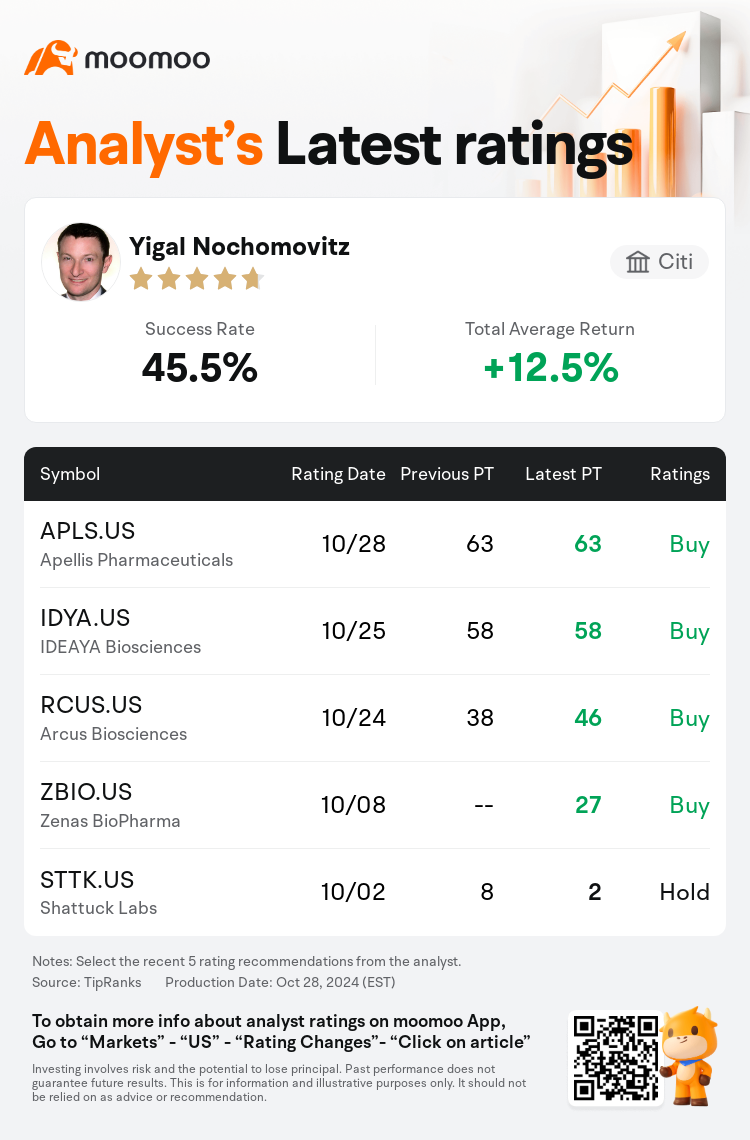

Citi analyst Yigal Nochomovitz maintains $Apellis Pharmaceuticals (APLS.US)$ with a buy rating, and maintains the target price at $63.

According to TipRanks data, the analyst has a success rate of 45.5% and a total average return of 12.5% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Apellis Pharmaceuticals (APLS.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Apellis Pharmaceuticals (APLS.US)$'s main analysts recently are as follows:

Complement inhibitors Syfovre and Izervay have been approved for geographic atrophy, focusing on decelerating the expansion of atrophy in the retina rather than a functional benefit such as vision improvement, the endpoint for anti-VEGFs in wAMD. Key opinion leader consultants are generally hesitant to recommend Syfovre or Izervay to patients, with projections that at their peak, only 20%-25% of patients will be suitable candidates.

A recent survey of U.S. retinal specialists indicates a continued overall growth for the complement inhibitor class with an increase in prescribing for both Syfovre and its competitor product. The survey suggests that Syfovre maintains its position as the market leader and has an advantage when it comes to initiating treatment in new patients.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

花旗分析師Yigal Nochomovitz維持$Apellis Pharmaceuticals (APLS.US)$買入評級,維持目標價63美元。

根據TipRanks數據顯示,該分析師近一年總勝率為45.5%,總平均回報率為12.5%。

此外,綜合報道,$Apellis Pharmaceuticals (APLS.US)$近期主要分析師觀點如下:

此外,綜合報道,$Apellis Pharmaceuticals (APLS.US)$近期主要分析師觀點如下:

補體抑制劑Syfovre和Izervay已獲批用於地理性萎縮,重點在於減緩視網膜萎縮的擴展,而不是像抗血管內皮生長因子在溼性年齡相關性黃斑變性中以視力改善爲終點的功能性益處。關鍵意見領袖諮詢師普遍不願意向患者推薦Syfovre或Izervay,預計在高峰期,只有20%-25%的患者會是合適的候選者。

最近的一項美國視網膜專家調查顯示,補體抑制劑類別繼續整體增長,對Syfovre及其競爭對手產品的開藥量增加。調查表明,Syfovre保持其市場領導地位,並且在新患者開始治療時具有優勢。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Apellis Pharmaceuticals (APLS.US)$近期主要分析師觀點如下:

此外,綜合報道,$Apellis Pharmaceuticals (APLS.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of