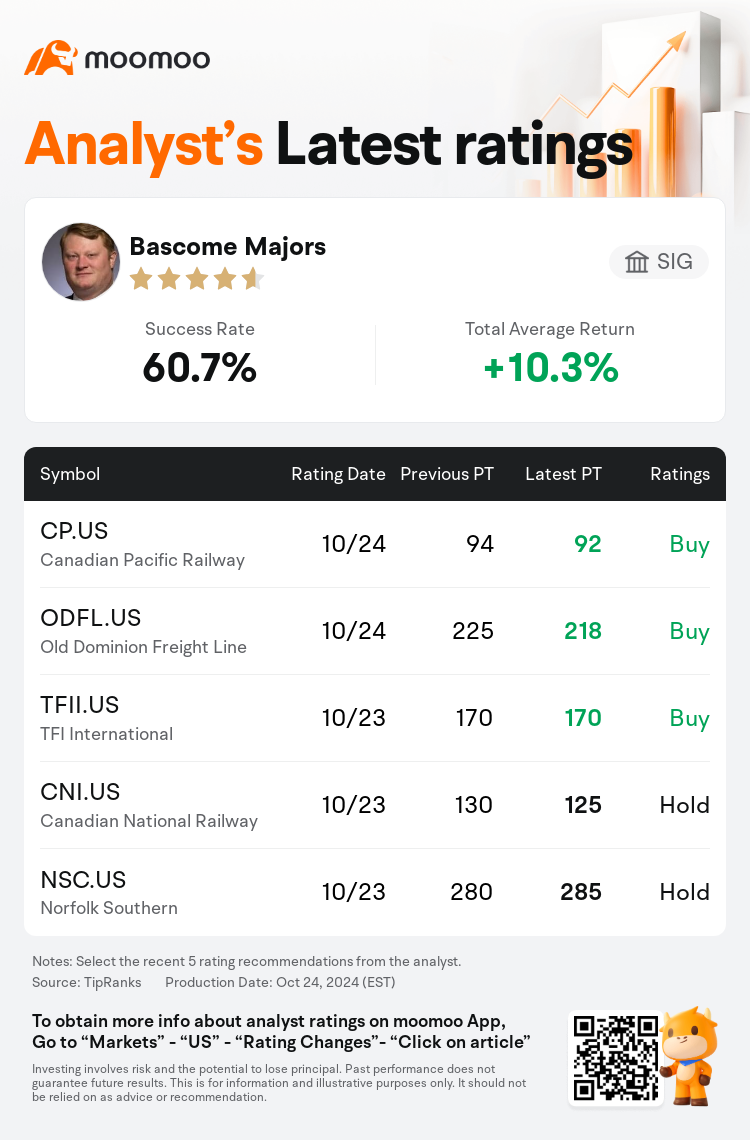

SIG analyst Bascome Majors maintains $Old Dominion Freight Line (ODFL.US)$ with a buy rating, and adjusts the target price from $225 to $218.

According to TipRanks data, the analyst has a success rate of 60.7% and a total average return of 10.3% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Old Dominion Freight Line (ODFL.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Old Dominion Freight Line (ODFL.US)$'s main analysts recently are as follows:

The company's Q3 operating results slightly missed expectations due to ongoing demand weakness and persistent cost inflation.

After Old Dominion disclosed its quarterly results, a notable decline in revenue of 3% from the previous year placed stress on outcomes due to negative fixed cost leverage. This situation manifested in a 72.7% operating ratio, marking a 210 basis point increase from the previous year and falling short of expectations by 30 basis points. Future earnings per share estimates for Q4, 2024, and 2025 have been adjusted. Nonetheless, the neutral stance is maintained as the company, with 30% excess capacity, is well-positioned to capitalize on any potential freight market recovery.

Old Dominion's third-quarter performance was marginally below expectations on an EBIT basis. Despite this, the company stands out in the transportation sector due to its exceptional execution. It is poised to benefit from potential upturns in the cycle, although the timing remains uncertain. Challenges from cyclical pressures have led to adjustments in earnings projections for the coming years.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

海納國際分析師Bascome Majors維持$Old Dominion Freight Line (ODFL.US)$買入評級,並將目標價從225美元下調至218美元。

根據TipRanks數據顯示,該分析師近一年總勝率為60.7%,總平均回報率為10.3%。

此外,綜合報道,$Old Dominion Freight Line (ODFL.US)$近期主要分析師觀點如下:

此外,綜合報道,$Old Dominion Freight Line (ODFL.US)$近期主要分析師觀點如下:

由於持續的需求疲軟和成本通脹,公司第三季度營運結果略低於預期。

Old Dominion披露季度業績後,與上一年相比,營業收入顯著下降3%,由於負面的固定成本槓桿壓力加劇了結果。這種情況表現爲72.7%的營運比率,較上一年增加了210個點子,低於預期30個點子。2024年和2025年第四季度的未來每股收益預期已經調整。儘管如此,由於公司擁有30%的過剩產能,可以充分利用任何潛在的貨運市場復甦,因此保持中立立場。

Old Dominion第三季度的表現在EBIt基礎上略低於預期。儘管如此,由於其卓越執行力,該公司在運輸領域脫穎而出。儘管時機仍然不確定,但它有望從週期性好轉中受益。來自週期性壓力的挑戰已導致對未來幾年收益預測的調整。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Old Dominion Freight Line (ODFL.US)$近期主要分析師觀點如下:

此外,綜合報道,$Old Dominion Freight Line (ODFL.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of