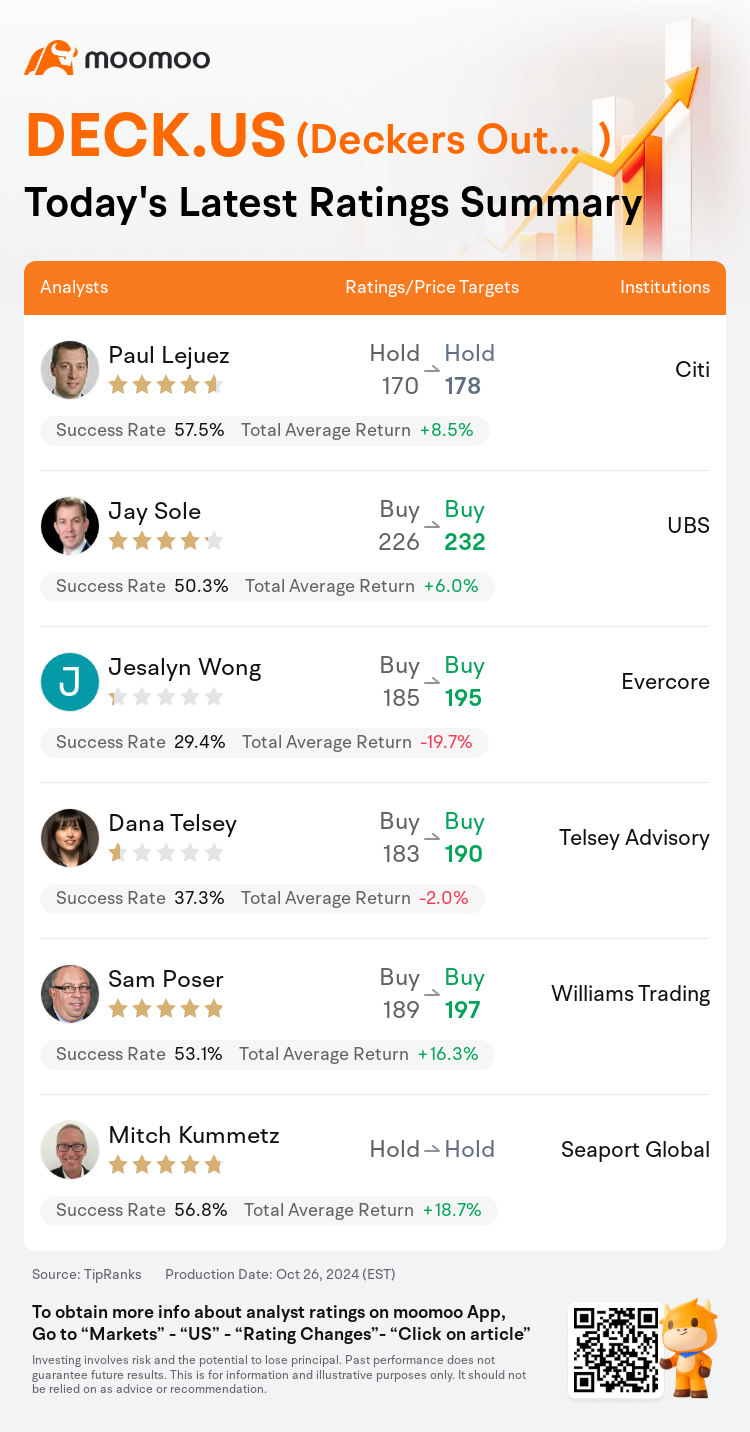

On Oct 26, major Wall Street analysts update their ratings for $Deckers Outdoor (DECK.US)$, with price targets ranging from $178 to $232.

Citi analyst Paul Lejuez maintains with a hold rating, and adjusts the target price from $170 to $178.

UBS analyst Jay Sole maintains with a buy rating, and adjusts the target price from $226 to $232.

Evercore analyst Jesalyn Wong maintains with a buy rating, and adjusts the target price from $185 to $195.

Evercore analyst Jesalyn Wong maintains with a buy rating, and adjusts the target price from $185 to $195.

Telsey Advisory analyst Dana Telsey maintains with a buy rating, and adjusts the target price from $183 to $190.

Williams Trading analyst Sam Poser maintains with a buy rating, and adjusts the target price from $189 to $197.

Furthermore, according to the comprehensive report, the opinions of $Deckers Outdoor (DECK.US)$'s main analysts recently are as follows:

It is anticipated that the consumer momentum enjoyed by Hoka will persist, contributing to robust sales growth for FY25 and potential earnings surpassing expectations. The projection is that Hoka will achieve a 21% five-year sales compound annual growth rate, which is central to the anticipated 15.5% five-year EPS compound annual growth rate for Deckers. The sentiment surrounding the stock is expected to remain positive as the company demonstrates its ability to sustain a high EPS growth trajectory.

Deckers Outdoor's Q2 earnings per share of $1.59 were significantly above the anticipated estimates, attributed to sales and gross margins surpassing expectations. Analysts have heightened their multiples on future fiscal year estimates, signifying a boost in confidence regarding near-term sales trends. However, it is suggested that the current share valuation represents a balanced risk/reward scenario.

The firm expressed optimism regarding Deckers Outdoor's performance in fiscal Q2, highlighting that the company surpassed expectations in all areas and also elevated its earnings forecast for the full year. Deckers is seen as 'operating in the bullseye,' particularly with Hoka at the nascent stages of worldwide expansion and Ugg consistently innovating and aligning with present lifestyle footwear trends.

Deckers Outdoor's fiscal Q2 report was exceptionally positive, outperforming expectations in various aspects. The company's success spanned across its brands and channels, leading to an uplifted fiscal 2025 outlook due to its consistent execution. The potential for further growth is supported by the introduction of new products and a robust international market presence.

Deckers Outdoor's fiscal Q2 performance was robust, surpassing expectations across all significant indicators. Despite the substantial outperformance, the company's forecast for FY25 was only modestly increased, suggesting a cautious stance towards the second half of the fiscal year.

Here are the latest investment ratings and price targets for $Deckers Outdoor (DECK.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

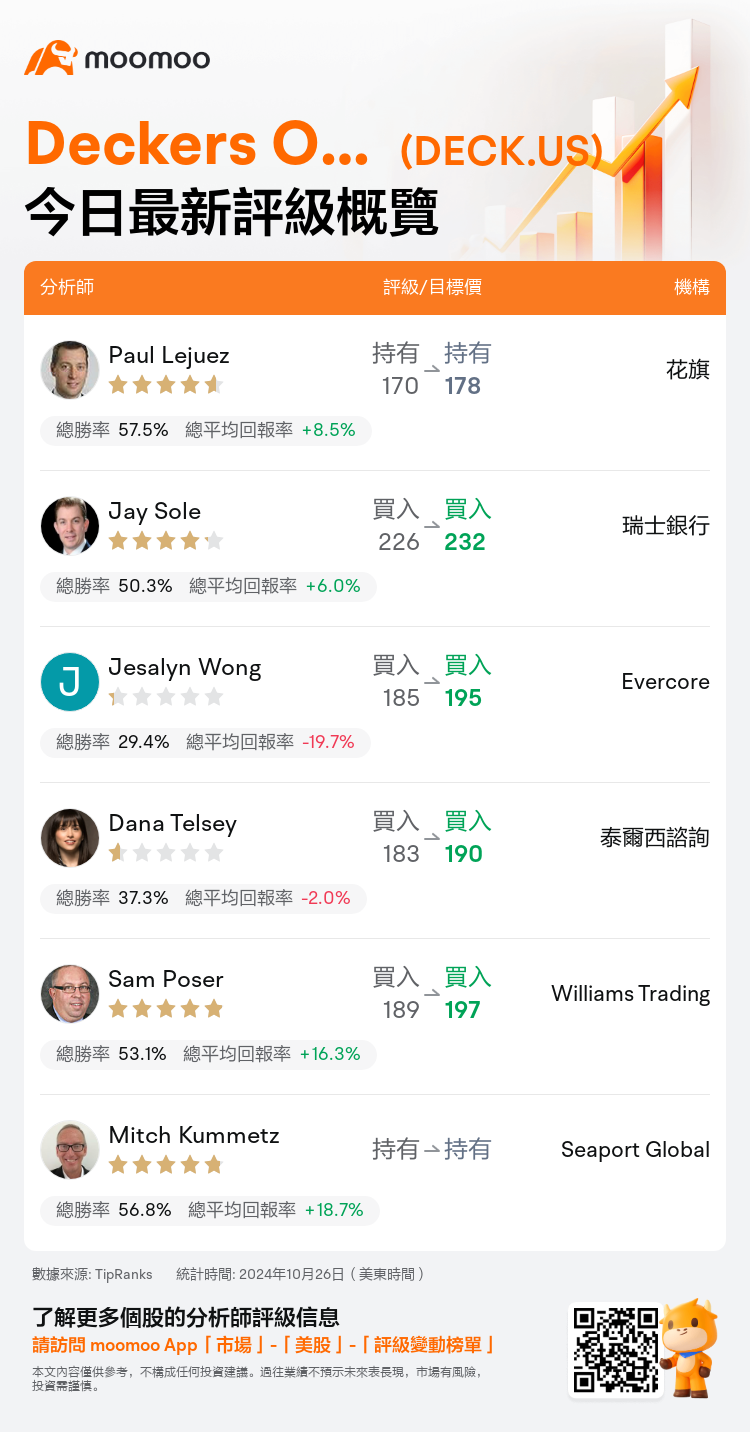

美東時間10月26日,多家華爾街大行更新了$Deckers Outdoor (DECK.US)$的評級,目標價介於178美元至232美元。

花旗分析師Paul Lejuez維持持有評級,並將目標價從170美元上調至178美元。

瑞士銀行分析師Jay Sole維持買入評級,並將目標價從226美元上調至232美元。

Evercore分析師Jesalyn Wong維持買入評級,並將目標價從185美元上調至195美元。

Evercore分析師Jesalyn Wong維持買入評級,並將目標價從185美元上調至195美元。

泰爾西諮詢分析師Dana Telsey維持買入評級,並將目標價從183美元上調至190美元。

Williams Trading分析師Sam Poser維持買入評級,並將目標價從189美元上調至197美元。

此外,綜合報道,$Deckers Outdoor (DECK.US)$近期主要分析師觀點如下:

預計Hoka受到的消費者動力將持續,爲2025財年的強勁銷售增長和超出預期的潛在盈利做出貢獻。預計Hoka將實現21%的五年銷售複合年增長率,這對Deckers預計的15.5%的五年EPS複合年增長率至關重要。圍繞股票的情緒預計將保持積極,因爲公司展示了其能夠維持較高的EPS增長軌跡。

Deckers Outdoor第二季度每股收益爲1.59美元,顯著高於預期,這歸因於銷售額和毛利超出預期。分析師已經提高了對未來財務年度預期的倍數,表明對近期銷售趨勢的信心提升。然而,目前的股價估值被認爲代表了一種平衡的風險/回報情景。

該公司對Deckers Outdoor在財政第二季度的表現表示樂觀,強調該公司在各個領域均超出預期,並提升了全年的盈利預測。Deckers被視爲『正處在靶心』,特別是隨着Hoka正在全球擴張的初始階段和Ugg不斷創新並與當前的生活方式鞋類趨勢保持一致。

Deckers Outdoor財政第二季度報告異常積極,各個方面的業績均超出預期。該公司的成功橫跨其品牌和渠道,導致財年2025前景上升,因爲其穩健的執行。通過推出新產品和強勁的國際市場存在,進一步增長的潛力得到支持。

Deckers Outdoor財政第二季度業績強勁,各項重要指標均超越預期。儘管業績大幅超越,但公司對2025財年的預測僅略有增加,暗示對財年下半部分持謹慎態度。

以下爲今日6位分析師對$Deckers Outdoor (DECK.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

Evercore分析師Jesalyn Wong維持買入評級,並將目標價從185美元上調至195美元。

Evercore分析師Jesalyn Wong維持買入評級,並將目標價從185美元上調至195美元。

Evercore analyst Jesalyn Wong maintains with a buy rating, and adjusts the target price from $185 to $195.

Evercore analyst Jesalyn Wong maintains with a buy rating, and adjusts the target price from $185 to $195.