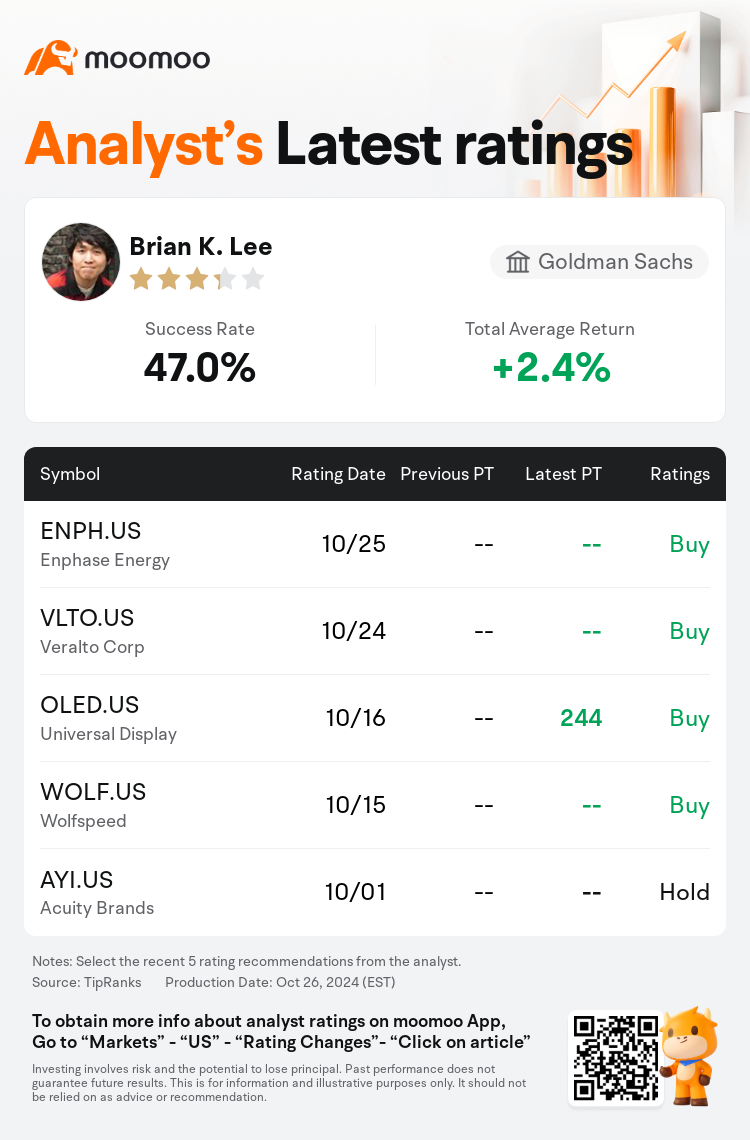

Goldman Sachs analyst Brian K. Lee maintains $Enphase Energy (ENPH.US)$ with a buy rating.

According to TipRanks data, the analyst has a success rate of 47.0% and a total average return of 2.4% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Enphase Energy (ENPH.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Enphase Energy (ENPH.US)$'s main analysts recently are as follows:

It's anticipated that investors may feel let down by the earnings report and forthcoming guidance, as Q3 figures fell short of expectations and a decrease in sequential storage shipments is projected for Q4. The underwhelming performance in Q3, as well as the primary variable affecting Q4 projections, is thought to be due to setbacks in Europe. This not only impacted the company's recent results but also suggests a potential negative implication for competitors in the solar energy sector. Nevertheless, the company's introduction of novel battery technology and metering solutions is expected to enhance its competitiveness in the market, particularly against prominent players in the industry.

Enphase Energy's Q4 revenue guidance was below expectations due to several headwinds. There is an anticipation that Europe may continue to pose challenges through 2025, potentially impacting current consensus estimates. Forecasts suggest a 17% deviation below consensus for revenue and EBITDA in 2025.

Enphase Energy's third-quarter outcomes fell short of forecasts due to reduced volume, and its fourth-quarter projections are also under the consensus, influenced by demanding market conditions in Europe and diminished battery deliveries. Despite implementing various internal improvement measures, the company is dealing with difficult economic circumstances in Europe and market disturbances in the U.S.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

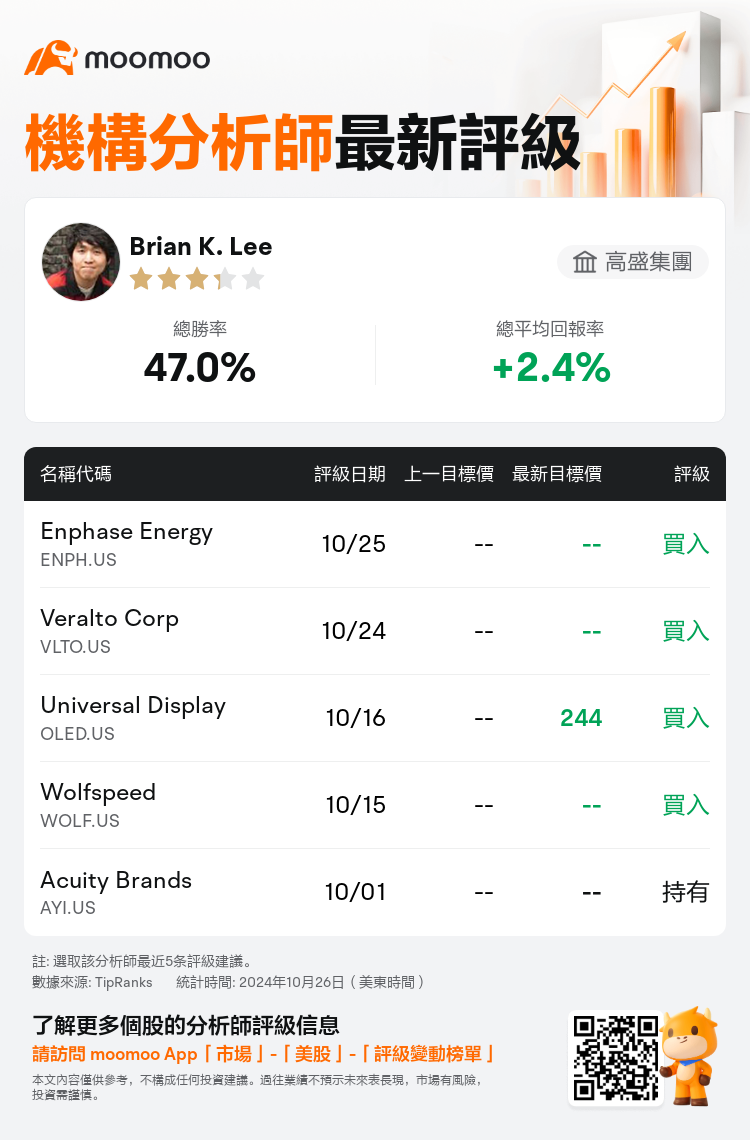

高盛集團分析師Brian K. Lee維持$Enphase Energy (ENPH.US)$買入評級。

根據TipRanks數據顯示,該分析師近一年總勝率為47.0%,總平均回報率為2.4%。

此外,綜合報道,$Enphase Energy (ENPH.US)$近期主要分析師觀點如下:

此外,綜合報道,$Enphase Energy (ENPH.US)$近期主要分析師觀點如下:

投資者預計可能對收入報告和未來指導感到失望,因爲第三季度數據低於預期,並且預計第四季度將出現順序存儲發貨的減少。第三季度表現不佳,以及影響第四季度預測的主要變量被認爲是歐洲的挫折。這不僅影響了公司最近的業績,還暗示着太陽能行業的競爭對手可能面臨潛在的負面影響。然而,公司推出的新型電池技術和計量解決方案預計將增強其在市場上的競爭力,特別是針對行業內知名參與者。

由於幾大不利因素,Enphase Energy的第四季度營收指導低於預期。人們預期歐洲可能繼續在2025年帶來挑戰,可能影響當前的共識預估。預測顯示,2025年營收和EBITDA預估共識下降了17%。

由於成交量減少,Enphase Energy第三季度的業績低於預測,其第四季度的預測也低於共識,受到歐洲市場嚴峻條件和電池交付減少的影響。儘管實施了各種內部改進措施,但該公司正面臨歐洲的困難經濟環境和美國市場的干擾。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Enphase Energy (ENPH.US)$近期主要分析師觀點如下:

此外,綜合報道,$Enphase Energy (ENPH.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of