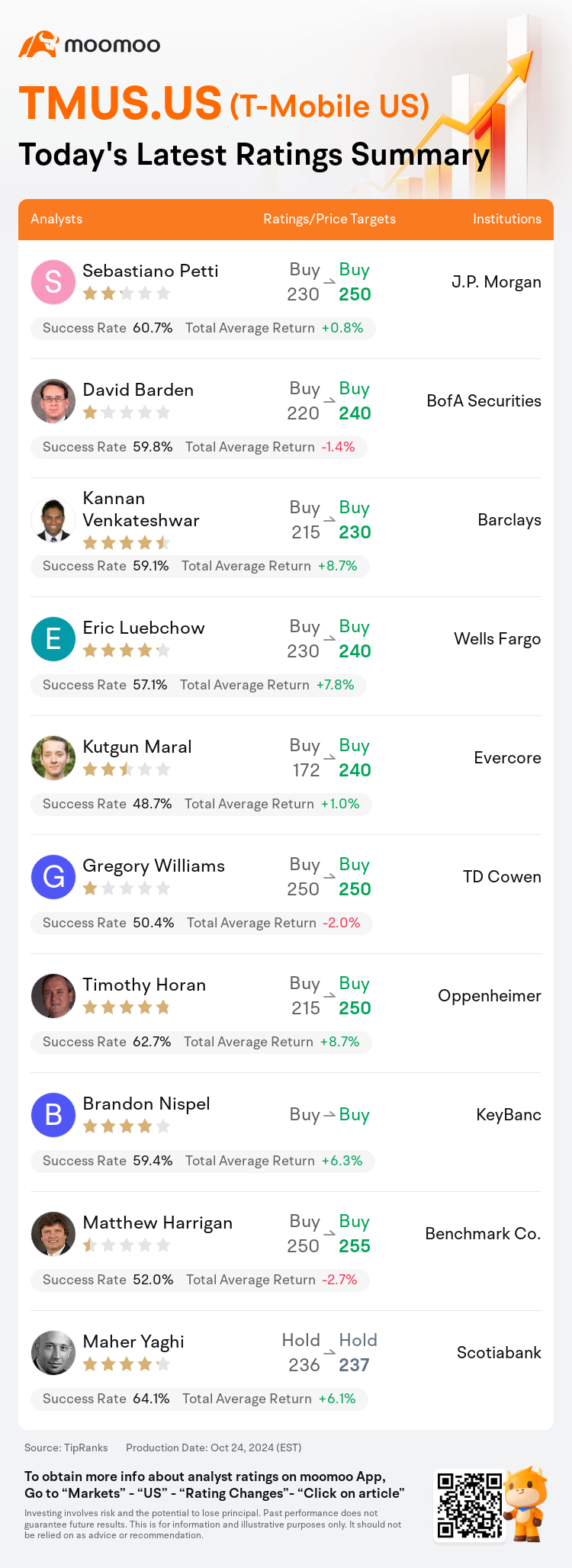

On Oct 24, major Wall Street analysts update their ratings for $T-Mobile US (TMUS.US)$, with price targets ranging from $230 to $255.

J.P. Morgan analyst Sebastiano Petti maintains with a buy rating, and adjusts the target price from $230 to $250.

BofA Securities analyst David Barden maintains with a buy rating, and adjusts the target price from $220 to $240.

Barclays analyst Kannan Venkateshwar maintains with a buy rating, and adjusts the target price from $215 to $230.

Barclays analyst Kannan Venkateshwar maintains with a buy rating, and adjusts the target price from $215 to $230.

Wells Fargo analyst Eric Luebchow maintains with a buy rating, and adjusts the target price from $230 to $240.

Evercore analyst Kutgun Maral maintains with a buy rating, and adjusts the target price from $172 to $240.

Furthermore, according to the comprehensive report, the opinions of $T-Mobile US (TMUS.US)$'s main analysts recently are as follows:

T-Mobile's performance surpassed expectations, continuing a trend of leading growth in the industry, which bolsters a positive outlook. It is believed that the core financials are indicative of mid- to high-single digit compound annual growth rates in revenue, EBITDA, and free cash flow. This is expected to facilitate $50 billion in capital returns and provide $20 billion in flexibility for potential mergers and acquisitions, debt reduction, and further financial returns up to the year 2027.

Following 'solid' Q3 outcomes that surpassed expectations for service revenue, core adjusted EBITDA, free cash flow, and post-paid phone net additions, T-Mobile is recognized for its robust shareholder return proposition. This is showcased by a substantial multi-year commitment to share buybacks and dividend payouts, an additional substantial capacity for enhancing shareholder returns, and a projected growth in free cash flow per share in the near future.

T-Mobile delivered robust results for the third quarter and uplifted both subscriber and financial forecasts comprehensively. The impressive third-quarter outcomes and the raised guidance for 2024 reinforce the investment perspective. T-Mobile continues to be favored as a long-term investment proposition.

T-Mobile's recent quarter performance was robust, however, the guidance provided carries certain 'caveats.' Despite significant headline growth, the impact on margins from elevated volumes coupled with reductions in wholesale revenue is being balanced by some one-off favorable factors.

Management presented an appealing strategy last month for T-Mobile to maintain its momentum in the core mobility sector, achieve significant broadband expansion, and sustain leading financial trajectories. Their ability to surpass expectations and elevate projections once again in Q3 demonstrated robust performance in alignment with this plan.

Here are the latest investment ratings and price targets for $T-Mobile US (TMUS.US)$ from 10 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

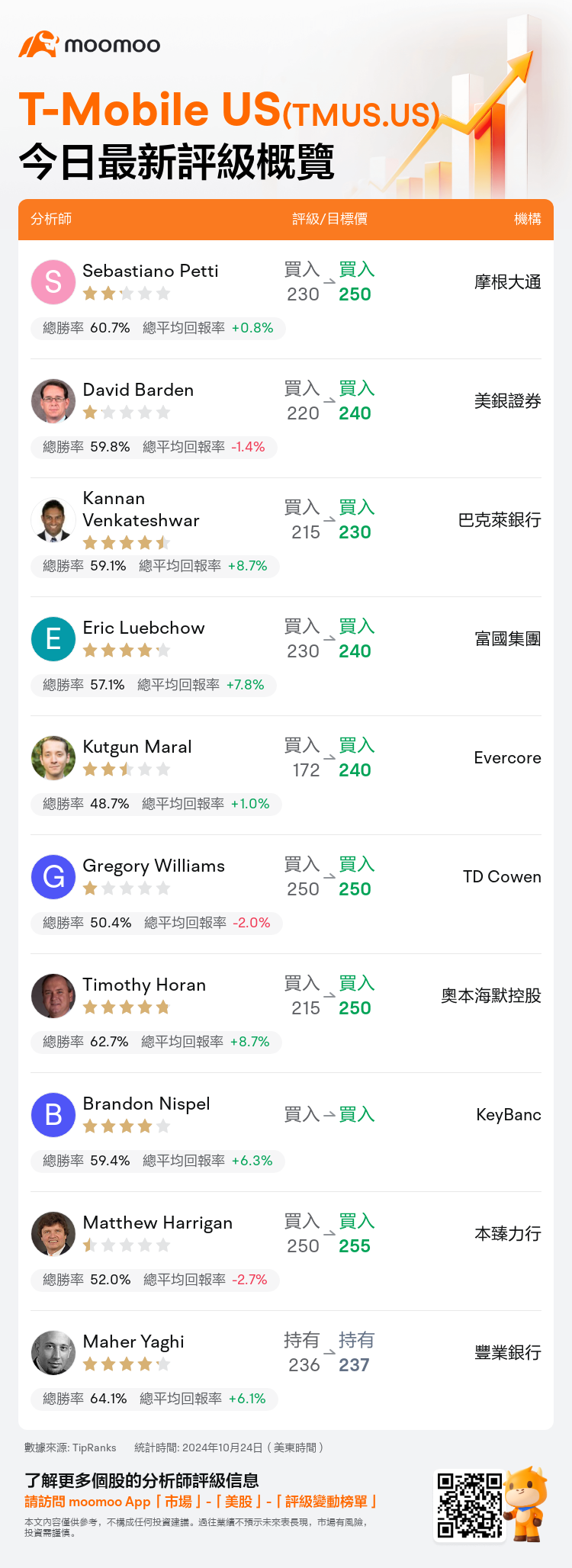

美東時間10月24日,多家華爾街大行更新了$T-Mobile US (TMUS.US)$的評級,目標價介於230美元至255美元。

摩根大通分析師Sebastiano Petti維持買入評級,並將目標價從230美元上調至250美元。

美銀證券分析師David Barden維持買入評級,並將目標價從220美元上調至240美元。

巴克萊銀行分析師Kannan Venkateshwar維持買入評級,並將目標價從215美元上調至230美元。

巴克萊銀行分析師Kannan Venkateshwar維持買入評級,並將目標價從215美元上調至230美元。

富國集團分析師Eric Luebchow維持買入評級,並將目標價從230美元上調至240美元。

Evercore分析師Kutgun Maral維持買入評級,並將目標價從172美元上調至240美元。

此外,綜合報道,$T-Mobile US (TMUS.US)$近期主要分析師觀點如下:

t-Mobile的表現超出預期,繼續引領行業增長趨勢,這進一步支持了積極的展望。人們相信核心財務數據表明營業收入、EBITDA和自由現金流的複合年增長率可達中到高個位數。預計將促成500億美元的資本回報,併爲潛在的併購、債務減少以及未來到2027年的進一步財務回報提供200億美元的靈活性。

在超出預期的Q3服務收入、核心調整後的EBITDA、自由現金流和後付費手機淨增用戶方面表現「穩健」之後,Mobile以其強大的股東回報方案而聞名。 這體現了對股票回購和股息支付的長期承諾,並提供了額外的增強股東回報的大規模能力,未來自由現金流每股預期增長。

t-Mobile爲第三季度帶來了強勁的業績,並全面提升了預測的訂戶和財務狀況。第三季度出色的成果和對2024年預測的提高,強化了投資觀點。t-Mobile持續受到青睞作爲長期投資方案。

t-Mobile最近一個季度的表現強勁,然而,所提供的指導帶有一定的「警告」。儘管頭條增長顯著,由於銷量增加導致的邊際壓力以及批發收入減少的影響正在被某些一次性有利因素平衡。

管理層上個月提出了一個吸引人的戰略,以幫助t-Mobile在覈心移動業務領域保持勢頭,實現重大寬帶擴展,並保持領先的財務發展軌跡。他們在Q3再次超出預期並提高了預期,展示了與該計劃一致的強勁業績。

以下爲今日10位分析師對$T-Mobile US (TMUS.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

巴克萊銀行分析師Kannan Venkateshwar維持買入評級,並將目標價從215美元上調至230美元。

巴克萊銀行分析師Kannan Venkateshwar維持買入評級,並將目標價從215美元上調至230美元。

Barclays analyst Kannan Venkateshwar maintains with a buy rating, and adjusts the target price from $215 to $230.

Barclays analyst Kannan Venkateshwar maintains with a buy rating, and adjusts the target price from $215 to $230.