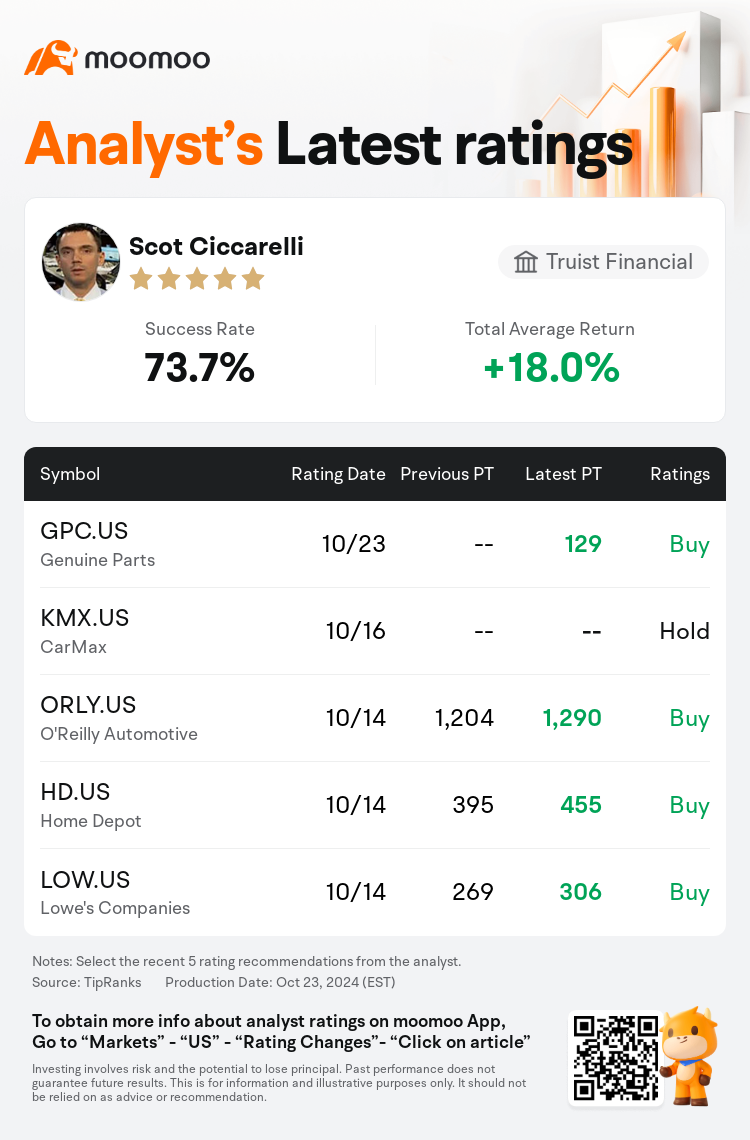

Truist Financial analyst Scot Ciccarelli maintains $Genuine Parts (GPC.US)$ with a buy rating, and sets the target price at $129.

According to TipRanks data, the analyst has a success rate of 73.7% and a total average return of 18.0% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Genuine Parts (GPC.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Genuine Parts (GPC.US)$'s main analysts recently are as follows:

Genuine Parts' Q3 results did not meet expectations, and despite the promising potential of the investment case, the company has not realized this potential in recent quarters. The outlook suggests a continuing weak environment into Q4, and there appears to be no immediate catalyst for the stock.

The third quarter outcomes for Genuine Parts were notably underwhelming, even compared to reduced forecasts, with the company grappling with higher-than-anticipated wage and rental inflation, particularly internationally. The difficulty of maneuvering a worldwide corporation is accentuated by persistent pressure on trends, limited cost flexibility after a protracted period of economic deceleration, and committed expenditures for planned investments. The performance of the stock is observed to correlate with the growth or contraction of the company's various business segments.

Genuine Parts' third-quarter results fell short of expectations on the revenue front once adjusted for acquisitions and were significantly below estimates on the profit side. Additionally, the company has cut its full-year forecast, indicating that the observed weakness is expected to continue into the fourth quarter.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

儲億銀行分析師Scot Ciccarelli維持$Genuine Parts (GPC.US)$買入評級,目標價129美元。

根據TipRanks數據顯示,該分析師近一年總勝率為73.7%,總平均回報率為18.0%。

此外,綜合報道,$Genuine Parts (GPC.US)$近期主要分析師觀點如下:

此外,綜合報道,$Genuine Parts (GPC.US)$近期主要分析師觀點如下:

Genuine Parts第三季度的業績未達到預期,儘管投資案例潛力巨大,但該公司在最近幾個季度尚未實現這一潛力。前景表明,第四季度環境持續疲軟,該股似乎沒有直接的催化劑。

即使與下調的預測相比,原裝零件第三季度的業績也明顯不佳,該公司正在努力應對高於預期的工資和租金通脹,尤其是在國際上。持續的趨勢壓力、長期經濟減速後成本靈活性有限,以及計劃投資的承諾支出,加劇了全球公司操縱的困難。據觀察,該股票的表現與公司各個業務部門的增長或收縮相關。

經收購調整後,Genuine Parts第三季度的收入業績低於預期,利潤方面也大大低於預期。此外,該公司下調了全年預測,表明觀察到的疲軟預計將持續到第四季度。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Genuine Parts (GPC.US)$近期主要分析師觀點如下:

此外,綜合報道,$Genuine Parts (GPC.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of