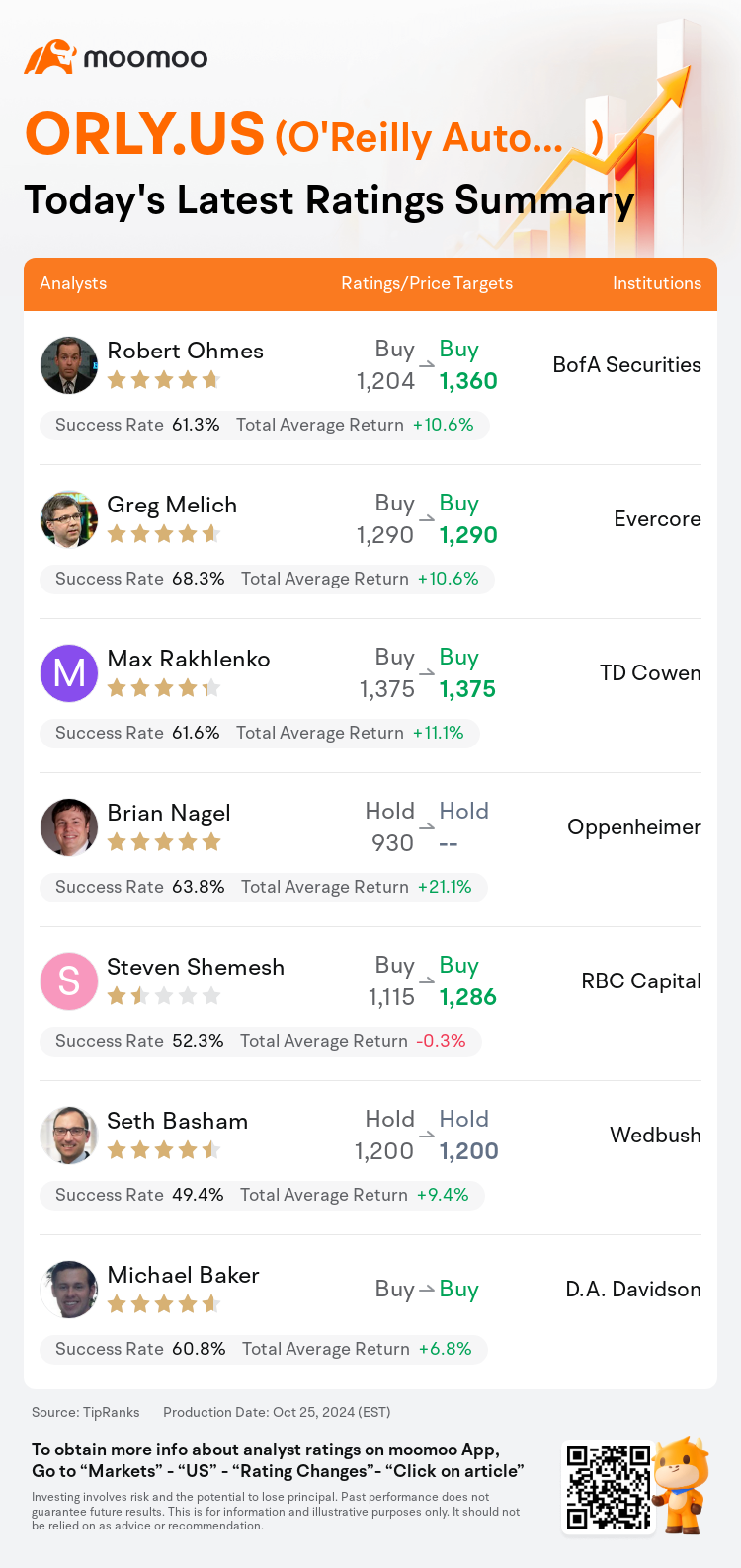

On Oct 25, major Wall Street analysts update their ratings for $O'Reilly Automotive (ORLY.US)$, with price targets ranging from $1,200 to $1,375.

BofA Securities analyst Robert Ohmes maintains with a buy rating, and adjusts the target price from $1,204 to $1,360.

Evercore analyst Greg Melich maintains with a buy rating, and maintains the target price at $1,290.

TD Cowen analyst Max Rakhlenko maintains with a buy rating, and maintains the target price at $1,375.

TD Cowen analyst Max Rakhlenko maintains with a buy rating, and maintains the target price at $1,375.

Oppenheimer analyst Brian Nagel maintains with a hold rating.

RBC Capital analyst Steven Shemesh maintains with a buy rating, and adjusts the target price from $1,115 to $1,286.

Furthermore, according to the comprehensive report, the opinions of $O'Reilly Automotive (ORLY.US)$'s main analysts recently are as follows:

O'Reilly Automotive's third-quarter report reflected anticipated outcomes, with comparable sales decelerating throughout the quarter, aligning with general industry measures.

O'Reilly Automotive's third-quarter earnings per share of $11.41 were reported, compared to the consensus of $11.54, alongside comp growth of 1.5% versus the expected 2.5%. This underperformance in comp growth is attributed to widespread consumer pressures and a subdued demand climate affecting both Professional and Do-It-Yourself segments. Despite these pressures, O'Reilly is still considered a top-tier player in the auto aftermarket space, an industry known for its resilience relative to the wider Consumer Discretionary sector.

The firm has reduced its estimates due to ongoing industry challenges and anticipates earnings momentum to stay moderate for the time being. Nonetheless, it believes that the company's exceptional execution and market share gains justify a valuation premium, leading to a slight increase in the valuation assessment.

The firm noted that O'Reilly Automotive's third-quarter comparable results aligned with expectations, acknowledging the company's adeptness in managing a challenging environment and its success in gaining market share within the Do-It-For-Me segment.

The company continues to gain market share, though its outperformance compared to peers has lessened in recent quarters due to broader category pressures, and there is limited visibility into future recovery. Forecasts for the company's EPS have been adjusted, with a revised outlook now set for the coming years.

Here are the latest investment ratings and price targets for $O'Reilly Automotive (ORLY.US)$ from 7 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

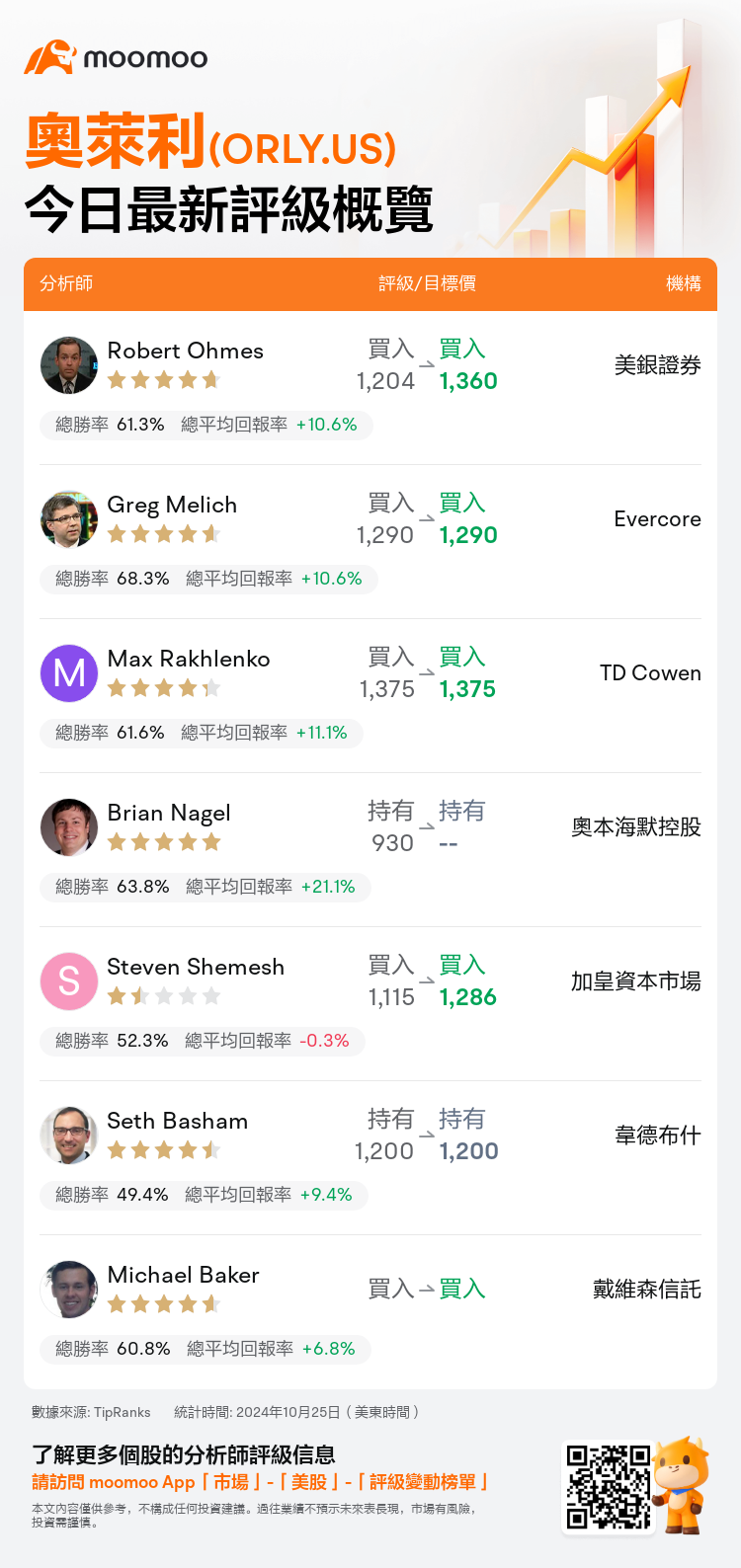

美東時間10月25日,多家華爾街大行更新了$奧萊利 (ORLY.US)$的評級,目標價介於1,200美元至1,375美元。

美銀證券分析師Robert Ohmes維持買入評級,並將目標價從1,204美元上調至1,360美元。

Evercore分析師Greg Melich維持買入評級,維持目標價1,290美元。

TD Cowen分析師Max Rakhlenko維持買入評級,維持目標價1,375美元。

TD Cowen分析師Max Rakhlenko維持買入評級,維持目標價1,375美元。

奧本海默控股分析師Brian Nagel維持持有評級。

加皇資本市場分析師Steven Shemesh維持買入評級,並將目標價從1,115美元上調至1,286美元。

此外,綜合報道,$奧萊利 (ORLY.US)$近期主要分析師觀點如下:

奧萊利汽車的第三季度報告顯示,符合預期結果,隨着季度內可比銷售額放緩,與行業整體水平保持一致。

奧萊利汽車第三季度每股收益11.41美元,較預期11.54美元有所下滑,與預期的2.5%的可比增長相比,僅實現了1.5%的增長。可比增長的低於預期表現被歸因於普遍存在的消費者壓力以及影響專業和自助市場的低迷需求環境。儘管受到這些壓力的影響,奧萊利仍然被認爲是汽車售後市場的頂級參與者,這是一個以其相對於更廣泛的消費者自由選擇行業板塊的韌性而聞名的行業。

由於持續面臨行業挑戰,公司已經降低了其預期,並預計其盈利勢頭在短期內將保持溫和增長。儘管如此,公司認爲公司卓越的執行力和市場份額增長證明了估值的溢價,導致估值評估略微增加。

公司指出,奧萊利汽車第三季度的可比結果符合預期,肯定了公司在應對具有挑戰性的環境和在市場份額增長方面的成功做法。

儘管公司繼續獲得市場份額,但由於更廣泛的行業壓力,與同行相比的業績在最近幾個季度有所下降,並且未來的復甦前景不明確。公司的每股收益預測已經調整,對未來幾年的展望已經制定。

以下爲今日7位分析師對$奧萊利 (ORLY.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

TD Cowen分析師Max Rakhlenko維持買入評級,維持目標價1,375美元。

TD Cowen分析師Max Rakhlenko維持買入評級,維持目標價1,375美元。

TD Cowen analyst Max Rakhlenko maintains with a buy rating, and maintains the target price at $1,375.

TD Cowen analyst Max Rakhlenko maintains with a buy rating, and maintains the target price at $1,375.