Earnings Growth of 2.7% Over 3 Years Hasn't Been Enough to Translate Into Positive Returns for Inner Mongolia Yili Industrial Group (SHSE:600887) Shareholders

Earnings Growth of 2.7% Over 3 Years Hasn't Been Enough to Translate Into Positive Returns for Inner Mongolia Yili Industrial Group (SHSE:600887) Shareholders

Inner Mongolia Yili Industrial Group Co., Ltd. (SHSE:600887) shareholders should be happy to see the share price up 24% in the last month. But that doesn't help the fact that the three year return is less impressive. In fact, the share price is down 34% in the last three years, falling well short of the market return.

伊利股份(SHSE:600887)的股東應該會高興看到股價在上個月上漲了24%。但遺憾的是,過去三年的回報率並不令人印象深刻。事實上,股價在過去三年下跌了34%,遠遠低於市場回報率。

Since Inner Mongolia Yili Industrial Group has shed CN¥6.0b from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

由於伊利股份在過去7天從其價值中削減了CN¥60億,讓我們看看長期下跌是否是由公司的經濟學驅動的。

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

用本傑明·格雷厄姆的話來說:「短期市場是一臺投票機,但長期市場是一臺稱重機」。檢查市場情緒如何隨時間推移變化的一種方式是查看公司股價和每股收益(EPS)之間的相互作用。

During the unfortunate three years of share price decline, Inner Mongolia Yili Industrial Group actually saw its earnings per share (EPS) improve by 8.4% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past.

在不幸的三年股價下跌期間,伊利股份實際上看到每年每股收益(EPS)提高了8.4%。這是一個謎,表明可能有一些暫時支撐股價的因素。另外,過去可能存在增長預期不合理的情況。

It's worth taking a look at other metrics, because the EPS growth doesn't seem to match with the falling share price.

值得關注其他指標,因爲EPS增長似乎與股價下跌不符。

We note that the dividend seems healthy enough, so that probably doesn't explain the share price drop. It's good to see that Inner Mongolia Yili Industrial Group has increased its revenue over the last three years. But it's not clear to us why the share price is down. It might be worth diving deeper into the fundamentals, lest an opportunity goes begging.

我們注意到,分紅派息看起來足夠健康,所以這可能不是股價下跌的原因。很高興看到伊利股份在過去三年裏增加了營業收入。但我們不清楚爲什麼股價下跌。也許值得更深入地了解基本情況,以免錯失機會。

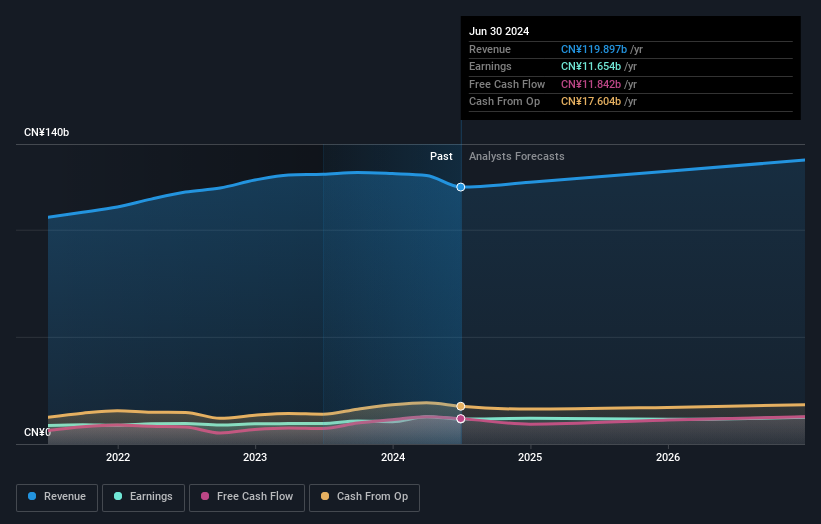

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

以下圖像顯示了公司的營業收入和盈利(隨時間變化)(單擊以查看準確的數字)。

Inner Mongolia Yili Industrial Group is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think Inner Mongolia Yili Industrial Group will earn in the future (free analyst consensus estimates)

伊利股份是一家知名股票,有很多分析師對其進行覆蓋,表明對未來增長有一定的預期。因此,檢查分析師對伊利股份未來盈利的看法是非常明智的(免費分析師共識估計)

What About Dividends?

那麼分紅怎麼樣呢?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Inner Mongolia Yili Industrial Group's TSR for the last 3 years was -27%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

重要的是要考慮任何給定股票的總股東回報以及股價回報。TSR納入了任何股權分置活動或折價融資的價值,以及根據股息再投資的假設,計算在內的任何分紅。因此,對於支付豐厚股息的公司,TSR往往比股價回報高得多。伊利股份過去3年的TSR爲-27%,超過了前面提到的股價回報。公司支付的股息因此提高了總股東回報。

A Different Perspective

不同的觀點

It's nice to see that Inner Mongolia Yili Industrial Group shareholders have received a total shareholder return of 6.1% over the last year. That's including the dividend. That gain is better than the annual TSR over five years, which is 2%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Keeping this in mind, a solid next step might be to take a look at Inner Mongolia Yili Industrial Group's dividend track record. This free interactive graph is a great place to start.

很高興看到伊利股份股東在過去一年中獲得了總股東回報率爲6.1%。這已經包含了分紅派息。這一增長優於五年來的年度TSR,爲2%。因此,最近該公司周圍的情緒似乎是積極的。在最好的情況下,這可能暗示着一些真正的業務動力,這暗示着現在可能是深入研究的好時機。牢記這一點,一個很好的下一步可能是查看伊利股份的分紅派息記錄。 這個免費互動圖表是一個很好的開始。

Of course Inner Mongolia Yili Industrial Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

當然,伊利股份可能不是最佳的股票選擇。因此,您可能希望查看這些免費的成長股票收藏。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

請注意,本文引用的市場回報反映了目前在中國交易所上市的股票的市場加權平均回報。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

During the unfortunate three years of share price decline, Inner Mongolia Yili Industrial Group actually saw its earnings per share (EPS) improve by 8.4% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past.

During the unfortunate three years of share price decline, Inner Mongolia Yili Industrial Group actually saw its earnings per share (EPS) improve by 8.4% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past.