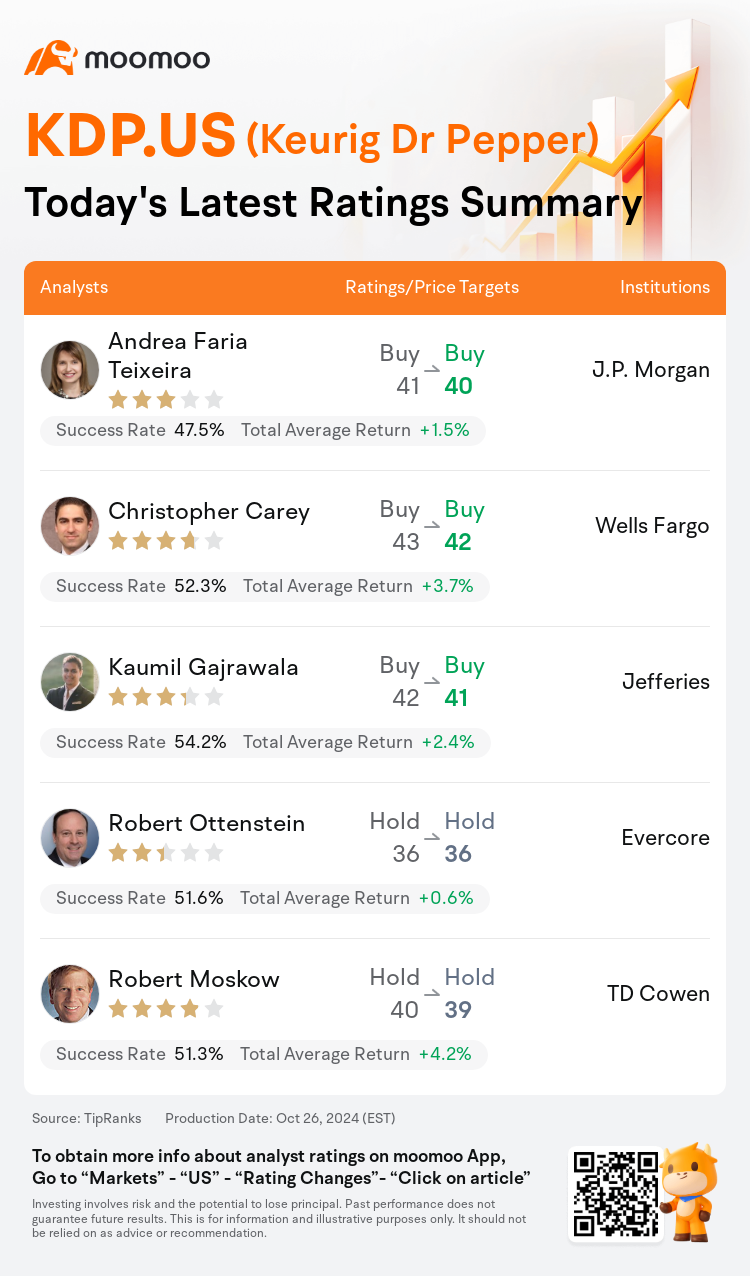

On Oct 26, major Wall Street analysts update their ratings for $Keurig Dr Pepper (KDP.US)$, with price targets ranging from $36 to $42.

J.P. Morgan analyst Andrea Faria Teixeira maintains with a buy rating, and adjusts the target price from $41 to $40.

Wells Fargo analyst Christopher Carey maintains with a buy rating, and adjusts the target price from $43 to $42.

Jefferies analyst Kaumil Gajrawala maintains with a buy rating, and adjusts the target price from $42 to $41.

Jefferies analyst Kaumil Gajrawala maintains with a buy rating, and adjusts the target price from $42 to $41.

Evercore analyst Robert Ottenstein maintains with a hold rating, and maintains the target price at $36.

TD Cowen analyst Robert Moskow maintains with a hold rating, and adjusts the target price from $40 to $39.

Furthermore, according to the comprehensive report, the opinions of $Keurig Dr Pepper (KDP.US)$'s main analysts recently are as follows:

Keurig Dr Pepper's recent quarterly performance in the U.S. coffee segment was considered disappointing, falling short of expectations in terms of sales and profit, despite a stronger showing in U.S. refreshment beverages. The primary factor contributing to the underwhelming coffee results was negative pricing, coupled with lower-than-anticipated coffee pod volumes. Nonetheless, the valuation of Keurig Dr Pepper is still perceived as appealing.

The company experienced a lackluster quarter influenced by an aggressive promotional landscape in the coffee sector and international performance that marginally fell short of expectations. Nevertheless, the firm witnessed a third sequential quarter of total company volume acceleration, and its earnings per share met projections.

The third quarter showed satisfactory performance for Keurig Dr Pepper, and the company appears well positioned to meet its long-term financial algorithm by 2025. The partnership with GHOST is expected to contribute approximately 300 basis points to growth, with an anticipated mid-teens EBITDA margin, providing the company with strategic flexibility, particularly in the coffee segment.

Here are the latest investment ratings and price targets for $Keurig Dr Pepper (KDP.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

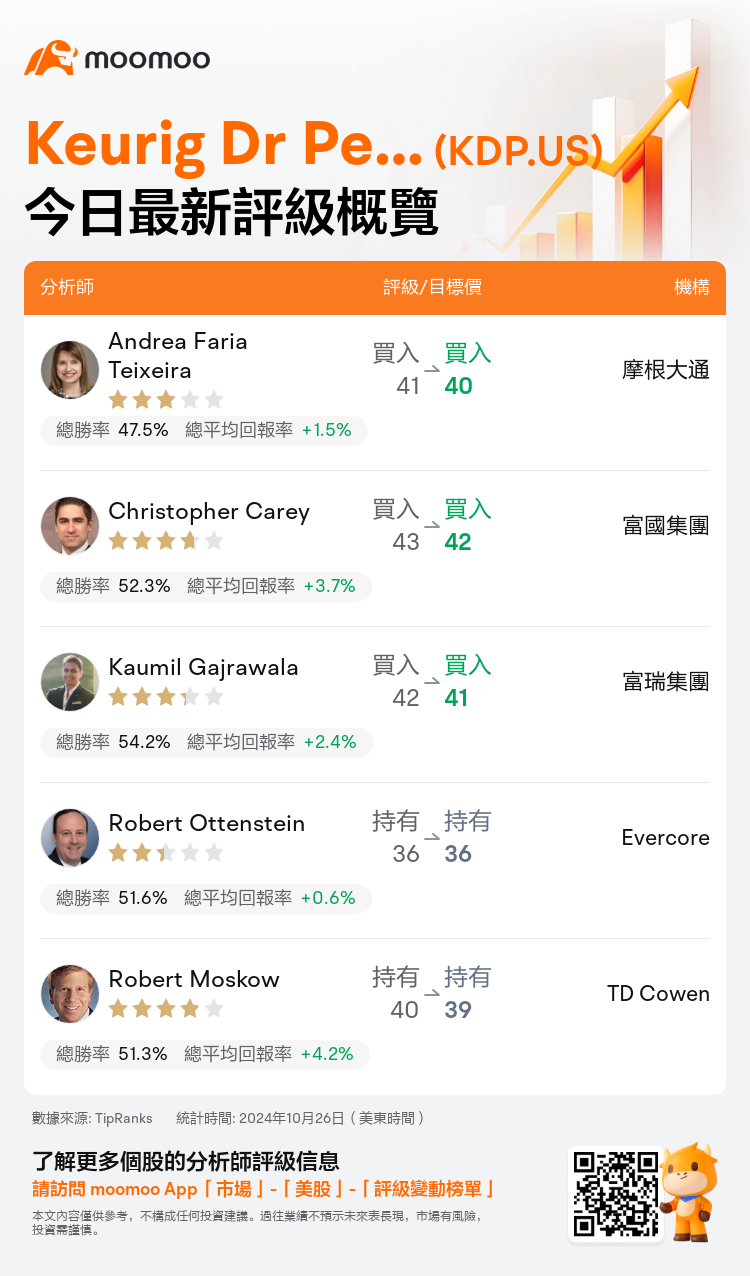

美東時間10月26日,多家華爾街大行更新了$Keurig Dr Pepper (KDP.US)$的評級,目標價介於36美元至42美元。

摩根大通分析師Andrea Faria Teixeira維持買入評級,並將目標價從41美元下調至40美元。

富國集團分析師Christopher Carey維持買入評級,並將目標價從43美元下調至42美元。

富瑞集團分析師Kaumil Gajrawala維持買入評級,並將目標價從42美元下調至41美元。

富瑞集團分析師Kaumil Gajrawala維持買入評級,並將目標價從42美元下調至41美元。

Evercore分析師Robert Ottenstein維持持有評級,維持目標價36美元。

TD Cowen分析師Robert Moskow維持持有評級,並將目標價從40美元下調至39美元。

此外,綜合報道,$Keurig Dr Pepper (KDP.US)$近期主要分析師觀點如下:

最近在美國咖啡板塊的表現讓keurig dr pepper感到失望,銷售和利潤均未達到預期,儘管在美國飲料方面表現較強。導致令人失望的咖啡業績的主要因素是負面定價,再加上低於預期的咖啡豆成交量。儘管如此,keurig dr pepper的估值仍被認爲具有吸引力。

公司經歷了一個平平淡淡的季度,受到咖啡板塊激烈的促銷格局以及國際業績略低於預期的影響。儘管如此,該公司見證了連續第三個季度的整體公司成交量加速,其每股收益達到了預期。

第三季度對keurig dr pepper來說表現令人滿意,該公司似乎有望在2025年前達到其長期財務算法。與GHOSt的合作預期將爲增長貢獻約300個點子,並預期中等規模EBITDA利潤率,爲公司提供戰略靈活性,特別是在咖啡板塊。

以下爲今日5位分析師對$Keurig Dr Pepper (KDP.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

富瑞集團分析師Kaumil Gajrawala維持買入評級,並將目標價從42美元下調至41美元。

富瑞集團分析師Kaumil Gajrawala維持買入評級,並將目標價從42美元下調至41美元。

Jefferies analyst Kaumil Gajrawala maintains with a buy rating, and adjusts the target price from $42 to $41.

Jefferies analyst Kaumil Gajrawala maintains with a buy rating, and adjusts the target price from $42 to $41.