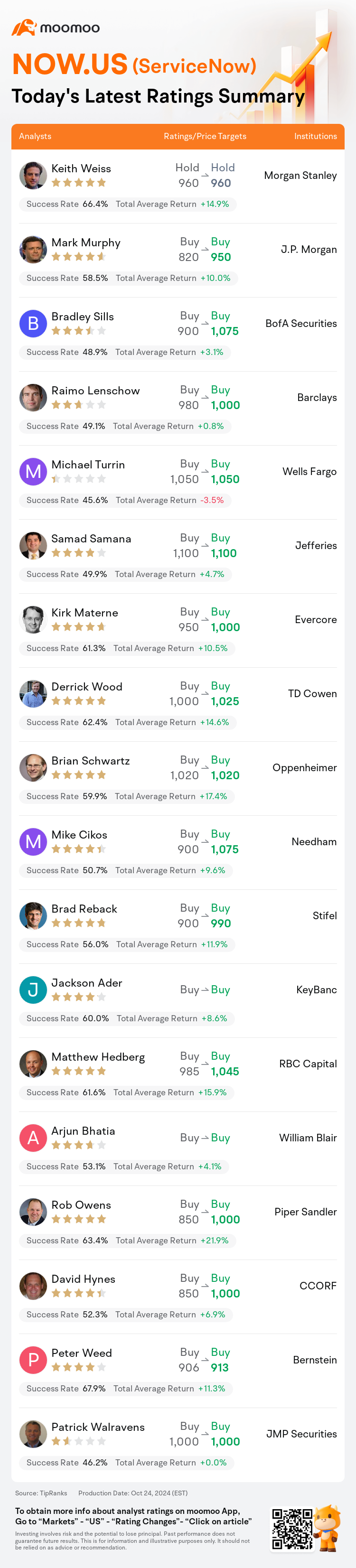

On Oct 24, major Wall Street analysts update their ratings for $ServiceNow (NOW.US)$, with price targets ranging from $913 to $1,100.

Morgan Stanley analyst Keith Weiss maintains with a hold rating, and maintains the target price at $960.

J.P. Morgan analyst Mark Murphy maintains with a buy rating, and adjusts the target price from $820 to $950.

BofA Securities analyst Bradley Sills maintains with a buy rating, and adjusts the target price from $900 to $1,075.

BofA Securities analyst Bradley Sills maintains with a buy rating, and adjusts the target price from $900 to $1,075.

Barclays analyst Raimo Lenschow maintains with a buy rating, and adjusts the target price from $980 to $1,000.

Wells Fargo analyst Michael Turrin maintains with a buy rating, and maintains the target price at $1,050.

Furthermore, according to the comprehensive report, the opinions of $ServiceNow (NOW.US)$'s main analysts recently are as follows:

The company demonstrated a robust Q3 performance surpassing expectations across various measures, accompanied by an optimistic fiscal 2024 revenue projection. It's evident that the company's significant inflection in artificial intelligence bookings sends a strong message.

ServiceNow delivered a robust performance in the third quarter, according to an analyst's research note. It is believed that the shares of ServiceNow will maintain their positive trajectory once the temporary fluctuations surrounding short-term quarterly forecasts have subsided. The company stands out for achieving superior sales growth compared to its competitors while maintaining high margin levels. Additionally, there is an evolving narrative around its credible ventures into generative artificial intelligence.

The firm recognizes ServiceNow's quarterly outcomes and insights from the conference call regarding net-new ACV from sectors that were previously underperforming, along with the uptake of AI products, as sufficient reasons to maintain a positive stance on the stock.

ServiceNow's recent report exceeded expectations, continuing a trend of strong performance, and the company's announcement regarding significant deal achievements with NOW Assist was seen as particularly positive. This provides more tangible proof of momentum with GenAI.

ServiceNow exhibited a robust third quarter, showcasing better-than-expected performance across key metrics, coupled with a positive revision of the full-year forecast. The momentum in GenAI is persisting and is influencing purchasing choices, highlighted by the adoption of Now Assist.

Here are the latest investment ratings and price targets for $ServiceNow (NOW.US)$ from 18 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

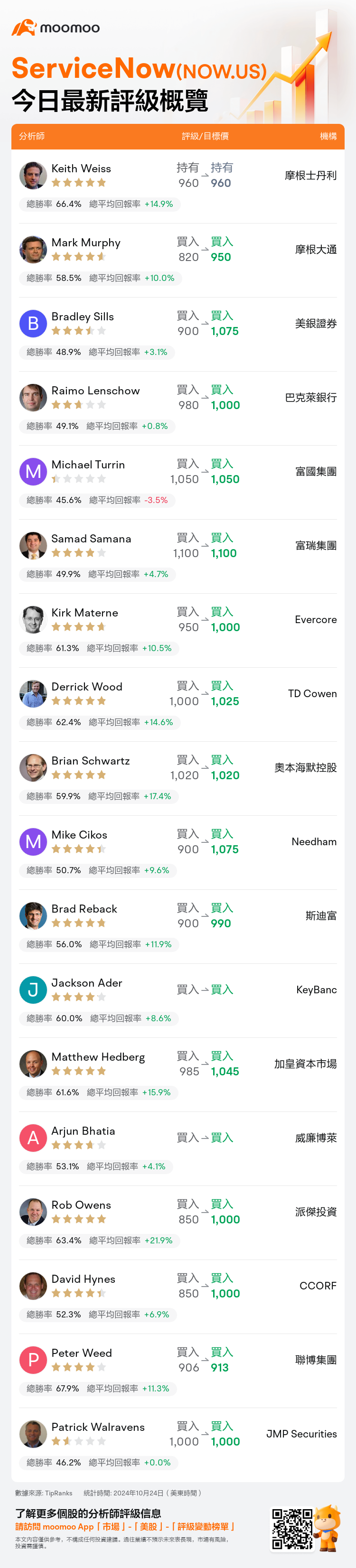

美東時間10月24日,多家華爾街大行更新了$ServiceNow (NOW.US)$的評級,目標價介於913美元至1,100美元。

摩根士丹利分析師Keith Weiss維持持有評級,維持目標價960美元。

摩根大通分析師Mark Murphy維持買入評級,並將目標價從820美元上調至950美元。

美銀證券分析師Bradley Sills維持買入評級,並將目標價從900美元上調至1,075美元。

美銀證券分析師Bradley Sills維持買入評級,並將目標價從900美元上調至1,075美元。

巴克萊銀行分析師Raimo Lenschow維持買入評級,並將目標價從980美元上調至1,000美元。

富國集團分析師Michael Turrin維持買入評級,維持目標價1,050美元。

此外,綜合報道,$ServiceNow (NOW.US)$近期主要分析師觀點如下:

公司展示了強勁的第三季度業績,超出了各項指標的預期,伴隨着對2024財年營業收入的樂觀預測。很明顯,公司在人工智能訂購方面的顯著轉折傳遞出了積極的信號。

servicenow在第三季度取得了強勁的表現,根據分析師的研究報告。人們認爲,一旦圍繞短期季度預測的暫時波動消退,servicenow的股價將保持積極的軌跡。該公司以實現較高的銷售增長而與競爭對手保持高毛利水平而脫穎而出。此外,圍繞其可信的生成式人工智能投資,有一個正不斷髮展的敘事。

該公司認可servicenow的季度業績,並從電話會議中獲得了關於先前表現不佳領域的淨新增ACV以及對AI產品的接受,這足以成爲保持股票積極態度的充分理由。

servicenow最近的報告超出了預期,延續了強勁業績的趨勢,而公司關於與NOW Assist達成重大交易成就的聲明被認爲是尤爲積極的。這爲與GenAI的動量提供了更具體的證據。

servicenow展示了強勁的第三季度業績,在關鍵指標上表現優於預期,並對全年預測進行了積極修訂。GenAI的勢頭仍在持續,並且正在影響購買選擇,表現出對Now Assist的採納。

以下爲今日18位分析師對$ServiceNow (NOW.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

美銀證券分析師Bradley Sills維持買入評級,並將目標價從900美元上調至1,075美元。

美銀證券分析師Bradley Sills維持買入評級,並將目標價從900美元上調至1,075美元。

BofA Securities analyst Bradley Sills maintains with a buy rating, and adjusts the target price from $900 to $1,075.

BofA Securities analyst Bradley Sills maintains with a buy rating, and adjusts the target price from $900 to $1,075.