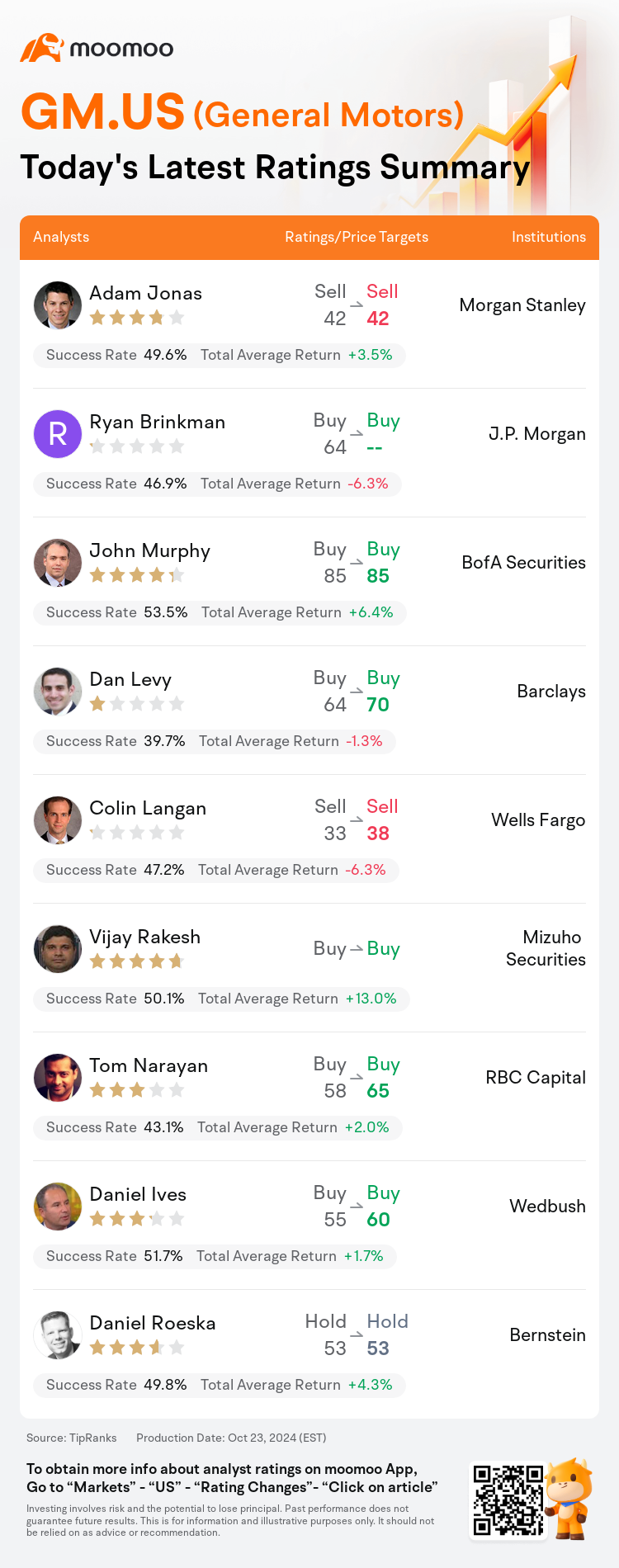

On Oct 23, major Wall Street analysts update their ratings for $General Motors (GM.US)$, with price targets ranging from $38 to $85.

Morgan Stanley analyst Adam Jonas maintains with a sell rating, and maintains the target price at $42.

J.P. Morgan analyst Ryan Brinkman maintains with a buy rating.

BofA Securities analyst John Murphy maintains with a buy rating, and maintains the target price at $85.

BofA Securities analyst John Murphy maintains with a buy rating, and maintains the target price at $85.

Barclays analyst Dan Levy maintains with a buy rating, and adjusts the target price from $64 to $70.

Wells Fargo analyst Colin Langan maintains with a sell rating, and adjusts the target price from $33 to $38.

Furthermore, according to the comprehensive report, the opinions of $General Motors (GM.US)$'s main analysts recently are as follows:

General Motors maintains its trajectory of strong gross margin earnings and robust free cash flow generation. While the market will determine the multiple it ultimately receives, it is argued that it 'clearly deserves to be far more than 5x.'

The firm conveyed increased confidence in General Motors' prospects leading into 2025. It was noted that the company delivered an exceptionally strong performance in the third quarter, akin to a top-tier athlete's performance, as it continues to deliver impressive results quarter after quarter. This success is attributed to the company's steadfast focus on refining its internal combustion engine (ICE) and electric vehicle (EV) offerings, alongside strategic debuts and a prioritized approach to profitability.

General Motors has experienced a rise in stock value of approximately 10% following the reaffirmation of its intention to repurchase around 100 million shares. Additionally, a third-quarter EPS beat and an increase in gross margin have led to an upward revision of the full-year EBIT guidance. Nevertheless, there remain risks associated with pricing, volumes, and the mix of battery electric vehicles, all of which influence the conservative guidance for the fourth quarter. Warranty matters have also emerged as a new area of concern.

The automotive sector has experienced a retreat in share prices, and despite a reduction in consensus numbers, there continues to be a downside risk to estimates given the prevailing bearish macroeconomic sentiment. Amidst concerns of a deflationary period succeeding post-pandemic price increases, it appears that General Motors is well-positioned to withstand a potential severe price deflationary scenario.

Here are the latest investment ratings and price targets for $General Motors (GM.US)$ from 9 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間10月23日,多家華爾街大行更新了$通用汽車 (GM.US)$的評級,目標價介於38美元至85美元。

摩根士丹利分析師Adam Jonas維持賣出評級,維持目標價42美元。

摩根大通分析師Ryan Brinkman維持買入評級。

美銀證券分析師John Murphy維持買入評級,維持目標價85美元。

美銀證券分析師John Murphy維持買入評級,維持目標價85美元。

巴克萊銀行分析師Dan Levy維持買入評級,並將目標價從64美元上調至70美元。

富國集團分析師Colin Langan維持賣出評級,並將目標價從33美元上調至38美元。

此外,綜合報道,$通用汽車 (GM.US)$近期主要分析師觀點如下:

通用汽車保持強勁毛利率收入和強勁自由現金流產生的軌跡。儘管市場將最終決定它最終獲得的倍數,但有人認爲它「明顯值得比5倍高得多。」

公司對通用汽車在2025年前景增加了信懇智能。人們注意到,該公司在第三季度表現異常強勁,類似於頂級運動員的表現,因爲它繼續在每個季度交出令人矚目的成績。這一成功歸因於公司堅定專注於改進其內燃發動機(ICE)和新能源車(EV)產品,以及戰略性推出和以盈利爲優先的方法。

隨着再度確認回購約10000萬股股票意圖,通用汽車股價約上漲了10%。此外,第三季度每股收益超預期,毛利率增加導致全年EBIT指導的上調。然而,與價格、銷量和新能源車種類的混合有關的風險仍然存在,所有這些因素影響了第四季度的保守指導。保修事宜也成爲新的關注領域。

汽車板塊股價出現回落,儘管共識數據有所減少,但考慮到當前看淡的宏觀經濟情緒,對估值仍存在下行風險。在擔心疫情後期價格上漲後可能出現通縮時期的情況下,通用汽車似乎已做好準備應對潛在的嚴重價格通縮情景。

以下爲今日9位分析師對$通用汽車 (GM.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

美銀證券分析師John Murphy維持買入評級,維持目標價85美元。

美銀證券分析師John Murphy維持買入評級,維持目標價85美元。

BofA Securities analyst John Murphy maintains with a buy rating, and maintains the target price at $85.

BofA Securities analyst John Murphy maintains with a buy rating, and maintains the target price at $85.