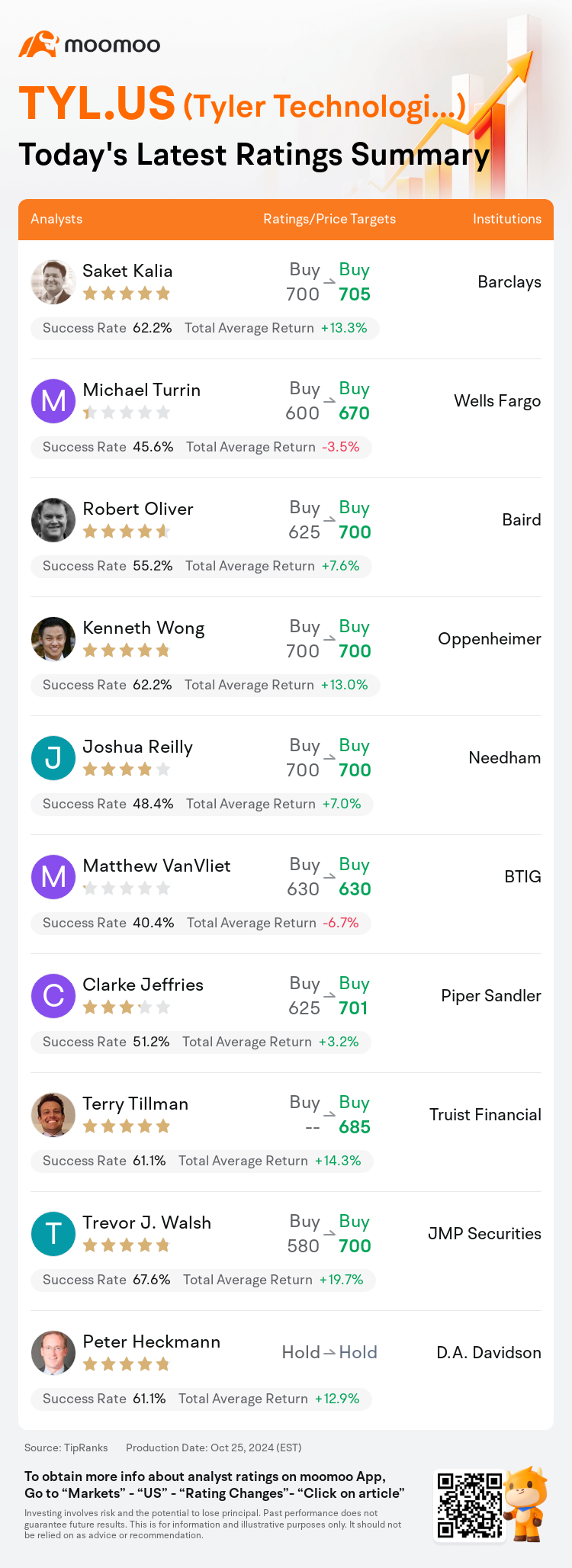

On Oct 25, major Wall Street analysts update their ratings for $Tyler Technologies (TYL.US)$, with price targets ranging from $630 to $705.

Barclays analyst Saket Kalia maintains with a buy rating, and adjusts the target price from $700 to $705.

Wells Fargo analyst Michael Turrin maintains with a buy rating, and adjusts the target price from $600 to $670.

Baird analyst Robert Oliver maintains with a buy rating, and adjusts the target price from $625 to $700.

Baird analyst Robert Oliver maintains with a buy rating, and adjusts the target price from $625 to $700.

Oppenheimer analyst Kenneth Wong maintains with a buy rating, and maintains the target price at $700.

Needham analyst Joshua Reilly maintains with a buy rating, and maintains the target price at $700.

Furthermore, according to the comprehensive report, the opinions of $Tyler Technologies (TYL.US)$'s main analysts recently are as follows:

Tyler Technologies reported Q3 results and increased its fiscal 2024 margin guide to 21%-23%, setting a new baseline for fiscal 2025.

Tyler Technologies has updated its 2024 free cash flow margin guidance upwards by 3 percentage points, aligning with its revenue results. The company has demonstrated a capacity to produce free cash flow significantly exceeding the previous 2025 target. This performance is credited to cloud efficiency initiatives and bolsters conviction in achieving a 24% free cash flow margin by 2027.

The successful transition of Tyler Technologies' business model has increased value for customers, the company itself, and its shareholders. It is observed that Tyler is delivering on all three fronts, and is doing so ahead of schedule.

Tyler Technologies reported robust Q3 results, with profitability surpassing expectations, although revenue was slightly below market consensus, it exceeded the company's own forecasts. The performance supports a positive outlook on Tyler's continued execution of initiatives aimed at enhancing both revenue and profitability, supported by strong demand within the public sector.

Here are the latest investment ratings and price targets for $Tyler Technologies (TYL.US)$ from 10 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

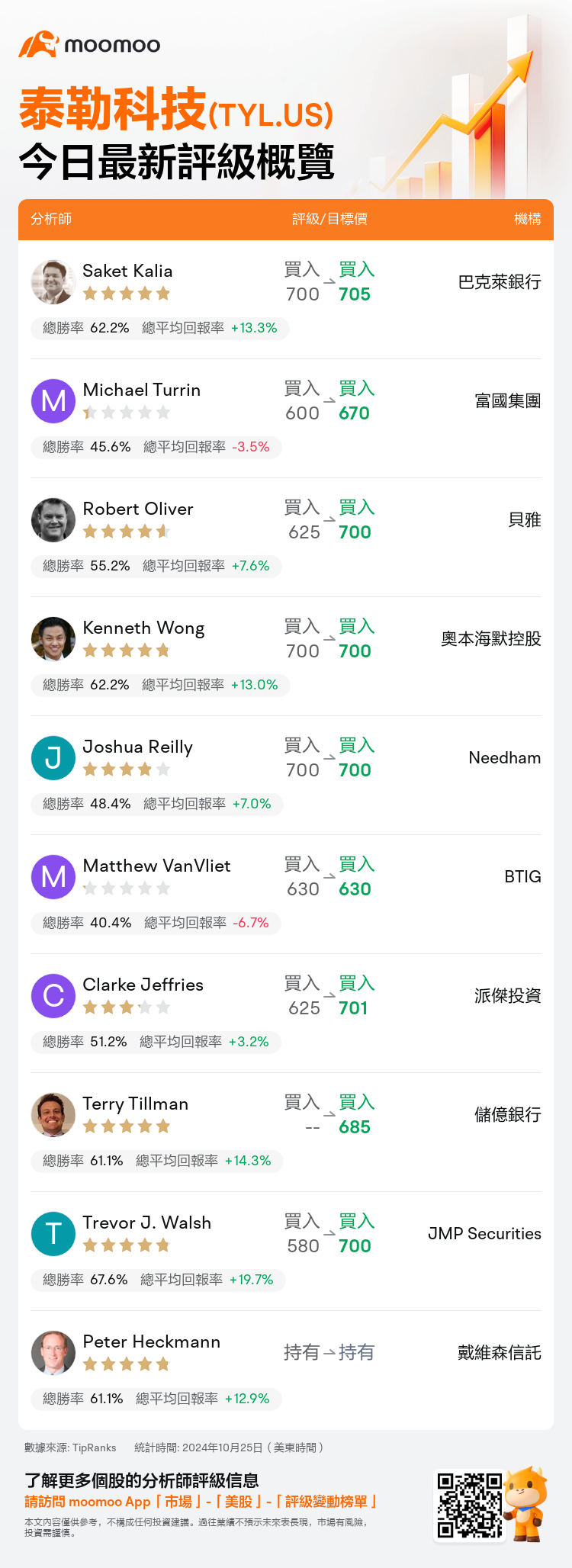

美東時間10月25日,多家華爾街大行更新了$泰勒科技 (TYL.US)$的評級,目標價介於630美元至705美元。

巴克萊銀行分析師Saket Kalia維持買入評級,並將目標價從700美元上調至705美元。

富國集團分析師Michael Turrin維持買入評級,並將目標價從600美元上調至670美元。

貝雅分析師Robert Oliver維持買入評級,並將目標價從625美元上調至700美元。

貝雅分析師Robert Oliver維持買入評級,並將目標價從625美元上調至700美元。

奧本海默控股分析師Kenneth Wong維持買入評級,維持目標價700美元。

Needham分析師Joshua Reilly維持買入評級,維持目標價700美元。

此外,綜合報道,$泰勒科技 (TYL.US)$近期主要分析師觀點如下:

泰勒科技報告了第三季度的業績,並將其2024財年利潤率指導提高到21%-23%,爲2025財年設定了新的基準。

泰勒科技已將其2024自由現金流利潤率指導上調3個百分點,與其營業收入結果保持一致。該公司已展示出生產遠遠超過之前目標的自由現金流的能力。這一表現歸功於雲效率舉措,增強了對到2027年實現24%自由現金流利潤率的信心。

泰勒科技業務模式的成功轉型爲客戶、公司本身和股東增加了價值。觀察到泰勒正在三個方面取得成功,並且還提前完成了這些目標。

泰勒科技報告了強勁的第三季度業績,利潤超出預期,儘管營業收入略低於市場共識,但超過了公司自己的預測。這一表現支持對泰勒在繼續執行旨在增強營業收入和利潤能力的行動的樂觀展望,強勁的公共部門需求提供了支撐。

以下爲今日10位分析師對$泰勒科技 (TYL.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

貝雅分析師Robert Oliver維持買入評級,並將目標價從625美元上調至700美元。

貝雅分析師Robert Oliver維持買入評級,並將目標價從625美元上調至700美元。

Baird analyst Robert Oliver maintains with a buy rating, and adjusts the target price from $625 to $700.

Baird analyst Robert Oliver maintains with a buy rating, and adjusts the target price from $625 to $700.