On Oct 24, major Wall Street analysts update their ratings for $GE Vernova (GEV.US)$, with price targets ranging from $285 to $330.

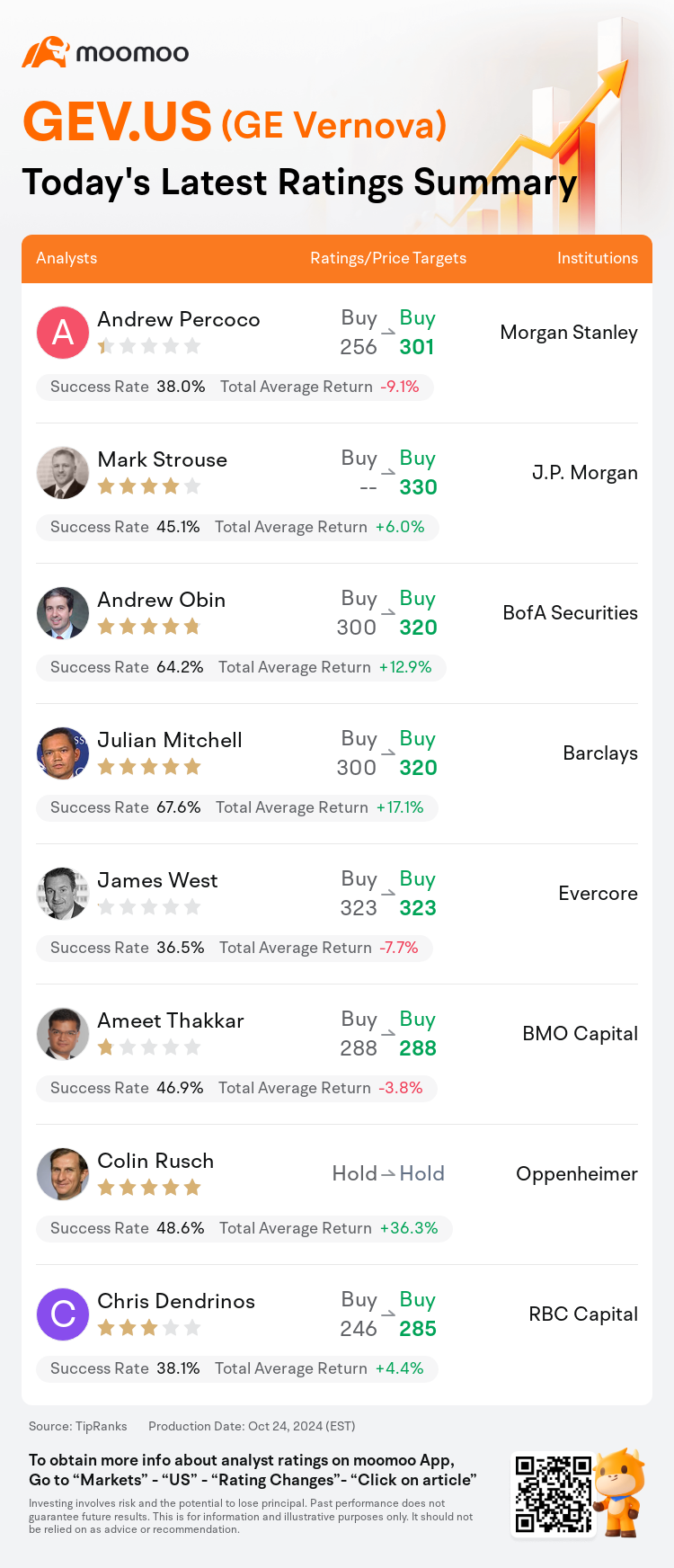

Morgan Stanley analyst Andrew Percoco maintains with a buy rating, and adjusts the target price from $256 to $301.

J.P. Morgan analyst Mark Strouse maintains with a buy rating, and sets the target price at $330.

BofA Securities analyst Andrew Obin maintains with a buy rating, and adjusts the target price from $300 to $320.

BofA Securities analyst Andrew Obin maintains with a buy rating, and adjusts the target price from $300 to $320.

Barclays analyst Julian Mitchell maintains with a buy rating, and adjusts the target price from $300 to $320.

Evercore analyst James West maintains with a buy rating, and maintains the target price at $323.

Furthermore, according to the comprehensive report, the opinions of $GE Vernova (GEV.US)$'s main analysts recently are as follows:

The firm notes a significant increase in year-over-year bookings within GE Vernova's Power and Electrification segments, highlighting a robust demand environment. The firm also anticipates the potential visibility of a path to approximately a 20% EBITDA margin within the company's Power business.

Following Q3 results, a projection of a swifter earnings trajectory and peers' re-rating higher justify a more elevated multiple applied to future adjusted EBITDA estimates.

The company's Q3 results are perceived to have been strong enough to sustain the recent positive performance of the stock. There is ongoing optimism about demand and pricing within the Power and Electrification segments which is likely to keep investor interest high leading up to the investor event scheduled for December 10. At this event, an update on long-term growth and margin targets is anticipated. It is also noted that the company carries relatively less risk associated with the U.S. election in comparison to others within the same coverage area.

GE Vernova presents a unique blend of robust organic growth within an industry facing capacity constraints, accompanied by significant self-improvement opportunities.

The company's Q3 EBITDA and free cash flow results exceeded expectations, bolstered by better-than-anticipated margins in the Power and Electrification segments. Challenges persist in the Wind business due to limited order demand and the ongoing reduction of the offshore backlog, but this situation is expected to improve by next year. Strong order demand in Power and Electrification underpins confidence in the company's future revenue and margin trajectory.

Here are the latest investment ratings and price targets for $GE Vernova (GEV.US)$ from 8 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間10月24日,多家華爾街大行更新了$GE Vernova (GEV.US)$的評級,目標價介於285美元至330美元。

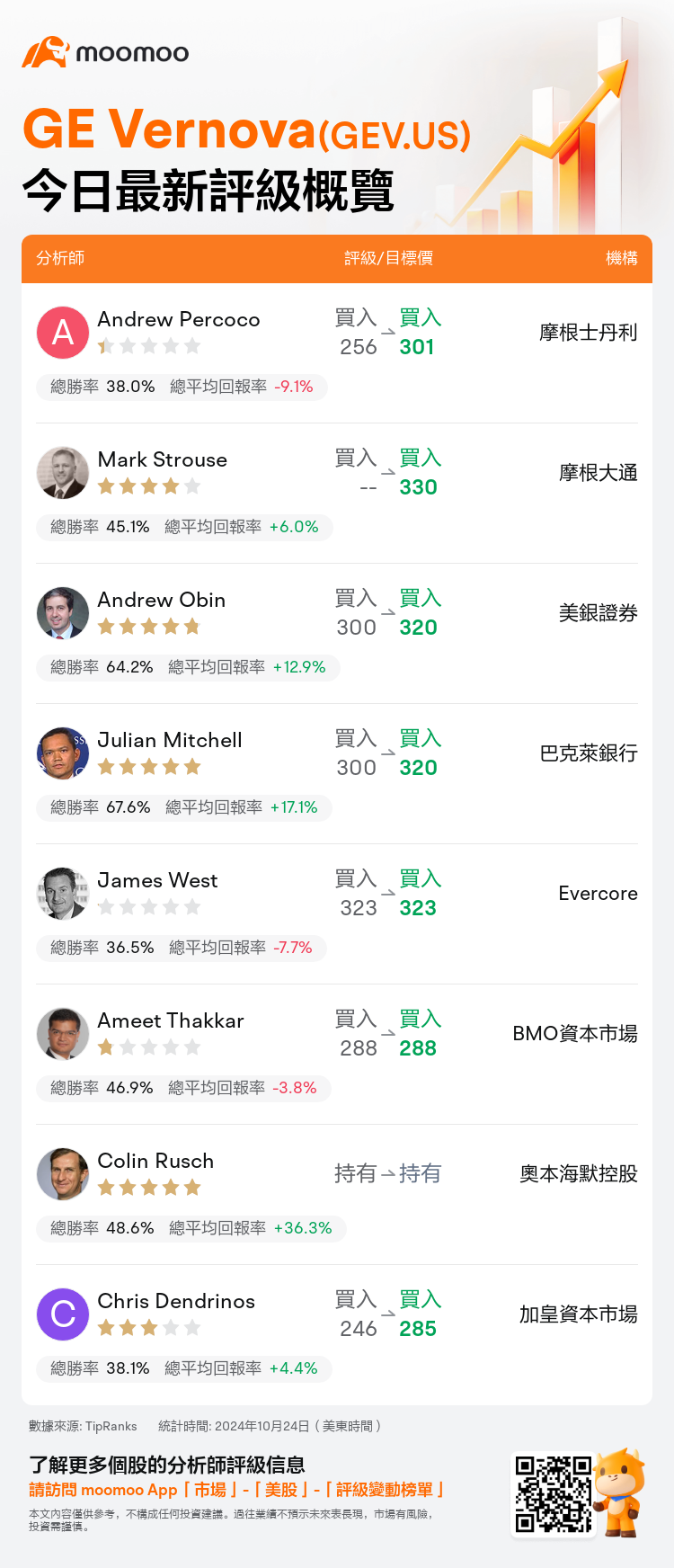

摩根士丹利分析師Andrew Percoco維持買入評級,並將目標價從256美元上調至301美元。

摩根大通分析師Mark Strouse維持買入評級,目標價330美元。

美銀證券分析師Andrew Obin維持買入評級,並將目標價從300美元上調至320美元。

美銀證券分析師Andrew Obin維持買入評級,並將目標價從300美元上調至320美元。

巴克萊銀行分析師Julian Mitchell維持買入評級,並將目標價從300美元上調至320美元。

Evercore分析師James West維持買入評級,維持目標價323美元。

此外,綜合報道,$GE Vernova (GEV.US)$近期主要分析師觀點如下:

公司注意到GE Vernova的動力和電氣部門的年度預訂大幅增加,突顯出強勁的需求環境。公司還預計,在公司的動力業務中可能看到大約20% EBITDA利潤率的路徑的潛在可見度。

在第三季度業績之後,更快的收益增長軌跡和同行更高的重新評估均證明,將更高的倍數應用於未來調整後的EBITDA預估是合理的。

公司的第三季度業績被認爲足夠強勁,足以支撐股票最近的正面表現。 關於動力和電氣領域的需求和定價持續樂觀,這可能使投資者對即將於12月10日舉行的投資者活動充滿興趣。 在此活動中,預計將更新公司的長期增長和利潤目標。 還注意到,與同一覆蓋區域內的其他公司相比,該公司承擔的與美國選舉有關的風險相對較小。

GE Vernova提供了在面臨產能限制的行業內強勁有機增長與顯著自我改善機會相結合的獨特組合。

公司第三季度的EBITDA和自由現金流結果超出預期,得益於動力和電氣部門較預期更好的利潤率。 風電業務仍面臨訂單需求有限和近海積壓不斷減少的挑戰,但預計情況將在明年得到改善。 在動力和電氣方面的強勁訂單需求支撐着對公司未來營業收入和利潤走勢的信心。

以下爲今日8位分析師對$GE Vernova (GEV.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

美銀證券分析師Andrew Obin維持買入評級,並將目標價從300美元上調至320美元。

美銀證券分析師Andrew Obin維持買入評級,並將目標價從300美元上調至320美元。

BofA Securities analyst Andrew Obin maintains with a buy rating, and adjusts the target price from $300 to $320.

BofA Securities analyst Andrew Obin maintains with a buy rating, and adjusts the target price from $300 to $320.