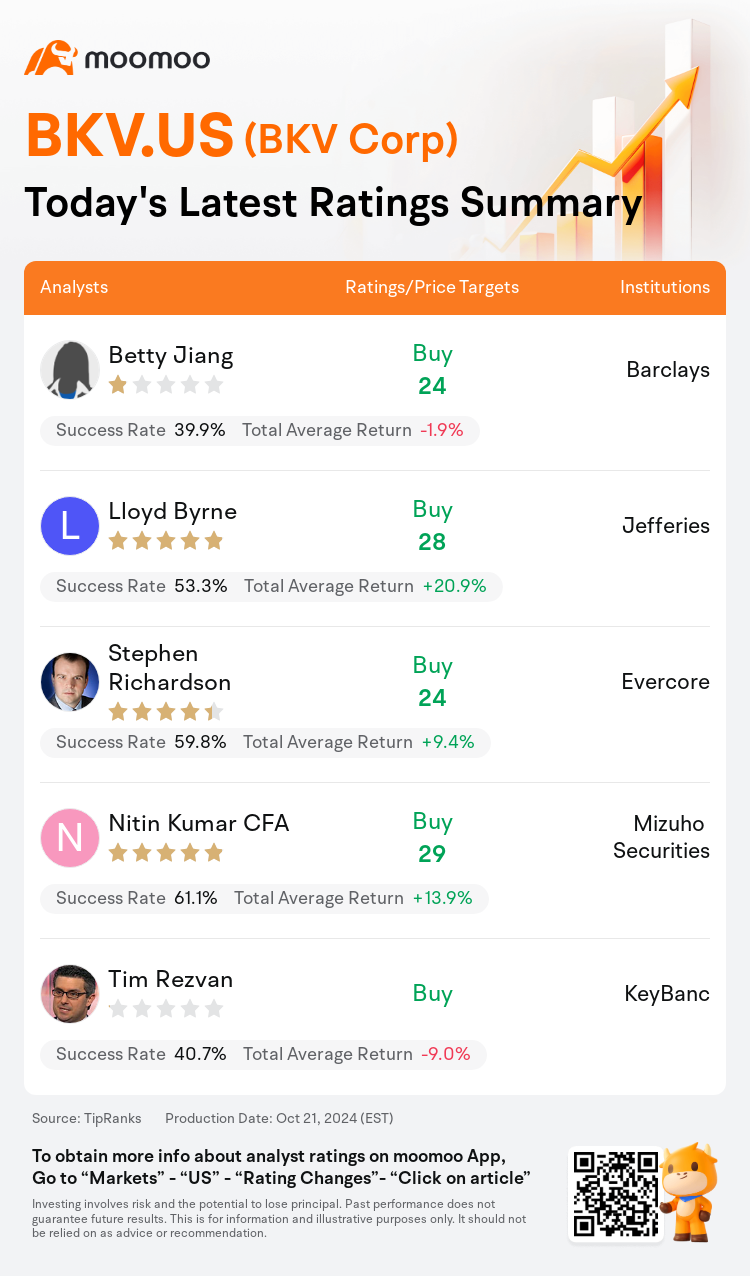

On Oct 21, major Wall Street analysts update their ratings for $BKV Corp (BKV.US)$, with price targets ranging from $24 to $29.

Barclays analyst Betty Jiang initiates coverage with a buy rating, and sets the target price at $24.

Jefferies analyst Lloyd Byrne initiates coverage with a buy rating, and sets the target price at $28.

Evercore analyst Stephen Richardson initiates coverage with a buy rating, and sets the target price at $24.

Evercore analyst Stephen Richardson initiates coverage with a buy rating, and sets the target price at $24.

Mizuho Securities analyst Nitin Kumar CFA initiates coverage with a buy rating, and sets the target price at $29.

KeyBanc analyst Tim Rezvan initiates coverage with a buy rating.

Furthermore, according to the comprehensive report, the opinions of $BKV Corp (BKV.US)$'s main analysts recently are as follows:

BKV Corp. is distinguished in the exploration and production sector through its unique approach of integrating a core in gas production with a growth strategy that encompasses power and carbon capture. While there are concerns regarding the complexity of the business and the growth risks given the current valuation, the potential for expansion in the two segments that command higher multiples seems to be significantly undervalued.

BKV Corp. is seen as providing a unique opportunity for investors to engage with the growth of power and carbon capture sectors. The company's structure and strategy, potentially assessed through a sum-of-the-parts analysis, are expected to contribute to its upward share price trajectory. BKV's comparatively modest scale is thought to offer investors an amplified connection to two enduring trends: the expansion of power and the shift towards energy transition.

The U.S. natural gas producer is noted for its integrated operations that span across midstream and downstream sectors, including ownership of a power plant complex in Texas. Recently, it also successfully implemented its initial carbon capture project. In June, the company revealed a deal to sell Carbon Sequestered Gas, securing a price above the standard Henry Hub rate. It is anticipated that the company will disclose additional sales agreements for CSG as it expands its carbon capture, utilization, and storage business.

The three separate business units of BKV Corp., while individually fairly valued, present a unique investment opportunity when considered as a cohesive entity. This integrated approach offers exposure to converging market trends and the prospect of enhanced margins across various energy value chains, exceeding their individual potential. The long-term value proposition of BKV's assets is particularly appealing to investors with patience, underscored by the company's modest balance sheet leverage and strategic hedging approach.

BKV Corp., which primarily focuses on natural gas exploration and production, is poised to benefit from several optimistic secular trends. The potential for growth is anchored in the increasing demand for natural gas, the opportunities presented by carbon capture, and the prospects of enhancing utilization rates of its merchant power assets through sales to the anticipated construction of data centers in Texas.

Here are the latest investment ratings and price targets for $BKV Corp (BKV.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

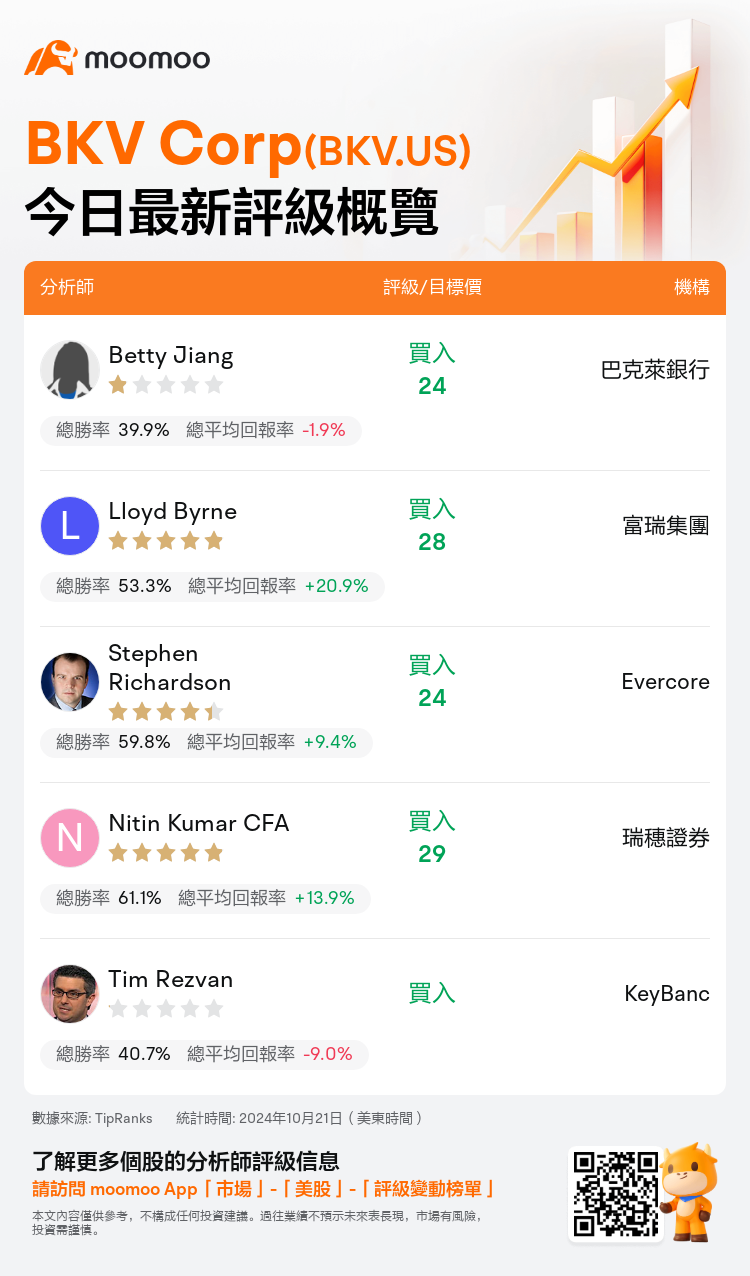

美東時間10月21日,多家華爾街大行更新了$BKV Corp (BKV.US)$的評級,目標價介於24美元至29美元。

巴克萊銀行分析師Betty Jiang首次給予買入評級,目標價24美元。

富瑞集團分析師Lloyd Byrne首次給予買入評級,目標價28美元。

Evercore分析師Stephen Richardson首次給予買入評級,目標價24美元。

Evercore分析師Stephen Richardson首次給予買入評級,目標價24美元。

瑞穗證券分析師Nitin Kumar CFA首次給予買入評級,目標價29美元。

KeyBanc分析師Tim Rezvan首次給予買入評級。

此外,綜合報道,$BKV Corp (BKV.US)$近期主要分析師觀點如下:

BKV公司通過將核心燃料幣生產與囊括電能和碳捕捉在內的增長策略相結合的獨特方式,在勘探和生產板塊中獨具特色。儘管業務複雜性和當前估值存在增長風險的問題,但在這兩個能夠獲得更高倍數的板塊中擴張的潛力似乎被嚴重低估。

BKV公司被視爲爲投資者提供一個獨特的機會,參與電能和碳捕捉板塊的增長。公司的結構和策略,可能通過部分分析進行評估,預計將有助於其股價上升軌跡。BKV相對較小規模被認爲爲投資者提供了與兩大持久趨勢更密切聯繫的連接:電能擴張和能源轉型的轉變。

這家美國天然氣生產商以跨中游和下游板塊的綜合運營而聞名,包括在德克薩斯州擁有發電廠綜合體的所有權。最近,該公司還成功實施了其首個碳捕捉項目。6月,該公司宣佈達成協議出售化碳封存燃料幣,價格高於標準Henry Hub價格。預計該公司將披露進一步的CSG銷售協議,因爲它擴展其碳捕捉、利用和存儲業務。

BKV公司的三個獨立業務部門,雖然在各自價值合理,但當作爲一個統一實體考慮時,提供了一個獨特的投資機會。這種綜合的方式爲投資者提供了接觸融合市場趨勢和在各種能源價值鏈中提高邊際利潤的前景,超過了它們各自的潛力。BKV資產的長期價值主張特別吸引那些具有耐心的投資者,而公司的謹慎資產負債表槓桿和戰略對沖方法爲此提供了支持。

主要專注於天然氣勘探和生產的BKV公司有望受益於幾種樂觀的長期趨勢。增長潛力集中在天然氣需求增加、碳捕捉帶來的機會,以及通過向德克薩斯州數據中心的預期施工銷售來提高其商業電能資產利用率的前景。

以下爲今日5位分析師對$BKV Corp (BKV.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

Evercore分析師Stephen Richardson首次給予買入評級,目標價24美元。

Evercore分析師Stephen Richardson首次給予買入評級,目標價24美元。

Evercore analyst Stephen Richardson initiates coverage with a buy rating, and sets the target price at $24.

Evercore analyst Stephen Richardson initiates coverage with a buy rating, and sets the target price at $24.