation For Alexander Li Compare With Other Companies In The Industry?

亞歷山大·李的總薪酬與行業中其他公司相比如何?

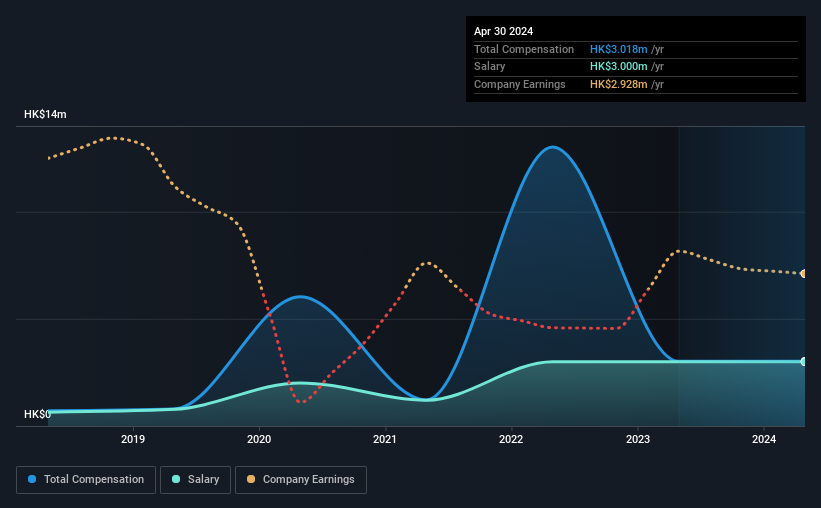

At the time of writing, our data shows that HSC Resources Group Limited has a market capitalization of HK$37m, and reported total annual CEO compensation of HK$3.0m for the year to April 2024. This was the same as last year. Notably, the salary which is HK$3.00m, represents most of the total compensation being paid.

根據我們的數據,鴻盛昌資源集團有限公司的市值爲HK$3700萬,並報告截至2024年4月的CEO年薪總額爲HK$300萬。這與去年相同。值得注意的是,30萬港元的薪水佔據了大部分薪酬。

In comparison with other companies in the Hong Kong Commercial Services industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was HK$1.8m. This suggests that Alexander Li is paid more than the median for the industry.

與香港商業服務行業市值低於16億港元的其他公司相比,報告的CEO薪酬中位數爲180萬港元。這表明亞歷山大·李的薪酬高於行業中位數。

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | HK$3.0m | HK$3.0m | 99% |

| Other | HK$18k | HK$18k | 1% |

| Total Compensation | HK$3.0m | HK$3.0m | 100% |

| 組成部分 | 2024 | 2023 | 比例(2024年) |

| 薪資 | 300萬元港元 | 300萬元港元 | 99% |

| 其他 | HK$18k | HK$18k | 1% |

| 總補償 | 300萬港元 | 300萬元港元 | 100% |

On an industry level, around 82% of total compensation represents salary and 18% is other remuneration. Investors will find it interesting that HSC Resources Group pays the bulk of its rewards through a traditional salary, instead of non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

在行業層面上,約82%的總薪酬代表工資,18%爲其他薪酬。投資者會發現鴻盛昌資源集團主要通過傳統工資形式支付大部分激勵,而非工資以外的福利。如果總薪酬偏向於工資,這意味着通常和表現掛鉤的變量部分較低。

HSC Resources Group Limited's Growth

鴻盛昌資源集團有限公司的增長

Over the last three years, HSC Resources Group Limited has shrunk its earnings per share by 48% per year. Its revenue is up 42% over the last year.

在過去三年中,鴻盛昌資源集團有限公司的每股收益每年減少了48%。其營業收入在過去一年增長了42%。

The reduction in EPS, over three years, is arguably concerning. On the other hand, the strong revenue growth suggests the business is growing. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

在過去三年中,EPS的下降可以說是令人擔憂的。另一方面,強勁的營業收入增長表明該業務正在增長。總之,我們無法對業務績效形成強烈的看法,但這是值得關注的。我們沒有分析師的預測,但您可以通過查看更詳細的歷史收益,營業收入和現金流圖表來更好地了解其增長情況。

Has HSC Resources Group Limited Been A Good Investment?

鴻盛昌資源集團有限公司是一個好的投資嗎?

Few HSC Resources Group Limited shareholders would feel satisfied with the return of -99% over three years. So shareholders would probably want the company to be less generous with CEO compensation.

過去三年,很少有鴻盛昌資源集團有限公司的股東會滿意-99%的回報。因此股東可能希望公司在CEO的報酬上不要那麼慷慨。

To Conclude...

總之...

HSC Resources Group pays its CEO a majority of compensation through a salary. The returns to shareholders is disappointing along with lack of earnings growth, which goes some way in explaining the poor returns. Shareholders will get the chance at the upcoming AGM to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

鴻盛昌資源集團通過工資的方式向其首席執行官支付了大部分的薪酬。對股東的回報令人失望,再加上缺乏盈利增長,這在一定程度上解釋了糟糕的回報。股東將有機會在即將舉行的股東大會上詢問董事會有關關鍵事項的問題,例如CEO的薪酬或其他可能存在的問題,並重新審視他們對公司的投資論點。

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 5 warning signs for HSC Resources Group (of which 3 can't be ignored!) that you should know about in order to have a holistic understanding of the stock.

分析CEO的薪酬總是明智之舉,同時對公司的關鍵績效領域進行徹底分析也很重要。這就是爲什麼我們進行了調研,並確定了鴻盛昌資源集團的5個警示信號(其中有3個不容忽視!)這些信號讓您了解這支股票的整體情況。

Switching gears from HSC Resources Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

從鴻盛昌資源集團切換到,如果您正在尋找完美的資產負債表和高回報率,那麼這份免費的高回報、低債務公司清單是一個絕佳的選擇。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

On an industry level, around 82% of total compensation represents salary and 18% is other remuneration. Investors will find it interesting that HSC Resources Group pays the bulk of its rewards through a traditional salary, instead of non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

On an industry level, around 82% of total compensation represents salary and 18% is other remuneration. Investors will find it interesting that HSC Resources Group pays the bulk of its rewards through a traditional salary, instead of non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.