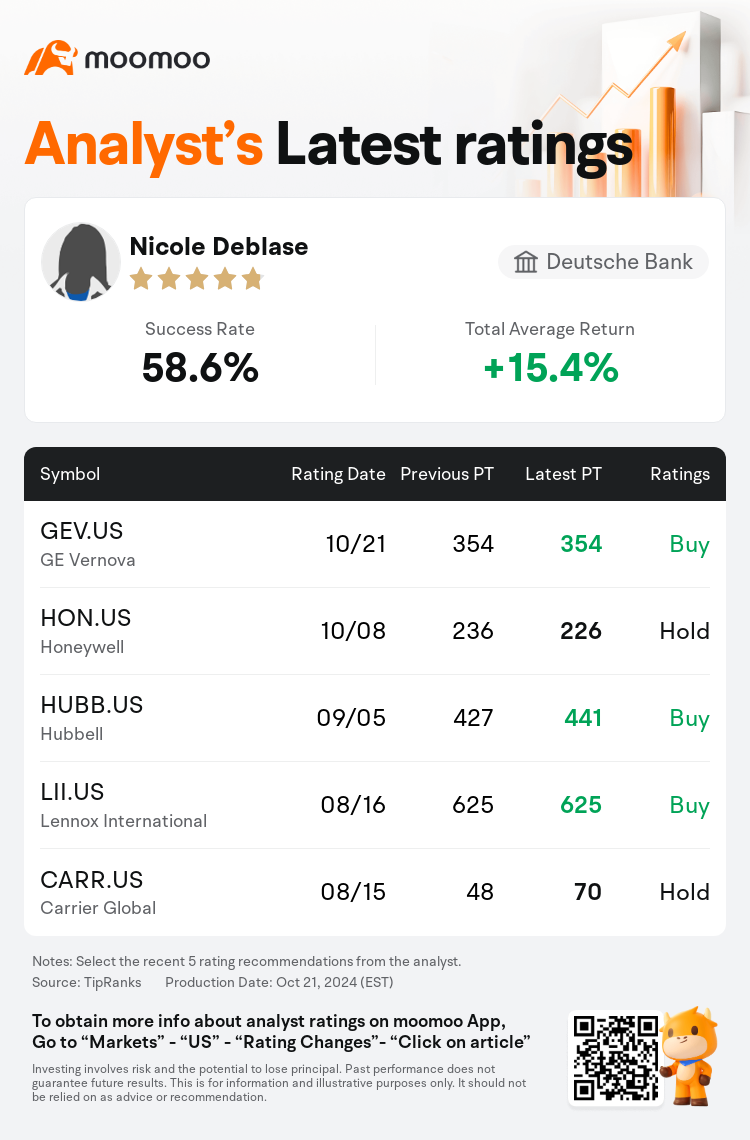

Deutsche Bank analyst Nicole Deblase initiates coverage on $GE Vernova (GEV.US)$ with a buy rating, and sets the target price at $354.

According to TipRanks data, the analyst has a success rate of 58.6% and a total average return of 15.4% over the past year.

Furthermore, according to the comprehensive report, the opinions of $GE Vernova (GEV.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $GE Vernova (GEV.US)$'s main analysts recently are as follows:

GE Vernova is recognized as a dominant player in the electric power sector, offering a suite of products and services that encompass the generation, transmission, management, transformation, and storage of electricity. It is seen as a concentrated bet on worldwide investment in power generation capacity, with expectations for the sector's investment climate being the most promising it has been in many years. Forecasts suggest an annual adjusted EBITDA growth of 63% leading up to 2027 for GE Vernova.

The firm's outlook on GE Vernova is maintained with a positive view, amidst a comprehensive assessment anticipating Q3 outcomes within the U.S. Clean Energy sector. Present conditions, influenced by the political election cycle, fluctuating interest rates, evolving trade policies, and competitive landscapes have yielded varied results, with a general investor sentiment leaning towards skepticism in the sector. Looking ahead to the November elections, the anticipation of sizable gains appears constrained, with a trend suggesting more risk on the downside, particularly as earnings approach. This is partly due to the competitive pressure among solar installers and anticipated project hold-ups for utility-scale operators. However, potential positive factors include GE Vernova's robust performance in Power and Electrification and a possible significant increase in gas turbine orders, which may contribute positively to the company's share value.

GE Vernova continues to be a preferred selection, with the anticipation of an investor update in December being a significant catalyst for revisions that will unfold over multiple years. Despite the possibility of not meeting consensus estimates in the third quarter, it's projected that the fiscal 2025 EBITDA will surpass the Street's expectations. Nevertheless, the genuine chance for the company's shares is linked to the 2026 outlook, where the long-dated backlog is expected to temper the immediate impact of higher margins in new orders.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

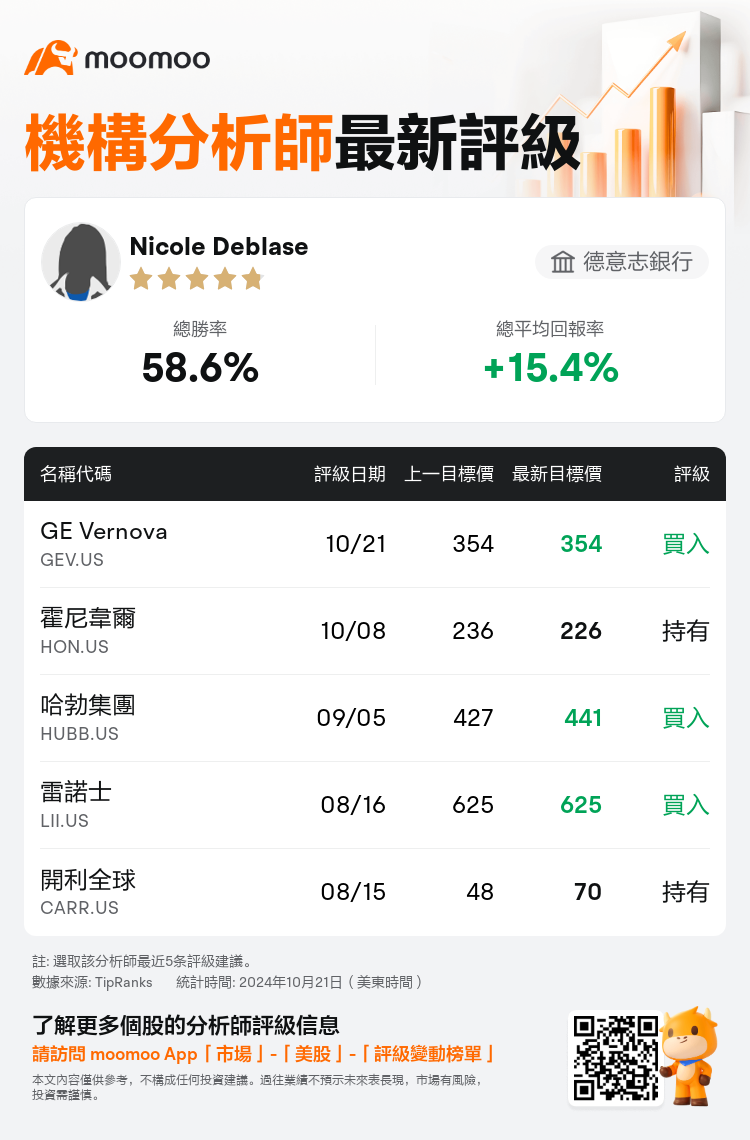

德意志銀行分析師Nicole Deblase首次給予$GE Vernova (GEV.US)$買入評級,目標價354美元。

根據TipRanks數據顯示,該分析師近一年總勝率為58.6%,總平均回報率為15.4%。

此外,綜合報道,$GE Vernova (GEV.US)$近期主要分析師觀點如下:

此外,綜合報道,$GE Vernova (GEV.US)$近期主要分析師觀點如下:

GE Vernova被認爲是電力板塊中的主導參與者,提供涵蓋電力的發電、傳輸、管理、變壓、儲存等產品和服務套件。全球投資電力產能方面,GE Vernova被視爲一筆集中的投注,預計該板塊的投資環境將是多年來最有前景的。預測顯示,截至2027年,GE Vernova的年調整後EBITDA增長率將達到63%。

公司對GE Vernova的展望持續看好,同時對美國清潔能源板塊的Q3業績進行全面評估。當前情況受政治選舉週期、利率波動、貿易政策的演變以及競爭格局的影響,取得了各種不同的結果,普遍投資者情緒更多地傾向於對該板塊持懷疑態度。展望11月的選舉,對於可預見的大幅增長的期待出現受限,趨勢顯示更多的風險從下行開始,尤其是在收益接近時。這在一定程度上歸因於太陽能安裝商之間的競爭壓力,以及公用規模運營商預期項目中斷的拖延。然而,潛在的積極因素包括GE Vernova在電力和電氣領域的強勁表現,以及燃氣輪機訂單的可能顯著增加,這可能對公司股價做出積極貢獻。

GE Vernova仍然是首選之選,預計12月的投資者更新將成爲未來幾年將會展開的重要變革的催化劑。儘管存在第三季度未達成共識預期的可能性,但預計到2025會計年度的EBITDA將超過行業的預期。然而,公司股份的真正機會與2026年的展望相關,那時長期積壓訂單有望抑制新訂單更高利潤的直接影響。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$GE Vernova (GEV.US)$近期主要分析師觀點如下:

此外,綜合報道,$GE Vernova (GEV.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of