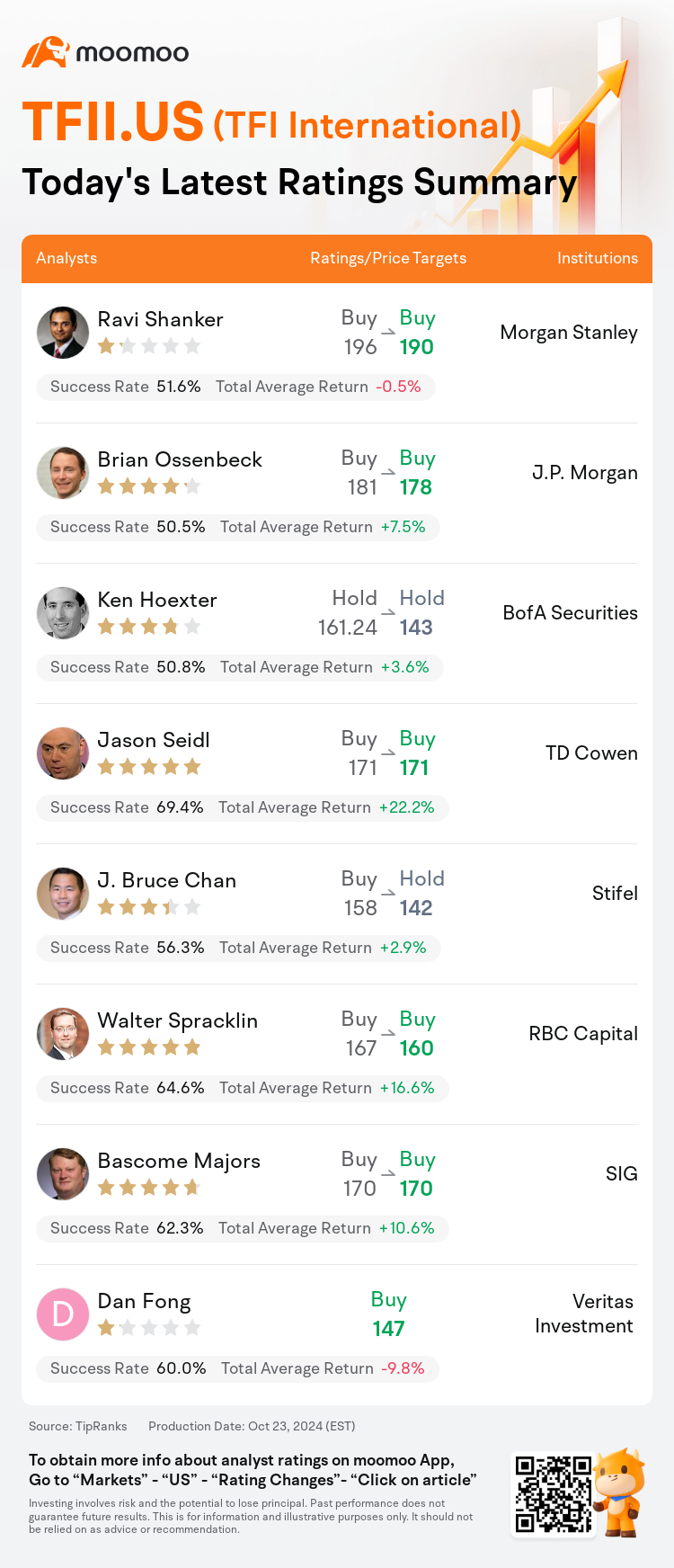

On Oct 23, major Wall Street analysts update their ratings for $TFI International (TFII.US)$, with price targets ranging from $142 to $190.

Morgan Stanley analyst Ravi Shanker maintains with a buy rating, and adjusts the target price from $196 to $190.

J.P. Morgan analyst Brian Ossenbeck maintains with a buy rating, and adjusts the target price from $181 to $178.

BofA Securities analyst Ken Hoexter maintains with a hold rating, and adjusts the target price from $161.24 to $143.

BofA Securities analyst Ken Hoexter maintains with a hold rating, and adjusts the target price from $161.24 to $143.

TD Cowen analyst Jason Seidl maintains with a buy rating, and maintains the target price at $171.

Stifel analyst J. Bruce Chan downgrades to a hold rating, and adjusts the target price from $158 to $142.

Furthermore, according to the comprehensive report, the opinions of $TFI International (TFII.US)$'s main analysts recently are as follows:

Following TFI International's release of Q3 adjusted EPS at $1.60, which fell short of the anticipated $1.76 and the market's $1.77 expectation, estimates for Q4, 2024, and 2025 EPS have been reduced by 7%, 4%, and 4%, respectively.

TFI International reported quarterly results that fell short of expectations, prompting a significant revision of future projections. Despite this, the company's robust generation of free cash flow has culminated in an exceptionally healthy balance sheet, providing ample flexibility for potential mergers and acquisitions as well as strategic share repurchase opportunities.

TFI International's Q3 results fell short of expectations due to operational ratio pressures from pricing discrepancies and service challenges. Additionally, the company's aim for a 90 operational ratio in Q4 appears to be unattainable, and there has been a reduction in the earnings per share guidance.

TFI International faces a challenging operating environment and network turnarounds. Analysts acknowledge the early progress following the company's UPS deal, yet they suggest that more ingrained issues may temper and postpone the anticipated margin enhancements in the less-than-truckload segment, potentially overshadowing advancements in other areas of the business. Additionally, expectations for a favorable outcome from a potential spinoff may be delayed until there is significant growth in market capitalization.

Here are the latest investment ratings and price targets for $TFI International (TFII.US)$ from 8 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間10月23日,多家華爾街大行更新了$TFI International (TFII.US)$的評級,目標價介於142美元至190美元。

摩根士丹利分析師Ravi Shanker維持買入評級,並將目標價從196美元下調至190美元。

摩根大通分析師Brian Ossenbeck維持買入評級,並將目標價從181美元下調至178美元。

美銀證券分析師Ken Hoexter維持持有評級,並將目標價從161.24美元下調至143美元。

美銀證券分析師Ken Hoexter維持持有評級,並將目標價從161.24美元下調至143美元。

TD Cowen分析師Jason Seidl維持買入評級,維持目標價171美元。

斯迪富分析師J. Bruce Chan下調至持有評級,並將目標價從158美元下調至142美元。

此外,綜合報道,$TFI International (TFII.US)$近期主要分析師觀點如下:

在 tfi international 發佈的第三季調整後每股收益爲1.60美元之後,低於預期的1.76美元和市場的1.77美元預期,對2024年和2025年第四季每股收益的預測分別降低了7%、4%和4%。

tfi international 報告的季度業績不符合預期,引發了未來預測的重大修訂。儘管如此,公司強勁的自由現金流產生使資產負債表異常健康,爲潛在的併購、戰略分紅以及股份回購機會提供了充足的靈活性。

由於定價差異和服務挑戰導致 tfi international 第三季業績不及預期。此外,公司在第四季實現90的營運比率目標似乎難以實現,並且盈利指引有所降低。

tfi international 面臨着複雜的運營環境和網絡重組。分析師們承認公司與UPS達成交易後的早期進展,但他們認爲更深層次的問題可能會限制和延後預期的零擔部門利潤增長,可能會掩蓋業務其他領域的進步。此外,在市場資本增長不足之前,從潛在分立中預期有利結果的預期可能會推遲。

以下爲今日8位分析師對$TFI International (TFII.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

美銀證券分析師Ken Hoexter維持持有評級,並將目標價從161.24美元下調至143美元。

美銀證券分析師Ken Hoexter維持持有評級,並將目標價從161.24美元下調至143美元。

BofA Securities analyst Ken Hoexter maintains with a hold rating, and adjusts the target price from $161.24 to $143.

BofA Securities analyst Ken Hoexter maintains with a hold rating, and adjusts the target price from $161.24 to $143.