Top 3 Tech Stocks You'll Regret Missing In Q4

Top 3 Tech Stocks You'll Regret Missing In Q4

The most oversold stocks in the information technology sector presents an opportunity to buy into undervalued companies.

信息技術板塊中最過度賣出的股票提供了購買低估公司的機會。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI指標是一種動量指標,它比較了股票在價格上漲時的強度與在價格下跌時的強度。與股票的價格走勢進行比較,可以給交易者更好的了解股票短期內表現的良好程度。當RSI低於30時,資產通常被認爲是超賣的,根據Benzinga Pro的數據。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是本行業板塊最近的主要超賣股票列表,RSI接近或低於30。

YXT.Com Group Holding Ltd – ADR (NASDAQ:YXT)

雲學堂控股有限公司–ADR(納斯達克:YXT)

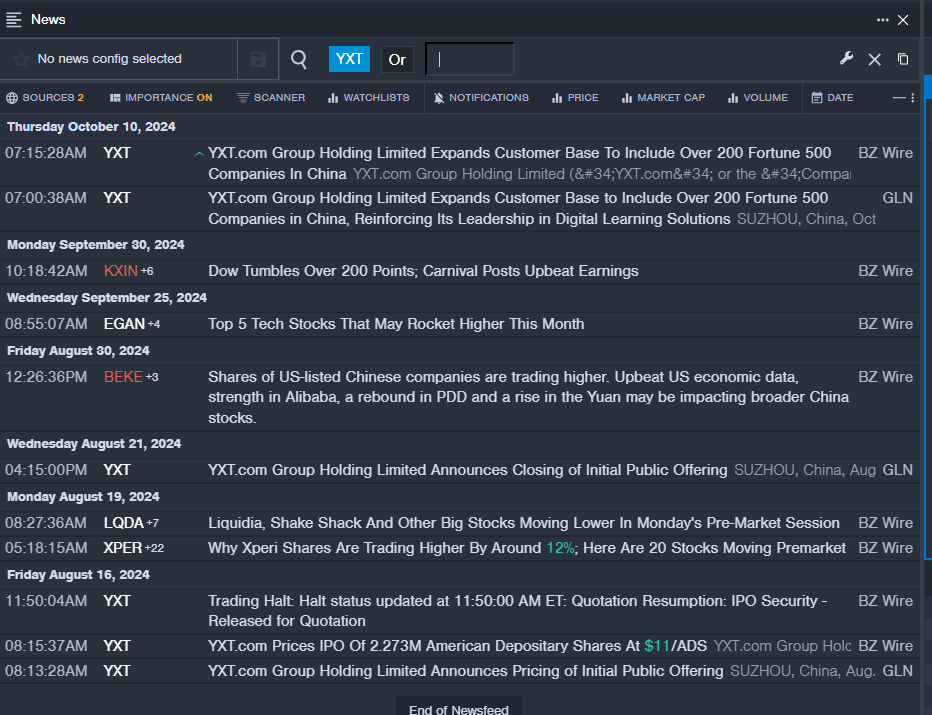

- On Oct. 10, YXT.com Group expanded customer base to include over 200 Fortune 500 companies in China. The company's stock fell around 42% over the past month and has a 52-week low of $2.10.

- RSI Value: 29.6347

- YXT Price Action: Shares of YXT.Com fell 6.3% to close at $2.10 on Wednesday.

- Benzinga Pro's real-time newsfeed alerted to latest YXT news.

- 雲學堂於10月10日將客戶群擴大到中國超過200家財富500強公司。該公司股票過去一個月下跌約42%,52周最低價爲2.10美元。

- RSI數值:29.6347

- 雲學堂股票走勢:YXt.Com的股價週三下跌6.3%,收於2.10美元。

- Benzinga Pro的實時新聞源提醒最新的雲學堂新聞。

Verint Systems Inc. (NASDAQ:VRNT)

verint系統公司(納斯達克代碼:VRNT)

- On Sept. 25, Needham analyst Joshua Reilly reiterated Verint with a Buy and maintained a $40 price target. The company's stock fell around 6% over the past five days and has a 52-week low of $18.41.

- RSI Value: 21.29

- VRNT Price Action: Shares of Verint fell 0.6% to close at $21.89 on Wednesday.

- Benzinga Pro's charting tool helped identify the trend in VRNT stock.

- 9月25日,Needham分析師Joshua Reilly重申買入Verint,並維持40美元的目標股價。該公司股價在過去五天內下跌約6%,52周最低價爲18.41美元。

- RSI數值:21.29

- VRNt股價走勢:Verint股價週三下跌0.6%,收於21.89美元。

- Benzinga Pro的圖表工具有助於識別VRNT股票的趨勢。

Seagate Technology Holdings PLC (NASDAQ:STX)

希捷科技控股有限公司(納斯達克股票代碼:STX)

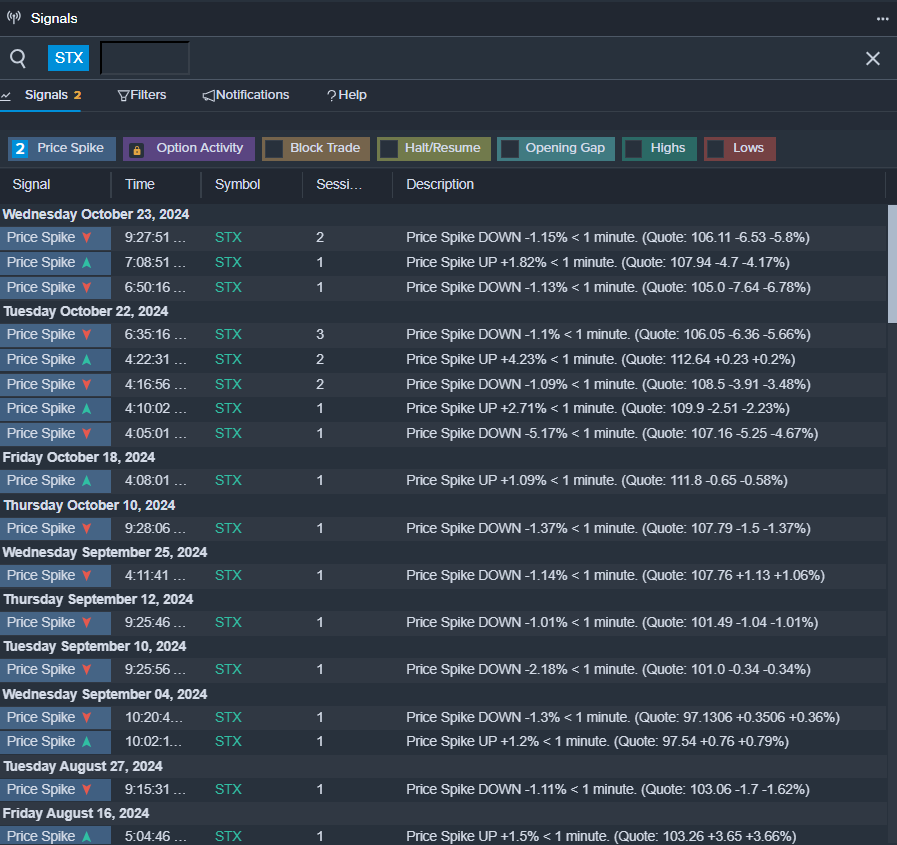

- On Oct. 22, the company reported first-quarter revenue of $2.17 billion, beating the consensus of $2.119 billion. Adjusted gross margin rose to 33.3% from 19.8% a year ago quarter. Adjusted operating margin escalated to 20.4% from 2.8% in the prior-year quarter. Adjusted EPS of $1.58 beat the consensus of $1.46. The company's shares fell around 8% over the past five days and has a 52-week low of $64.12.

- RSI Value: 27.97

- STX Price Action: Shares of Seagate fell 8.1% to close at $103.52 on Wednesday.

- Benzinga Pro's signals feature notified of a potential breakout in STX shares.

- 公司報告,截至10月22日,第一季度營業收入達21.7億美元,超過21.19億美元的共識。調整後的毛利率從去年同期的19.8%上升至33.3%。調整後的營業利潤率從去年同期的2.8%上升至20.4%。每股收益調整後爲1.58美元,超過了1.46美元的共識。公司股票在過去五天下跌了約8%,52周最低價爲64.12美元。

- RSI數值:27.97

- STX價格走勢:希捷股票週三下跌8.1%,收於103.52美元。

- 財經資訊平台的信號功能通知稱希捷股票可能會突破。

Read More:

更多閱讀:

- Wall Street's Most Accurate Analysts Give Their Take On 3 Tech Stocks Delivering High-Dividend Yields

- 華爾街最準確的分析師們對3家科技股提供的高股息收益進行評價。