Dada Nexus Limited (NASDAQ:DADA) Stock Rockets 33% But Many Are Still Ignoring The Company

Dada Nexus Limited (NASDAQ:DADA) Stock Rockets 33% But Many Are Still Ignoring The Company

Dada Nexus Limited (NASDAQ:DADA) shares have had a really impressive month, gaining 33% after a shaky period beforehand. But the last month did very little to improve the 53% share price decline over the last year.

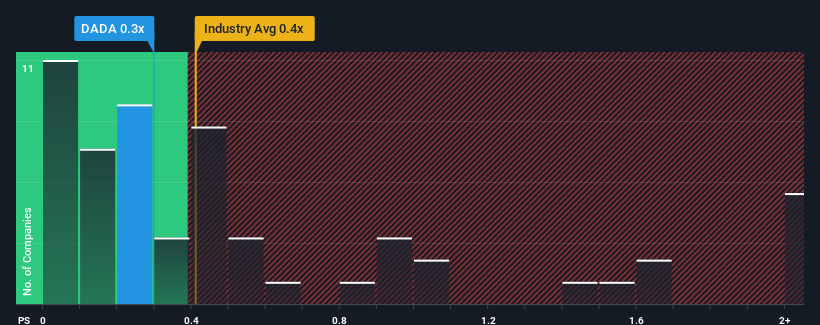

In spite of the firm bounce in price, it's still not a stretch to say that Dada Nexus' price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Consumer Retailing industry in the United States, where the median P/S ratio is around 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

How Has Dada Nexus Performed Recently?

Dada Nexus could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Dada Nexus will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Dada Nexus?

The only time you'd be comfortable seeing a P/S like Dada Nexus' is when the company's growth is tracking the industry closely.

The only time you'd be comfortable seeing a P/S like Dada Nexus' is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 2.6%. Even so, admirably revenue has lifted 57% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 8.9% per annum as estimated by the eleven analysts watching the company. That's shaping up to be materially higher than the 5.0% each year growth forecast for the broader industry.

In light of this, it's curious that Dada Nexus' P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Dada Nexus' P/S?

Dada Nexus' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Dada Nexus currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Dada Nexus, and understanding should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.