Top 3 Real Estate Stocks That May Surge In Q4

Top 3 Real Estate Stocks That May Surge In Q4

可能在第四季度大漲的前三家房地產業股票

The most oversold stocks in the real estate sector presents an opportunity to buy into undervalued companies.

房地產板塊中最超賣的股票爲買入低估公司提供良機。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI指標是一種動量指標,它比較了股票在價格上漲時的強度與在價格下跌時的強度。與股票的價格走勢進行比較,可以給交易者更好的了解股票短期內表現的良好程度。當RSI低於30時,資產通常被認爲是超賣的,根據Benzinga Pro的數據。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是本行業板塊最近的主要超賣股票列表,RSI接近或低於30。

WP Carey Inc (NYSE:WPC)

WP凱雷公司(紐交所:WPC)

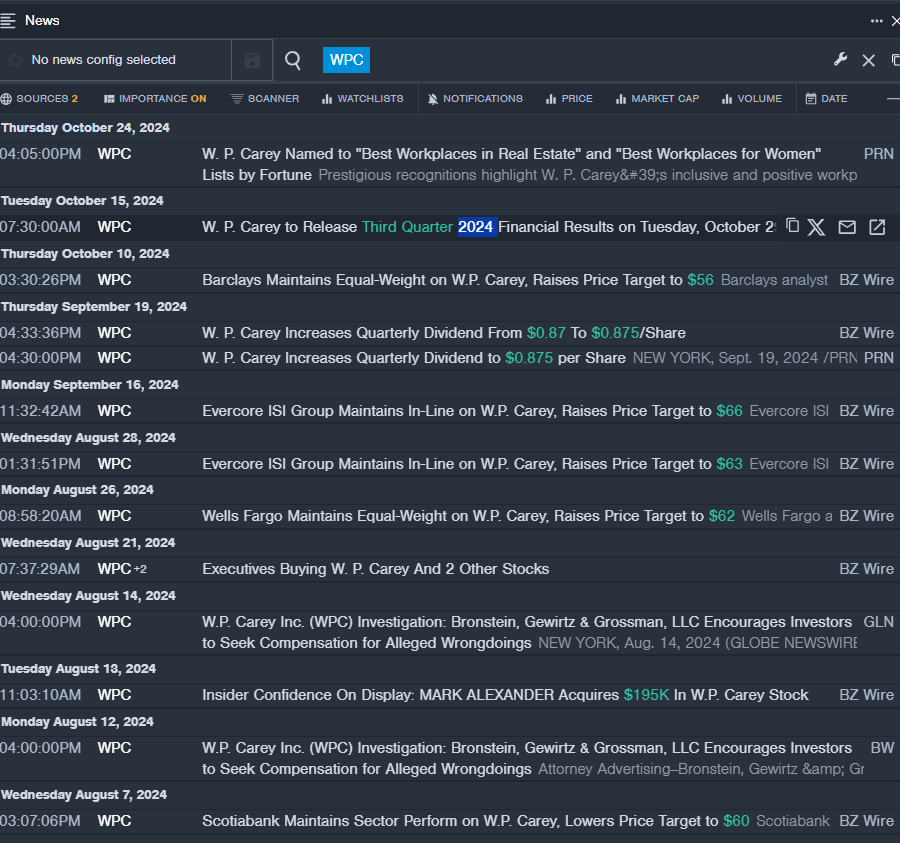

- W. P. Carey will release its financial results for the third quarter ended Sept. 30, after the market closes on Tuesday, Oct. 29. The company's stock fell around 8% over the past month and has a 52-week low of $50.52.

- RSI Value: 25.64

- WPC Price Action: Shares of WP Carey fell 2.2% to close at $57.28 on Friday.

- Benzinga Pro's real-time newsfeed alerted to latest WPC news.

- W. P. Carey將於10月29日星期二收盤後公佈截至9月30日第三季度的財務業績。該公司股價在過去一個月下跌了約8%,52周最低價爲50.52美元。

- RSI數值:25.64

- WPC價格走勢:WP凱雷股票週五下跌2.2%,收於57.28美元。

- Benzinga Pro的實時新聞提醒了最新的WPC新聞。

Service Properties Trust (NASDAQ:SVC)

service properties trust (納斯達克:SVC)

- On Oct. 16, Service Properties Trust announced it reduced its quarterly dividend. The company's stock fell around 21% over the past month and has a 52-week low of $3.44.

- RSI Value: 29.93

- SVC Price Action: Shares of Service Properties Trust fell 2.7% to close at $3.62 on Thursday.

- Benzinga Pro's charting tool helped identify the trend in SVC stock.

- 納斯達克公司Service Properties Trust宣佈減少其季度股息。該公司股價在過去一個月下跌了約21%,並且52周內最低價爲$3.44。

- RSI值:29.93

- SVC價格走勢:Service Properties Trust的股價週四下跌了2.7%,收於$3.62。

- Benzinga Pro的圖表工具有助於識別SVC股票的趨勢。

Creative Media & Community Trust Corp (NASDAQ:CMCT)

Creative Media & Community Trust Corp (納斯達克股票代碼:CMCT)

- On Aug. 8, Creative Media posted better-than-expected quarterly results. "Our core FFO improved from the first quarter of 2024 due to improved net operating income across all of our real estate segments – multifamily, office and hotel," said David Thompson, Chief Executive Officer of Creative Media & Community Trust Corporation. "Our goal is to strengthen our balance sheet and improve our cash flow. In order to achieve this goal, we continue to actively evaluate asset sales and other ways to reduce both our recourse debt and overall debt." The company's shares fell around 16% over the past five days and has a 52-week low of $0.42.

- RSI Value: 19.89

- CMCT Price Action: Shares of Creative Media & Community Trust fell 1.5% to close at $0.46 on Friday.

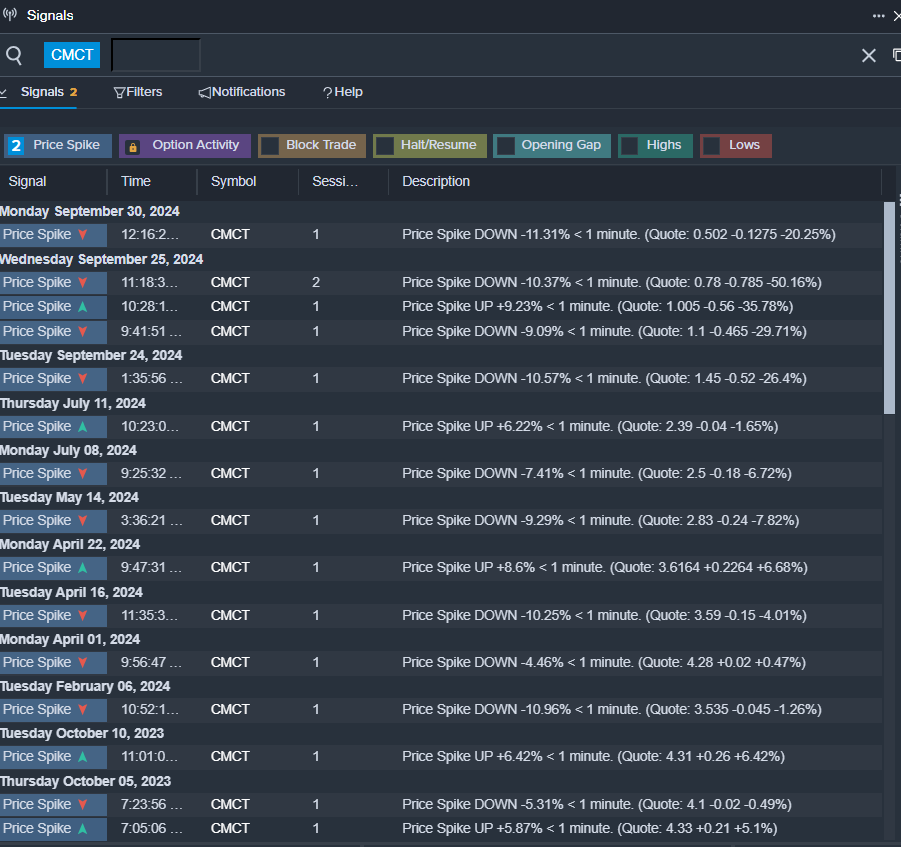

- Benzinga Pro's signals feature notified of a potential breakout in CMCT shares.

- Creative Media於8月8日發佈了好於預期的季度業績報告。Creative Media & Community Trust Corporation的首席執行官David Thompson表示:「由於我們房地產業務中各個板塊的淨營收增加,包括多戶住宅、辦公和酒店,我們的核心FFO與2024年第一季度相比有所改善。」 「我們的目標是加強資產負債表,並改善現金流。爲實現這一目標,我們繼續積極評估資產出售和其他方式,以減少我們的追索債務和總體債務。」 該公司股價在過去五天下跌了約16%,並且52周內最低價爲$0.42。

- RSI數值:19.89

- CMCt價格走勢:Creative Media & Community Trust股票週五下跌1.5%,收盤價爲0.46美元。

- Benzinga Pro的信號功能提醒CMCt股票存在潛在的突破。

Read More:

閱讀更多:

- Wall Street's Most Accurate Analysts Give Their Take On 3 Real Estate Stocks Delivering High-Dividend Yields

- 華爾街最準確的分析師對3家提供高股息收益的房地產業股票發表看法