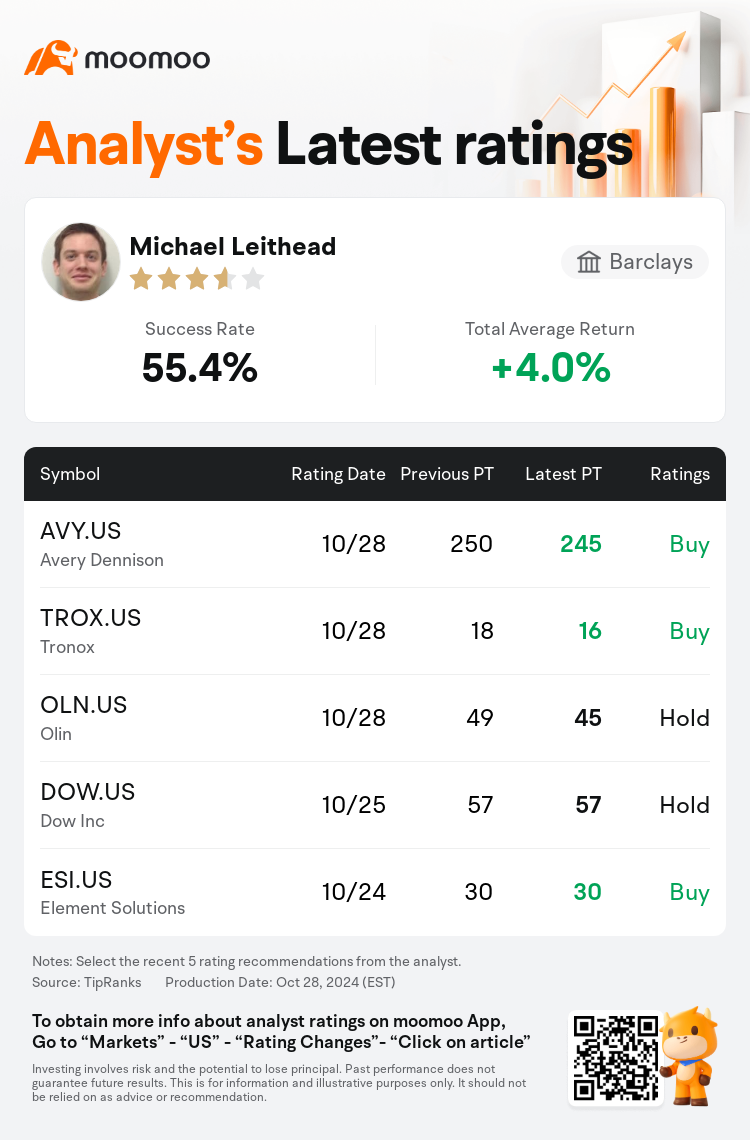

Barclays analyst Michael Leithead maintains $Avery Dennison (AVY.US)$ with a buy rating, and adjusts the target price from $250 to $245.

According to TipRanks data, the analyst has a success rate of 55.4% and a total average return of 4.0% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Avery Dennison (AVY.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Avery Dennison (AVY.US)$'s main analysts recently are as follows:

Avery Dennison's entry into extensive food markets has been marked by its recent RFID agreement with Kroger, signaling its initial foray into this sector. However, the company is anticipated to encounter challenging comparisons in intelligent labels logistics towards the second half of 2024. A more cautious stance is adopted for now, pending a clearer insight into the evolving business dynamics.

Despite Avery Dennison recording a slight overperformance and introduction of a new platform for grocery stores, the share prices experienced a decline. This was partly due to the current challenges faced by the Vestcom platform and worries about a temporary setback in RFID logistics. These concerns have led some investors to conclude that the RFID growth narrative might be concluding, or that Avery Dennison is losing its market share. Contrary to these investor beliefs, the analyst perceives these issues as temporary, emphasizing that the company's Materials division is on solid ground and the increasing uses for RFID technology are expected to drive revenue growth and enhance profit margins, positioning the company for potential outperformance by 2025.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

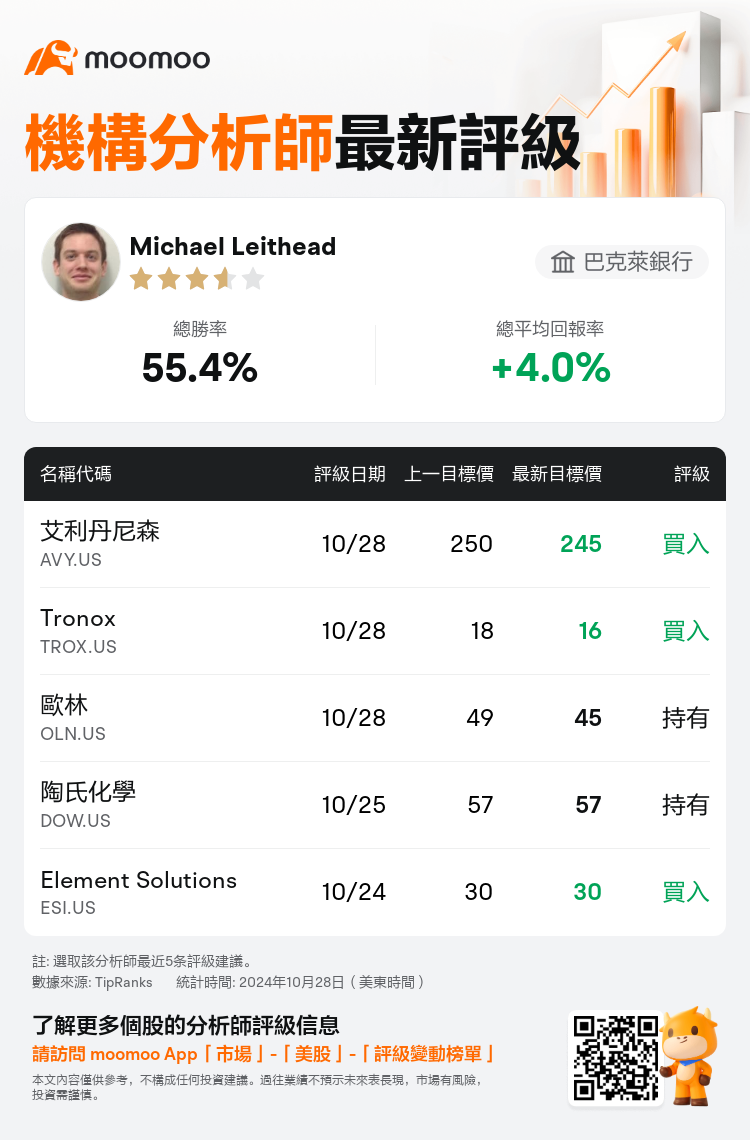

巴克萊銀行分析師Michael Leithead維持$艾利丹尼森 (AVY.US)$買入評級,並將目標價從250美元下調至245美元。

根據TipRanks數據顯示,該分析師近一年總勝率為55.4%,總平均回報率為4.0%。

此外,綜合報道,$艾利丹尼森 (AVY.US)$近期主要分析師觀點如下:

此外,綜合報道,$艾利丹尼森 (AVY.US)$近期主要分析師觀點如下:

艾利丹尼森進軍廣泛的食品市場,最近與Kroger達成的RFID協議標誌着其對該行業的初次涉足。然而,預計該公司將在2024年下半年面臨智能標籤物流方面的具有挑戰性的比較。目前,對於這一情況採取更爲謹慎的態度,等待對不斷變化的業務動態有一個更清晰的了解。

儘管艾利丹尼森錄得輕微的超額表現,並針對雜貨商店推出新平台,股價卻出現下跌。這在一定程度上是由於Vestcom平台面臨的當前挑戰和對RFID物流的暫時挫折引起的。這些擔憂導致一些投資者得出結論,即RFID增長敘事可能正在結束,或者艾利丹尼森正在失去市場份額。與這些投資者信念相反,分析師認爲這些問題是暫時的,強調公司的材料部門穩健,RFID技術的不斷應用預計將推動營業收入增長和提高利潤率,爲公司在2025年實現潛在超額表現奠定基礎。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$艾利丹尼森 (AVY.US)$近期主要分析師觀點如下:

此外,綜合報道,$艾利丹尼森 (AVY.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of