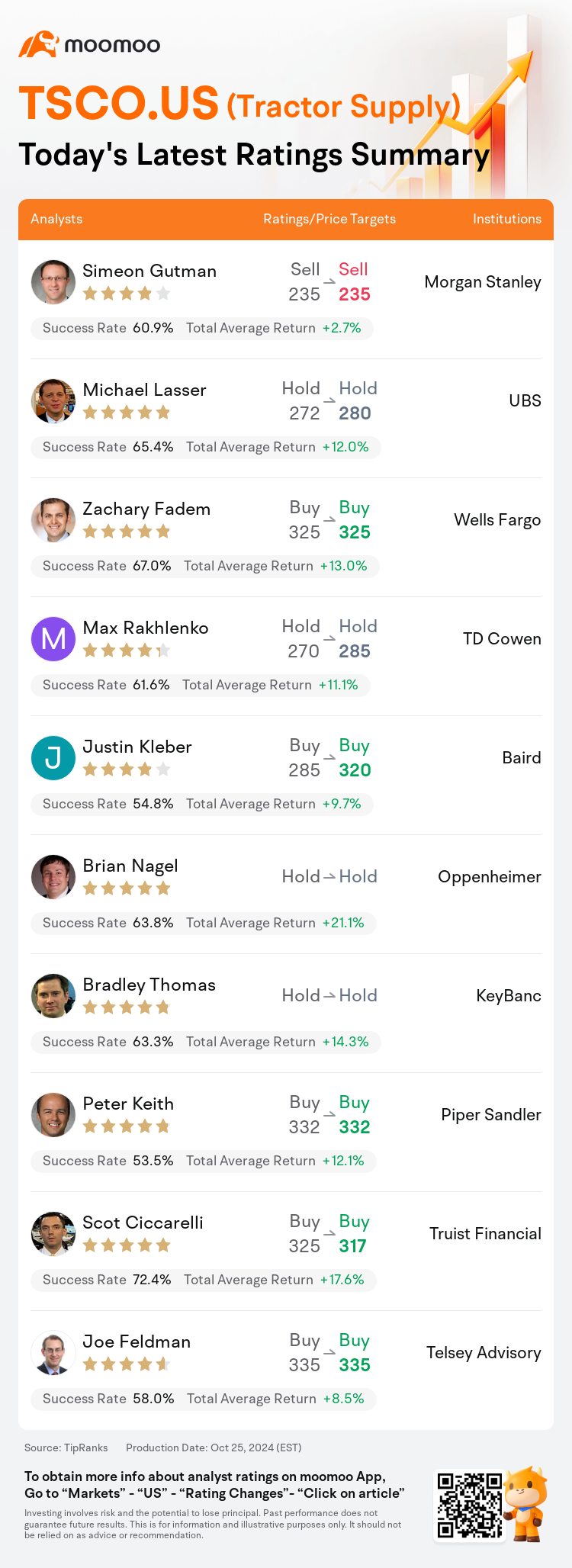

On Oct 25, major Wall Street analysts update their ratings for $Tractor Supply (TSCO.US)$, with price targets ranging from $235 to $335.

Morgan Stanley analyst Simeon Gutman maintains with a sell rating, and maintains the target price at $235.

UBS analyst Michael Lasser maintains with a hold rating, and adjusts the target price from $272 to $280.

Wells Fargo analyst Zachary Fadem maintains with a buy rating, and maintains the target price at $325.

Wells Fargo analyst Zachary Fadem maintains with a buy rating, and maintains the target price at $325.

TD Cowen analyst Max Rakhlenko maintains with a hold rating, and adjusts the target price from $270 to $285.

Baird analyst Justin Kleber maintains with a buy rating, and adjusts the target price from $285 to $320.

Furthermore, according to the comprehensive report, the opinions of $Tractor Supply (TSCO.US)$'s main analysts recently are as follows:

It was anticipated that share estimates would be revised upward prior to the company's report. However, subtle indications from the company have instead led to a slight reduction in estimates for 2025. The company is expected to present the next phase of its plans in December, which may generate enthusiasm regarding the retailer's future prospects.

Following the Q3 report, Tractor Supply's sales continue to be unimpressive, casting doubt on the company's objective to return to mid-single-digit comparable store sales growth. Meanwhile, it is expected that margin improvements will begin to level off. Despite projections not indicating an upward trend, Tractor Supply is considered to offer a measure of resilience and could benefit from certain post-election tendencies that might sustain the stock's higher valuation.

The assessment of Tractor Supply's performance suggests that even with a solid quarter and an improved guidance forecast, the market's reaction was not sufficient to maintain stock values near peak levels due to perceptions of overvaluation ahead of earnings announcements. The risk-to-reward ratio is viewed as limited given the current multiples on forward earnings and EBITDA, with the analyst's outlook for earnings per share in 2024 and 2025 remaining steady.

Here are the latest investment ratings and price targets for $Tractor Supply (TSCO.US)$ from 10 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

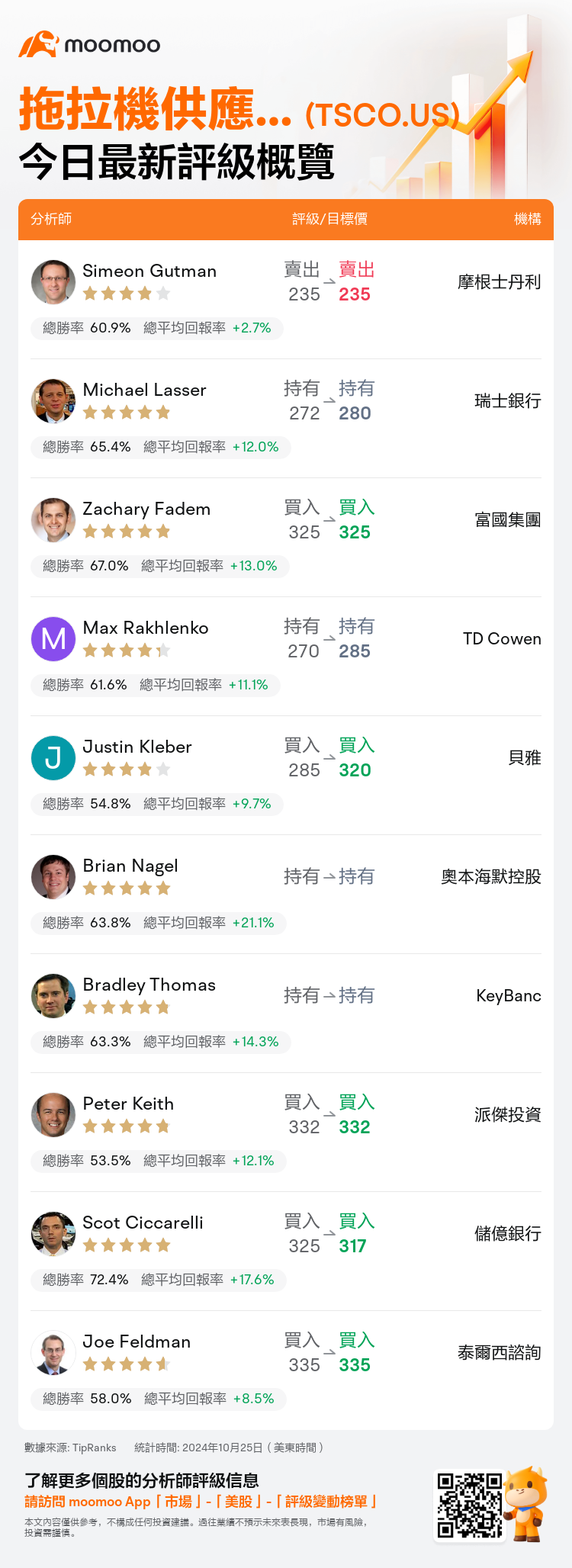

美東時間10月25日,多家華爾街大行更新了$拖拉機供應公司 (TSCO.US)$的評級,目標價介於235美元至335美元。

摩根士丹利分析師Simeon Gutman維持賣出評級,維持目標價235美元。

瑞士銀行分析師Michael Lasser維持持有評級,並將目標價從272美元上調至280美元。

富國集團分析師Zachary Fadem維持買入評級,維持目標價325美元。

富國集團分析師Zachary Fadem維持買入評級,維持目標價325美元。

TD Cowen分析師Max Rakhlenko維持持有評級,並將目標價從270美元上調至285美元。

貝雅分析師Justin Kleber維持買入評級,並將目標價從285美元上調至320美元。

此外,綜合報道,$拖拉機供應公司 (TSCO.US)$近期主要分析師觀點如下:

預計在公司報告之前,股票預估值將被上調。然而,公司微妙的跡象反而導致了2025年預估稍有減少。預計公司將在12月份呈現其未來計劃的下一階段,這可能會激起對零售商未來前景的熱情。

在第三季度報告後,拖拉機供應公司的銷售繼續不盡如人意,對公司重返每店銷售增長率中單位數的目標產生了懷疑。與此同時,預計利潤率的改善將開始趨於平穩。儘管預測未顯示上升趨勢,拖拉機供應公司被認爲具有一定的抗壓能力,並且可能從某些選舉後的傾向中受益,這可能支撐股票的較高估值。

對拖拉機供應公司業績的評估表明,即使在一個輝煌的季度和一個改善的指導預測後,市場的反應也不足以維持股票價值接近高峰水平,這是因爲在盈利公告之前對過高估值的認知。風險與回報比被認爲是有限的,考慮到前瞻收益和EBITDA目前的倍數,分析師對2024年和2025年每股收益的展望仍然穩定。

以下爲今日10位分析師對$拖拉機供應公司 (TSCO.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

富國集團分析師Zachary Fadem維持買入評級,維持目標價325美元。

富國集團分析師Zachary Fadem維持買入評級,維持目標價325美元。

Wells Fargo analyst Zachary Fadem maintains with a buy rating, and maintains the target price at $325.

Wells Fargo analyst Zachary Fadem maintains with a buy rating, and maintains the target price at $325.