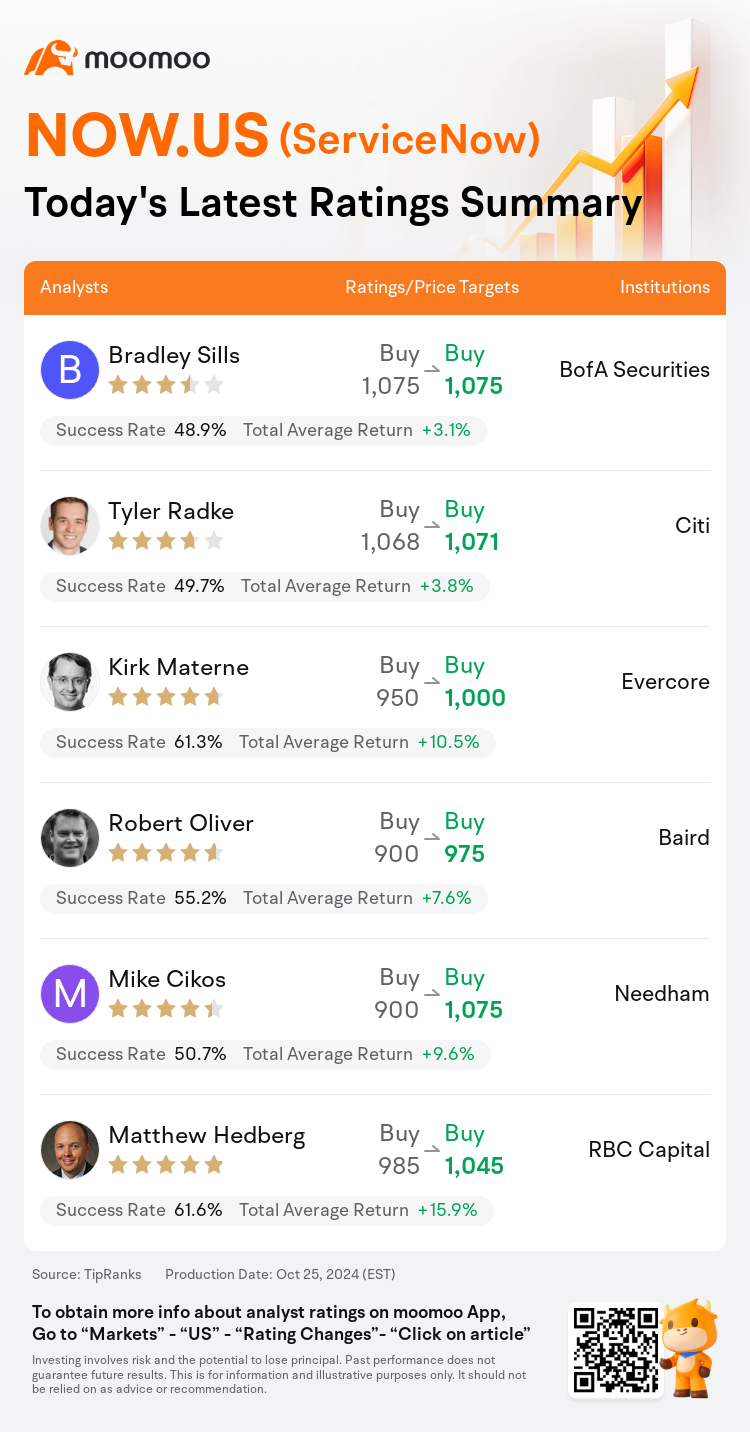

On Oct 25, major Wall Street analysts update their ratings for $ServiceNow (NOW.US)$, with price targets ranging from $975 to $1,075.

BofA Securities analyst Bradley Sills maintains with a buy rating, and maintains the target price at $1,075.

Citi analyst Tyler Radke maintains with a buy rating, and adjusts the target price from $1,068 to $1,071.

Evercore analyst Kirk Materne maintains with a buy rating, and adjusts the target price from $950 to $1,000.

Evercore analyst Kirk Materne maintains with a buy rating, and adjusts the target price from $950 to $1,000.

Baird analyst Robert Oliver maintains with a buy rating, and adjusts the target price from $900 to $975.

Needham analyst Mike Cikos maintains with a buy rating, and adjusts the target price from $900 to $1,075.

Furthermore, according to the comprehensive report, the opinions of $ServiceNow (NOW.US)$'s main analysts recently are as follows:

The company's notable third-quarter performance, which included a 'beat and raise' outcome and showcased increasing revenue from generative artificial intelligence, confirms its exceptional position within the enterprise software sector.

ServiceNow delivered a robust performance in the third quarter, surpassing expectations across various indicators and indicating an upward revision for fiscal 2024 revenues. The significant inflection in artificial intelligence bookings is regarded as a strong proclamation of the company's progress.

The company showcased a robust performance in the third quarter, which was well-received across various sectors, as noted by an analyst. It is anticipated that the company's shares will remain favorable once temporary quarterly expectations are reconciled. With superior sales growth compared to its competitors and robust margins, along with an evolving and convincing narrative around generative artificial intelligence, the company stands out in its market segment.

ServiceNow has shown commendable performance with a notable upside, and its subscription revenue guidance for 2024 has been raised significantly beyond expectations. The company's execution continues to impress, with several positive takeaways from the recent quarter including the growing strength of its platform, the robust adoption of Pro Plus/Now Assist, the debut of Workflow Data Fabric, and an expanding pipeline as the year comes to a close.

The firm acknowledges the quarter's outcomes and insights from the conference call regarding new contract value from previously underperforming sectors, along with the uptake of AI products, are sufficient reasons to maintain a positive stance on the company and to increase the firm's expectations.

Here are the latest investment ratings and price targets for $ServiceNow (NOW.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

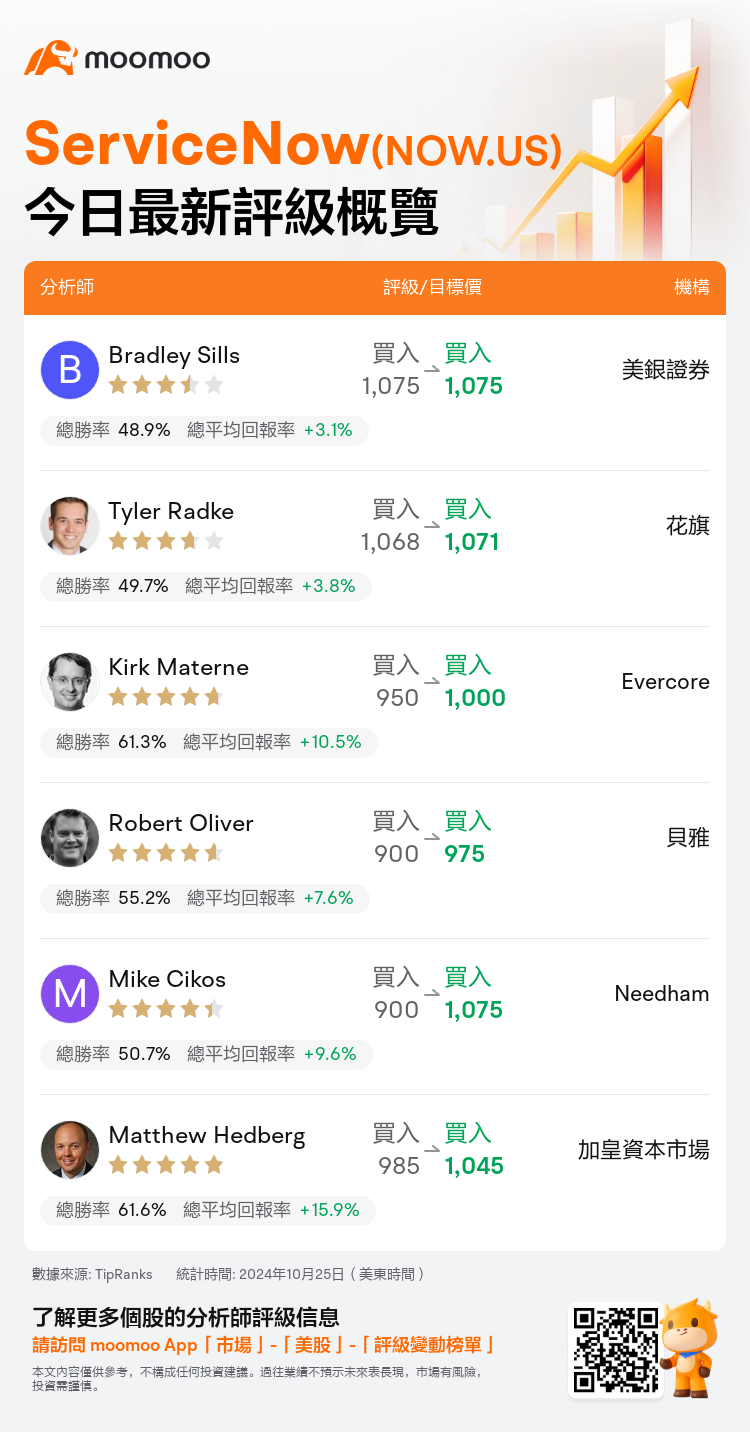

美東時間10月25日,多家華爾街大行更新了$ServiceNow (NOW.US)$的評級,目標價介於975美元至1,075美元。

美銀證券分析師Bradley Sills維持買入評級,維持目標價1,075美元。

花旗分析師Tyler Radke維持買入評級,並將目標價從1,068美元上調至1,071美元。

Evercore分析師Kirk Materne維持買入評級,並將目標價從950美元上調至1,000美元。

Evercore分析師Kirk Materne維持買入評級,並將目標價從950美元上調至1,000美元。

貝雅分析師Robert Oliver維持買入評級,並將目標價從900美元上調至975美元。

Needham分析師Mike Cikos維持買入評級,並將目標價從900美元上調至1,075美元。

此外,綜合報道,$ServiceNow (NOW.US)$近期主要分析師觀點如下:

該公司在第三季度表現顯著,包括'超額完成和提高'的結果,展示了從生成式人工智能中增加的營業收入,證實了其在企業軟件板塊的卓越地位。

ServiceNow在第三季度表現強勁,各種因子超出預期,並顯示出對2024財政年度營業收入的上調。人工智能預訂的顯著變化被認爲是公司進展的強有力宣言。

該公司在第三季度展現出強勁表現,在各個板塊受到分析師的肯定。預計一旦臨時季度預期得以調和,公司股價將繼續受歡迎。與競爭對手相比,銷售增長優越,並具有穩健的利潤率,再加上環繞生成式人工智能的發展和令人信服的敘述,該公司在市場板塊中脫穎而出。

ServiceNow展現出可觀的表現,有明顯的增長,其2024年的訂閱營業收入指引大幅超出預期。公司的執行仍然令人印象深刻,從最近一個季度可以得出許多積極信息,包括平台的日益強大、Pro Plus/Now Assist的穩健採納、Workflow Data Fabric的首次亮相,以及隨着年底臨近管道的擴大。

公司承認季度結果以及從電話會議中獲得的見解,新合同價值來自先前表現不佳的板塊,以及人工智能產品的採用,足以維持對公司的積極看法並提高公司的期望。

以下爲今日6位分析師對$ServiceNow (NOW.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

Evercore分析師Kirk Materne維持買入評級,並將目標價從950美元上調至1,000美元。

Evercore分析師Kirk Materne維持買入評級,並將目標價從950美元上調至1,000美元。

Evercore analyst Kirk Materne maintains with a buy rating, and adjusts the target price from $950 to $1,000.

Evercore analyst Kirk Materne maintains with a buy rating, and adjusts the target price from $950 to $1,000.