Market Mover | Metcash shares plummet over 6%, facing significant selling pressure

Market Mover | Metcash shares plummet over 6%, facing significant selling pressure

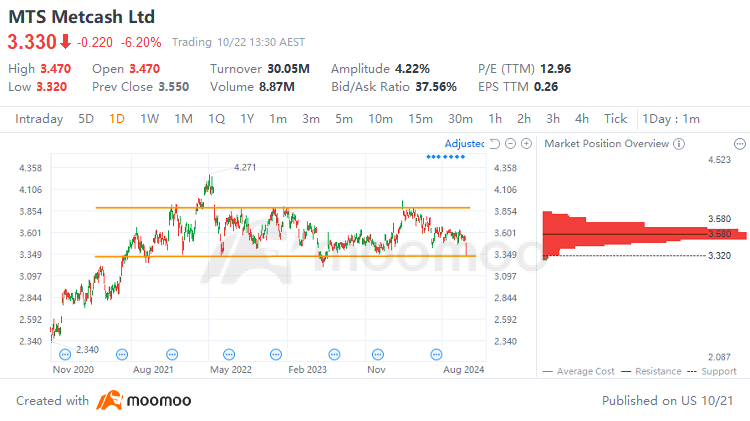

$Metcash Ltd (MTS.AU)$ shares fell 6.20% on Tuesday, with trading volume expanding to A$30.05 million. Metcash has fallen 5.38% over the past week, with a cumulative loss of 2.33% year-to-date.

$Metcash Ltd (MTS.AU)$ 週二股價下跌6.20%,成交量擴大至澳元3005萬。Metcash在過去一週下跌了5.38%,年初累計虧損2.33%。

Metcash's technical analysis chart:

Metcash的技術面分析圖表:

Technical Analysis:

技術面分析:

Support: A$3.32

Resistance: A$3.88

Price range A$3.32 to A$3.88:

The trading range indicates a heavy concentration of selling orders, with the stock price on an downward trend. There's a high concentration of trapped positions within the trading range, which implies strong resistance to any upward movement. The stock started to decline near A$3.88 due to selling pressure and repeatedly tested the A$3.32 level, where it seems to find some support. Going forward, it's crucial to watch whether the support at A$3.32 holds and if it can lead to a potential rebound.

壓力位:A$3.32

支撐位:A$3.88

價格區間A$3.32至A$3.88:

交易範圍顯示有大量的賣出訂單,股價呈下降趨勢。交易範圍內有大量被套的倉位,這意味着對於任何上漲動向都存在強烈的阻力。股價在A$3.88附近開始下跌,受到賣壓影響並反覆測試A$3.32的水平,似乎在那裏找到了一些支撐。未來至關重要的是觀察A$3.32的支撐是否保持,並且是否能帶來潛在的反彈。

Market News :

市場資訊:

Goldman Sachs downgraded Metcash's shares to a sell rating, with a reduced price target of A$3.10 from A$3.80. Metcash is facing a challenge because online shopping is becoming increasingly popular in the grocery market. Woolworths, Coles, and Amazon are continually expanding their product offerings and accelerating their same-day delivery services. Goldman Sachs says this is making the value proposition of Metcash's IGA stores less attractive and increasing their price disadvantage.

高盛將Metcash的股票評級下調至賣出,並將目標價格從A$3.80降至A$3.10。Metcash面臨挑戰,因爲網上購物在雜貨市場中越來越受歡迎。Woolworths、Coles和亞馬遜不斷擴大其產品供應並加快他們的當日配送服務。高盛表示,這使Metcash的IGA商店的價值主張變得不那麼吸引人,並增加了它們的價格劣勢。

Goldman Sachs believes Metcash will underperform market expectations in the medium term. They said:

高盛認爲Metcash在中期將會表現不佳。他們表示:

We cut our FY25E-27E group revenue by 1-2% and EBIT by 5-6% on lower Hardware corporate own/JV margins. Our FY24E-27E group revenue/EBIT CAGRs are 4.4%/6.9% and our FY25E-27E EBIT (ex-Horizon costs) are ~4% below FactSet consensus.

我們將FY25E-27E集團營收下調1-2%,EBIt下調5-6%,主要是因爲硬件公司自有/合資利潤率較低。我們的FY24E-27E集團營收/EBIt複合年增長率爲4.4%/6.9%,而我們的FY25E-27E EBIt(不包括Horizon成本)比FactSet共識低約4%。

Overall Analysis:

總體分析:

Fundamentally, focus on the company's performance and operational status. Technically, pay attention to whether the support levels hold and if the resistance levels can be effectively breached.

基本上,關注公司的業績和運營狀況。從技術上講,要注意支撐位能否持穩,以及阻力位是否能被有效突破。

In this scenario, investors should adopt a cautious strategy, setting stop-loss points to manage risk and maintaining ongoing vigilance regarding company developments and market conditions.

在這種情況下,投資者應採取謹慎的策略,設置止損點來管理風險,並對公司發展和市場情況保持持續警惕。

Source: Bloomberg

資料來源:彭博社

Resistance: A$3.88

Resistance: A$3.88