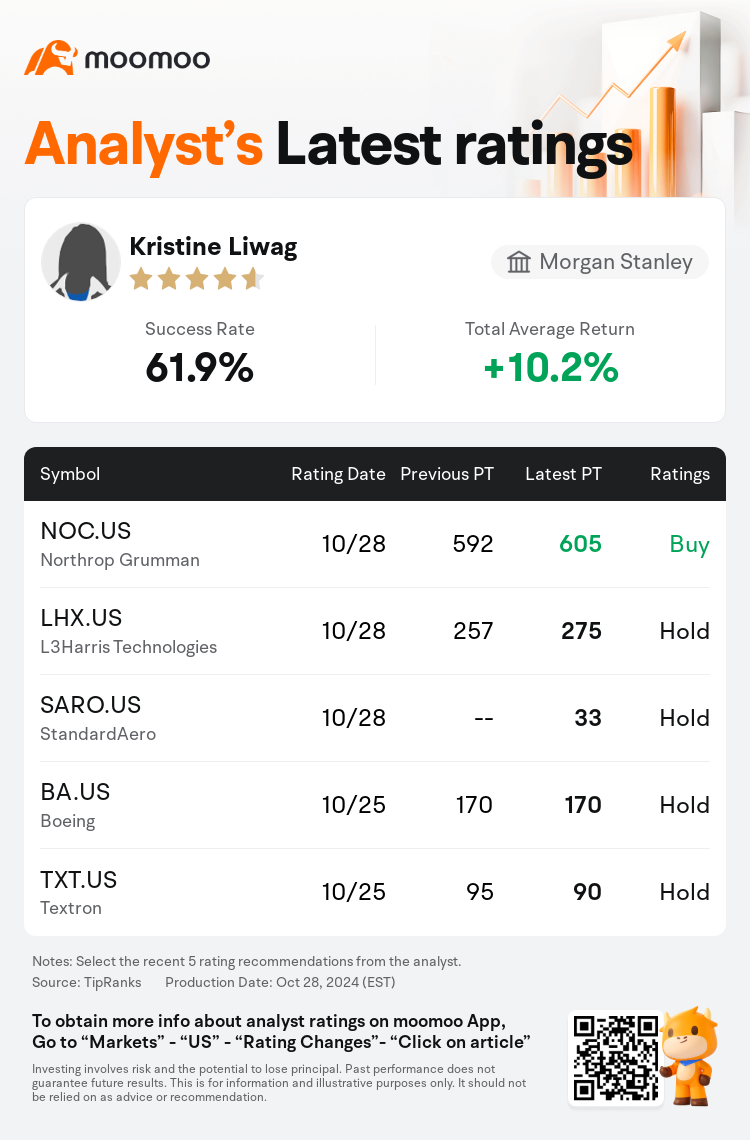

Morgan Stanley analyst Kristine Liwag maintains $Northrop Grumman (NOC.US)$ with a buy rating, and adjusts the target price from $592 to $605.

According to TipRanks data, the analyst has a success rate of 61.9% and a total average return of 10.2% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Northrop Grumman (NOC.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Northrop Grumman (NOC.US)$'s main analysts recently are as follows:

Northrop Grumman's third-quarter earnings per share and earnings before interest and taxes exceeded expectations, leading to an upward revision, despite revenue being slightly below consensus. The company has maintained its guidance, with an anticipated revenue growth of 3%-4% by 2025. The past three quarters have showcased consistent operational performance with numerous upward revisions across various business segments. Northrop Grumman is evidencing a resurgence of robust growth, improved profit margins, and enhanced free cash flow, all while efficiently progressing on two of the Department of Defense's most critical long-term priority projects.

Northrop Grumman's third quarter results were robust, and its operating margin story appears promising. However, it's believed that much of the positive news may already be factored into the company's current stock value. Northrop Grumman is expected to maintain a relatively strong position regardless of the outcome of the 2024 Presidential election, although there could be potential delays in the GBSD - Ground Based Strategic Deterrent - program.

The 2025 objectives set by Northrop Grumman appear to be within reach and may even present opportunities for the usual positive amendments. The company's forecast for Q4 seems to be on the cautious side, indicating potential for outperformance.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

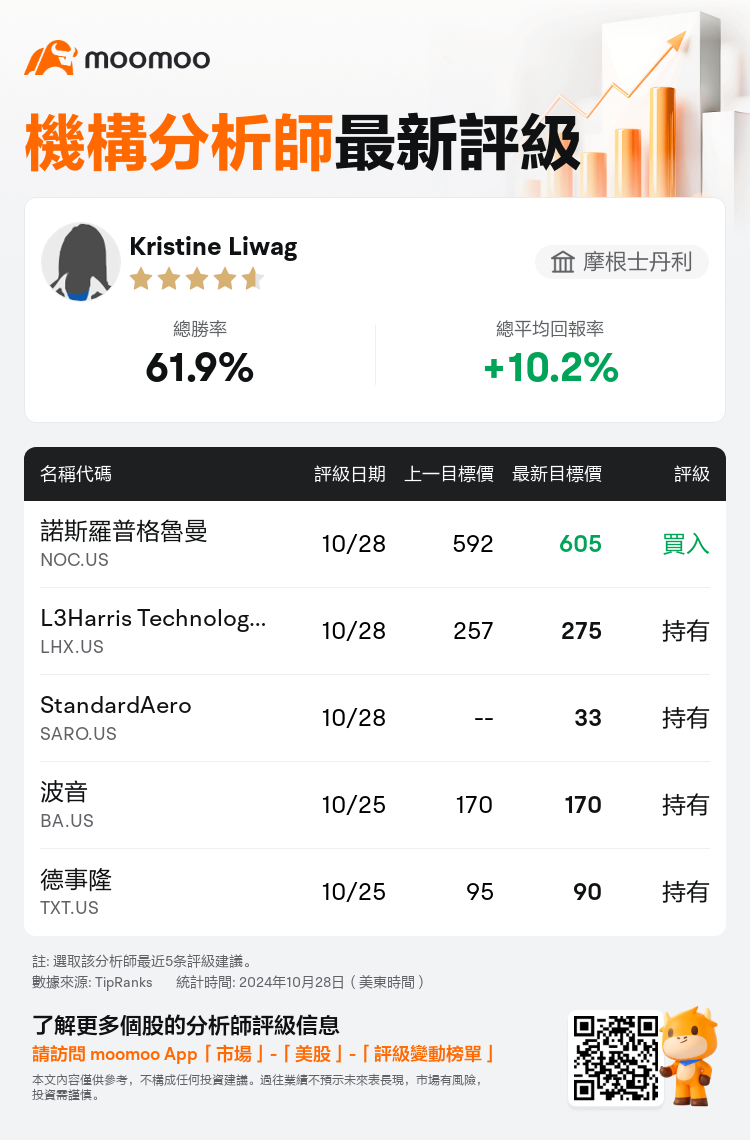

摩根士丹利分析師Kristine Liwag維持$諾斯羅普格魯曼 (NOC.US)$買入評級,並將目標價從592美元上調至605美元。

根據TipRanks數據顯示,該分析師近一年總勝率為61.9%,總平均回報率為10.2%。

此外,綜合報道,$諾斯羅普格魯曼 (NOC.US)$近期主要分析師觀點如下:

此外,綜合報道,$諾斯羅普格魯曼 (NOC.US)$近期主要分析師觀點如下:

諾斯羅普格魯曼的第三季度每股收益和利息及稅前利潤超出預期,導致上調,儘管營業收入略低於共識。該公司已經維持了其指引,並預計到2025年營業收入增長3%-4%。過去三個季度展示了穩定的運營業績,各業務板塊均出現了多次向上修訂。諾斯羅普格魯曼正在經歷強勁增長的復甦,利潤率提高,自由現金流增強,同時高效地推進國防部兩個最關鍵的長期優先項目之一。

諾斯羅普格魯曼的第三季度業績強勁,營業利潤率情況看似令人期待。然而,人們認爲,許多積極的資訊可能已經融入了公司當前的股票價值。預計諾斯羅普格魯曼將保持相對強勁的地位,無論2024年總統選舉結果如何,儘管GBSD - 地基戰略性威懾 - 計劃可能會出現潛在的延遲。

諾斯羅普格魯曼制定的2025年目標似乎可以實現,並且可能會爲通常的積極修正帶來機會。公司對第四季度的預測似乎有所保守,表明有可能實現更佳業績。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$諾斯羅普格魯曼 (NOC.US)$近期主要分析師觀點如下:

此外,綜合報道,$諾斯羅普格魯曼 (NOC.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of