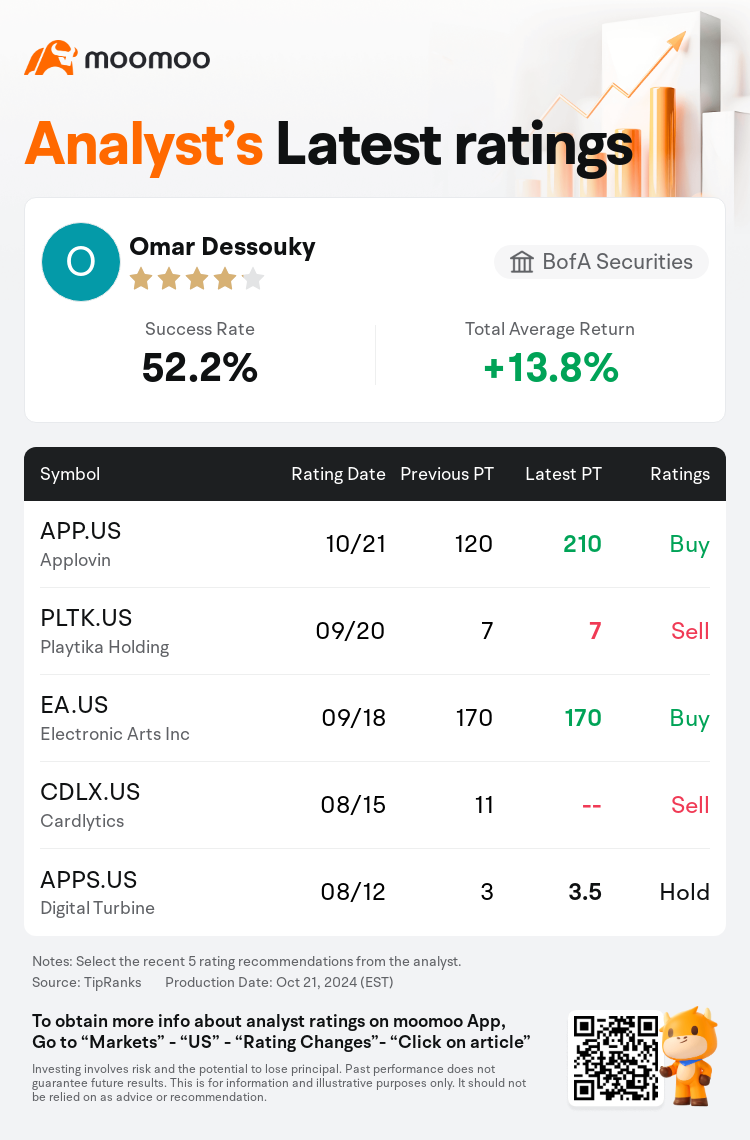

BofA Securities analyst Omar Dessouky maintains $Applovin (APP.US)$ with a buy rating, and adjusts the target price from $120 to $210.

According to TipRanks data, the analyst has a success rate of 52.2% and a total average return of 13.8% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Applovin (APP.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Applovin (APP.US)$'s main analysts recently are as follows:

The global video game industry's growth appears moderate, yet stable mobile trends are seen as a positive sign. There is an anticipation for console spending to pick up in the following year, influenced by a robust lineup of games and the potential launch of a next-generation gaming console. Favorite picks within the sector include companies known for their strong presence in gaming.

The introduction of AppLovin's Axon 2.0 AI engine in the second quarter of 2023 is seen as a catalyst for the company's ongoing growth and profitability transformation, which is perceived to have been overlooked by the market and analysts. This has led to a reassessment of the company's prospects as a growth entity, with heightened expectations for its software revenue growth in upcoming years, particularly due to a strong core business that capitalizes on mobile gaming advertisements. Consequently, there's an increased valuation based on these optimistic projections for the company's future EBITDA.

AppLovin is considered an essential infrastructure for the mobile gaming industry and is establishing its presence as a significant player in the big data and AI landscape. Analysts note that despite the swift increase in the stock's value, a market pullback would present a buying opportunity. They also suggest that the stock's re-valuation is justifiable and likely to be enduring, with expectations of considerable growth potential in its primary business area.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

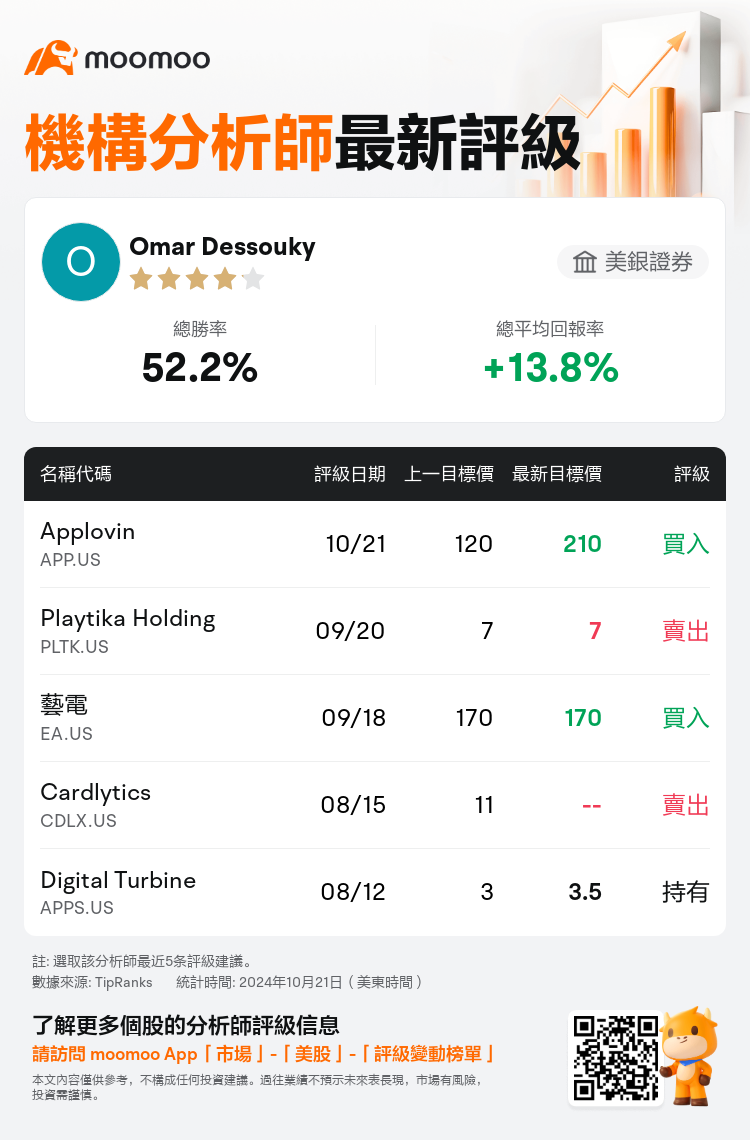

美銀證券分析師Omar Dessouky維持$Applovin (APP.US)$買入評級,並將目標價從120美元上調至210美元。

根據TipRanks數據顯示,該分析師近一年總勝率為52.2%,總平均回報率為13.8%。

此外,綜合報道,$Applovin (APP.US)$近期主要分析師觀點如下:

此外,綜合報道,$Applovin (APP.US)$近期主要分析師觀點如下:

全球視頻遊戲行業的增長似乎溫和,但穩定的移動趨勢被視爲一個積極的信號。受強勁的遊戲陣容以及下一代遊戲機可能推出的影響,預計來年主機支出將回升。該行業最受歡迎的公司包括以其在遊戲領域的強大影響力而聞名的公司。

AppLovin於2023年第二季度推出的Axon 2.0 AI引擎被視爲該公司持續增長和盈利轉型的催化劑,而市場和分析師認爲這種轉型被市場和分析師所忽視。這促使人們重新評估了該公司作爲成長型實體的前景,人們對其未來幾年軟件收入增長的預期更高,特別是由於利用手機遊戲廣告的強勁核心業務。因此,基於對公司未來息稅折舊攤銷前利潤的樂觀預測,估值有所提高。

AppLovin被認爲是移動遊戲行業的重要基礎設施,並正在確立其在大數據和人工智能領域的重要參與者的地位。分析師指出,儘管該股的價值迅速上漲,但市場回調將帶來買入機會。他們還認爲,該股的重估是合理的,而且可能會持續下去,預計其主要業務領域將有可觀的增長潛力。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Applovin (APP.US)$近期主要分析師觀點如下:

此外,綜合報道,$Applovin (APP.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of