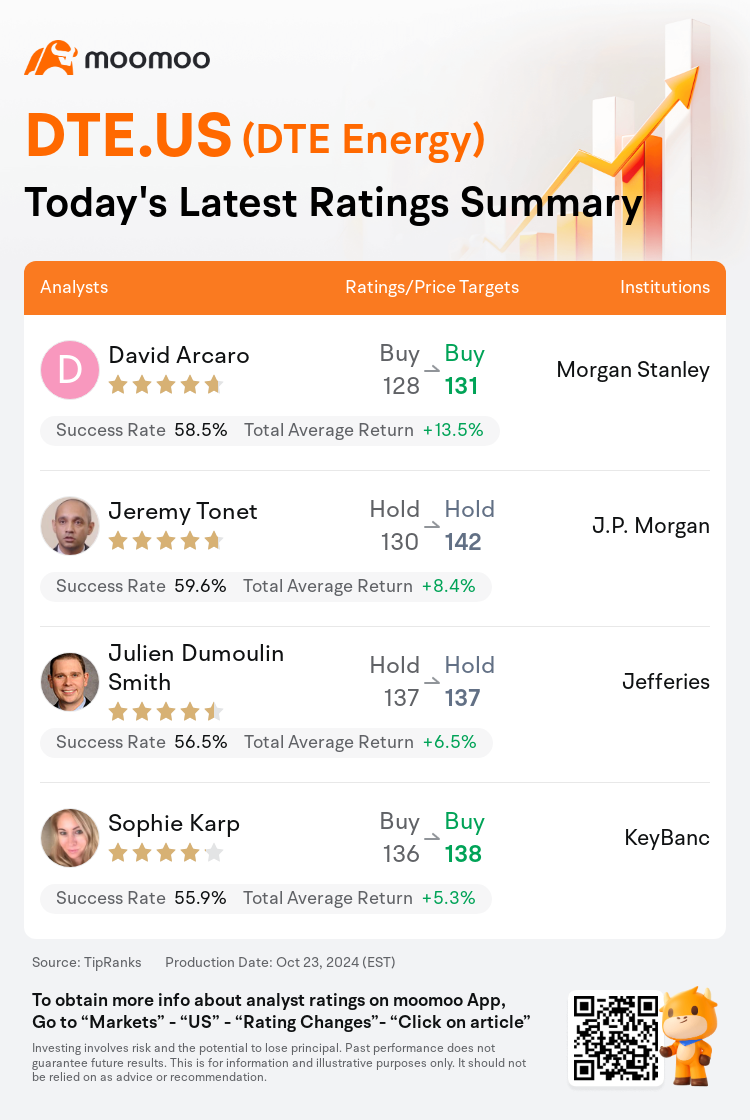

On Oct 23, major Wall Street analysts update their ratings for $DTE Energy (DTE.US)$, with price targets ranging from $131 to $142.

Morgan Stanley analyst David Arcaro maintains with a buy rating, and adjusts the target price from $128 to $131.

J.P. Morgan analyst Jeremy Tonet maintains with a hold rating, and adjusts the target price from $130 to $142.

Jefferies analyst Julien Dumoulin Smith maintains with a hold rating, and maintains the target price at $137.

Jefferies analyst Julien Dumoulin Smith maintains with a hold rating, and maintains the target price at $137.

KeyBanc analyst Sophie Karp maintains with a buy rating, and adjusts the target price from $136 to $138.

Furthermore, according to the comprehensive report, the opinions of $DTE Energy (DTE.US)$'s main analysts recently are as follows:

Expectations are set for a constructive outcome from the forthcoming Michigan Public Service Commission meeting on November 7, which could influence DTE Energy's distribution rate case for DTE Gas and potentially reduce DTE's current valuation gap with CMS Energy.

The company anticipates that investments in the Electric segment, which focus on grid reliability and clean generation, will propel earnings in 2024. Additionally, DTE has observed its Gas and Vantage segments demonstrating year-over-year growth thus far into 2024. It is expected that this positive trajectory will persist, and the company is likely to gain from favorable load growth trends within its operational region along with heightened resilience spending in Michigan. These factors, within an accommodating regulatory framework, are anticipated to sustain momentum through 2024 and justify a valuation that exceeds the sector's average.

The expectation is for DTE Energy to achieve a 7.7% EPS compound annual growth rate through 2024-2028, which aligns with the company's guidance of 6%-8%. The energy company's non-utility business, DTE Vantage, is anticipated to expand slightly faster than $15M annually in earnings, translating to an 11% CAGR until 2028. Nevertheless, it seems that the current share price may already reflect these growth prospects, leading to a preference for a more opportune moment to invest.

Here are the latest investment ratings and price targets for $DTE Energy (DTE.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

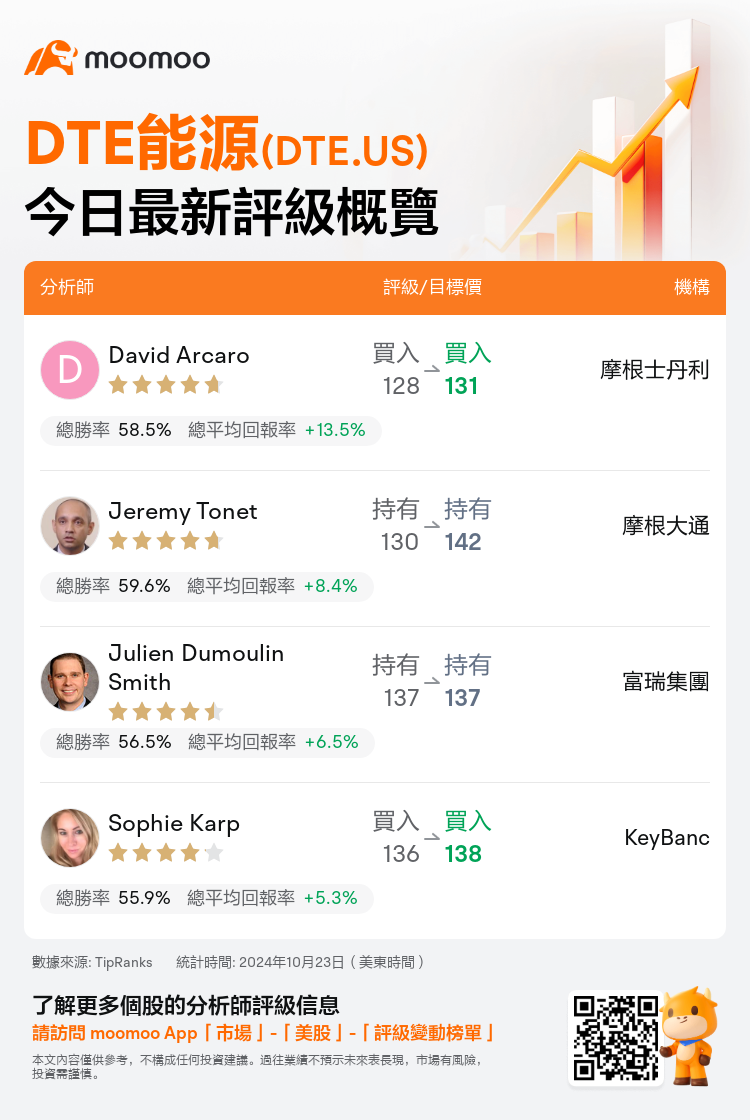

美東時間10月23日,多家華爾街大行更新了$DTE能源 (DTE.US)$的評級,目標價介於131美元至142美元。

摩根士丹利分析師David Arcaro維持買入評級,並將目標價從128美元上調至131美元。

摩根大通分析師Jeremy Tonet維持持有評級,並將目標價從130美元上調至142美元。

富瑞集團分析師Julien Dumoulin Smith維持持有評級,維持目標價137美元。

富瑞集團分析師Julien Dumoulin Smith維持持有評級,維持目標價137美元。

KeyBanc分析師Sophie Karp維持買入評級,並將目標價從136美元上調至138美元。

此外,綜合報道,$DTE能源 (DTE.US)$近期主要分析師觀點如下:

對於即將於11月7日舉行的密歇根州公共服務委員會會議,人們對於能源能源的配電費率案例可能產生積極結果的期望已經設定,這可能會減少dte能源目前與cms能源之間的估值差距。

公司預計對電力板塊的投資,重點放在電網可靠性和清潔發電方面,將推動2024年的收益。此外,dte已經觀察到其燃料幣和vantage板塊在2024年初展示了逐年增長的趨勢。預計這種正面的軌跡將持續,公司可能會受益於其經營區域內有利的負荷增長趨勢以及密歇根州更高的韌性支出。在一個寬鬆的監管框架內,這些因素預計將通過2024年持續勢頭,並證明其估值超過該行業平均水平。

預期dte能源在2024年至2028年期間實現每股收益compound的7.7%年增長率,這與公司6%-8%的指導一致。這家能源公司的非公共服務業務dte vantage預計將比每年1500萬美元快速增長,到2028年將實現11%的CAGR。然而,目前的股價似乎已經反映了這些增長前景,導致更傾向於在一個更爲機遇的時刻進行投資。

以下爲今日4位分析師對$DTE能源 (DTE.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

富瑞集團分析師Julien Dumoulin Smith維持持有評級,維持目標價137美元。

富瑞集團分析師Julien Dumoulin Smith維持持有評級,維持目標價137美元。

Jefferies analyst Julien Dumoulin Smith maintains with a hold rating, and maintains the target price at $137.

Jefferies analyst Julien Dumoulin Smith maintains with a hold rating, and maintains the target price at $137.