There May Be Underlying Issues With The Quality Of China Quanjude(Group)Ltd's (SZSE:002186) Earnings

There May Be Underlying Issues With The Quality Of China Quanjude(Group)Ltd's (SZSE:002186) Earnings

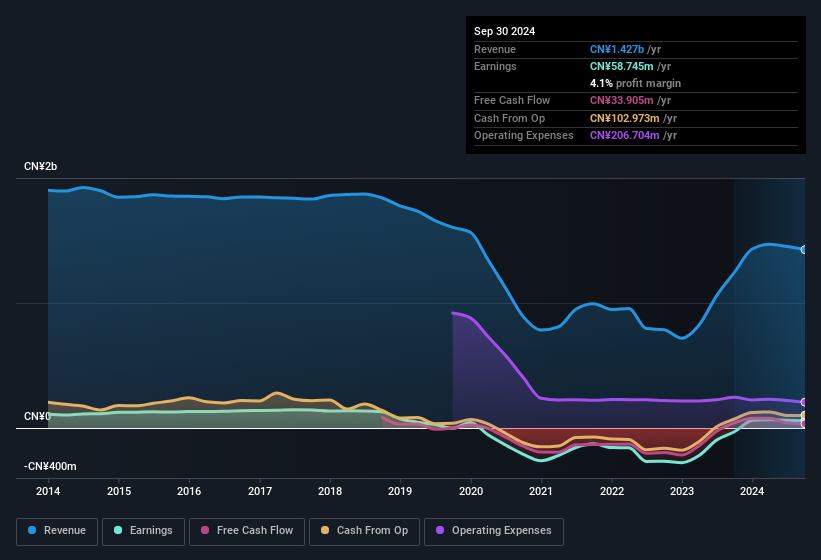

China Quanjude(Group) Co.,Ltd. (SZSE:002186) announced strong profits, but the stock was stagnant. We did some digging, and we found some concerning factors in the details.

全聚德集團股份有限公司(SZSE:002186)宣佈盈利強勁,但股票走勢停滯。我們進行了一些調查,發現了一些令人擔憂的細節因素。

The Impact Of Unusual Items On Profit

除了稀釋之外,還應該注意的是,萬集科技在過去12個月中因不尋常項目獲得了價值人民幣3.5萬元的利潤。雖然我們希望看到利潤增加,但當這些不尋常項目對利潤做出重大貢獻時,我們會更加謹慎。我們對全球大部分上市公司的數據進行了分析,發現不尋常項目往往是一次性的。這正如我們所期望的那樣,因爲這些提升被描述爲"不尋常"。相對於其利潤而言,萬集科技在2021年12月前的不尋常項目貢獻大。因此,我們可以推斷出,這些不尋常項目正在使其財務利潤顯著增強。

Importantly, our data indicates that China Quanjude(Group)Ltd's profit received a boost of CN¥5.7m in unusual items, over the last year. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. Which is hardly surprising, given the name. If China Quanjude(Group)Ltd doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

重要的是,我們的數據顯示,全聚德集團有限公司的利潤在過去一年中在飛凡項目上獲得了570萬元的提升。雖然盈利增加總是令人高興的,但來自飛凡項目的大額貢獻有時會減弱我們的熱情。我們對全球大多數上市公司進行了數據分析,很常見飛凡項目是一次性的。這並不奇怪,考慮到名稱。如果全聚德集團有限公司不再看到這種貢獻的重複,那麼其他條件保持不變,我們預計其利潤會在今年下降。

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of China Quanjude(Group)Ltd.

注意:我們始終建議投資者檢查資產負債表的實力。點擊這裏查看我們對全聚德集團有限公司資產負債表分析。

Our Take On China Quanjude(Group)Ltd's Profit Performance

我們對全聚德集團有限公司的盈利表現看法

Arguably, China Quanjude(Group)Ltd's statutory earnings have been distorted by unusual items boosting profit. Because of this, we think that it may be that China Quanjude(Group)Ltd's statutory profits are better than its underlying earnings power. The good news is that it earned a profit in the last twelve months, despite its previous loss. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. While it's very important to consider the profit and loss statement, you can also learn a lot about a company by looking at its balance sheet. We've done some analysis and you can see our take on China Quanjude(Group)Ltd's balance sheet by clicking here.

可以說,全聚德(集團)有限公司的法定收益因飛凡的異常項目而被放大,從而提高了利潤。因此,我們認爲全聚德(集團)有限公司的法定利潤可能優於其潛在盈利能力。好消息是,儘管之前虧損,但在過去的十二個月裏,它賺取了利潤。當然,在分析其收益方面,我們只是皮毛;人們還可以考慮毛利率、預測增長率、投資回報率等其他因素。雖然考慮利潤和損失表非常重要,但您也可以通過查看資產負債表來了解公司的很多情況。我們已經做了一些分析,您可以通過點擊這裏查看我們對全聚德(集團)有限公司財務狀況的看法。

This note has only looked at a single factor that sheds light on the nature of China Quanjude(Group)Ltd's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

這份備忘錄僅着眼於揭示全聚德(集團)有限公司利潤性質的一個因素。但如果您能集中精力關注細枝末節,總會有更多發現。有些人認爲股東權益較高是一個優質企業的良好跡象。因此,您可能希望查看這個免費的高股東權益企業收藏系列,或者這份擁有高內部持股的股票清單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接與我們聯繫。或者,發送電子郵件至editorial-team @ simplywallst.com。

Simply Wall St的這篇文章是一般性質的。我們僅基於歷史數據和分析師預測提供評論,使用公正的方法,我們的文章並非意在提供財務建議。這並不構成買入或賣出任何股票的建議,並且不考慮您的目標或財務狀況。我們旨在爲您帶來基於基礎數據驅動的長期聚焦分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St對提及的任何股票都沒有持倉。

Arguably, China Quanjude(Group)Ltd's statutory earnings have been distorted by unusual items boosting profit. Because of this, we think that it may be that China Quanjude(Group)Ltd's statutory profits are better than its underlying earnings power. The good news is that it earned a profit in the last twelve months, despite its previous loss. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. While it's very important to consider the profit and loss statement, you can also learn a lot about a company by looking at its balance sheet. We've done some analysis and you can see our take on China Quanjude(Group)Ltd's balance sheet by clicking here.

Arguably, China Quanjude(Group)Ltd's statutory earnings have been distorted by unusual items boosting profit. Because of this, we think that it may be that China Quanjude(Group)Ltd's statutory profits are better than its underlying earnings power. The good news is that it earned a profit in the last twelve months, despite its previous loss. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. While it's very important to consider the profit and loss statement, you can also learn a lot about a company by looking at its balance sheet. We've done some analysis and you can see our take on China Quanjude(Group)Ltd's balance sheet by clicking here.