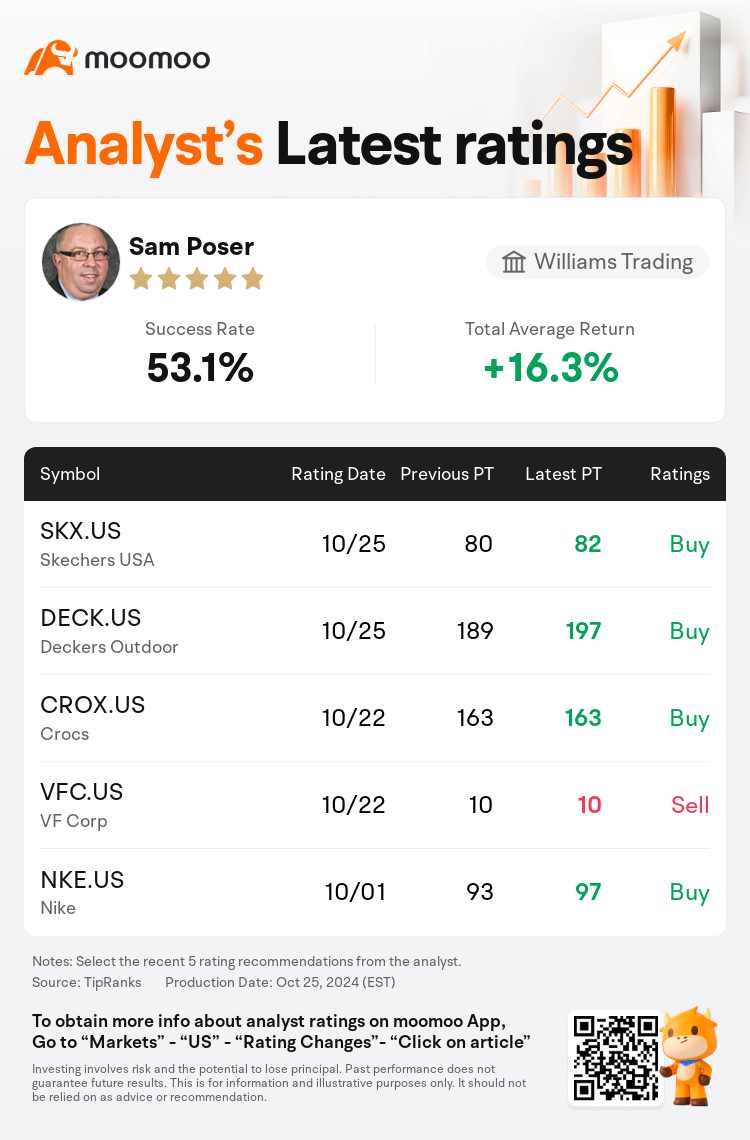

Williams Trading analyst Sam Poser maintains $Skechers USA (SKX.US)$ with a buy rating, and adjusts the target price from $80 to $82.

According to TipRanks data, the analyst has a success rate of 53.1% and a total average return of 16.3% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Skechers USA (SKX.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Skechers USA (SKX.US)$'s main analysts recently are as follows:

The firm has modified its expectations for Skechers, noting the management's decision to increase the lower end of its future sales outlook, acknowledging the brand's sustained strength across various channels. This amendment has led to an adjustment in the firm's earnings projections, increasing the forecast for the upcoming fiscal year while slightly revising the following year's estimate downwards.

Skechers' third-quarter performance exceeded expectations and prompted an increase in forecasts, influenced by robust wholesale results and positive trends in Europe, the Middle East, and Africa. This was somewhat balanced by a lower gross margin due to challenges in China and increased promotional activity. These issues are viewed as temporary.

Skechers' recent performance, characterized by a 16% sales growth and the sustenance of near-record gross margins during Q3, was notable, especially considering the shift back to wholesale channels coupled with challenges in China and other headwinds.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

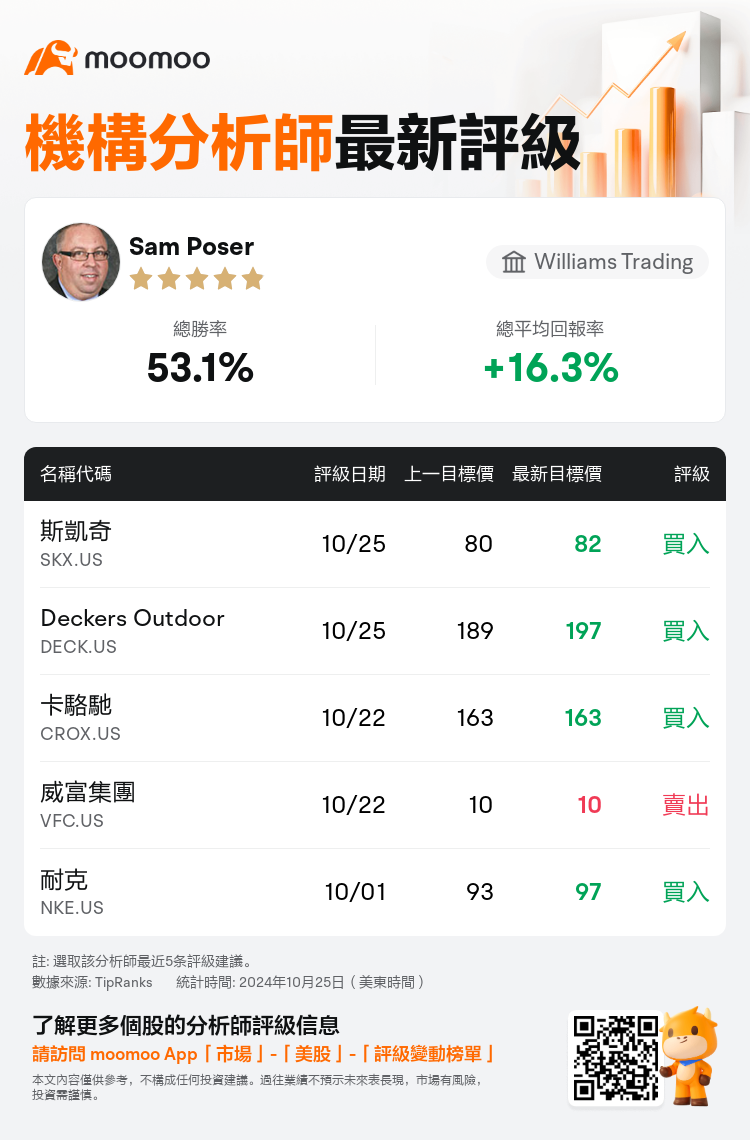

Williams Trading分析師Sam Poser維持$斯凱奇 (SKX.US)$買入評級,並將目標價從80美元上調至82美元。

根據TipRanks數據顯示,該分析師近一年總勝率為53.1%,總平均回報率為16.3%。

此外,綜合報道,$斯凱奇 (SKX.US)$近期主要分析師觀點如下:

此外,綜合報道,$斯凱奇 (SKX.US)$近期主要分析師觀點如下:

該公司已調整對Skechers的預期,注意到管理層決定提高未來銷售業績預期的底線,承認該品牌在各個渠道上持續的實力。這一修正導致公司盈利預測的調整,提高了未來財政年度的預測,同時略微調低了下一財年的估計。

Skechers的第三季度業績超出預期,促使預測增加,受益於強勁的批發業績和歐洲、中東和非洲地區的積極趨勢。儘管由於中國市場的挑戰和促銷活動增加導致毛利率較低,這在一定程度上得到了平衡。這些問題被視爲暫時的。

Skechers最近的業績表現,特點是第三季度銷售增長16%,並在面臨中國和其他不利因素的情況下保持接近歷史最高水平的毛利率,這是引人注目的,尤其考慮到再次轉向批發渠道並面臨中國市場和其他挑戰。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$斯凱奇 (SKX.US)$近期主要分析師觀點如下:

此外,綜合報道,$斯凱奇 (SKX.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of