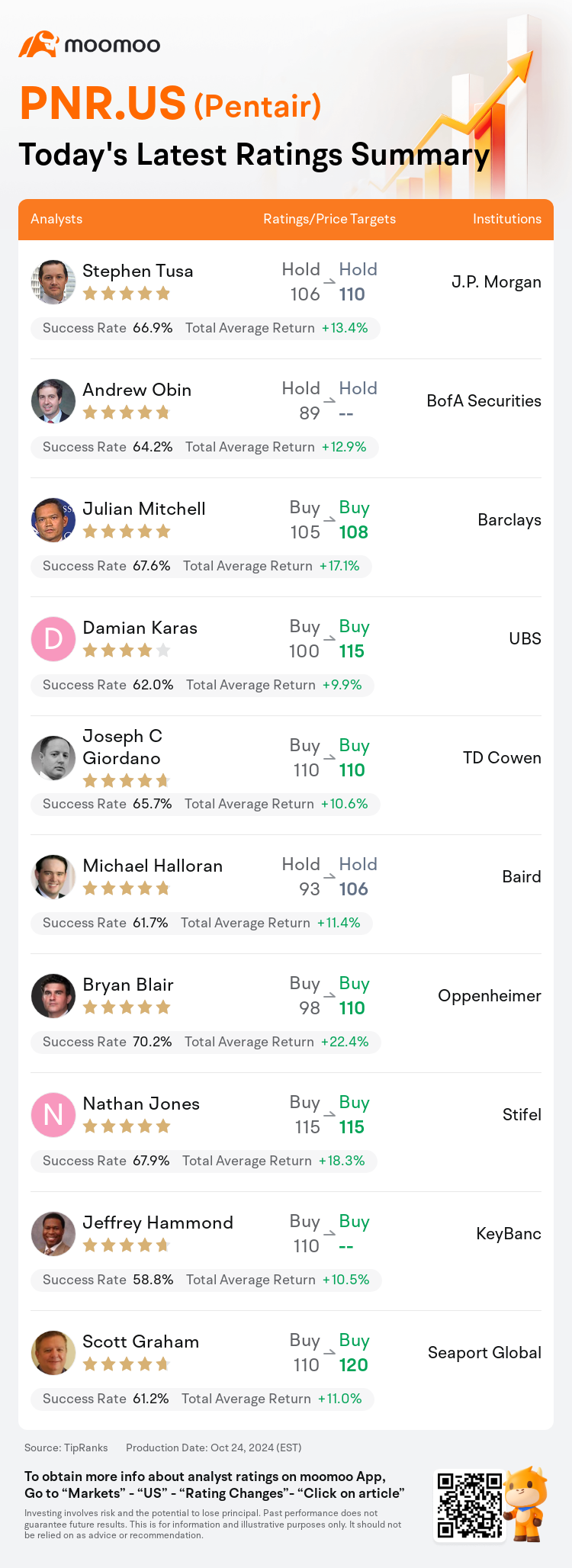

On Oct 24, major Wall Street analysts update their ratings for $Pentair (PNR.US)$, with price targets ranging from $106 to $120.

J.P. Morgan analyst Stephen Tusa maintains with a hold rating, and adjusts the target price from $106 to $110.

BofA Securities analyst Andrew Obin maintains with a hold rating.

Barclays analyst Julian Mitchell maintains with a buy rating, and adjusts the target price from $105 to $108.

Barclays analyst Julian Mitchell maintains with a buy rating, and adjusts the target price from $105 to $108.

UBS analyst Damian Karas maintains with a buy rating, and adjusts the target price from $100 to $115.

TD Cowen analyst Joseph C Giordano maintains with a buy rating, and maintains the target price at $110.

Furthermore, according to the comprehensive report, the opinions of $Pentair (PNR.US)$'s main analysts recently are as follows:

The firm's growing confidence in Pentair's capacity for margin growth surpassing the goal of 24% by 2026 is bolstered by the company's sustained margin improvement despite sales challenges, as it progresses through the second phase of its three-stage transformation. Pentair is also at the initial stages of applying the 80/20 principle, with expectations for positive outcomes to emerge in 2025. Additionally, a potential decrease in interest rates could boost demand within the consumer discretionary segments of its Pool and Water Solutions businesses in the coming years.

Pentair appears to be well positioned for another year of double-digit earnings growth in 2025, accompanied by high teens free cash flow margins.

The company delivered a strong performance in the third quarter, marked by a record-setting free cash flow for the year so far, and noted growth in the Pool segment for the second quarter in a row, coupled with a significant year-over-year margin enhancement. It's highlighted that the ongoing 'transformation benefits' within the company and initial successes from their strategic initiatives are compensating for the softer flow and certain delays in capital expenditures from industrial customers.

Management at Pentair appears to be outperforming their plan, and it is anticipated that FY26 goals will probably be surpassed in the next year, barring any market changes. Additionally, the valuation continues to be compelling when compared to other companies in the water sector.

The firm remains impressed with the degree of transformation tailwinds more than offsetting softer year-over-year demand trends and feels that the 80/20 policy offers incremental opportunities for improvement beyond the current long-term framework. Looking ahead, there is maintained confidence in the potential for share rerating higher long-term as investors better appreciate the compelling transformation.

Here are the latest investment ratings and price targets for $Pentair (PNR.US)$ from 10 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

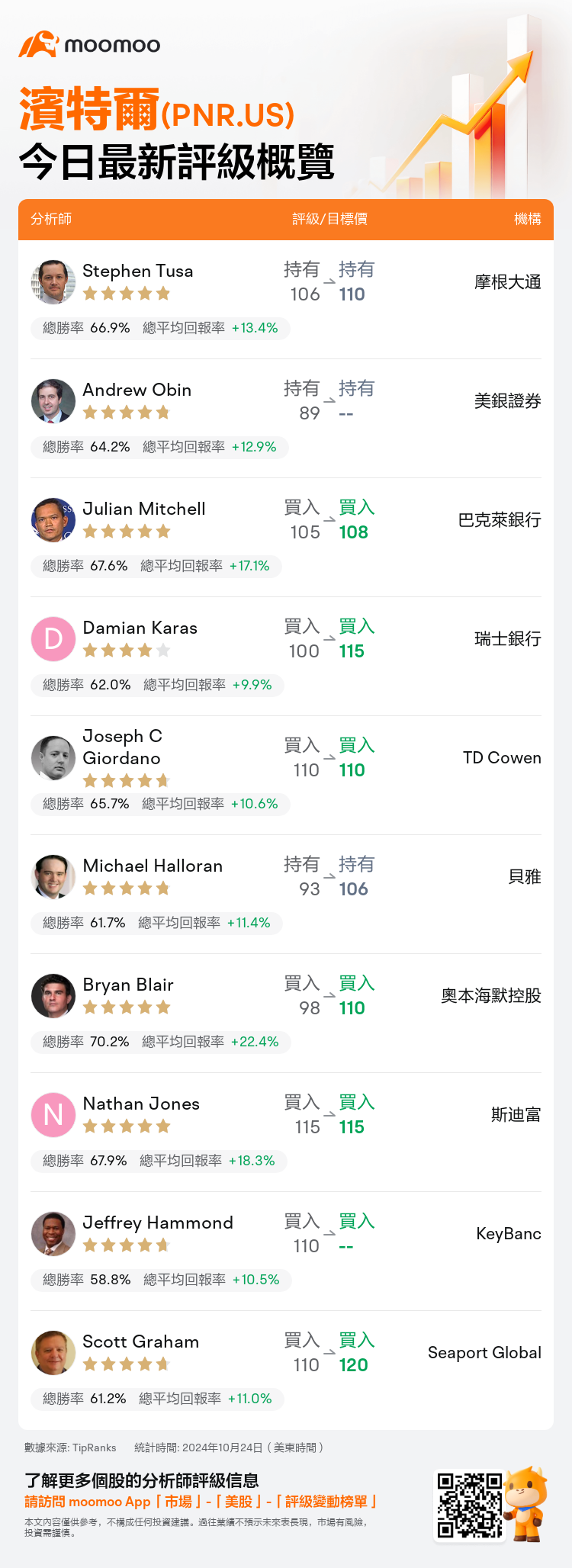

美東時間10月24日,多家華爾街大行更新了$濱特爾 (PNR.US)$的評級,目標價介於106美元至120美元。

摩根大通分析師Stephen Tusa維持持有評級,並將目標價從106美元上調至110美元。

美銀證券分析師Andrew Obin維持持有評級。

巴克萊銀行分析師Julian Mitchell維持買入評級,並將目標價從105美元上調至108美元。

巴克萊銀行分析師Julian Mitchell維持買入評級,並將目標價從105美元上調至108美元。

瑞士銀行分析師Damian Karas維持買入評級,並將目標價從100美元上調至115美元。

TD Cowen分析師Joseph C Giordano維持買入評級,維持目標價110美元。

此外,綜合報道,$濱特爾 (PNR.US)$近期主要分析師觀點如下:

公司對濱特爾在2026年前能夠實現利潤增長目標24%的能力充滿信心,這得益於公司堅持的利潤改善,儘管銷售挑戰仍在進行中,在其三階段轉型的第二階段取得進展的同時。濱特爾也正處於應用80/20原則的初期階段,預計正面成果將在2025年出現。此外,利率期貨潛在下降可能會在未來幾年內推動其Pool和Water Solutions業務中消費類自由現金流分廠的需求增長。

濱特爾似乎已經爲2025年再次實現兩位數收益增長做好了充分準備,伴隨着高青少年自由現金流利潤率。

該公司在第三季度表現強勁,到目前爲止,年度自由現金流已創紀錄,並且Pool板塊連續第二季度增長,同時伴隨顯著的年同比利潤率提升。強調公司內部持續的「轉型收益」以及戰略倡議的初步成功正在彌補工業客戶投資流向較軟和某些資本支出延遲的劣勢。

濱特爾的管理層似乎已經超額完成他們的計劃,預計FY26的目標可能在明年被超越,除非有市場變化。此外,與水務板塊的其他公司相比,估值仍然具有吸引力。

公司對轉型的長遠風向標印象深刻,超過軟化的年同比需求趨勢,認爲80/20政策爲改善提供了增量機會,超越當前的長期框架。展望未來,對分期重新定價的潛力保持信心,長期上漲,投資者將更加重視這一引人注目的轉型。

以下爲今日10位分析師對$濱特爾 (PNR.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

巴克萊銀行分析師Julian Mitchell維持買入評級,並將目標價從105美元上調至108美元。

巴克萊銀行分析師Julian Mitchell維持買入評級,並將目標價從105美元上調至108美元。

Barclays analyst Julian Mitchell maintains with a buy rating, and adjusts the target price from $105 to $108.

Barclays analyst Julian Mitchell maintains with a buy rating, and adjusts the target price from $105 to $108.